The pricing policies of main exporters of Handbags and Travel bags

The analysis of pricing policies applied by different competitor countries can become information of high strategic value for companies in the sector

Published by Marzia Moccia. .

Premium price Competitor analysis Foreign markets Uncertainty International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

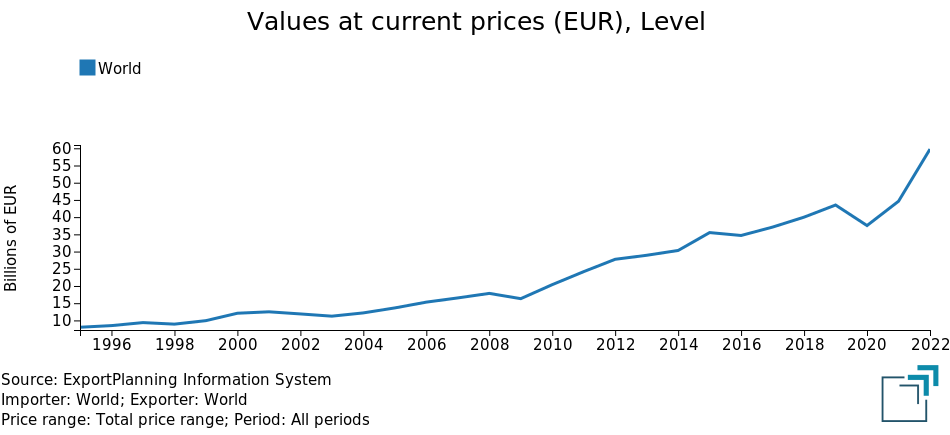

In the article World trade of leather, hides, leather goods supply chain we had documented the particularly positive conjuncture and high dynamism that has characterized world trade in the downstream products of the leather-leather-leather supply chain during the most recent quarters. In fact, that of finished products is the only sector of the leather supply chain that has recovered the corresponding pre-pandemic levels.

Specifically, during 2022, world trade in the two most representative products in the industry, Handbags and Travel Bags, grew by 34 percent in euros, reaching a record of 59.8 billion euros, corresponding to a 37% increase over the corresponding 2019 levels.

Fig.1 – World Trade in Handbags and Travel Bags

Even with the positive results, it seems clear that the increases just described have been strongly influenced by a significant rise in prices that occurred over the past three years, which also mirrored increases in raw materials and energy costs.

Rising commodity prices in fact created severe tensions in the international market, leading many companies to adjust their price lists upward in order to absorb the cost increases they experienced. Moreover, the process and timing through which these price increases were passed downstream may have differed depending on the different competitors involved.

How then to compare the different pricing policies practiced by the major competing countries?

To meet this need, the ExportPlanning team developed the product Price Competitors within the scope of the service Market Insights, which allows you to check the alignment of your company's sales lists with the price dynamics of major exporting countries from foreign trade information.

ExportPlanning price indexes: from AUVs to the Laspeyres index

Foreign trade statistics make information available in both values and quantities, thus allowing a price reference to be derived from the ratio of values to physical quantities. This ratio, however, is not properly a "price," but an Average Unit Value (AUV).

Identifying actual price change solely through AUV can be misleading, however, when considering an aggregate of products or countries. In fact, the change in the AUVs of an aggregate reflects not only changes in elemental prices, but also changes in relative quantities from one year to the next. For example, it is possible to imagine two products of different price, which remains stable from one year to the next while varying the respective quantities of the products. It follows that the aggregate AUV of the two goods will report a change. It would be wrong to attribute this variation to prices, as it is due to the shift in quantities from one more expensive (or cheaper) product to the other.

The way to overcome this critical issue is to calculate the average price change using the Laspeyres Index, which holds constant the weights given by quantities. A third methodology for calculating the "representative" price change of an aggregate is to consider the median of the changes.

Competing price: the case of Handbags and Travel Bags

Given the international framework and methodology just described, what information can we then glean from the price increases implemented by the main exporting countries of Handbags and Tote Bags?

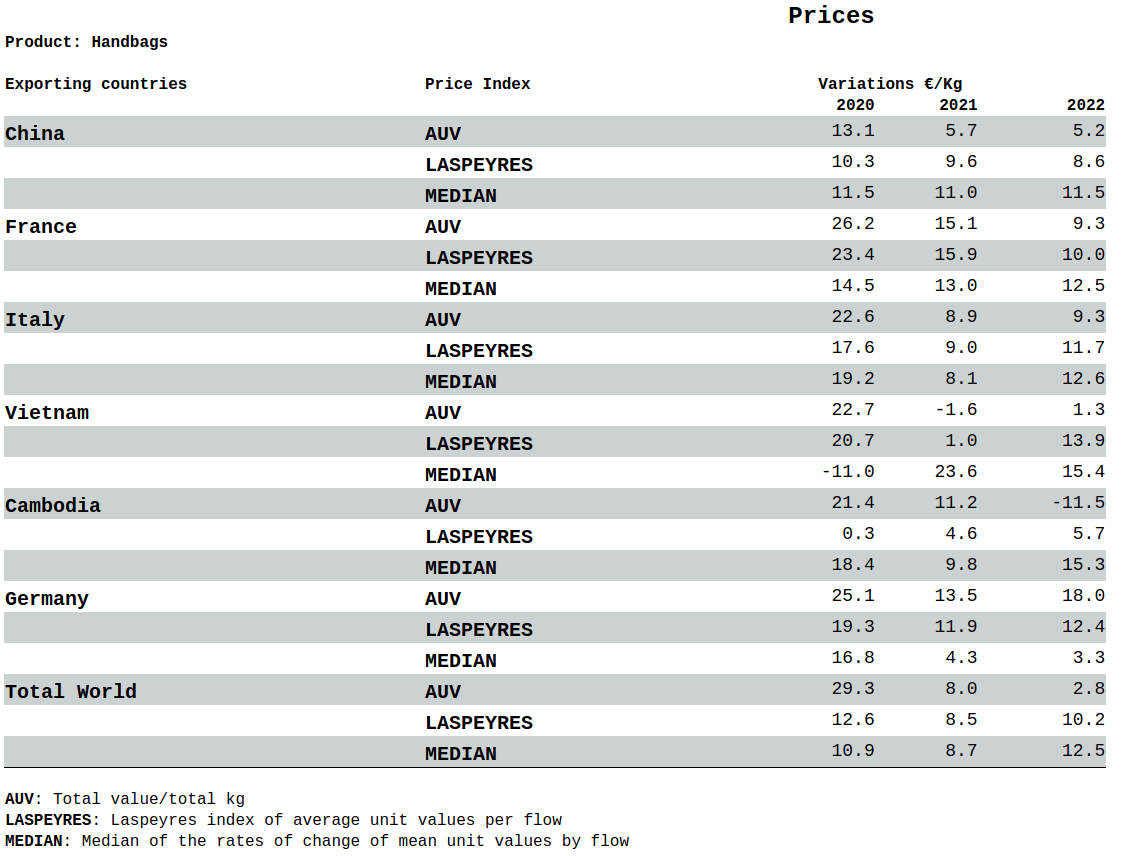

The tables shown show the export price changes recorded by the main exporting countries of the two products, comparing the figure for VMU, Laspeyres index and median of AUV changes.

Pricing policies of major handbag exporters

First, in the case of Handbags it is particularly significant to highlight how the increase in product prices has been close to double digits over the past three years, including 2020, testifying to how the most luxurious bands have shown relative resilience even in the pandemic context. Such a significant increase could, however, also conceal a gradual trend of decreasing average weight per bag, aimed at containing its size and promoting comfort.

This evidence emerges unequivocally from all the indicators in the table, and is particularly robust in the case of the Laspeyres index (Tab. 1).

Tab.1 – Handbags: changes in export prices of major competitors

Breaking down the analysis by different exporting countries, it was mainly European exporters, including Italy and France, headquarters of the major luxury fashion houses, to be characterized by the largest increases, largely above the global benchmark average over the three years of analysis. The result documents the ability of EU exporters to exercise their market power, aided by the existence of internationally recognized brands. In particular, France appears to have been ahead of the curve in progressive price increases, concentrating most of the increases in the years 2020 and 2021.

However, the increases did not only affect exporters in the higher price brackets, but also Cina and Vietnam, testifying to a possible upgrading of the two countries' supply structure.

The only exporter bucking the trend is Cambodia, for which increases were well below the period average (Laspeyres index).

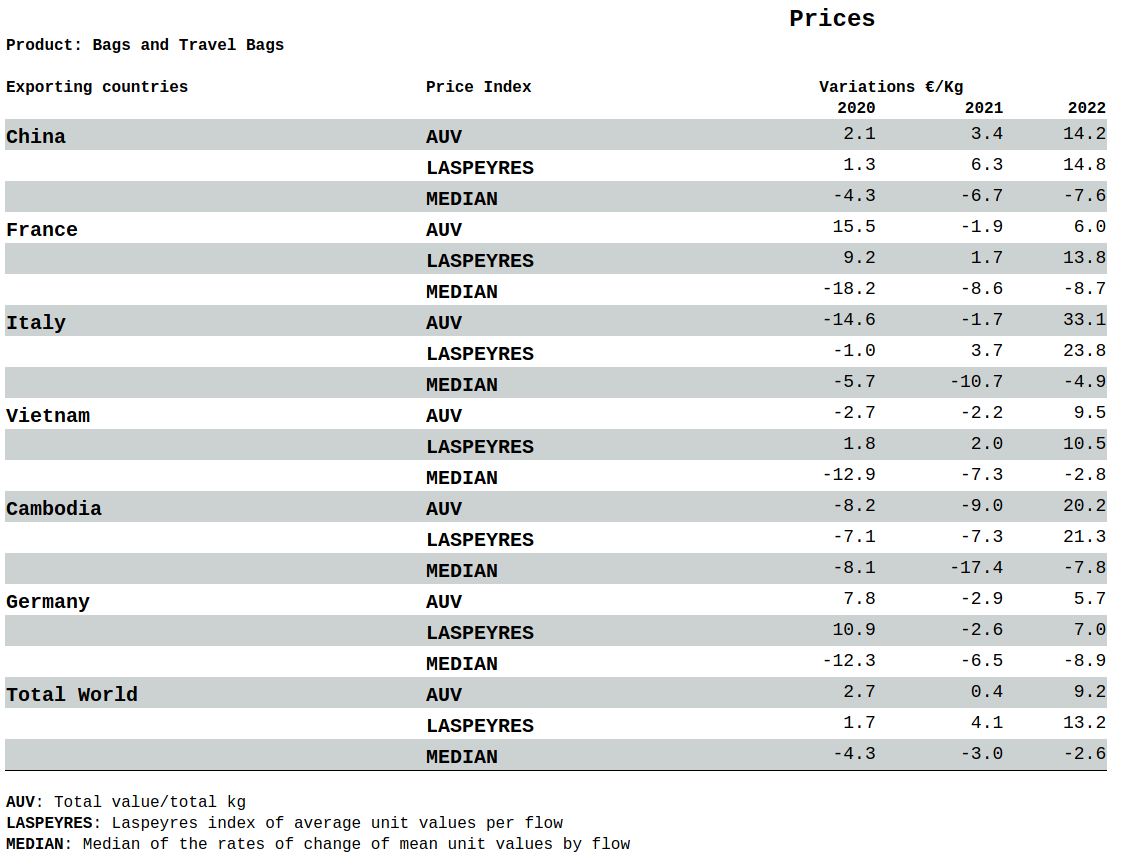

Pricing policies of major exporters of Travel Bags

A different industry picture emerges, however, in the case of Travel Bags: first, in this case, increases on an international scale are mainly concentrated in 2022, against an overall change of 13.2 percent, as reported by the Laspeyres price index (Tab.2).

Tab.3 – Travel bags: changes in export prices of major competitors

Over the past year, it is Italy that has recorded the largest increases, followed only by Cambodia, whose increases, however, can be attributed to a rebound process following a negative two-year period.

A second particularly interesting aspect is related to the sign discrepancy between the change in aggregate AUV and the median of AUV rates of change (MEDIAN). When faced with a positive aggregate change, the MEDIAN index gives us information on the distribution of these increases: in the case under analysis, in 50 percent of the markets served by the exporters in the table there was a price reduction. However, these are very small markets, which do not affect the overall result.

This result unites all major exporters in the sector and may testify to a more geographically concentrated market power than in the case of Handbags.

In the international framework just described, where the uncertainty associated with the dynamics of costs and prices practiced along the supply chain is still particularly significant, verifying the alignment of one's own pricing policies with those practiced by the main reference competitors, at the level of a specific business area, appears to be an exercise of analysis of high strategic value for a company, as highlighted by the case of Handbags and Travel Bags.