Brexit Game: Still Open?

In the last week optimism for an agreement between the EU and the UK wanes, while ECB extends monetary stimulus

Published by Alba Di Rosa. .

Covid-19 Exchange rate Dollar Euro Uncertainty Pound Economic policy Brexit Central banks Eurozone Exchange rates

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

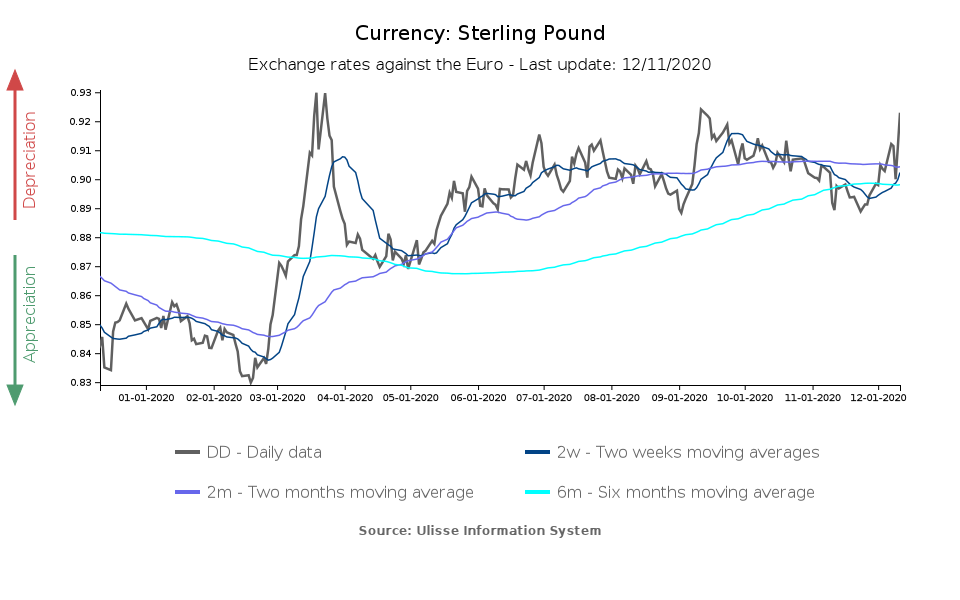

Stalemate on Brexit continues. Despite last week's false alarm, Brexit has not yet reached its tipping point. The optimism for the possibility of reaching an agreement, quite widespread on financial markets in the last weeks, has therefore partially faded in recent days. Compared to Friday 4, the pound lost ground against both the euro (-2.2%) and the dollar (-2.4%). If until the first days of December the pound was just losing ground against a strong euro, but could still keep up with a weak dollar, this week a new wave of pessimism about Brexit led the British currency to weaken against both its major benchmarks.

Specifically, the currency began to weaken since mid-week, due to a lack of progress in the negotiations. The fall became more pronounced today, following statements made yesterday by British Prime Minister Boris Johnson and this morning by European Commission President Ursula von der Leyen: both made it clear that, at this point, the balance leans toward the no deal option. The British Prime Minister told citizens to prepare for the possibility of a no-deal Brexit and spoke of the possibility that UK's future trade relations with the EU could be more similar to those the EU has with Australia than those it has with Canada.

According to analysts, the underlying hope for a last minute deal still exists, as failure to reach one would be detrimental to both sides. The reaction of the markets in the last few days, however, indicates that the fear for the other option is becoming more and more concrete.

ECB extends stimulus. Other relevant news in the financial week are the latest monetary policy directives from the European Central Bank, released following yesterday's Governing Council meeting. As anticipated in the October meeting, a "recalibration" of monetary policy tools took place, taking into account the economic impact of the second wave of the Covid-19 outbreak. Indeed, new economic data available to the central bank suggest that the effects of the pandemic on the economy and inflation are proving stronger than initially estimated.

The key points of the new directives can be summarized as follows:

- the Pandemic Asset Purchase Programme (PEPP), aimed at maintaining favorable financing conditions, has been increased in terms of budget and extended at least until March 2022 (the possibility of reinvesting principal payments from maturing securities is extended, however, at least until the end of 2023);

- with regard to the targeted longer-term refinancing operations (TLTRO III), aimed at ensuring the inflow of liquidity to the real economy, particularly favourable conditions have been extended until June 2022;

- the traditional Asset Purchase Programme (APP) will continue, on the other hand, in the amount of €20 billion per month, for as long as it is necessary to reinforce the accommodative impact of interest rates;

- reference interest rates have been left unchanged.

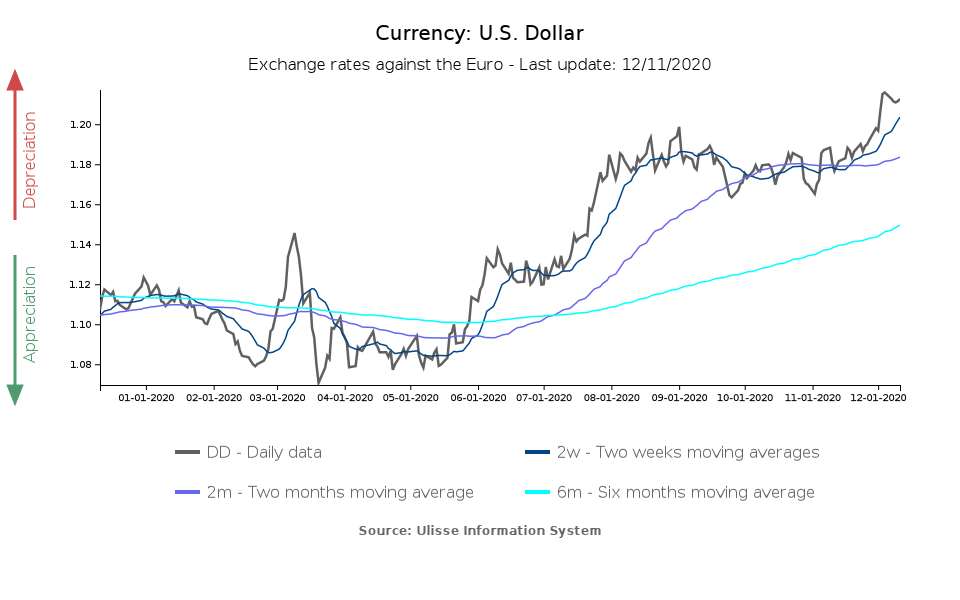

Thus, the stimulus to the Eurozone economy has been extended, in line with market expectations. In connection with the announcements, the single currency showed a slight strengthening in terms of intra-day values, and then closed at 1.21 - a level that was confirmed today.

On the subject of the appreciation of the euro, one of the most discussed at the moment, the statements of President Lagarde were substantially in line with what she said in September, when the euro-dollar exchange rate had touched 1.20 for the first time in more than 2 years, beginning to raise the first fears.

As in September, Lagarde reiterated that "We (the central bank, editor's note) do not target exchange rates"; however, the exchange rate is an element to be monitored in relation to the downward pressure it can exert on prices. In addition to what already declared in September, she added that they "will continue to monitor it (the exchange rate) very carefully going forward".

It can be deduced that the euro is on the radar of the ECB, without necessarily being a cause for concern if the Eurozone economy manages to recover and inflationary dynamics to normalize.