Second Wave: Covid Fear Hits Financial Markets

Published by Alba Di Rosa. .

Exchange rate Central banks Euro Uncertainty Covid-19 Japanese yen Exchange rate risk Dollar Swiss franc Great Lockdown Exchange ratesThis week financial markets were shaken by the second wave of Covid-19, which has now officially started in many countries around the world, with strong accelerations in the number of new daily infections. Financial markets have been affected by a general climate of sell-off, in relation to government announcements of more restrictive measures to slow down the pace of the epidemic.

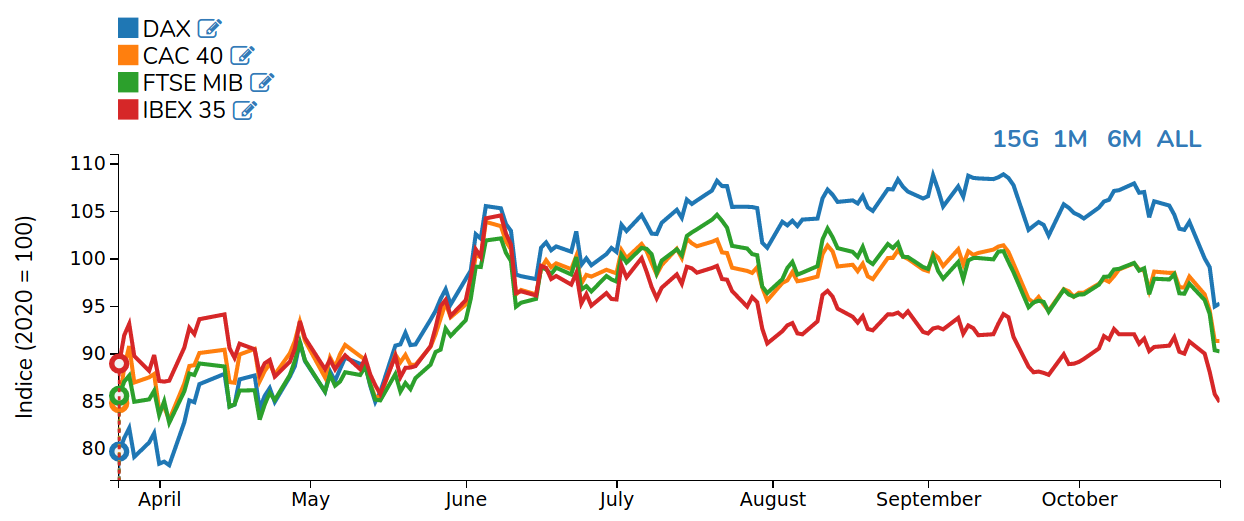

Stock indexes, both in Europe and in the US, have suffered a blow. After the fall recorded during the spring and the stability of the summer months, since the second half of October stock indexes in the major European countries have recorded a synchronized fall, particularly over the last week, in the face of the increase in Covid-19 confirmed cases and the consequent deterioration of economic recovery prospects.

Stock exchange indexes: Germany, France, Italy and Spain

Index: 2020=100

In view of the growing numbers of infections and consequent governments' containment measures, the economic recovery that has just begun in Q3 could already be at risk. In recent weeks, experts have begun to talk about an inevitable "double dip", a second recession in Q4-2020, after the general recovery observed in Q3.

Today Eurostat released data on EU GDP growth in Q3-2020: the data show a 12.7% rebound for the Eurozone economy in Q3 (-4.3% YoY), a recovery that has exceeded expectations, after QoQ falls of -3.7% and -11.8% respectively recorded in Q1 and Q2.

A further contraction in the fourth quarter would thus drive the recovery away and further amplify the economic impact of the pandemic. Signs in this sense come from the Eurozone PMI for the service sector which, in September and again in October, was below the threshold of 50, after exceeding it in July and August.

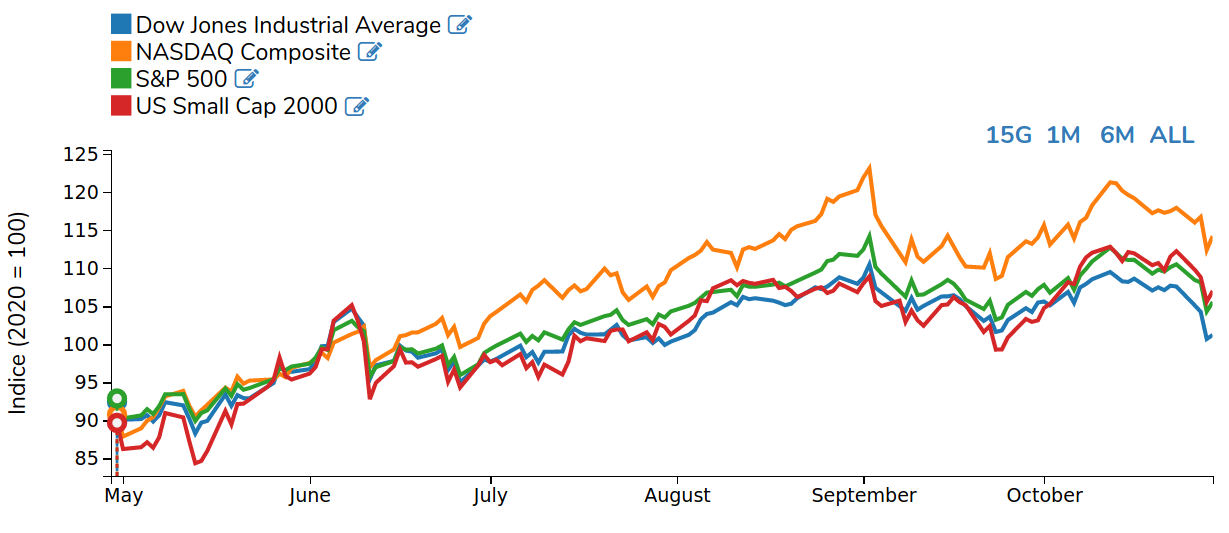

Since early October, US stocks have shown a dynamics similar to the one of their European peers. On the contrary we can spot differences in their trend during summer months, when European stock indexes showed a substantial stability and Wall Street an almost continuous growth until the beginning of September.

US Stock indexes

Index: 2020=100

US financial markets are therefore pricing the risk of a double dip, as well, with Covid-19 infections showing a new upsurge in the country. On top of that, uncertainty is also present in relation to the upcoming presidential elections.

In line with the strong volatility of US stock exchanges, the VIX index reached on Wednesday a 4-month high.

FX: back to safe-haven

As regards currency markets, exchange rates have also suffered from the renewed climate of tension, to the benefit of safe-haven currencies. In the last few days, the dollar has shown a recovery against to the euro, from 1.18 to 1.17.

In addition to the safe-haven role of the greenback, data on economic growth in the US in the third quarter, released yesterday by the Bureau of Economic Analysis of the US Department of Commerce, and resulted above expectations, also supported the dollar. Compared to the previous quarter, the US economy grew by 7.4%, corresponding to an annualized rate of 33.1%, after an annualized economic downturn of 31.4% in Q2.

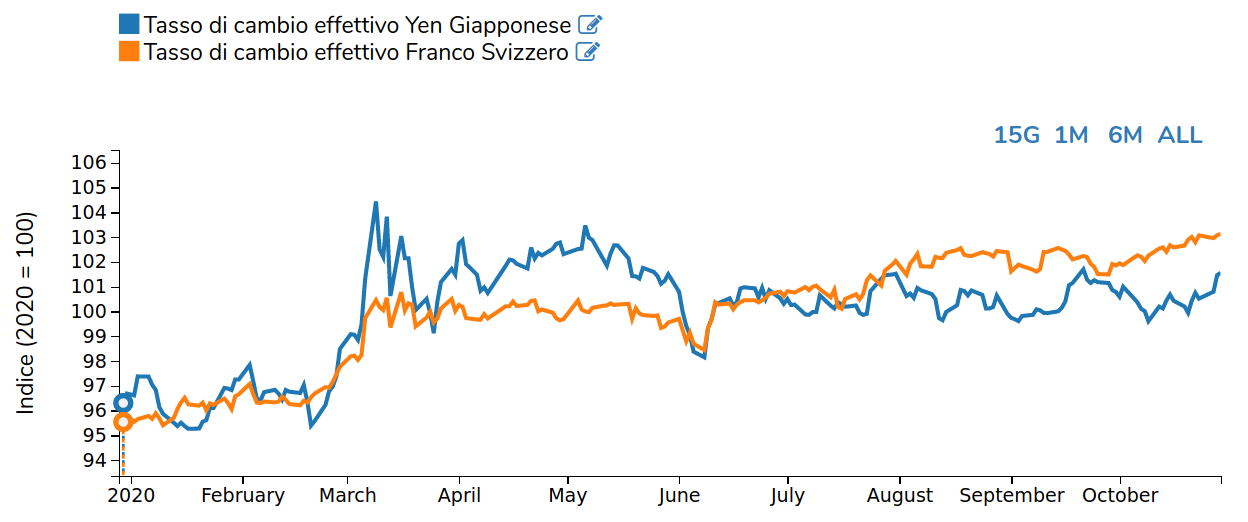

The Japanese yen and the Swiss franc have in turn shown a strengthening since the beginning of the October "second wave": in the last two weeks the yen has gained 1.5% and the franc 0.9% in terms of effective exchange rate, as can be seen from the graph below.

Effective exchange rate: Japanese yen and Swiss franc

Index: 2020=100

The euro, on the contrary, is showing in the last days a certain weakness against the greenback, mainly due to the recent monetary policy statements of the European Central Bank, but also to the emergency context related to the pandemic that is taking hold again in Europe and is bringing back into the field the threat of new lockdowns - already announced for France and Germany on Wednesday.

In a context of renewed challenges to health protection and economic growth opportunities, yesterday the Governing Council of the ECB, while keeping rates unchanged for the time being, opened the doors to new monetary stimulus in December. The Governing Council spoke about "recalibrating" the available instruments, in order to "respond to the unfolding situation and to ensure that financing conditions remain favourable to support the economic recovery and counteract the negative impact of the pandemic on the projected inflation path".