Brexit Saga: Approaching the Endgame

The British government’s latest move on Brexit leads the pound’s exchange rate risk on the rise; meanwhile, the ECB delivers soft comments on the strong euro, but keeps it in check

Published by Alba Di Rosa. .

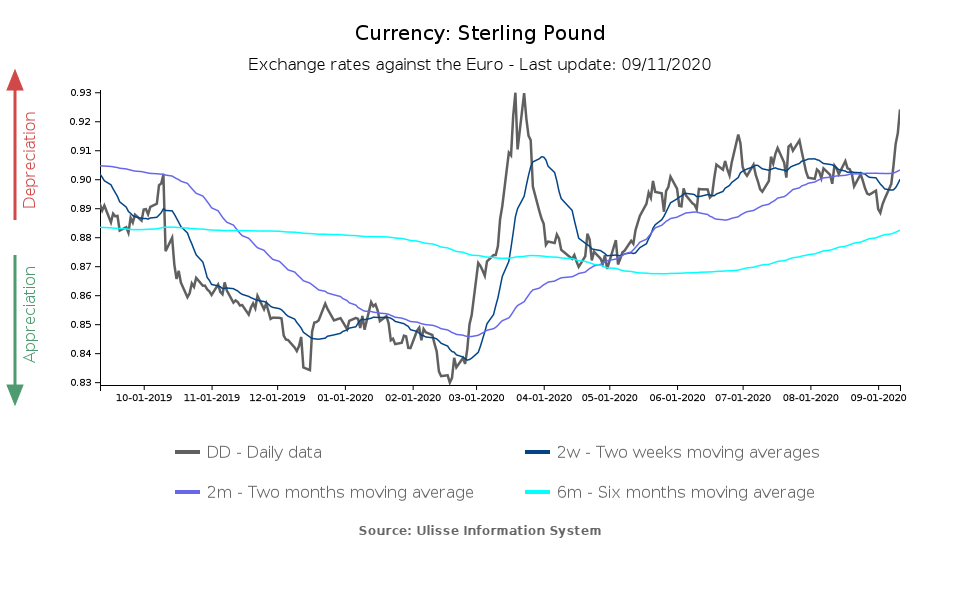

Exchange rate Europe Eurozone Central banks Brexit Uncertainty Pound Exchange rate risk Euro Exchange ratesThis week the British pound has returned to the spotlight, losing in a few days almost 3% of its value against the euro. This reversal of the trend comes after a summer of relative stability for the pound's exchange rate, a stability that contrasts with the dynamics observed in recent days, as can be seen from the graph below.

The reasons for this change of course are linked to the latest developments on Brexit, which have brought the no deal threat back to the fore. Market fears of the economic consequences of such an event were immediately recorded by the pound.

Latest Brexit news

Earlier this week, rumors began to circulate about the Johnson government's next move on Brexit. These rumors were confirmed on Wednesday, when the government introduced a controversial bill to the House of Commons. The Internal Market Bill would in fact violate the pact made by the United Kingdom with the Union with the Withdraval Agreement, signed in October 2019 and ratified by the British Parliament in January 2020. In particular, this bill would violate the agreements on state aid and customs controls in the Irish Sea.

Criticized by the opposition and the European Union, the approval of this bill would therefore constitute a violation of the international law, as admitted by the government itself, although "in a very specific and limited way" according to Brandon Lewis, Northern Ireland Secretary.

The reaction from Brussels was the threat of legal ation if the bill is not withdrawn by the end of September.

Opinions on the British government's move are varied: some argue that it may represent a strategic move, aimed at increasing the pressure on the Union to reach an agreement, while others argue that the exit without an agreement may actually be one of London's desired outcomes, which would guarantee greater freedom of action. What seems certain is that the British administration does not seem willing to reach a deal at all costs.

As the odds of an agreement decrease, the outlook for the sterling becomes more precarious. The common opinion is the start of a phase of weakness for the pound in the coming months, if the clash with the EU continues - a weakness that could be accentuated, at least in the short term, should a no deal scenario actually materialize.

ECB and monetary policy

Another key financial event in the last few days was the monetary policy meeting of the European Central Bank, which took place on September 10. The event was highly anticipated by financial markets, after last week's statements by ECB policy-makers about the significant - and potentially worrying - appreciation of the single currency. In particular, financial markets were waiting for the reaction of the Governing Council and the comment of President Lagarde, in the face of a euro-dollar exchange rate that recently touched 1.20 for the first time in more than 2 years.

The ECB Governing Council has decided to leave interest rates unchanged. New macroeconomic forecasts for the Eurozone have also been communicated: compared to June, the forecast for GDP growth in the Eurozone in 2020 has been revised upwards to -8%, while it has remained unchanged for the following two years (for which a recovery of +5% and +3.2% is respectively expected).

With regard to the appreciation of the euro, President Lagarde confirmed that the issue has been addressed by the Council. It was specified that "We (the central bank, editor's note) do not target the exchange rate. Our mandate is price stability". Nevertheless, to the extent that the strength of the exchange rate can exert a negative impact on price stability, the issue will be carefully monitored and evaluated when making decisions. Further rate cuts are not excluded, as the president has reiterated the institution's willingness to use all available policy instruments to fulfill its mandate.