India: New Covid Wave Poses Risks to Economic Recovery

Published by Alba Di Rosa. .

Covid-19 Exchange rate Asia Emerging markets Uncertainty Exchange rate risk Economic policy Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

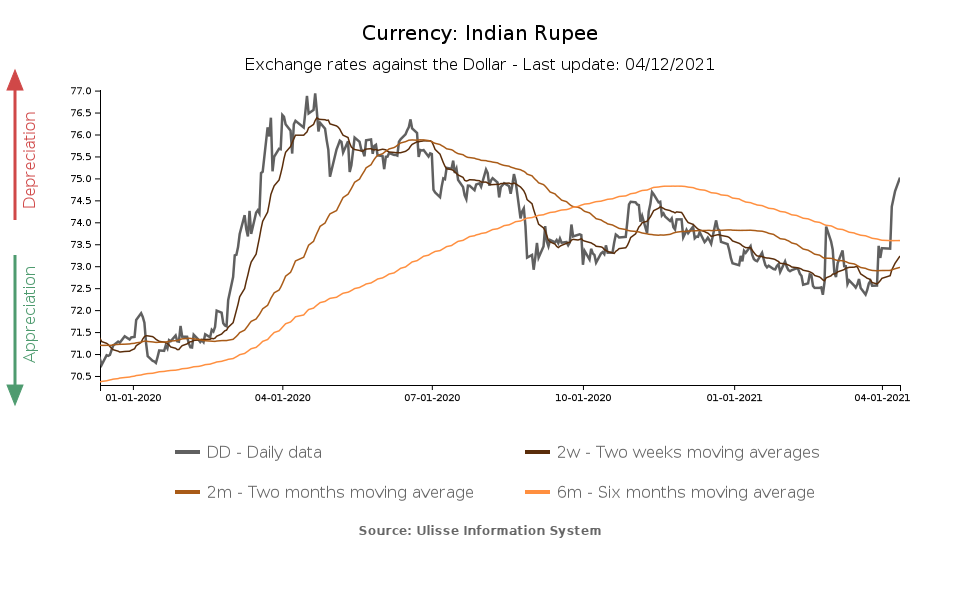

A currency that has attracted international attention during April is the Indian rupee. After a contained but progressive strengthening phase, which led the rupee to partially recover from the effects of the Covid shock, the currency has suffered the largest depreciation against the dollar in the cluster of EM floating currencies since early April, losing 2.2 % of its value against the greenback.

Despite positive macroeconomic projections for the long term, the currency of the world's second most populous country seems to have recently felt the impact of two factors: the new wave of the Covid-19 epidemic, that has been spreading in the country since March, and the Reserve Bank of India's (RBI) latest expansionary monetary policy action.

Macroeconomic projections: sustained growth in 2021

In the April scenario recently released by the International Monetary Fund (World Economic Outlook),

the country's growth prospects appear optimistic. However, the IMF's Chief Economist herself pointed out that the forecasts were made before the start of the wave of the epidemic currently underway in India.

Estimates have been revised upwards for both 2020 and 2021, due to a stronger recovery than initially expected after the easing of lockdowns. The contraction of India's GDP in 2020 was revised to -8% from -10.3% in the October scenario, while the forecast for 2021 increased from 8.8% to 12.5%. The economy is also expected to continue growing at yearly rates above 6% in the period 2022-2026.

New wave of Covid-19

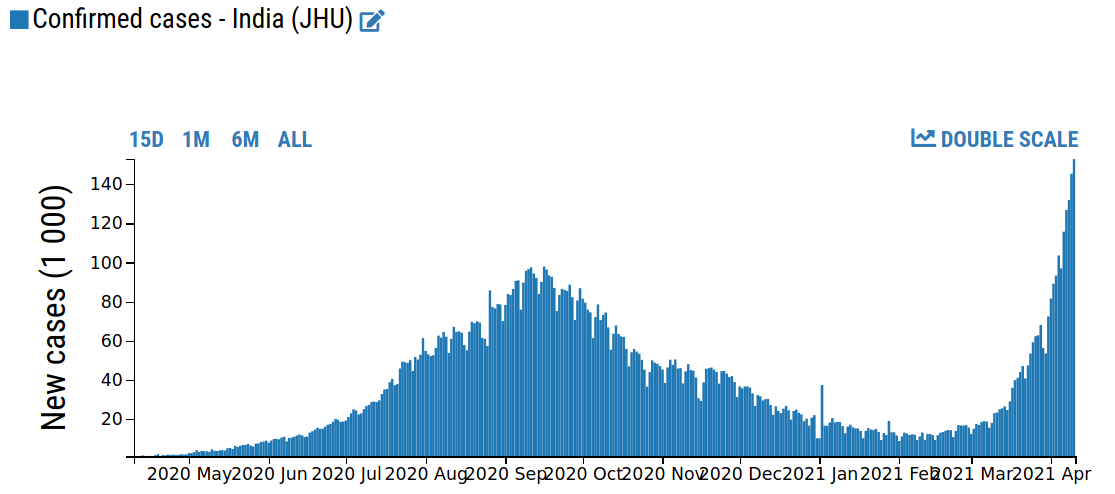

The recent uptick in Covid-19 infections has added considerable uncertainty to this scenario, and thus to the economy's chances of recovery, as stated by the governor of the Reserve Bank of India.

After a period of stability above 10,000 new infections per day in the first two months of the year, the curve sharply turned upwards again from March 2021. What is worrying is the level and speed of the increase, which is characterized by an exponential trend. The level of daily new infections has already surpassed the peak of the previous wave, exceeding 150,000 new confirmed cases on Saturday, April 10 (source: DailyDataLab).

Deaths are also rising fast, from daily figures of about a hundred in February, to almost 900 last Saturday.

In this context, there are also concerns about the vaccination campaign, which is not shining in terms of speed and efficiency. According to currently available data, India records 7.57 vaccinations per 100 people, ranking 58th in the world (source: Our world in data). In the face of the emergency on the domestic front, India - one of the world's largest producers of the AstraZeneca vaccine - is slowing down exports to speed up its domestic vaccination campaign.

Monetary policy action

So while the new wave of the epidemic, with related concerns about the impact of restrictions on economic activity, has weighed on the Indian currency in the recent period, a key factor driving the weakening of the exchange rate relates to a recent central bank action.

The Reserve Bank of India's latest Monetary Policy Committee was held between April, 5 and 7. It was unanimously agreed to leave the key interest rate unchanged at 4% and to continue with an accommodative monetary policy for as long as necessary to support sustained growth and mitigate the impact of Covid-19 on the economy.

The decision that surprised markets, which had not expected such dovishness1, is the implementation, for the fiscal year (FY) 2021-22, of a Government Securities Acquisition Programme (G-SAP 1.0). The central bank is thus committing in advance to purchase a certain amount of government bonds, with the aim of encouraging an orderly and stable development of the yield curve, while maintaining accommodative liquidity conditions. The aim is to ensure financial conditions that can help consolidate the economic recovery.

For Q1 of FY2021-22, the RBI has already committed to purchase INR1 trillion worth of securities. The first purchase will be conducted on April 15.

Bond yields also felt the effect of the central bank's decision: the yield on 10-year Indian bonds fell from 6.12% to 6.02% over the past week.

1. Expansionary monetary policy line favouring low interest rates.