The Turkish lira roller-coaster

On the brink of a new currency crisis, the Erdogan administration announces a change of course in terms of economic policy

Published by Alba Di Rosa. .

Covid-19 Exchange rate Emerging markets Turkish lira Uncertainty Exchange rate risk Economic policy Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

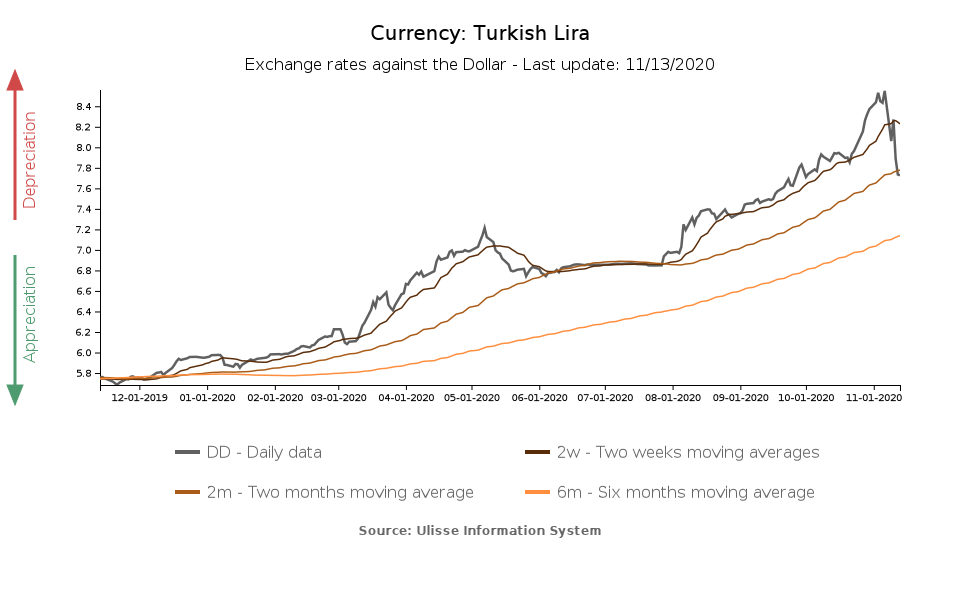

One of the currencies that has recently been in the eye of the storm is most certainly the Turkish lira, which showed very intense fluctuations between October and November. Between the last ten days of October and the first days of November, the currency lost almost 9% of its value against the dollar, reaching the historical high of 8.55 TRY per USD. At the beginning of the year it took less than 6 lira to buy a dollar: the overall fall therefore amounts to about 40%.

Even in the months before the latest fall, the weakening of the lira against the dollar has been quite significant - basically a continuous trend since the beginning of August; then, since the end of October, this trend has shown an acceleration, as can be seen from the graph below.

In the last week, instead, the Turkish currency has abruptly reversed this trend, recovering in a few days 9.6% of its value against the greenback, and closing today at 7.73 TRY per USD - back to early October levels. Which events guided this dynamics?

The fall

Taking a closer look at the timing of the weakening, we can see that the fall of the lira started roughly from October 22, the day of the last meeting of the Monetary Policy Committee of the Turkish central bank. On this occasion, the Central Bank of the Republic of Turkey (CBRT) decided, contrary to the expectations of the markets, not to increase the reference interest rate, which remained at 10.25%. In a context of inflation close to 12% (October 2020, YoY), in particular acceleration on a MoM basis (+2.1%), and previous weakness of the currency, the start of an acute phase of depreciation signaled investors' decisive loss of confidence in the central bank's ability to support the lira.

In the same days, the currency was also negatively affected by geopolitical tensions with the US and the EU, the general climate of uncertainty on the markets related to the US elections, as well as the introduction of new restrictions in many countries, related to the second wave of Covid-19, which weakened risk appetite.

The recovery

The subsequent leap of the lira, which led it to recover ground, is linked to the events of last weekend: on November 7, the governor of the Turkish central bank Murat Uysal was replaced by Naci Ağbal; the next day Berat Albayrak, son-in-law of President Erdogan and Minister of Finance of the country, announced his resignation. Between the closing of the markets on Friday, November 6 and the reopening on November 9, the Turkish lira rebounded by 5.7% against the dollar.

In addition to the change in the economic leadership of the country, on Wednesday came the official announcement by President Erdogan of a change of direction in terms of economic and monetary policy, towards a more orthodox approach: this has therefore generated the strong approval of the markets for the opening of Ankara towards more conventional policies, which are expected to lead to a stabilization of the Turkish currency and economy.

The currency continued its recovery in the following days, supported by this news, and in the same way one of the main stock market indexes in the country, the BIST, showed a significant upward trend.

Turkey: BIST 100 Index

The key date to monitor at this point is November 19, when the next central bank monetary policy meeting will be held. Given the announcements made by the Turkish administration, a rise in interest rates is expected, which could mark the start of the new monetary policy strategy; however, this in itself will not be enough to revive the fortunes of an economy already relatively tried even before the Covid crisis, and for which a contraction in GDP of -5% is expected for the current year (source: World Economic Outlook, October 2020).

If President Erdogan's seems willing to restore central bank's credibility in the eyes of the markets, this change of leadership has certainly not increased its independence from the central government, since the new governor of the CBRT is a former minister, member of the ruling party. Nevertheless, if in the coming weeks and months the central bank and the Ministry of Finance will follow up their announcements, what will follow may still be better times for the lira.