New all-time High for World Packaging Trade

2022 year of strong growth in values but also in quantities, thanks to the presence of numerous BLue OCean (BLOC) markets

Published by Marcello Antonioni. .

Marketselection Intermediate goods Export markets Uncertainty International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

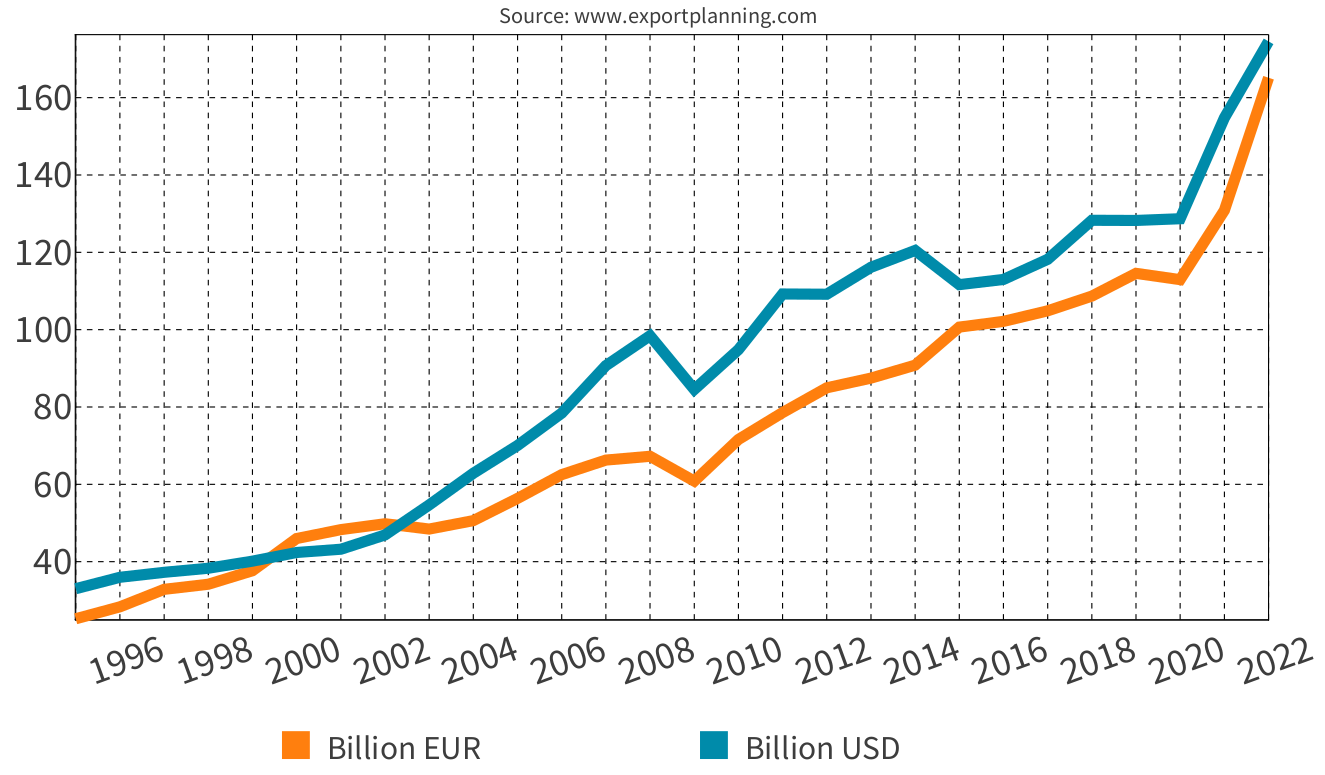

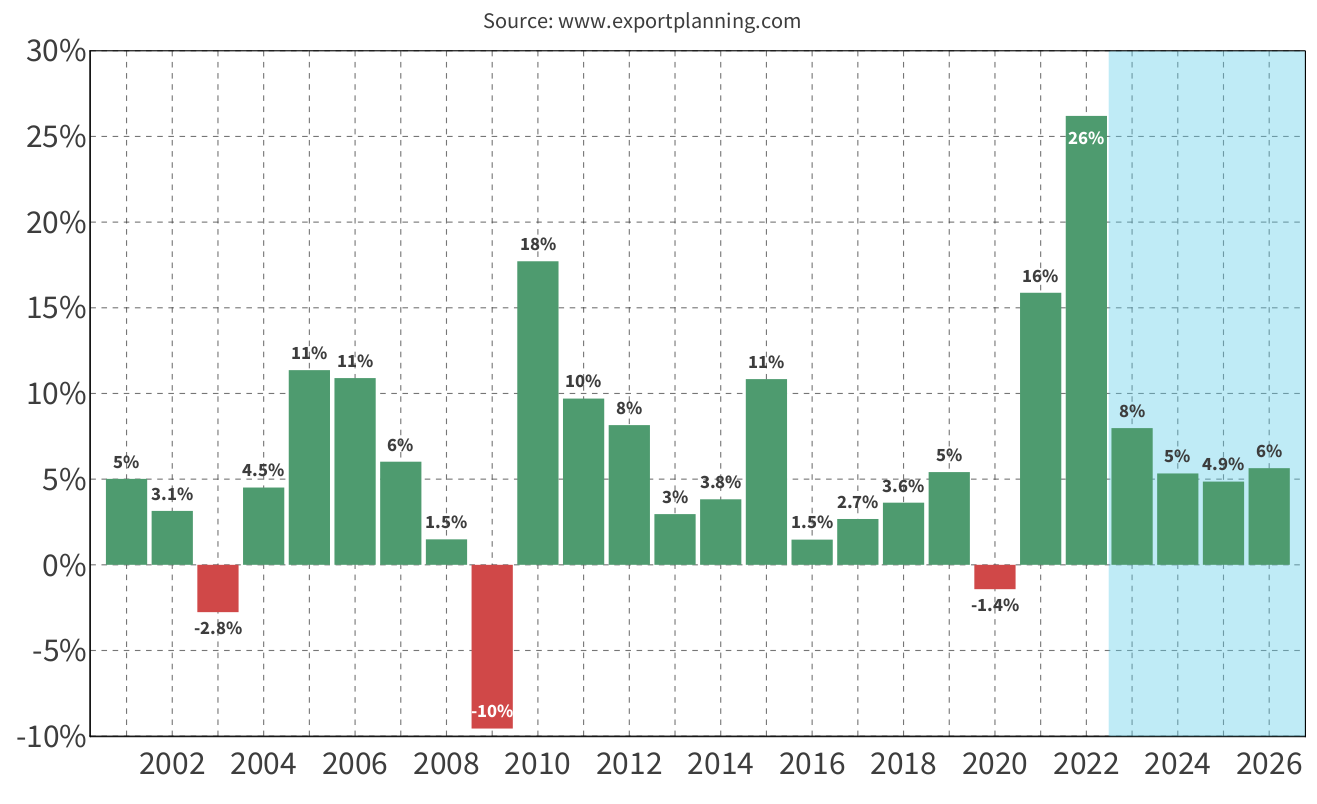

Worldwide sales of packaging products continue to show record growth. According to the ExportPlanning pre-estimates (based on the first 9 months of the year), in the final balance 2022 should show an average annual growth in world trade in packaging products of +26.2% in euro values and +6.8% at constant prices.

The increase in the prices of basic raw materials and energy costs has certainly led to an adjustment of the price lists along the supply chain such as to make the price component a dominant element in the increases in the nominal values of foreign turnover of companies in the industry. To this must be added the devaluation of the euro on average for the year, estimated at over 10 percentage points against the dollar.

However, the assessment of the evolution of world trade in the industry is confirmed to be significantly positive even when measured at constant prices, testifying to a context of demand that is nonetheless lively.

Overall, with reference to the values expressed by world trade in packaging products in the pre-final balance of 2022, these are levels of more than 44 percentage points higher than the pre-pandemic levels in euro values and by over 16 percentage points if expressed at constant prices.

World trade of Packaging products

Worldwide sales increases across all major packaging sectors

World trade in packaging by sector

| Levels 2022 | % changes at current prices | % changes at constant prices | |||

| Sector | (Bn €) | 2022/2021 | 2022/2019 | 2022/2021 | 2022/2019 |

| Plastics | 69.1 | +23.1 | +36.8 | + 5.8 | +11.5 |

|---|---|---|---|---|---|

| Paper&Cardboard | 40.9 | +28.6 | +44.3 | + 9.0 | +18.6 |

| Metal | 20.6 | +28.8 | +59.1 | + 5.5 | +30.1 |

| Glass | 18.8 | +25.1 | +41.2 | + 6.7 | +14.7 |

| Wood | 15.7 | +32.0 | +66.9 | + 8.1 | +14.7 |

| TOTAL | 165.1 | +26.2 | +44.2 | + 6.8 | +16.1 |

Source: ExportPlanning-Ulisse Datamart

The increases highlighted by world trade in the sector during 2022 affected all the main sectors of the sector in a transversal manner. In the valuations at constant prices - therefore net of inflationary and currency phenomena - all the sectors recorded average annual increases of more than 5 percentage points, with the best performances for the Paper and Cardboard (+9%) and Wood (+8.1%) sectors. The growth achieved compared to the pre-pandemic period (2019) appears to be particularly significant, with overall double-digit percentage increases at constant prices for all the sectors analysed, with the best performance for Metal packaging (+30.1%) and packaging in Paper and Cardboard (+18.6%).

The presence of numerous BLue OCean (BLOC) markets is the basis of the increases in worldwide sales of the industry

The dynamics of intense growth in world trade in the industry are underpinned by the acceleration phases experienced by imports from various international markets (so-called BLue OCean markets: see the article "BLOC Foreign Markets" ) in the various sectors of the industry.

In the continuation of this article some particularly representative cases of this phenomenon will be examined, at the level of individual sectors of the industry.

Plastics Packaging

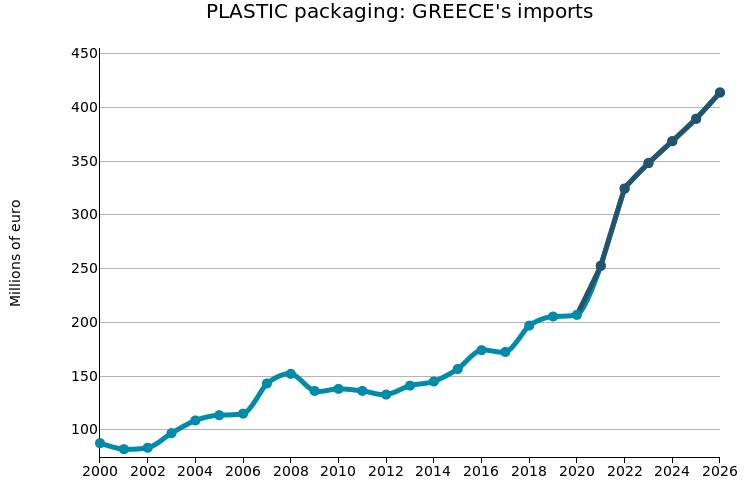

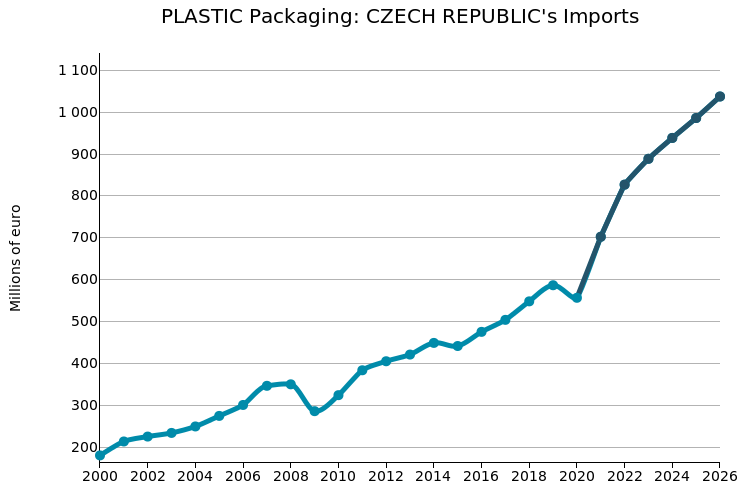

In 2022, world trade in the plastics packaging1 sector showed a dynamic of high growth (+23.1% in euro values), with an expected end of the year of a new record value in world trade, equal to over 69 billion euros (compared to 2019 +36.8% in values in euros, +11.5% at constant prices).

This performance originates in numerous markets in an acceleration phase in their imports. The main BLOC markets in the sector are as follows:- Greece: this is an emerging market in this sector ("just" 324 million euros of imports in 2022), but which is showing a phase of acceleration that it has experienced in the last decade an exponential growth, going from 70 million euros of imports in 2012 to around 1.2 billion euros estimated at the end of 2022. In the 2026 scenario, the threshold of 1.5 billion euros is expected to be exceeded;

- United States: in this case it is a leading market (1st world importer in the sector), with a value in 2022 (pre-estimates) of almost 11 billion euros. In the last two years, also thanks to cost increases along the supply chain, this market has experienced an overall growth in imports of the sector of 53%. In the 2026 scenario, a further increase of about 27 percentage points is expected, reaching almost the threshold of 14 billion euro;

- Czech Republic: this market has an intermediate dimension in terms of imports of the sector considered, with an estimated value of 827 million euros in 2022. This is a level of approximately 322 million euro higher than that of five years before (+64%), testifying to a significant phase of acceleration. This growth dynamic is expected to continue in the forecast scenario to 2026, with an expected value well above one billion euro.

Source: ExportPlanning-Forecast Datamart

Paper and Cardboard Packaging

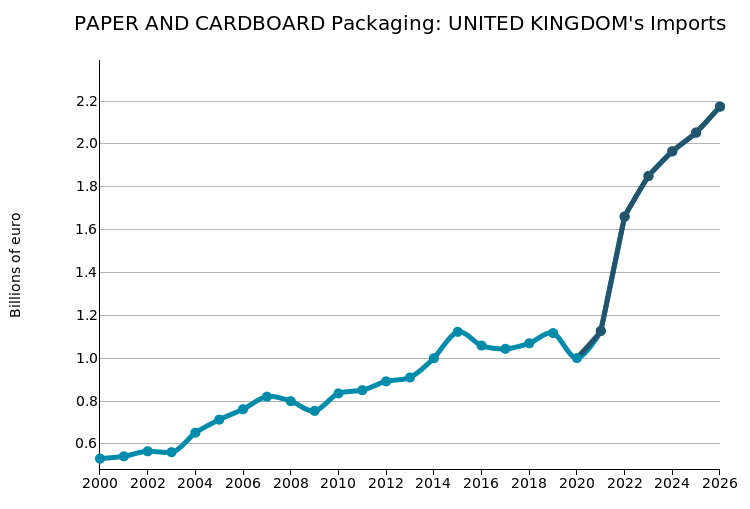

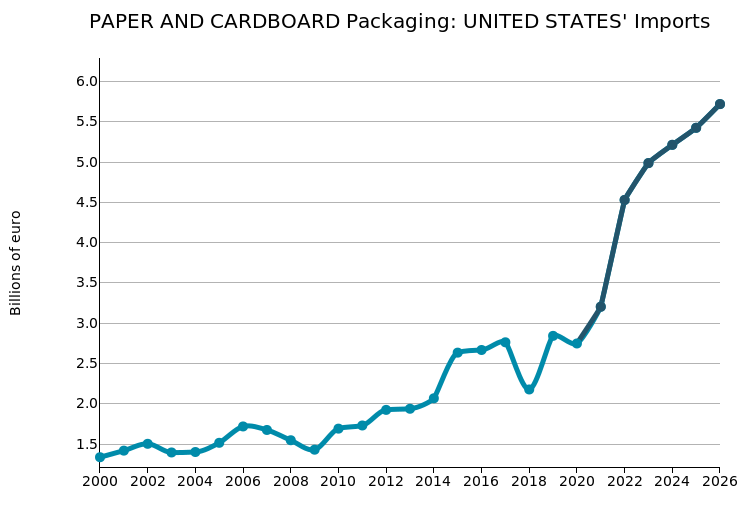

The paper and cardboard packaging products2 sector is showing particularly accelerated world trade dynamics. At the end of 2022, the value of world trade in the sector is estimated to exceed the record threshold of 40 billion euros (compared to 2019 +44.3% in values in euros, +18.6% at constant prices).

The main BLOC markets of the sector are the following:- United Kingdom: this is the 7th market importer in the sector, with an estimated value for the year of 1.7 billion euro. In the last five years, British imports of the sector have achieved cumulative growth close to 60 percentage points (+617 million euro). In the 2026 scenario, the market is expected to touch the threshold of 2.2 billion euro;

- Greece: this is still a relatively small market ("just" 349 million euros of imports in the sector, according to 2022 pre-estimates), but with values that have more than tripled over the just five years old. In the 2026 scenario, a further increase of about 30 percentage points is expected, reaching 454 million euro;

- United States: the main import market in the world for the sector, with an estimated value at the end of the year of 4.5 billion euros, has shown overall growth of 108 percentage points over the last four years (+2.4 billion euros). This growth dynamic is expected to continue in the forecast scenario, albeit at a less intense pace, with an expected value of more than 5.7 billion euros in 2026.

Source: ExportPlanning-Forecast Datamart

Metal Packaging

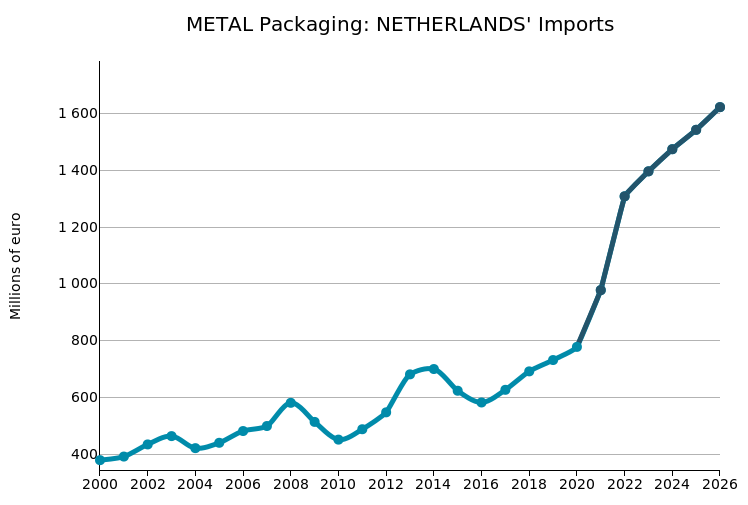

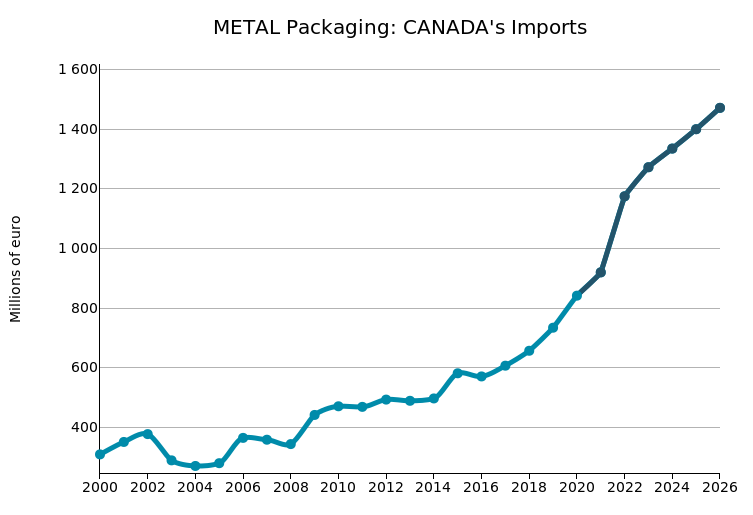

Global trade in the metal packaging3 sector is expected to close 2022 with a record value of 20.6 billion euros, 59 percent higher than pre-pandemic (+30.1% at constant prices).

The main BLOC markets of the sector are the following:- Netherlands: this is the 3rd world importer of the sector, with an estimated value for the year of 1.3 billion, on levels 79 percent higher than pre-pandemic levels. In the 2026 scenario, the market is expected to exceed the threshold of 1.6 billion euro;

- United Kingdom: this is the 6th world importer in the sector, with a value of 836 million euros (pre-estimates 2022). These are more than double the levels of just six years earlier. In the 2026 scenario, a further increase of almost 30 percentage points is expected, reaching 1.1 billion euro;

- Canada: 4th import market in the world for the sector, with an estimated year-end value of 1.2 billion euros, has shown overall growth of 94 percentage points over the last five years (+569 million euros). This growth dynamic is expected to continue in the forecast scenario, albeit at a less intense pace, with an expected value in 2026 close to 1.5 billion euros.

Source: ExportPlanning-Forecast Datamart

Glass Packaging

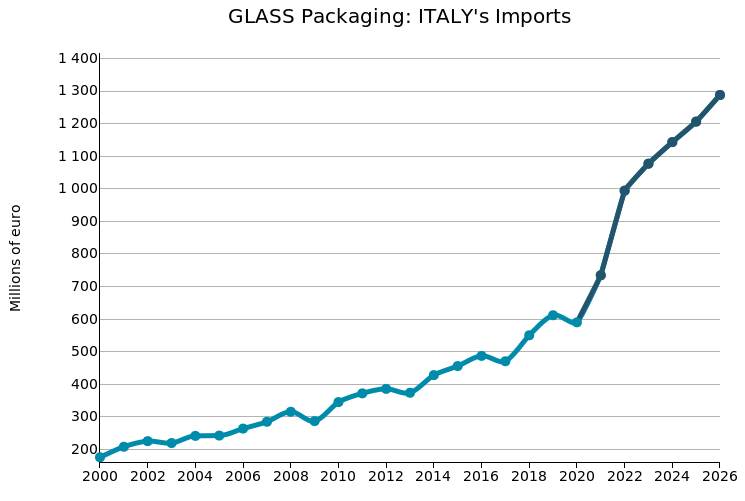

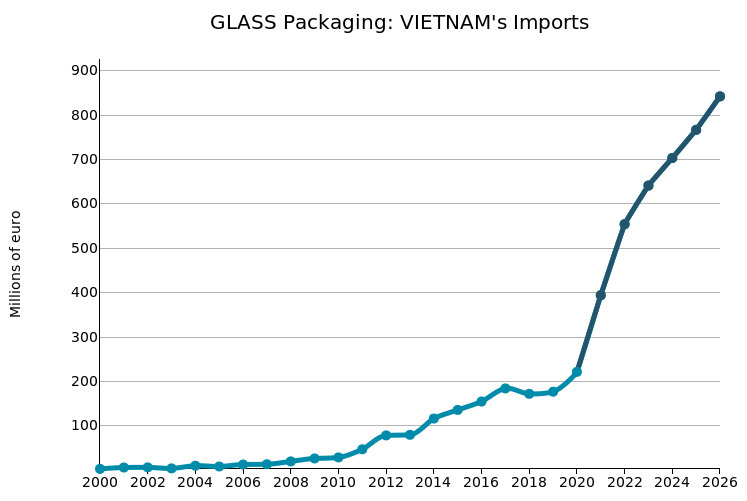

In the period 2020-2022, world trade in the glass packaging4 sector showed a dynamic of high growth (+41.2% in euro values, +14.7% % at constant prices, with year-end estimates of a new record value (18.8 billion euros).

This performance originates in numerous markets in an acceleration phase in their imports: Italy, Spain, Vietnam, Brazil, Portugal, Romania, Greece, Colombia. In particular, the main BLOC markets of the sector are the following:- Italy: this is the 3rd world importer in this sector, with a 2022 value (pre-estimates) of around 1 billion euros. It expresses an almost constant growth trend, which has accelerated in the last two years. In the 2026 scenario, a further increase of almost 300 million euros is expected, reaching the threshold of 1.3 billion euros;

- Spain: this is the 4th world importer in the sector, with a 2022 value (pre-estimates) of 860 million euros. In the last two years, also thanks to cost increases along the supply chain, this market has experienced an overall growth in imports of the sector of 90%. In the 2026 scenario, a further increase of 33 percentage points is expected, reaching the threshold of 1.1 billion euro;

- Vietnam: this is the 10th world importer in the sector, with an estimated value of 554 million euros in 2022. In just three years (2020-2022) this market has seen its import values expressed in euro more than triple, testifying to a significant phase of acceleration. This growth dynamic is expected to continue, albeit at a slower pace, in the forecast scenario to 2026 (+52%), with an expected value of 842 million euro.

Source: ExportPlanning-Forecast Datamart

Wooden Packaging

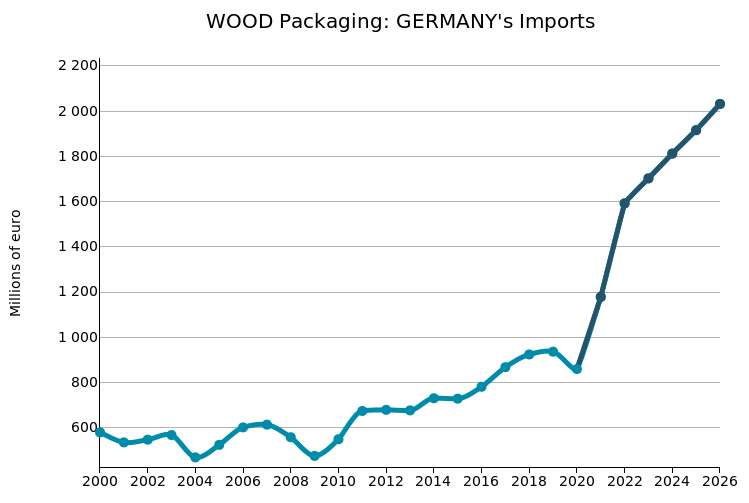

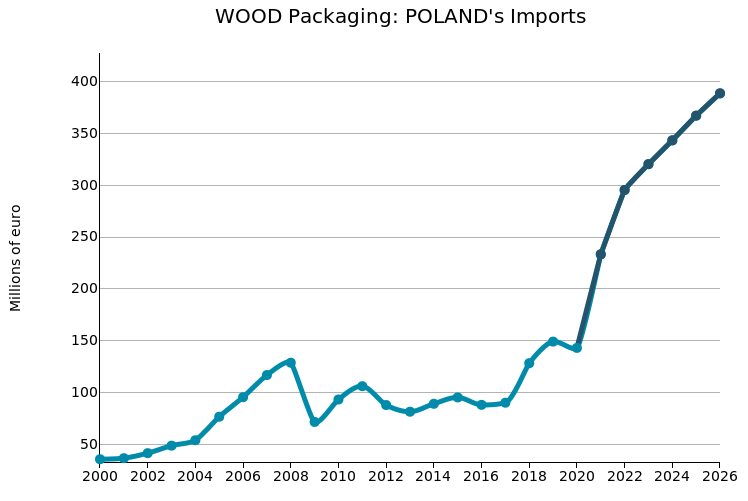

In the 2020-2022 period, world trade in the wooden packaging5 sector showed a very accelerated trend (+67% in euro values, +14.7% in constant prices), with estimates at the end of the year of a new record value (15.7 billion euros).

This performance originates in numerous markets in an acceleration phase in their imports: United Kingdom, United States, Germany, France, Poland, Austria, Hungary, Czech Republic, Denmark, Romania, Portugal. In particular, among these BLOC markets of the sector, the cases of:- Germany: this is the 2nd world importer of this sector, with a 2022 value (pre-estimates) of 1.6 billion euros. In the two-year period 2021-2022, also thanks to the cost increases along the supply chain, this market expressed an 85 percent growth in values in euro, equal to +732 million euro. In the 2026 scenario, a further increase of 440 million euros is expected, reaching the threshold of 2 billion euros;

- France: this is the 5th world importer in the sector, with a 2022 value (pre-estimates) of 935 million euros. In the last two years, this market has doubled the value of its imports. In the 2026 scenario, a further increase of 27 percentage points is expected, reaching almost 1.2 billion euro;

- Poland: this is the 12th world importer in the sector, with an estimated value of 295 million euros in 2022. In just five years (2017-2022) this market has seen its import values expressed in euro more than triple, testifying to a significant phase of acceleration. This growth dynamic is expected to continue, albeit at a slower pace, in the forecast scenario to 2026 (+32%), with an expected value of 388 million euro.

Source: ExportPlanning-Forecast Datamart

Conclusions

At the end of a 2022 that marked new high points for the world trade in packaging (both in monetary values and in quantities), it should be emphasized that in 2023, growth opportunities will probably be less favourable. In the ExportPlanning scenario, based on the latest World Economic Outlook of the International Monetary Fund, 2023 should show (also thanks to the expected progressive normalization of production input costs and the expected stabilization of the euro exchange rate against the dollar) a significant slowdown of world trade in the sector expressed in euro values (falling from +26% in 2022 to +8% expected for next year.

World trade Forecast for Packaging products: % changes in euro

In such a context of slowdown, one of the advantages of the BLOC markets is that they are relatively unaffected by the international cycle (resilience to the international cycle): the forces that govern the first stages of the development process of imports of a product in a given country are, in fact, long-term, linked to the country's structural development.

In essence, imports that are accelerating are more cyclically resilient. It is necessary for the country to be hit by a significant economic crisis in order for the structural processes that fuel the accelerating phase of imports of various products to be interrupted.

In conclusion, also for the packaging sector, the uncertainty about the slowdown/recession that could hit the world economy in 2023 suggests that the search for foreign BLOC markets, resilient to the cycle, could be, at this moment, a optimal solution.

1) For a description of the products included in the sector, see the relative description sheet.

2) For a description of the products included in the sector, see the relative description sheet.

3) For a description of the products included in the sector, see the relative description sheet.

4) For a description of the products included in the sector, see the relative description sheet.

5) For a description of the products included in the sector, see the relative description sheet.