Food & Beverages: Sustained Growth of Global Sales

Cooling international trade has not affected the industry. US, Germany and China are the leading markets in Q2-2019.

Published by Marcello Antonioni. .

Food&Beverage Conjuncture Check performance Export markets Agribusiness

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

International trade of Packaged Food and Beverages1 recorded a +4.1% year-over-year (YOY) increase at constant prices in Q2/2019, according to ExportPlanning's estimates2. The result was slightly more positive than the previous quarter and importantly, it reaffirmed a long period of growth.

Once more, the sector demonstrated better performance than the average for the manufactured goods industry as a whole, which recorded a YOY growth in world trade of less than two percent at constant prices.

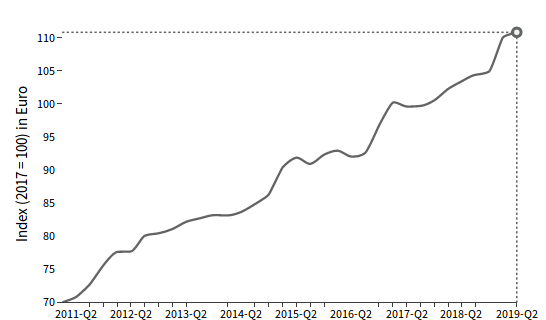

Sector sales reached a new high for seasonally-adjusted values in euros in many international markets

As detailed in ExportPlanning's MarketBarometer3, global sales of Packaged Food and Beverages for the last quarter reached a new absolute maximum for seasonally-adjusted value measured in euro.

Packaged Food & Beverages

Total flows in seasonally-adjusted euro (2017 Indexes =100)

World Markets |

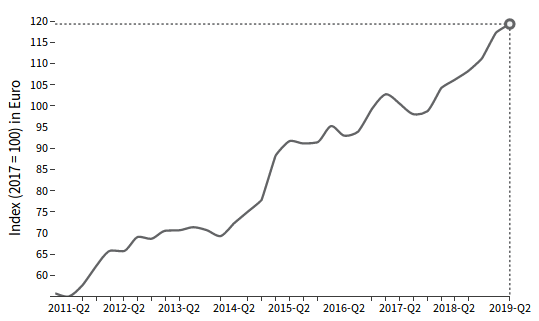

US Market |

|

|

|

|

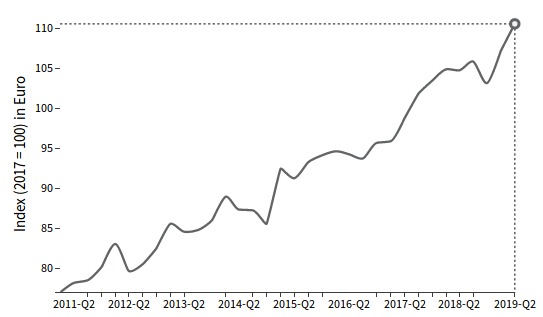

German Market |

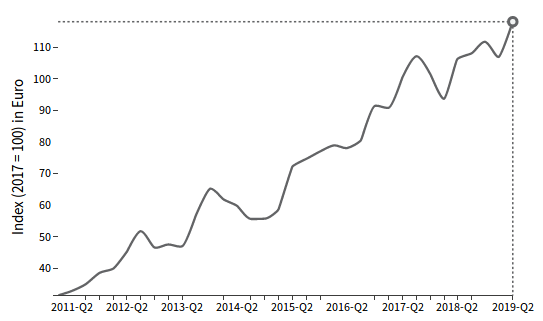

Chinese Market |

|

|

|

|

Source: ExportPlanning -MarketBarometer

USA remains the leading global market;

significant growth in Germany and China

US market

The largest contribution to global sales of Packaged Food & Beverage over the last quarter was once again recorded by the US market, which is continuing a phase of robust growth that has now been underway for several quarters. The most recent period marks a new double-digit increase in euro change rates.

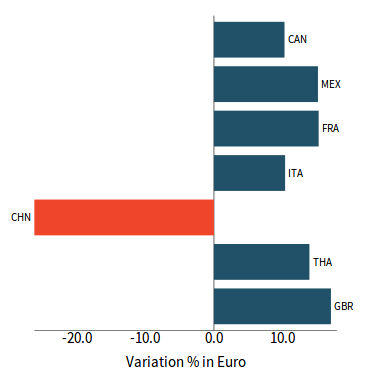

In the first half of this year, the best importer performances came from France, Mexico, Thailand and the United Kingdom; a positive trend was also recorded by Italy. In sharp contrast, the US market showed a big drop in imports from China.

US market: competitors cumulative year/year trends at end of H1-2019

Source: ExportPlanning MarketBarometer

German market

The German market is the second ranked contributor to global growth in sales of Packaged Food and Beverages over the second quarter of this year. In particular, German imports of Packaged Food and Beverages in the last quarter marked an YOY increase of +8% in euro.

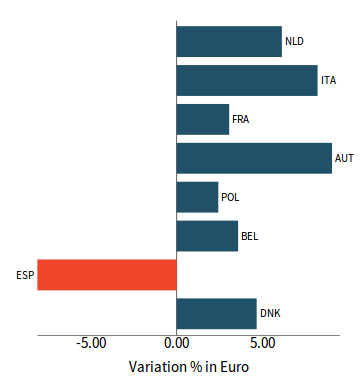

In the first half of this year, imports from Austria and Italy were the best performers on the German market, whilst imports from Spain registered a fall.

German market: competitors cumulative year/year trends at end of H1-2019

Source: ExportPlanning MarketBarometer

Chinese market

In Q2-2019 the Chinese market of Packaged Food and Beverages accelerated, becoming the third largest contribution in absolute values for global sales in the sector. In the second quarter, Chinese imports measured in euro values increased by 13.4% compared to the previous quarter and by around 10% compared to the same quarter in 2018.

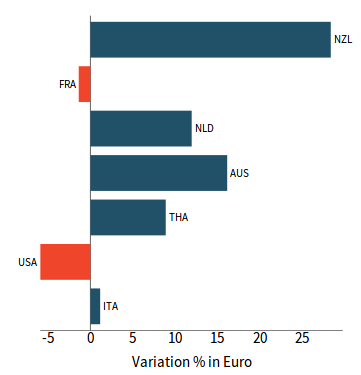

In H1-2019, Chinese imports from New Zealand and Australia along with those of the Netherlands and Thailand demonstrated the most dynamic sector flows. Conversely, there was a strong drop in Chinese imports from the US and, albeit more contained, a reduction of imports from France.

Chinese market: competitors cumulative year/year trends at end of H1-2019

Source: ExportPlanning MarketBarometer

1) For an detailed description of the various product categories within the sector under analysis, see the related

classification table.

2) Trends refer to StudiaBo calculations that consider a sample of about 70 reporting countries, representing over 80% of total global flows.

3) The MarketBarometer tool monitors economic trends in various international markets for a given industry (sector/product), with details of imports from the main competitor countries. Information is expressed in terms of indexes, providing the user with comparative benchmarking.

For help with the MarketBarometer tools, see the related User Guide.