US-China: a deal, at last

A focus on macroeconomic and exchange rate provisions

Published by Alba Di Rosa. .

Exchange rate Asia Dollar Trade balance Chinese yuan Trade war Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

After months of negotiations, tariffs and retaliation, a deal has been signed. On January 15, US president Donald Trump and Chinese Vice Premier Liu He signed a “Phase One Deal” in Washington, laying the foundations for the truce and overcoming part of the heavy uncertainty that has been weighing on the yuan and the world economy since the beginning of the trade war.

The signing of the agreement was widely expected by financial markets, after the long negotiations and the American president’s official announcement on December 31.

I will be signing our very large and comprehensive Phase One Trade Deal with China on January 15. The ceremony will take place at the White House. High level representatives of China will be present. At a later date I will be going to Beijing where talks will begin on Phase Two!

— Donald J. Trump (@realDonaldTrump) 31 dicembre 2019

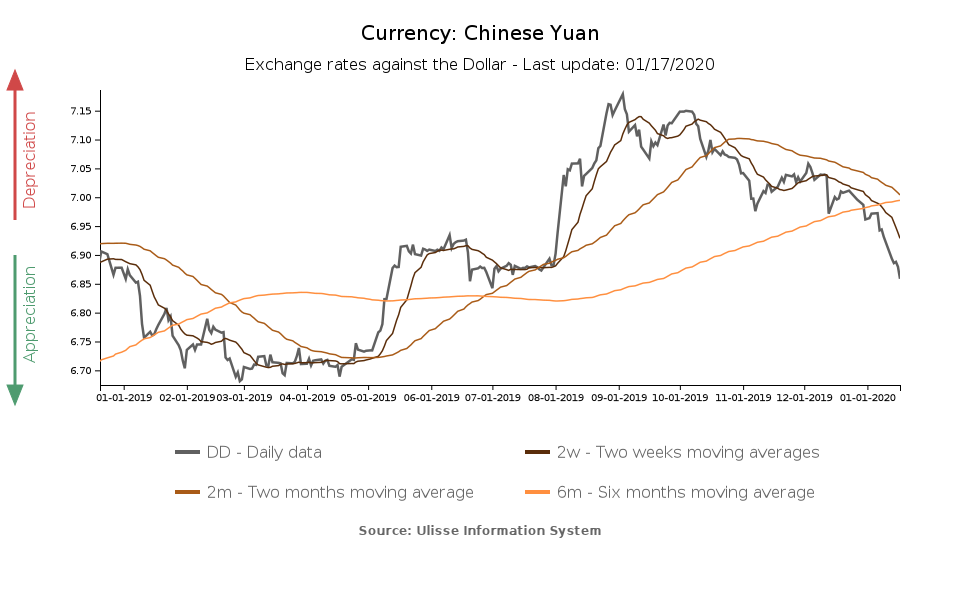

The event was celebrated by the Chinese currency with a strengthening compared to the greenback: over the last two weeks, the yuan gained 1.6 percentage points against the dollar. However, this dynamics is part of a general recovery trend that began in September, after a peak of maximum 2019 depreciation (7.18 yuan per dollar).

The content of the agreement

The "Phase One Deal" also touched on the currency theme. Negotiations between the two parties have in fact led to an agreement that requires changes and reforms to China's economic and trade regime in several key areas, including currency and foreign exchange issues.

In this context, the agreement implies the commitment of the parties to:

- “Achieve and maintain a market-determined exchange rate”

- Avoid competitive devaluations, e.g. through significant interventions in FX markets

- Avoid manipulation of exchange rates that could hinder a natural balance of payments adjustment or aimed at obtaining an "unfair competitive advantage".

As regards to transparency commitments, balance of payments and international reserves data should be regularly disclosed. To a large extent, these commitments are therefore in line with those previously made by China in the context of G20 and the International Monetary Fund.

An element of criticality for the US Administration, which is not mentioned in the agreement, is the publication of data about foreign exchange intervention, carried out by the People's Bank of China (PBOC) and indirectly through state-owned banks.

For their part, the US removed the label of "currency manipulator" - imposed by the U.S. Treasury on China in August - before the signing of the agreement. The label was imposed during one of the most tense moments of the trade war, when the PBOC allowed its currency to break the threshold of 7 yuan per dollar. The weakening of the yuan was considered an action "aimed at gaining an unfair competitive advantage in terms of international trade", a danger now diminished according to the report "Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States" (US Treasury, January 2020), given the strengthening of the yuan in the last months.

The case of the dollar

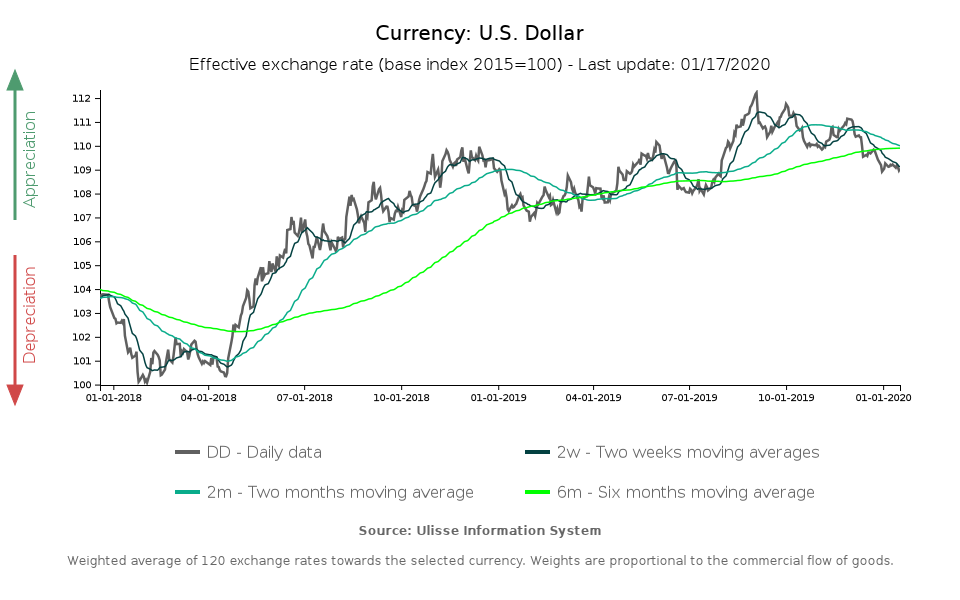

With regard to the other currency at stake, the US dollar, it shows an appreciation in terms of effective exchange rate since mid-2018; this strengthening has been fuelled, among other factors, by the global context of uncertainty and weak growth. This climate has generated a decrease in investors' appetite for risk, to the benefit of safe-haven currencies.

Since the beginning of September, however, as tensions gradually eased, the dollar began to lose ground, while the yuan recovered.

According to the IMF, the greenback remains overvalued: this is a cause for concern for the US as it risk to exacerbate trade and current account imbalances.

Trump administration’s tariff actions aimed at reducing imbalances could therefore be frustrated on several fronts: on the one hand with the phenomenon of trade diversion, i.e. the redirection of US demand (originally directed to China) towards other countries, and on the other hand on the currency front, with an excessive appreciation of the dollar that could jeopardize US competitiveness.