Automotive Components: Developments on EU Foreign Trade

Semiconductor shortage emerges as wake-up call for the industry

Published by Alba Di Rosa. .

Covid-19 Europe Asia Electronics Automotive Export Foreign markets High-tech Automotive

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

In last week's article, focused on the recent performance of the automotive sector in the EU, we reported that the sector is currently affected by two key factors: the progressive shift towards electricity and the impact of the Covid crisis. In this context, it might be useful to investigate the adaptability of the various supply chains involved; among these, the automotive components sector1 certainly plays a major role. Data on EU foreign trade, available on ExportPlanning, allow a specific focus on the subject.

The dynamics of EU exports

The role of EU exports of car components is significant on a global scale: according to our data, 44.3% of world exports of the sector would be attributable to the Union in 2019; further key roles are played by China (11.3%) and the United States (10.6%). Mexico and Japan also boast a significant position among the top 5 largest exporters, respectively exceeding shares of 7%.

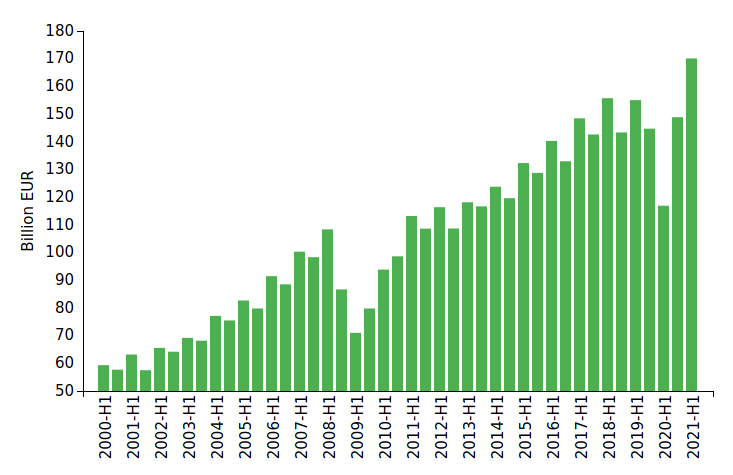

As for EU exports of automotive components, after the 2008-2009 crisis they showed a steady year-over-year (YoY) increase; weak but still positive variation in 2019 (+0.2%). In 2020, with the start of the health crisis, we can see instead an overall contraction of 11.3%, in line with the general industry paralysis. The sharpest fall was recorded in the second quarter of the year (-42.7% YoY), before returning to positive territory in the fourth quarter of 2020 (+8.2%).

Comparing 2021 flows with the pre-Covid situation (2019), we can see the presence of an actual recovery for EU exports of the sector: an increase of 9.7% is in fact estimated for H1-2021, compared to the same period of 2019.

Fig. 1 – EU exports of automotive components

(from H1-2000 to H1-2021)

Source: StudiaBo elaborations on ExportPlanning data.

Top players

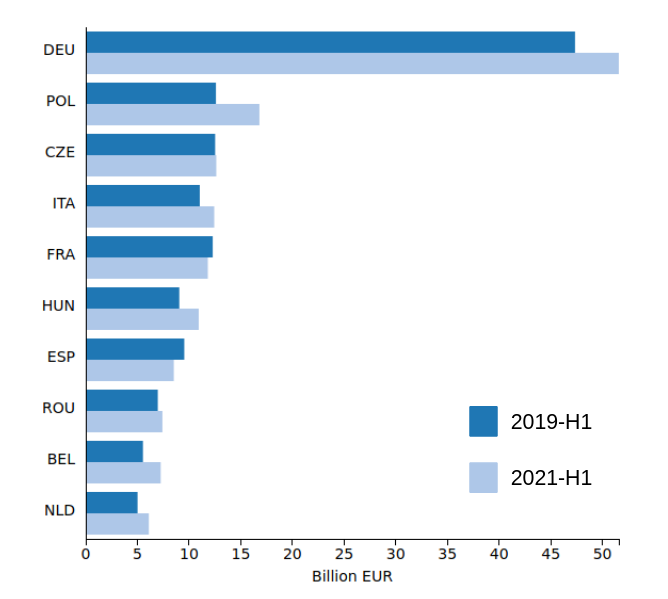

Focusing on the top European exporters in the automotive components sector, the German leadership can be confirmed: Germany reports €51.6 billion in exports in H1-2021, up by almost 9% compared to the same period in 2019.

Among the 10 largest EU exporters, we find additional countries that boast lower export levels, but faster growth rates in H1-2021, compared to the corresponding period in 2019. We can see increases greater than 30% for Poland (second major exporter in Europe) and Belgium; exports from Hungary and the Netherlands grew by more than 20%. Two Eastern European countries are therefore among those that have shown the fastest growth rates; a more modest increase (+6.4%) emerges for Romania.

In contrast, among the largest EU exporters, negative performances are reported for Spain and France, which show drops of 10.6% and 3.9% respectively between H1-2019 and H1-2021. Italy, on the contrary, shows a 12.7% growth in the first half of this year, gaining the fourth position in the EU ranking of major exporters, behind the Czech Republic, and recovering a position at the expense of France.

Fig. 2 - EU exports of automotive components, by country

(H1-2019 vs H1-2021)

Source: StudiaBo elaborations on ExportPlanning data.

Analysis by product

As for the dynamics of the various sectors of the components' industry, between H1-2019 and H1-2021 EU exports showed, as expected, the greatest increases for Batteries and accumulators (+110.7%) and Battery and accumulator parts (+49.6%). Exports of electrical (+7.6%) and non-electrical (+9.1%) parts and accessories for motor vehicles grew more modestly; growth of just over 1% is estimated for the more "traditional" components area - which are not directly involved in the transition to electric vehicles - such as engines and chassis, car bodies and tires.

Another group of components that is increasingly gaining a key role in automotive manufacturing refers to semiconductors; this is attributable to the growing role of electronics for infotainment2 and safety purposes, as well as the progressive shift of the automotive industry towards electric power, as discussed in the previous article.

An element of tension and risk on which international observers are currently focused, however, is the current shortage of semiconductors on the market, exploded in relation to the pandemic shock, but also to the strong increase in demand by various industries already started before the pandemic.

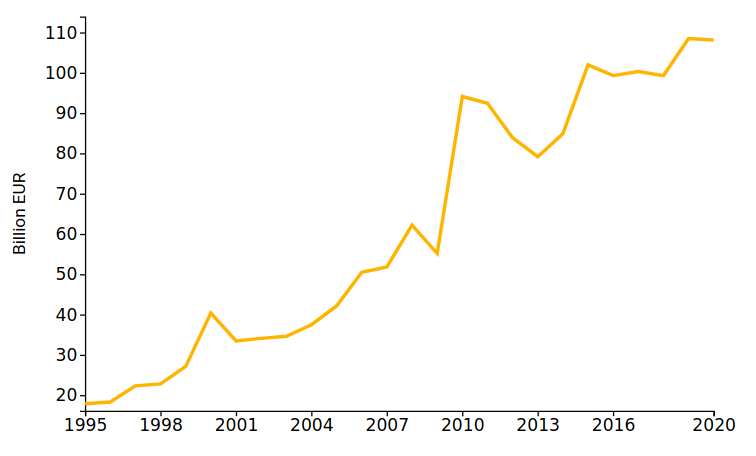

As can be seen from the graph below, worldwide demand for semiconductors has grown exponentially in recent years, in relation to the increasingly important role they play in electronics, the automotive sector and artificial intelligence. Looking at the most recent data, we can see that global semiconductor demand increased by 9.2% in 2019, to then enter a slight slowdown in 2020 (-0.3%) in the context of the Covid crisis.

Fig. 3 – World demand for semiconductors (1995-2020)

Source: StudiaBo elaborations on ExportPlanning data.

The latest quarterly data show that semiconductor trade is picking up this year, with global demand up by 8.5% in Q1 and 7.3% in Q2. According to industry analysts, however, trade flows would most likely be even more dynamic if the current supply shortage were not in place. This problem, which has erupted due to a damaging mix of increased demand and Covid crisis, is expected to last until 2022/2023, limiting the automotive industry's production potential.

The key role of Asia in the export of these products, in a sector that requires significant investment and specialized workforce, generates in fact the consequent impossibility to quickly compensate for the lack of supply through domestic production or imports of alternative origin.

According to ExportPlanning data, in 2019 almost 30% of the exports of this sector came from China. The remaining major exporters still reside in Asia, with the exception of Germany and the United States, whose market share is around 5%.

1. Based on ExportPlanning product classification, the following items belong to the cluster of automotive components:

Tires and air chambers (D3.51),

Non-electric parts and accessories for motorvehicles (D3.22),

Engines and chassis for motor vehicles (D3.11),

Radio, watches and other tools for car (D3.23),

Parts of batteries and accumulators (D3.14),

Batteries and accumulators (D3.12),

Parts and accessories for motor vehicles (D3.21),

Bodies and parts of bodies and trailers (D3.13).

2. Information and entertainment.