The dragon's slowdown and the implications for EU exports

Has the golden age of Chinese growth come to an end? What implications for major European exporters?

Published by Simone Zambelli. .

Slowdown Asia Importexport Foreign market analysis

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

At the current juncture, one of the questions that now often returns fervently among international economists and analysts pertains to the future of the Dragon Country: has China's golden period of growth come to an end?

After the difficulties experienced by the Asian giant following the "zero Covid" policies of pandemic containment, 2023 was supposed to be a year of restart for the Chinese economy. However, most economists agree that this restart is very fragile. Not surprisingly, over the summer months, the "consensus" downgraded Chinese growth estimates for 2023, with the possibility of a failure to reach the 5 percent growth target for the second year in a row.

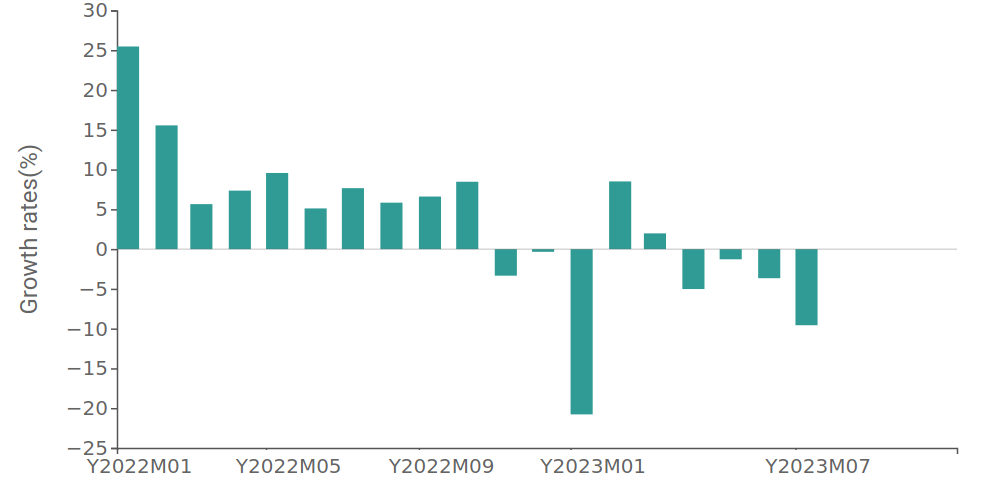

Foreign trade information also documents the difficulties of the Chinese economy: the following graph shows the monthly trend changes in the dollar imports of the Dragon country over the most recent quarters.

Fig.1 – Trend change in Chinese imports from the world

It is evident, how Chinese imports - as declared by the country at its office of Customs statistics – have now been in negative territory since late 2022, with the only exceptions being February and March.

The cyclical difficulties are also set against a backdrop of "structural" challenges for the country's economy, with a revival of growth seemingly closely tied to a strong revival of domestic consumption. According to economist Giorgio Arfaras, in fact, the transition to a developed economy can only occur if growth is motivated by consumption and not only to the current model closely linked to investment and exports. Fundamental transition, which will depend on the country's ability to build a welfare state model that can reduce the savings rate and stably increase consumption.

The implications of a slowdown in China's economy are, of course, significant on an international scale, taking into consideration the fact that, according to the International Monetary Fund's most recent estimates, the country is expected to contribute about 30 percent of total world growth in the current year.

Consequences that would also be relevant for European economies commercially linked with the Dragon country. In particular, the following analysis focuses on relations on the export front.

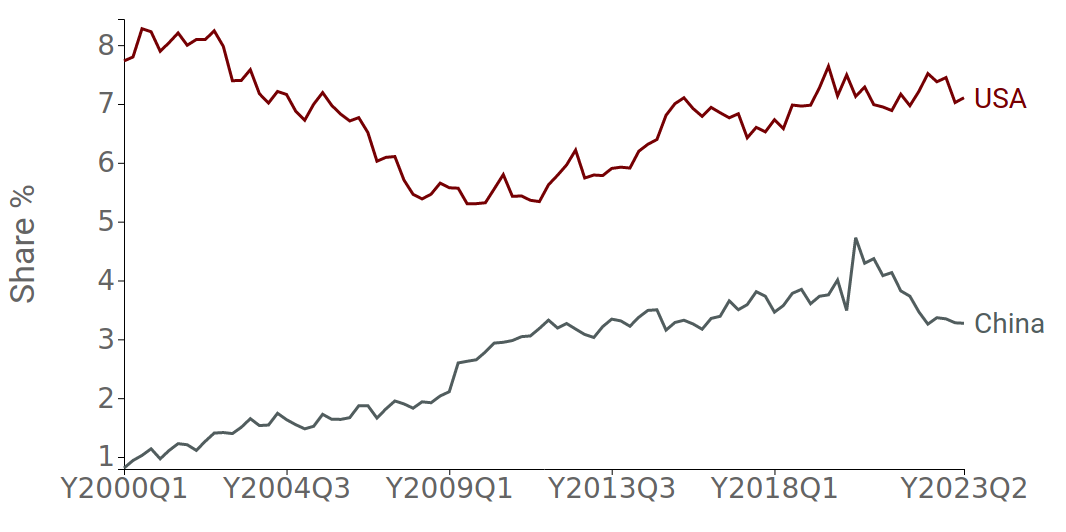

Indeed, over the decade, China has gradually grown as a destination market for European exports.

Fig. 2 – Dynamics of the share of European exports to China and the U.S.

While in the early 2000s, China did not even hold 1 percent of European exports, in the last 20 years its weight in the total destination markets served has increased to be close to about 3.5 percent. This has happened mainly as a result of the Great Recession. Particularly interestingly, the share of exports going to the U.S. market, on the other hand, have experienced the opposite dynamic in the same years.

However, since 2020, after a strong post-pandemic rebound, China's weight in total European exports to China has declined, currently standing at just under 3 percent.

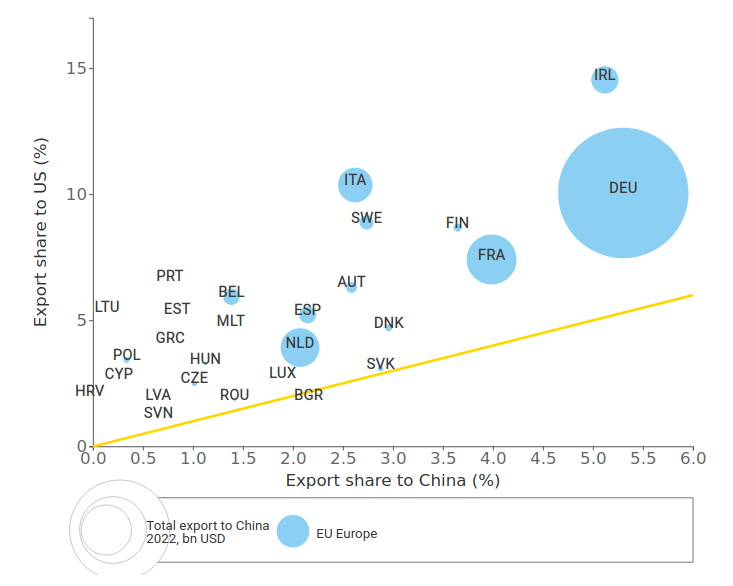

However, this dynamic hides relatively differentiated positioning for the different member states: the following graph positions European economies in relation share of exports directed toward China (X-axis) and share toward the U.S. (Y-axis); the size of the ball is proportional to the value of exports to China of the different states.

Fig. 3 – Export Share of European Countries to China and the US

(ball size is proportional to the level of exports of different states to China)

The graph makes it clear that the most exposed country turns out to be Germany, with an export share close to 7 percent, followed by Ireland and, at a relative distance, France. Italy, on the other hand, despite being one of the top 5 countries in terms of export value to China in 2022, has a relatively small export share to China of less than 3 percent, compared with an export share to the U.S. market that is quite comparable to that of Germany, and close to 10 percent.

China's import slowdown by sector

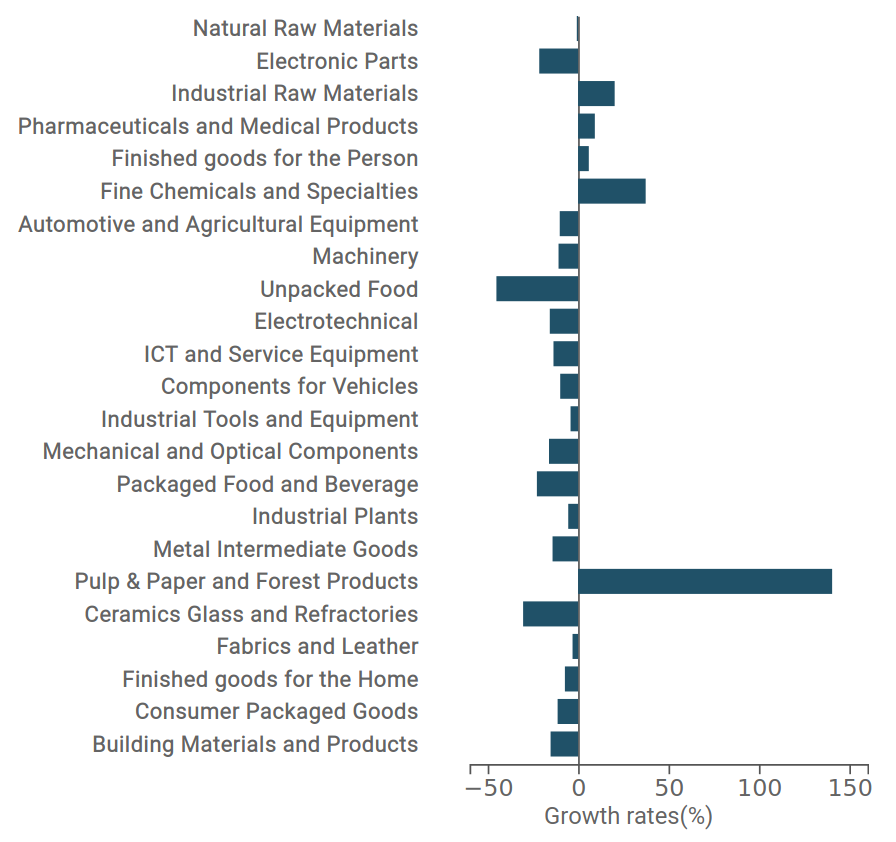

Given the picture just described, it is particularly significant to investigate which import sectors are experiencing the most significant falls, based on Chinese customs data collected and systematized by ExportPlanning (Fig.4).

Fig. 4 – Trend change in Chinese import

(first 7 months of 2023 / first 7 months of 2022)

It immediately jumps out as most sectors (shown in the graph in descending order of importance) are in negative territory, among which electronic components, in particular, stand out, with a change that falls below -20 percent, and more generally the entire electronics, electrical engineering and ICT tools sector. In addition to possible cyclical difficulties, the result naturally reflects the consequences of the technology clash that has been going on for some years now with the United States and related U.S. restrictive measures.

Also falling were durable goods, such as transport equipment, machinery and industrial equipment, and most intermediate goods, indirectly reflecting the difficulties in manufacturing. The only major exception is imports of intermediate goods in paper and wood, with the result attributable mainly to a mere rebound effect from the very negative results of the same period last year.

Among the few sectors in positive territory are health products and instruments (although slowing down compared to the same period last year), confirming the extent to which the Covid emergency is still affecting the Chinese population. Also holding up are finished personal products, dragged mainly by the jewelry sector, for which the nominal result also seems to be supported by a gradual increase in average unit prices.

Conclusions

The recovery of the Chinese economy still seems to have a highly fragile character and raises serious questions about the future pattern of economic growth in the Dragon country, marked by short- and long-term challenges.

Some European countries, such as France and Germany, could suffer major repercussions from the difficulties in the Chinese market; in contrast, from this point of view, Italy is more protected and much more linked in terms of export flows to the United States. However, it is clear the absolute importance that the "Chinese knot" represents in the possible future recovery of world demand: will China be able to return to a new season of relevant growth, pushing domestic consumption? Or is the era of the "Chinese miracle" really over?