FX Update: Dollar Weakness and Brexit Wait

Published by Alba Di Rosa. .

Exchange rate Europe Eurozone Central banks Euro Brexit Uncertainty United States of America Exchange rate risk Dollar Covid-19 Emerging markets Exchange ratesThe main news of the week in the FX world comes from two fronts: euro-dollar and the pound. On the one hand, the dollar consolidates its bear trend, which indirectly benefits many currencies, and on the other hand, the pound reflects the hope for an agreement which hangs in the balance.

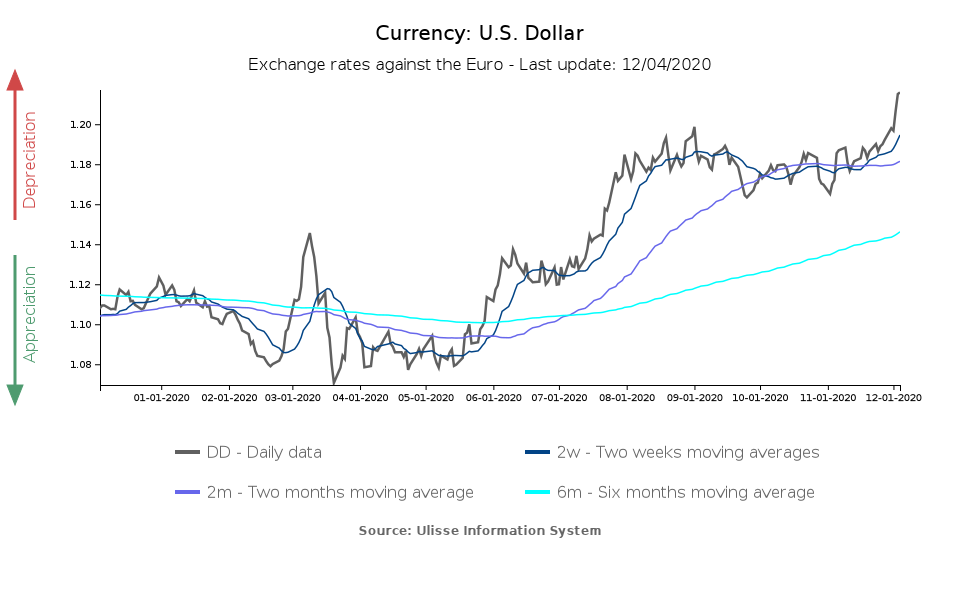

Euro-dollar: new record

The single currency made headlines this week, further strengthening against the dollar and breaking the threshold of $1.20 per euro. Yesterday the exchange rate reached 1.22: the dollar has never been so weak since spring 2018. Only in the last week, the euro strengthened by more than 2 percentage points against the greenback.

The reasons for this dynamics mainly lie in the optimism of the markets about the various vaccines against Covid-19, that have been recently announced, and whose large-scale distribution is expected to support the rebound of the world economy next year. This week the UK was the first country in the world to approve a vaccine against Covid-19 for large-scale use: it is Pfizer-Biotech's, and it will be available to the population as early as next week.

On top of that we can find the monetary policy factor, i.e. the FED's intention to keep interest rates low for a long time, which is therefore leading to the dollar to settle towards a level of greater weakness compared to its the recent past.

It is therefore noticeable that the described dynamics, in progress on FX market, are mainly the result of expectations for what will happen in the coming months, rather than the effect of current phenomena, economic and otherwise.

The euro rally also seems to mainly reflect the mood of investors and specific factors related to the appeal of the dollar, rather than intrinsic drivers. Indeed, the Eurozone economy does not shine for its performance, but risks further damage as a result of the second wave of Covid and related restrictions. This issue will most likely be addressed at next week's meeting of the ECB Governing Council.

Therefore, if the euro stands out among the major beneficiaries of the weakness of the dollar, this same weakness supports, conversely, the strengthening of other currencies, as well (as seen last week for the case of the yuan).

Looking at the last 3 months, some floating emerging currencies have particularly benefited from the bear trend of the dollar, as shown in the chart below.

EM currencies appreciation against US dollar

September 1, 2020 – December 3, 2020

At about the same level, the Mexican peso and the South African rand gained more than 8 percentage points against the greenback in the last 3 months. Some Latin American currencies also strengthened considerably: the Colombian and Chilean peso are close to +6% and +3% respectively and the Brazilian real is up 4.5%. In the Asian area, the new Taiwan dollar and the Thai baht strengthened by about 3%, while the Malaysian currency is close to +2%.

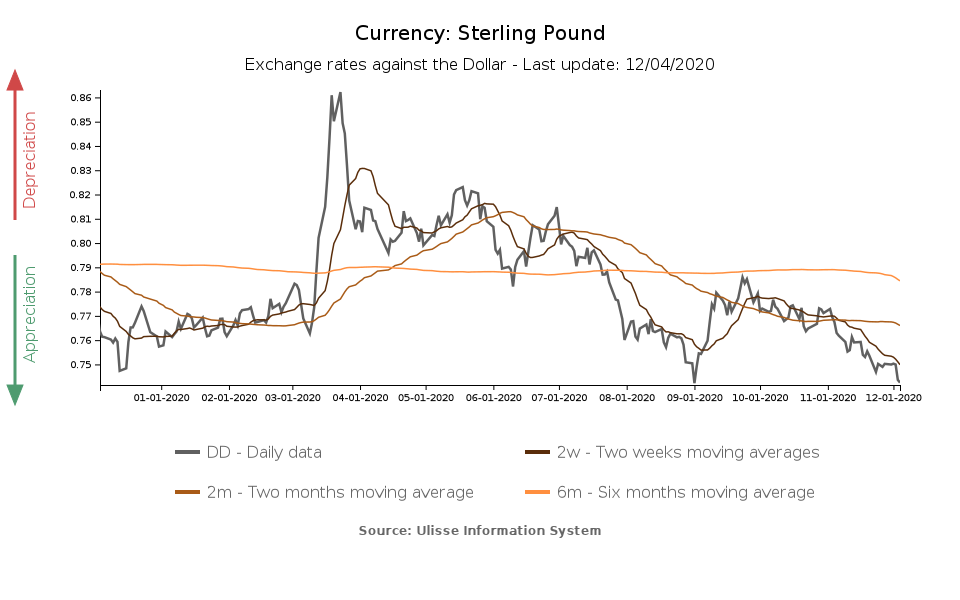

Pound sterling: Brexit is now (really) looming

Along with EM currencies, the weakness of the dollar is also exerting its effects on the pound: dominated by uncertainty related to Brexit, whose deadline is now very close (the exit from the Union is scheduled for December 31), the British currency has shown a weakening against the euro in the last 10 days of November, while showing a strengthening against the dollar since the end of September. Currently, the pound is trading with the dollar at 0.743 (pounds per dollar); it did better only at the beginning of September (0.742). These levels have not been seen since spring 2018.

As the deadline for an agreement approaches, the pound is therefore extremely volatile, but at the same time driven by an underlying optimism of the markets, which are pricing the possibility of a last-minute agreement between the EU and the UK that would avoid the prospect of hard Brexit. According to some, the agreement could be reached as early as this weekend.