Esportare negli USA in tempi di dazi: aspetti da monitorare

Dazi al 50%, tariffe differenziate e concorrenza globale: una guida per interpretare rischi e opportunità

Published by Marco Pappalardo. .

Foreign markets Uncertainty Trade war Global economic trendsA recent Wall Street Journal article reports the contents of a letter sent by the president of the German Mechanical Engineering Association, Bertram Kawlath, to the President of the European Commission, Ursula von der Leyen. In the letter, deep concerns are expressed regarding the extension of the 50% tariff on steel and aluminum products from all trading partners, which affects all goods imported into the United States in proportion to the amount of these metals they contain.

The letter highlights how these additional tariffs could have a significant impact on the European mechanical engineering sector, putting at risk the stability of the agreement reached last July between Von der Leyen and Donald Trump. The Framework Agreement between the European Union and the United States had so far imposed a generalized 15% tariff on most European-exported goods, representing, according to Kawlath, a delicate balance that could now be jeopardized by the expansion of protectionist measures on steel- and aluminum-derived products.

The Penalization of European Exports: Between Reality and Appearance

At first glance, European exports of steel, aluminum, and related products appear to suffer a competitive price disadvantage equivalent to the average between the 50% tariff applied to the value of the steel and aluminum content in the product and the 15% tariff applied to the remaining portion.

In reality, to assess the actual penalization of European products, it is also necessary to consider—on a broader level—the likely changes in the prices of other competitors offering the same products.

A first element of analysis concerns domestic producers. In this regard, it is important to consider the different steel price on the United States market compared to the average European price.

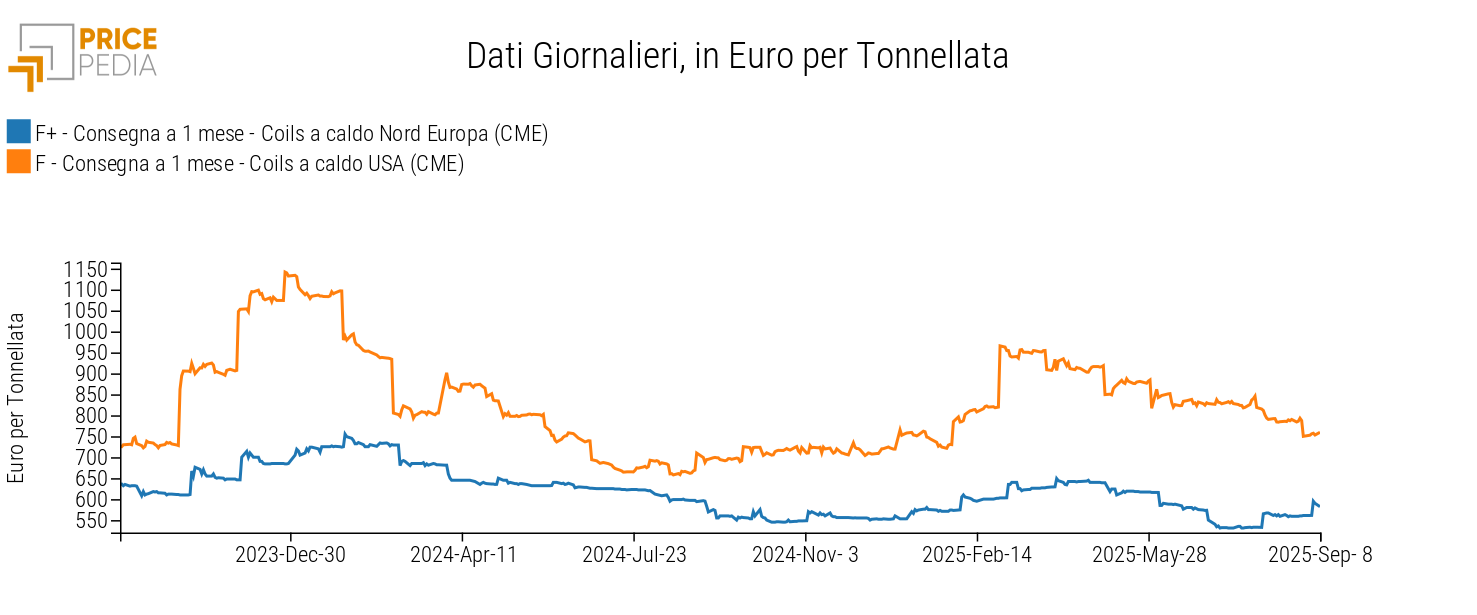

For example, by comparing the historical price series of hot-rolled coils listed on the Chicago Mercantile Exchange (CME), referencing delivery prices on the U.S. market and the Northern European market, it can be observed that U.S. steel is consistently more expensive, with a gap that has gradually widened following the introduction of tariffs on steel.

The chart therefore highlights how American companies bear higher steel costs compared to their European competitors.

Fig.1 – Steel price in the United States market vs average European price

Source: PricePedia elaborations

The imposition of tariffs on imported steel leads to an increase in production costs for the American industry. This occurs for two main reasons: on one hand, the application of tariffs raises the prices of imported steel; on the other hand, U.S. steel producers can align their prices with the higher prices of imported goods, thereby contributing to rising costs for downstream manufacturing companies.

The loss of competitiveness of European companies compared to U.S. companies can therefore be assessed as corresponding only to the distinctive 15% tariff, and not to the combination of this with the specific 50% tariff on the steel and aluminum content.

International Competitors in the U.S. Market: What Threat to European Exports?

The competitiveness of European products does not depend solely on direct competition with U.S.-made goods, but also on the competition between European companies and other exporters in the American market, which represents the second key factor in this analysis.

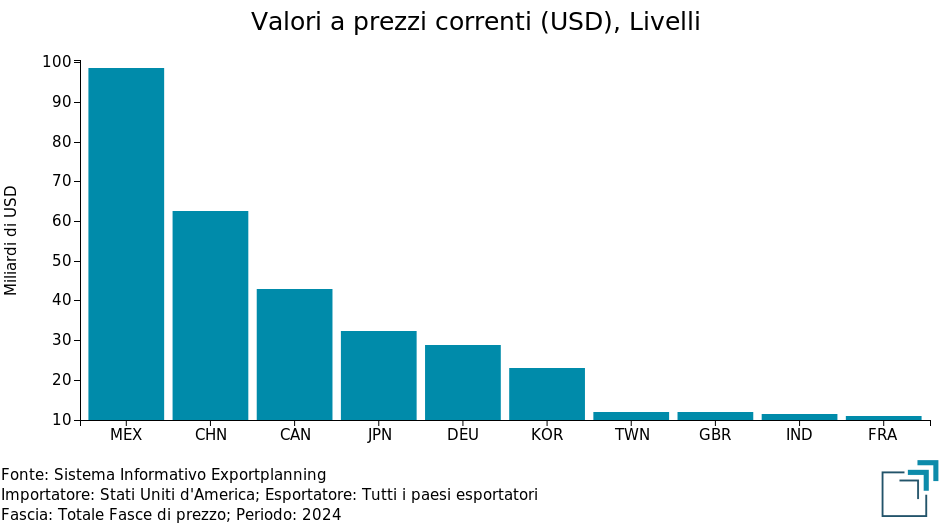

The following chart shows the main global exporters of metalworking products[1] to the U.S., ranked by export value in 2024.

Fig.2 – Main Exporters to the USA, Metalworking Sector (2024)

Source: ExportPlanning Elaborations.

The chart shows that Mexico, China, Canada, Japan, and Germany are the main suppliers of intermediate metal goods, mechanical components, and parts for transportation equipment to the United States. With the Executive Order of July 31, 2025, the Trump administration introduced "reciprocal" tariffs differentiated by trading partner, establishing different tariff conditions depending on each country’s negotiating position. This results in varying degrees of exposure to the effects of tariffs for different trading partners, simultaneously creating obstacles and potential opportunities for European companies.

Consequently, part of the competitiveness of European metalworking products in the U.S. market depends on these differentiated rates. The European Union, however, enjoys a relative advantage: the tariff on European imports is 15%, among the lowest in the world (excluding the United Kingdom), whereas the tariff on Chinese imports, for example, is 35%.

Competitiveness of Exported Products on the U.S. Market: An Analysis Based on Price Ranges

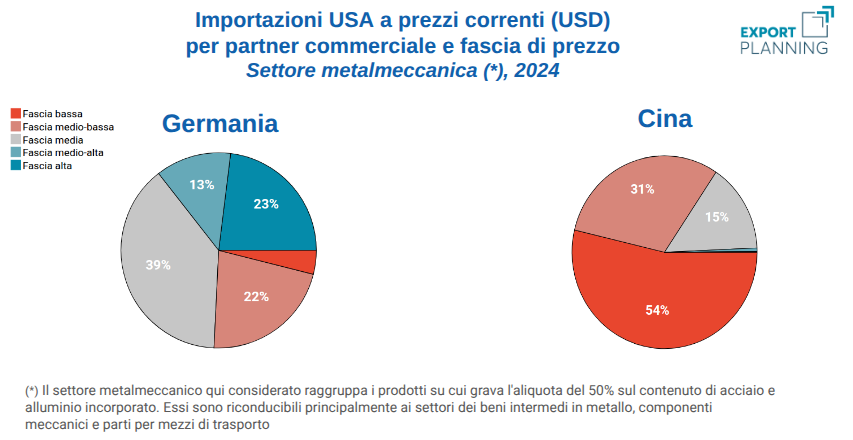

Finally, another element that helps assess the competitiveness of European exports to the U.S. market is the evaluation of metalworking exports by price range.

As shown in the two charts below, European exports (particularly German ones) are mainly concentrated in the mid-to-high price range, while Chinese exports are predominantly in the low-price range, highlighting an additional factor of differentiation in competitiveness among countries.

Source: ExportPlanning elaborations.

Conclusions

The loss of competitiveness of European exports to the United States should be assessed by considering the relative prices of the products, and not only the effect of tariffs on the prices of goods originating from the EU. The increase in costs resulting from the tariffs introduced by the American administration affects not only European producers and other global exporters — whose goods become more expensive — but also U.S. companies that purchase steel from both foreign suppliers and domestic producers, potentially impacting their overall costs and final prices.

Overall, a loss of competitiveness for EU mechanical engineering firms in the U.S. market is certain, but the impact on the reduction of European exports may not be particularly significant, especially in light of the higher quality of European products.

An equally important issue concerns the contraction of investment by American industry, which reflects the uncertainty generated by the ambiguous trade policy of the Trump administration. Unclear regulations, increased bureaucracy, and uncertainty about possible countermeasures make it difficult to interpret the rules and plan long-term strategies.

In this context, European exports are not only penalized by prices, but also by the overall trend of U.S. demand, which is influenced by investor caution.

[1] In this aggregate, we have included products subject to the 50% tariff on embedded steel and aluminum content. These are mainly related to the sectors of metal intermediate goods, mechanical components, and parts for transportation equipment.