The Barometer of World Trade: What the First Nine Months Tell Us

Published by Simone Zambelli. .

Exchange rate Conjuncture Global demand Uncertainty Global economic trendsIn a complex international environment, marked by the shift in the multilateral cooperation system imposed by the protectionist actions of the Trump administration, the update of ExportPlanning’s Global Economic Outlook datamart allows us to outline a picture of the first nine months of 2025 in order to measure and monitor in real time the ongoing changes in global trade in the most recent months.

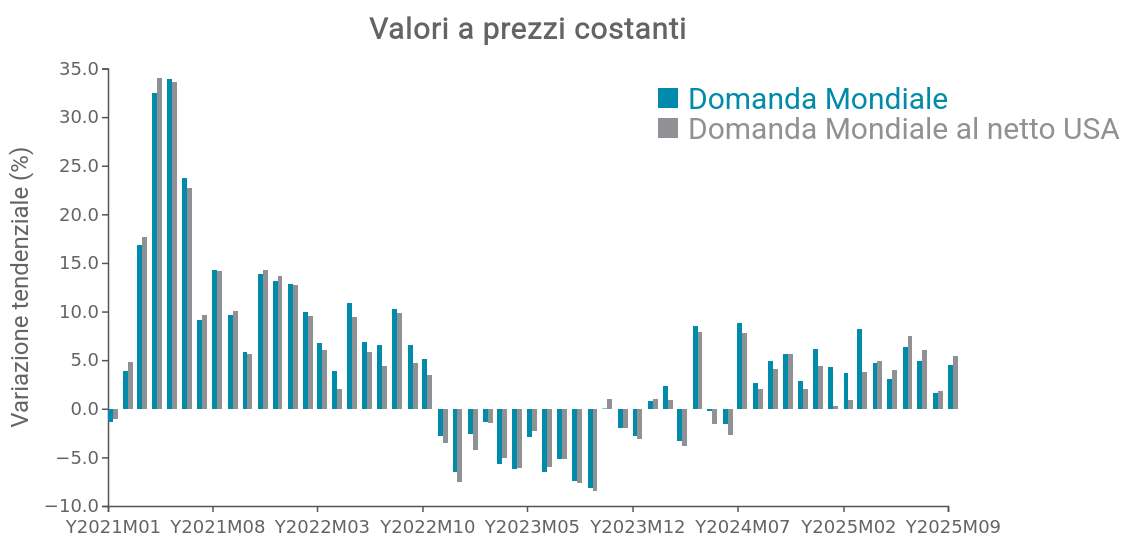

In Fig.1, the series of year-on-year changes in global imports of goods at constant prices on a monthly basis is shown. That means net of price and exchange rate dynamics, comparing data collected and systematized by ExportPlanning with those of the Central Planning Bureau, an institution that also collects and processes information on international trade in goods.

In order to obtain a trend "purged" of extraordinary phenomena, such as the rush to purchases that affected US foreign demand, the chart reports the dynamics of global trade with and without the United States.

Fig.1 - Global demand at constant prices

(year-on-year change on monthly data)

Source: ExportPlanning

The two series of trade flow dynamics show different signals especially for the first quarter of 2025: global demand for goods excluding the US "contained" growth at 1.6 percent in the January-March 2025 period compared to the same period in 2024 (versus a year-on-year increase of 5 percent when including US trade). During the first quarter, in fact, the US stock-building rush significantly supported global demand, representing a strong support and growth factor at a time when international uncertainty was particularly high.

Starting from the second quarter, the growth dynamics of global trade net of the United States remained stronger than that including the US. This trend indicates that the American contribution to global growth has gradually faded, marking the start of a phase of normalization in the pace of expansion of international trade.

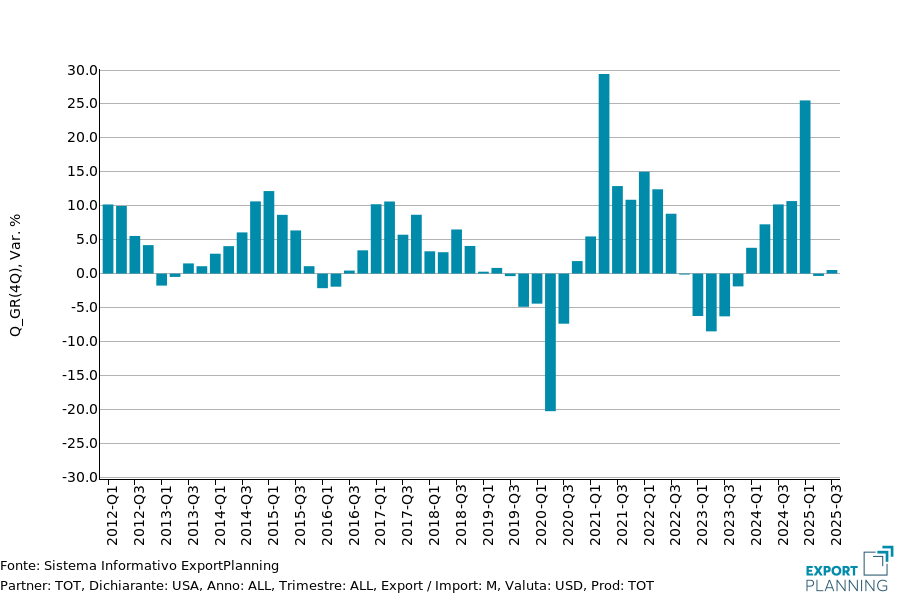

As shown in Figure 2, after the marked peak recorded in the first quarter of 2025 — driven by the inventory boom accumulated by US companies in anticipation of the introduction of new tariffs — US trade growth quickly halted, contributing to the overall slowdown in global dynamics1.

Fig.2 - US imports at constant prices by quarter

(year-on-year change on quarterly data)

Source: ExportPlanning

Overall, in the first nine months of 2025, global trade in goods increased by 4.6 percent in volume compared to the same period of the previous year. However, excluding US dynamics, growth drops to 3.8 percent, confirming that the expansionary push from the United States — particularly strong in the first part of the year — has now run its course, leaving room for a more moderate pace of development.

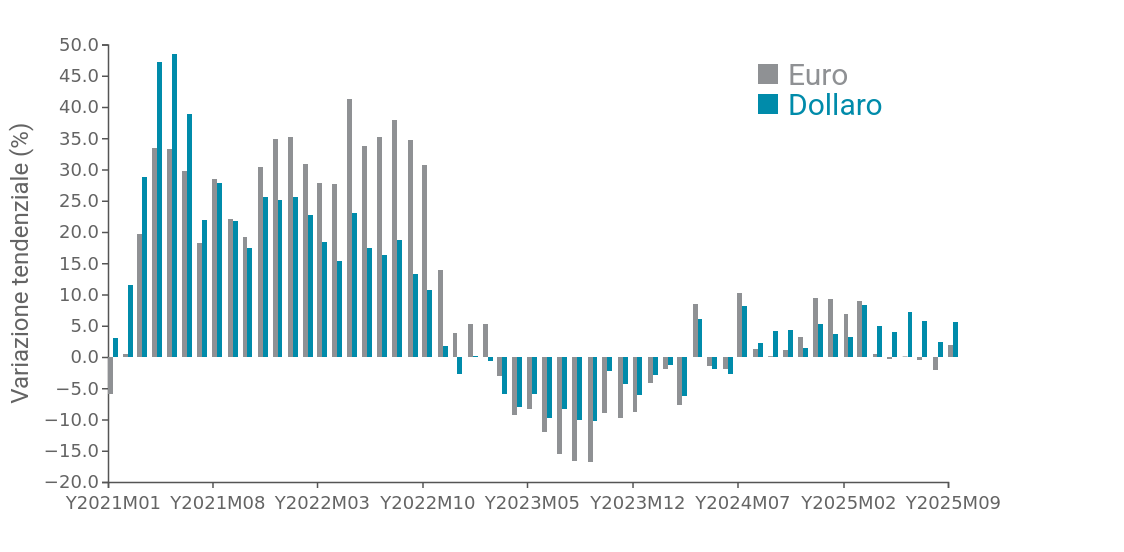

Another element characterizing the current scenario is the growing divergence between global trade trends measured in nominal terms in euros and those expressed in dollars.

Fig.3 - Global demand at current prices Euro vs Dollar

(year-on-year change on monthly data)

Source: ExportPlanning

The depreciation of the dollar, which had already begun in 2024, intensified in recent months of 2025, creating a wide gap between global trade variations expressed in euros and in dollars.

In the third quarter of 2025, in fact, growth in dollars stood at around +4.5 percent, while in euros the dynamic is in negative territory, highlighting a significant divergence due to exchange rate effects.

This trend confirms the importance of analyzing conditions at constant prices, in order to strip data of exchange rate and price effects and obtain a more accurate reading of real global trade trends.

Conclusions

Overall, the recent trend in global trade shows signs of continuity in the second part of the year, outlining a picture of stability but without new accelerations. The outlook for 2026 appears more uncertain, with a possible weakening of global dynamics in a context characterized by increasing geopolitical tensions and progressively tighter trade policies.

Monitoring global conditions and international market opportunities is one of ExportPlanning’s areas of specialization, thanks to the extensive Information System that includes over 5,500 customs tariffs and more than 150 geographies.

Learn more about our Market Insights reports and data

1) Despite the US shutdown resulting in the paralysis of the public administration and therefore also the suspension of customs activities, with official data frozen at July, thanks to the advanced nowcasting techniques developed by ExportPlanning it was possible to estimate the evolution of US trade also for the third quarter of 2025.