US Demand Drives Global Agricultural Machinery Trade

Boosted by growth in agricultural industry, trade data point to strong increase in US imports of agricultural machinery

Pubblicato da Gloria Zambelli. .

United States of America Trade war Trade balance Global demand Food&Beverage Global Economic TrendsThe continued expansion of the world's population and the need to increase both the quantity and quality of demand for agricultural products is driving up investment in agricultural machinery in every part of the globe, from the developed economies of Europe and North America to emerging countries. Feeding the world in a sustainable way will represent one of the most pressing challenges in the coming decades. In this context, one of the main topic at the center of international political agendas is the progressive integration of advanced technologies into agri-food sector in order to increase production efficiency and sustainability of agricultural products improving soil health, minimizing water use, and reducing pollution levels.

Moreover, in the year of the pandemic, global demand for agri-food products continued to grow, reflecting new consumption habits. As a result, global demand for agricultural machinery has been experiencing a new phase of growth, after declines recorded in 2019 and the early months of the pandemic. The Q1-2021 data confirms this positive trend for the fourth quarter in a row, displaying an increase of more than 25% year-over-year and 18% over Q1-2019 values.

The United States is the world's leading exporter of agricultural intermediate products. World trade data on imports of agricultural machinery is therefore useful information to indirectly map the performance of the US agri-food industry in recent months.

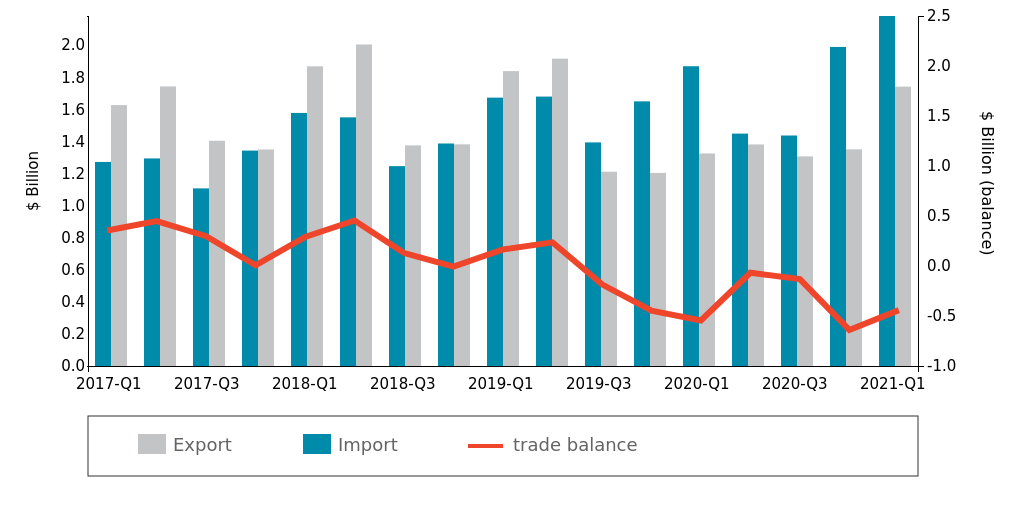

Given the status of leading importer of agricultural machinery on the international scene, US supported global demand growth for the sector, topping $2 billion in imports in first quarter 2021. US exports also open 2021 in positive territory, signaling a double-digit growth of 31% YoY in Q1-2021 ( 5% compared to 2019). As can be seen from the chart below, the growth in US imports of agricultural machinery has been particularly significant in recent quarters, to the extent that the US trade balance has been gradually deteriorating for the industry.

Agricultural Equipment:US Trade Balance

(2017-Q1 to 2021-Q1)

Indeed, the combination of a global weak demand and the trade tariffs on steel and aluminum, which negative impacted manufacturing processes caused the progressive deterioration of US trade balance of agricultural equipment in the pre-pandemic period. Nevertheless, the differential between imports and exports is limited and historically below 500 million dollars in absolute value, highlighting a remarkable inclination to commercial interchange.

US Agricultural machinery imports: widespread growth

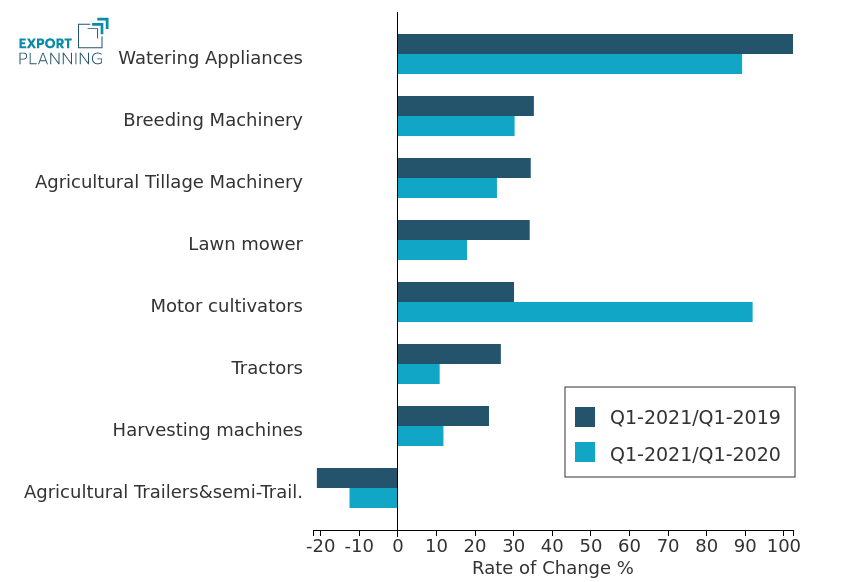

To get a comprehensive picture of the fast-evolving US agricultural machinery demand, we should focus, however, on the different kind of products which actually make up the sector. In the following graph are reported the rate of change of US imports recorded in Q1-2021 compared both to 2019-Q1 and to Q1-2021 by the eight categories of agricultural machinery.

Agricultural Equipment: % rate of change of US imports, by products

Although 2020 presented unprecedented challenges, data reveals that imports in the first quarter of 2021 were outperforming both those of Q1-2020 and Q1-2019, mirroring the high resilience of the segment's demand during the onset of health emergency. Overall, demand growth appears to be diffused among the different clusters belonging to the segment: only Agricultural Trailers and Semi-Trailers bucked the trend, with growth rate dropping below -10% YoY ( -20% compared to 2019). In the last two years US import of Watering Appliances skyrocketed duplicating the flows of first quarter 2019 during the last quarter (+ 44 million of dollars). In part this trend confirms the revolution taking place in the agricultural sector: innovations in precision irrigation technologies are growing even more crucial as growers face water scarcity due to drought, aquifer depletion, and water allocations. The new products out there allow growers to remotely monitor nearly every aspect of irrigation, saving water, time, fuel and vehicle wear and tear. Similarly, Motor Cultivator score quite well, recording a rebound higher than 90% YoY. As for Tractors, the main cluster of agricultural machinery that accounts for more than half of the segment's total, purchases grew significantly, albeit more modestly than for other kind of products (+ 10% YoY).

The evolution of US demand for agricultural machinery and products

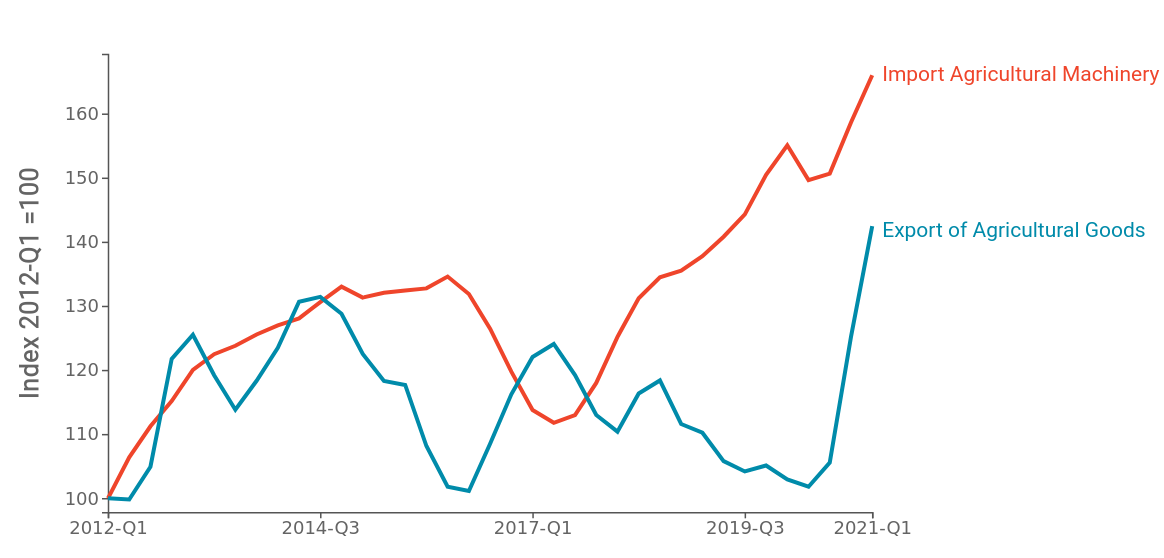

After providing an initial overview of agricultural machinery, it is now particularly interesting to take a closer look at the link between the growth in US demand for machinery and exports of main agricultural products. The following graph allows us to observe the dynamics of of both series, taking the value in 2012-Q1 back to 100.

Dynamics of US imports of Agricultural Machinery and US exports of Agricultural goods

Index = 2012-Q1, (2012-Q1 to 2021-Q1)

After an initial period of alignment, starting in 2018 the trend of the two curves began to divert due to the increase in protectionist policies on the international scene. In recent quarters, the progressive return of convergence is observed, signaled by a growth in both US machine imports and US exports of agricultural products.

It is interesting to point out that, the trend observed for Agricultural products seem to anticipate, in certain periods, those of agricultural machinery, confirming the close relationship between production (agricultural products) and investment (agricultural machinery).

Conclusions

In light of what has been observed, the outlook for the post-Covid scenario for the agricultural machinery and products industry appears encouraging. Export opportunities for American farmer are considerable. In addition, the growth in investments is certainly a positive sign for the achievement of the objectives of sustainability and production efficiency in the agricultural sector.