FX Update: Towards the Past and the Future

The cases of Afghanistan and Nigeria

Published by Alba Di Rosa. .

Exchange rate Exchange rate risk Economic policy Central banks Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

In recent weeks, two countries in the group of frontiers and least developed have taken center stage in the forex scene, due to two different turning points: the case of Afghanistan, moving towards the past, and that of Nigeria, heading towards a scenario that appears like a possibile future for the currency world.

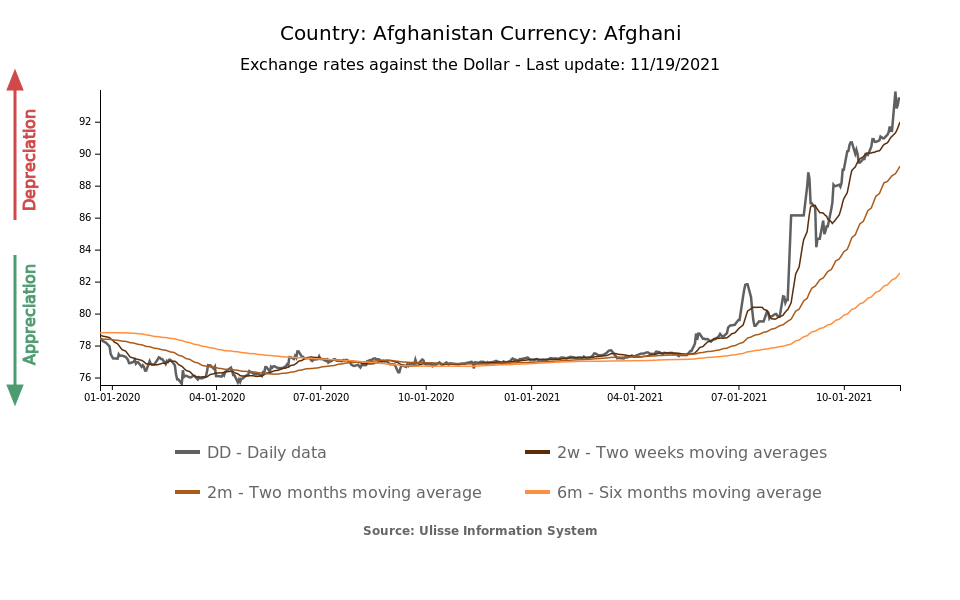

Afghanistan bans the use of foreign currency

In mid-August, Afghanistan was marked by the recapture of Kabul by the Taliban. The historic shift that took place in the country last summer, and its related socio-economic consequences, obviously led the national currency to gradually depreciate, after years of a managed and relatively stable exchange rate regime. The weakening trend of the currency, which started during the summer following the Taliban offensive, continued during the autumn, as can be clearly seen in the chart below.

The latest FX news about the country concerns the introduction, in early November, of a total ban on the use of foreign currency - under penalty of legal consequences. This news is all the more relevant in a country where the use of foreign currency was widespread - particularly the dollar and, in border areas, Pakistani and Iranian currencies (see our previous article).

Nigeria embraces the digital future

In contrast, Nigeria, Africa's most populous country and the continent's largest one in terms of GDP, seems to be looking to the future. In fact, Nigeria has recently risen to the center of the economic scene for the launch, on October 25, of the eNaira, a central bank digital currency (CBDC). As stated by the International Monetary Fund (IMF), this is the second case in the world of a CBDC fully open to the public, after that of the Bahamas.

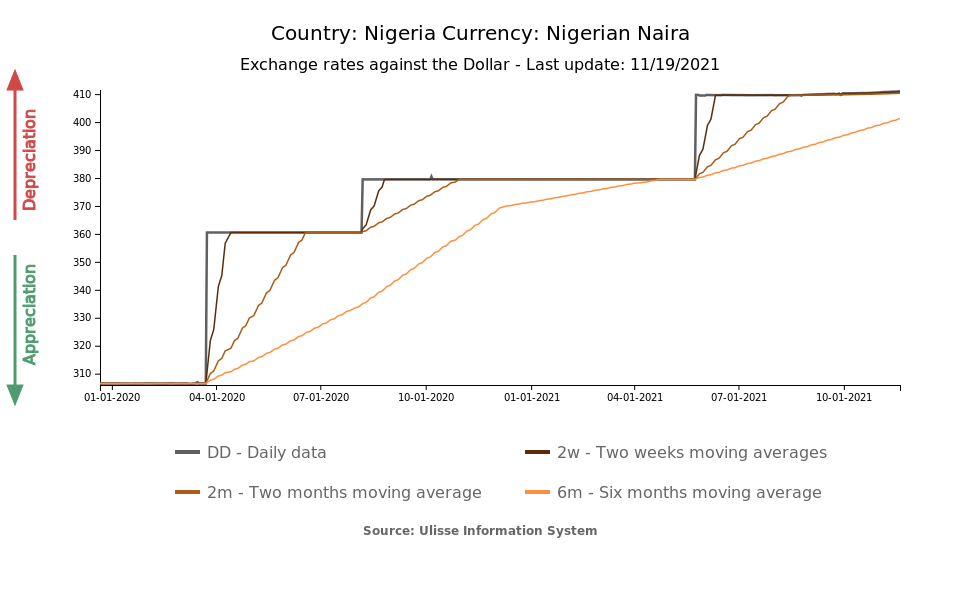

The Nigerian naira. Starting from the traditional currency currently in force in the country, according to the IMF Nigeria adopts a stabilized arrangement (see the Annual Report on Exchange Arrangements and Exchange Restrictions, 2020): the country's currency therefore boasts a limited flexibility towards the dollar and the Central Bank of Nigeria plays a key role in managing the exchange rate - which tends to be kept within the desired range.

As you can see from the chart below, the currency shows periods of complete stability against the dollar, followed by sudden weakenings due to central bank's decisions.

According to Bloomberg, these falls indicate the central bank's intention to move toward greater flexibility in the exchange rate, thereby achieving an exchange rate that more closely reflects actual dynamics going on in the black market.

In this context, how does the CBDC fit in? The central bank digital currency, as the name implies, is a digital currency issued by the central bank. It is therefore an official currency, in spite of its virtual form. It differs, for example, from the well-known Bitcoin because it is issued and controlled by the central bank of the country of interest, although it assumes the digital form that it shares with cryptocurrencies.

The topic of CBDCs has been gaining momentum in recent years. According to a paper by the Bank for International Settlements1, since late 2018 central banks have been showing an increasingly positive approach to CBDCs in their speeches.

More central banks around the world are therefore delving into this topic: for example, a group of 7 central banks (Bank of Canada, Bank of England, Bank of Japan, European Central Bank, Federal Reserve, Sveriges Riksbank, and Swiss National Bank), together with the Bank for International Settlements, is currently working to explore this topic, with a view to its possible future adoption in an increasingly digital economy.

While eNaira uses the same technology as Bitcoin, unlike classic cryptocurrencies it is subject to stringent central bank controls and derives its value from the traditional currency, to which it is pegged. The objectives for which it was introduced are highlighted by the IMF as follows:

- increase financial inclusion;

- reduce remittance-related costs, in a country where incoming remittances are significant;

- reduce the role of the informal economy by introducing a methodology of agile and inexpensive, but tracked and therefore more transparent transactions.

While the risks of such a digital turn are inevitably significant, the IMF shows its availability to help, unlike what happened with the adoption of Bitcoin in El Salvador. This path therefore seems to show the possibility of combining the new world of digital currencies with the traditional monetary one.

1. BIS Working Papers, NO 880 - Rise of the central bank digital currencies: drivers, approaches and technologies