Cosmetics industry: world markets accelerating

Published by Marcello Antonioni. .

Fashion Marketselection Health products Export markets Foreign markets Uncertainty International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

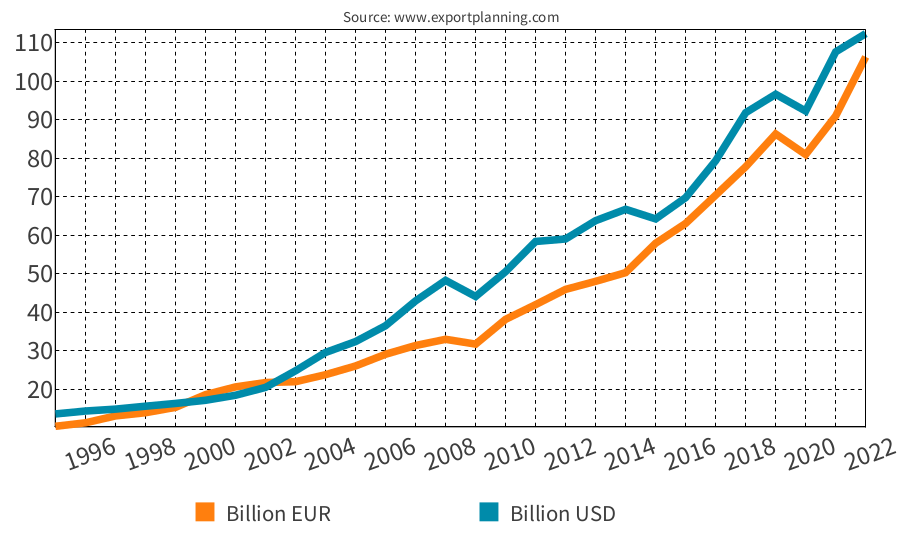

The Beauty & Cosmetics1 sector has achieved another record year: in final 2022, based to pre-estimates ExportPlanning, the world trade of the sector it is expected to well exceed the 100 billion euro threshold, settling at 106.3 billion (+17% compared to 2021). This performance is part of a trend of high long-term growth: in the last decade (2013-2022) the increase in sectoral world trade in euro values was a total of 132 per cent, with an average annual rate (CAGR) close to 9 percentage points.

World trade of cosmetic products

Even in the 2023-2026 scenario, despite an expected slowdown in the international economy, world trade in beauty & cosmetics products is expected to continue to grow at an average annual rate of more than +7% in euro values.< /p>

The dynamics of intense growth in world trade in the sector are underpinned by the phases of acceleration experienced by imports from various international markets, mainly Asian, in the various areas of business in the sector.

In the following, some particularly representative cases of this phenomenon will be examined, at the level of the individual business areas of the sector.

Protective creams and make-up preparations

The protective creams and make-up preparations business area has been experiencing a great international development: in the last decade, world trade in this business area has in fact more than tripled in euro values, with a 2022 pre-estimate of around 57 billion euros (compared to 18 billion in 2021), which the Covid-19 crisis has not affected in any way.

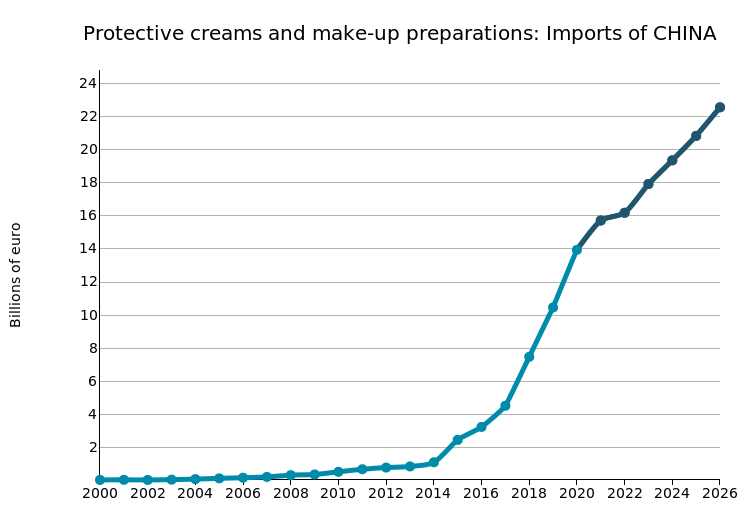

In this context, there are numerous markets undergoing acceleration at an international level; the following are particularly noteworthy:- China: this is a market that has literally "taken off" in terms of imports of this business area. As the graph below illustrates, after a prolonged phase of latency (with values just over one billion euros), starting from the middle of the last decade, Chinese imports of protective creams and preparations for makeup have embarked on a phase of strong acceleration, reaching this year (according to ExportPlanning pre-estimates) to exceed 16 billion euro. This phase of growth is also expected to be confirmed in the forecast scenario to 2026 (reaching 22.6 billion euros);

- United States: this is a market that has experienced a phase of strong growth in the last decade, with values more than tripling in the last decade (from 1.4 billion euros of imports in 2012 to 4.2 billion in pre-final 2022), and expectations of a consolidation of this growth in the scenario to 2026 (5.5 billion euro);

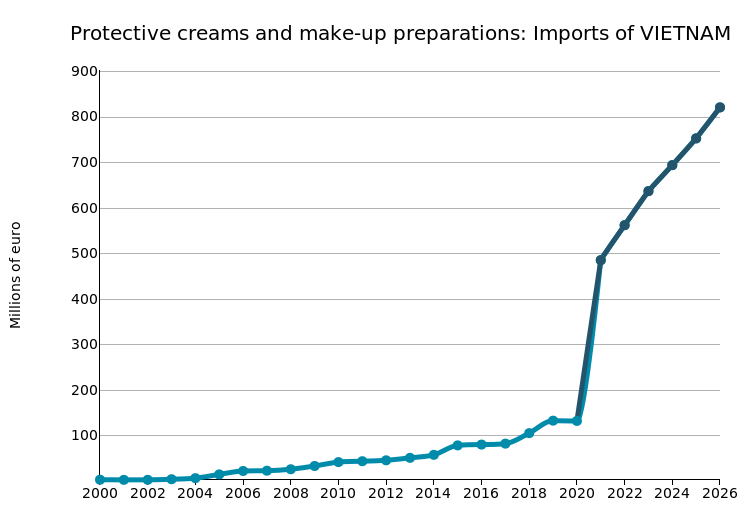

- Vietnam: this is an emerging market, which is growing at particularly accelerated rates: in the last five years (2017-2022) Vietnamese imports of protective creams and make-up preparations have gone from still low levels (less than 83 million euros) at over 562 million in the 2022 pre-final balance. The ExportPlanning forecasts set up a scenario of continued market growth (expected to exceed 820 million euros in imports over the horizon to 2026).

Source: ExportPlanning-Forecast Datamart

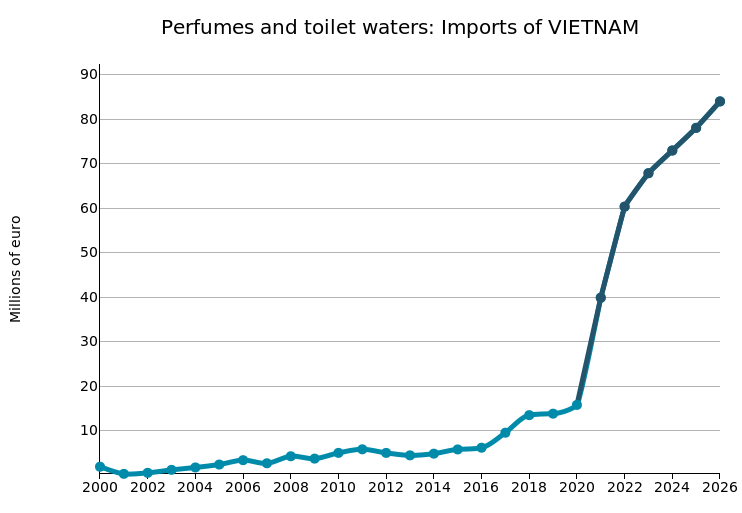

Perfumes and toilet waters

In 2022, world trade in the perfumes and toilet waters business area showed a dynamic of high growth, with expectations at the end of the year of a new record value in world trade, equal to approximately 24 billion euros (+27.1% compared to 2021; +80.4% compared to ten years earlier).

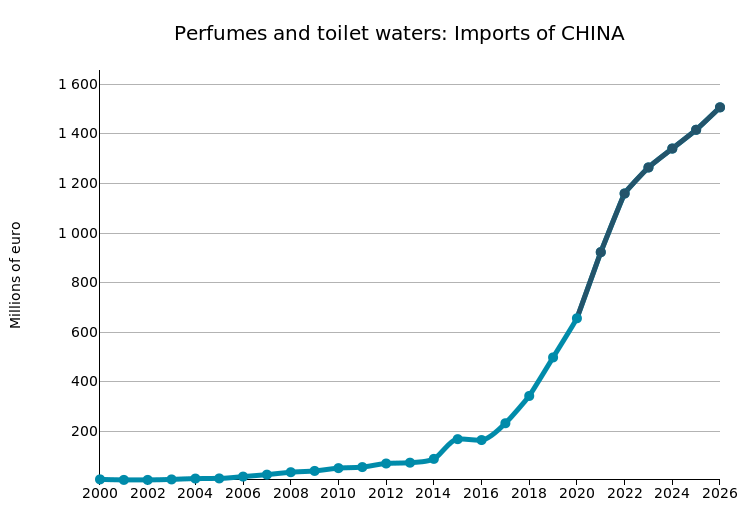

This performance originates in numerous markets in an acceleration phase in their imports. The main acceleration markets in the business area considered are the following:- China: this is a market that is already dimensionally significant in this business area (4th world importing country in 2022), which has recorded exponential growth in the last decade, going from 70 million euros of imports in 2012 to around 1.2 billion euros estimated at the end of 2022. In the 2026 scenario, the threshold of 1.5 billion euros is expected to be exceeded;

- Vietnam: in this case it is still a niche market, which has however experienced a phase of very strong acceleration in imports in recent years: from values below 10 million euros in 2017 this year (pre-estimates) it has exceeded 60 million euros. In the 2026 scenario, the achievement of a value of 84 million euro is expected;

- Saudi Arabia: this market has an intermediate size to the previous two, in terms of imports of the business area considered, with an estimated value of 448 million euros in 2022. This is about 140 million euro higher than five years earlier (+45%), testifying to a significant phase of acceleration. This growth dynamic is expected to continue in the forecast scenario to 2026, with an expected value close to 510 million euro.

Source: ExportPlanning-Forecast Datamart

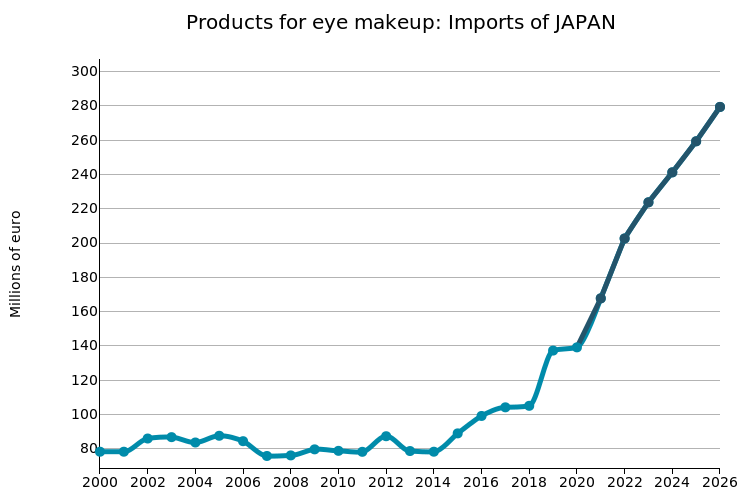

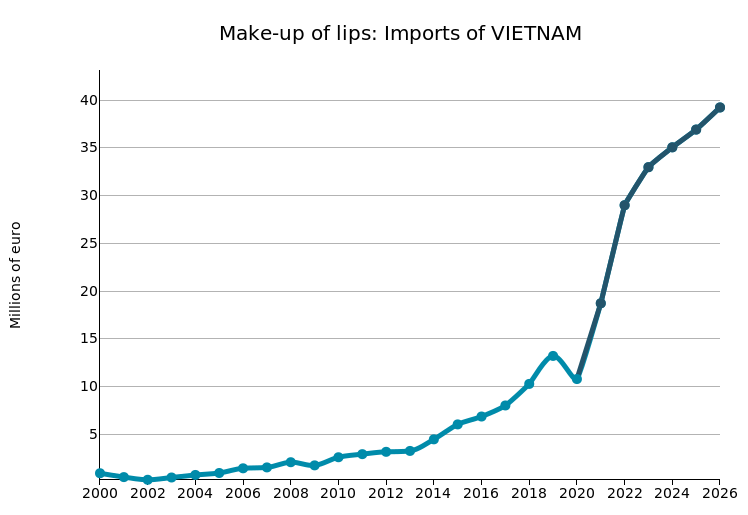

Makeup products

The make-up products business area, after a phase of very intense growth (+90% in the period 2015-2019), was strongly affected by the Covid crisis in the two-year period 2020-2021, with an overall fall in world trade of more than 23 percentage points, only partially recovered in 2022.

Even in the most recent period, however, some markets have shown an acceleration phase in their imports, such as the following for example:- Japan: in the eye make-up products segment, the current year is expected to close at 203 million euros, on levels that are almost double those of the two-year period 2017-2018, testifying to a phase of very intense growth, expected to continue also in the forecast scenario to 2026 (reaching 279 million euros);

- Vietnam: in the lip make-up products segment, it has achieved strong acceleration in the last two years (2021-2022), reaching close to the threshold of 30 million euros (compared to a value of just over 10 million in 2020); this growth dynamic is expected to consolidate in the 2023-2026 scenario (reaching 40 million euros).

Fonte: ExportPlanning-Datamart Previsioni

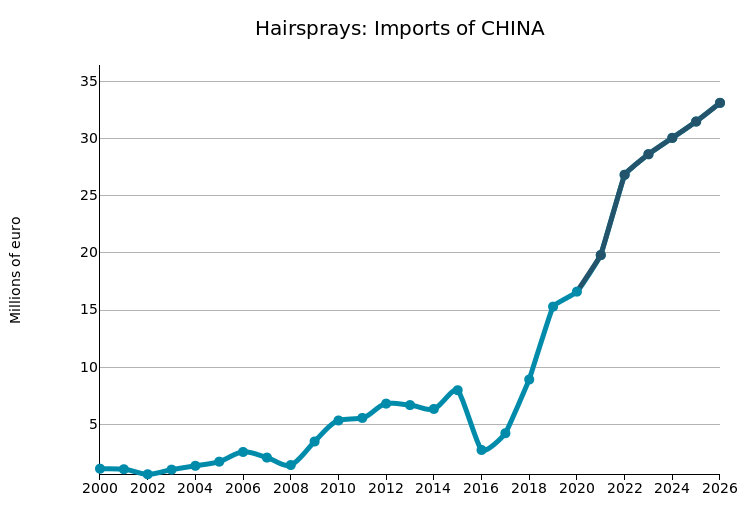

Hair products

The hair products (lotions and lacquers) business area has experienced strong growth in world trade in the last two years, arriving in 2022 (according to ExportPlanning pre-final data) close to 10 billion euros. These are almost double levels compared to those of just a few years ago.

The main accelerating markets, driving the growth of world trade in this business area, are the following:- China: this is a market that has grown exponentially in the space of a few years: from values in 2016 of less than 100 million euros, Chinese imports of hair products have arrived this year ( ExportPlanning pre-estimates) at levels close to half a billion euro. The ExportPlanning forecasts for this market are for a continuation of the growth phase to 2026 (with the achievement of a value of over 660 million euros); in particular, we note the acceleration phase underway in the hair sprays segment (see the graph below);

- Germany: the German market has shown in the last decade (2013-2022) an overall growth close to +90% in euro values in imports of hair products; this increase dynamic is expected to consolidate in the 2023-2026 scenario (reaching a value of approximately 670 million euro);

- United States: in the most recent two-year period (2021-2022) the US market has achieved an overall increase of more than 60 percentage points in euro values in imports of hair products, for a estimated value in the final balance for this year of over 1.4 billion euros (against 893 million in 2020). In the forecast scenario to 2026, a further increase of around 436 million euros is expected, coming close to the value of 1.9 billion euros.

Depilatory products

In the last decade, the value in euros of world trade in the depilatory products business area has more than doubled, going from less than 2 billion euros in 2012 to an estimated 4.1 billion in the final balance 2022.

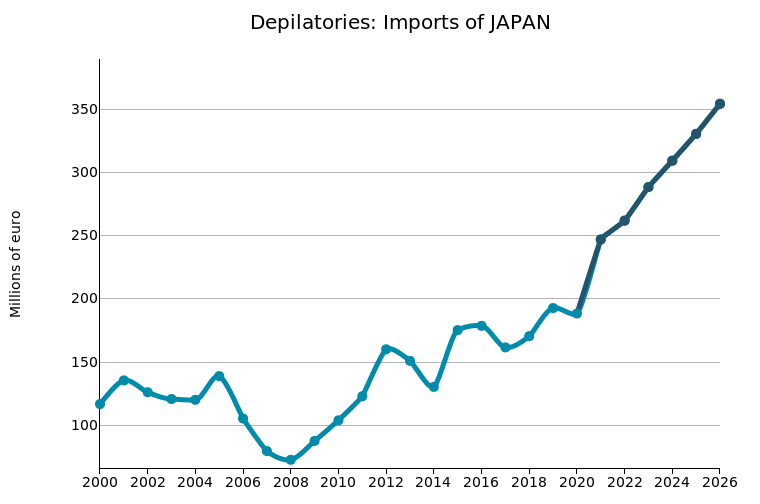

The main accelerating markets, underlying this excellent performance, are the following:- Japan: as the graph below shows, Japanese imports of depilatory products have shown a cumulative growth of more than 60 percentage points in euro values in the last five years (2017-2022), reaching the record figure of 262 million euros (pre-estimates 2022). In the 2023-2026 forecast horizon, the market is expected to consolidate these growth dynamics, reaching over 354 million euros in 2026;

- France: this is another market undergoing acceleration, which in the last decade (2012-2022) has seen imports of depilatory products more than double (expected at the end of the year at 213 million of Euro). Over the forecast horizon, a new high point is expected to be reached (251 million euros in 2026);

- Canada: in the last five years (2017-2022) Canadian imports of hair removal products have shown a cumulative growth of 67 percentage points in euro values, reaching 146 million euros pre - final balance for 2022. In the forecast scenario up to 2026, the continuation of this phase of growth is expected, with imports expected to reach 186 million euros;

- Vietnam: the Vietnamese market, also in this business area, is an emerging market undergoing significant acceleration in the most recent period. In the two-year period 2021-2022, Vietnamese imports of depilatory products, starting from relatively low levels (just over 10 million euros), more than quintupled (55 million euros in 2022 pre-final balance) and are expected to continue to grow in period 2023-2026, to reach close to 80 million euros.

Source: ExportPlanning-Forecast Datamart

Conclusions

World trade in the Beauty & Cosmetics sector is showing very sustained growth dynamics, thanks to the presence of many markets undergoing acceleration in the various business areas that make up the sector.

These markets are mainly in Asia, as documented in this article for the cases of China (protective creams and make-up preparations; perfumes and toilet waters; hair sprays), Vietnam (protective creams and make-up preparations; perfumes and toilet waters; lip make-up products; depilatory products) and Japan (eye make-up products; depilatory products).

1) In this sector analysis, the following product segments were considered:

- perfumes and toilet waters

- lip make-up products

- eye makeup products

- preparations for manicure or pedicure

- face powders

- protective creams and make-up preparations

- preparations for waving or straightening, permanent

- hair lotions

- hair sprays

- depilatory products.

- Wine: "South Korea: an Accelerating Market for Wine imports";

- Textile Machinery: "Textile Machinery: Foreign market Opportunities undergoing 'structural' Acceleration";

- Converting Machines: "Paper converting and converting machines: the opportunities of international markets in a phase of 'structural' acceleration";

- Agricultural Machinery: "Agricultural Machinery and the geography of potential".