Turkish Crisis and new Omicron Variant

Latest news from the FX world

Published by Alba Di Rosa. .

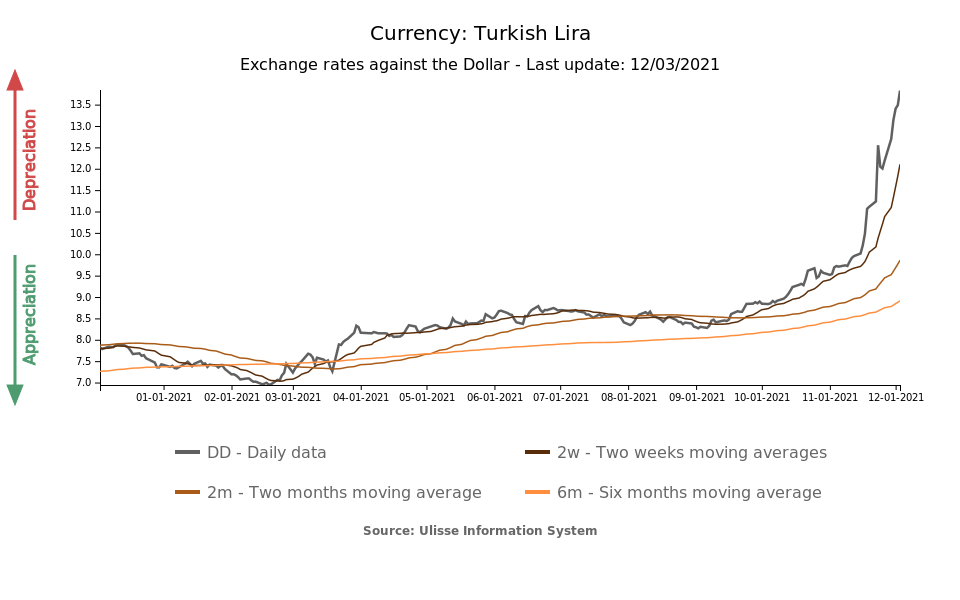

Exchange rate Exchange rate risk Central banks Uncertainty Dollar Turkish lira Covid-19 Exchange ratesIn the forex world, again this week the Turkish lira has taken center stage, due to the action of President Erdogan that remains far from monetary orthodoxy. If last week its exchange rate against the greenback reached a peak of 12.55 TRY per USD, the situation has worsened further in recent days: today, the exchange rate closed at 13.83.

What’s going on in Turkey?

The dynamics of the currency continues to clearly testify to the disapproval of the markets towards the monetary policy approach of President Erdogan: after the latest cut of the benchmark interest rates at the end of November, the weakening of the lira keeps going.

Additional factors have recently brought further pressure on the currency: the new unconventional statements of the Turkish president date back to Tuesday evening, when he stressed that a rate cut will lead inflation to fall - contrary to the general view of international economists. During the week, the replacement of Finance Minister Lufti Elvan took place as well: the former minister was basically accused of excessive orthodoxy in terms of economic policies.

In this situation of general pressure, the Turkish central bank has found it necessary to implement relief measures for the exchange rate - which weakened by more than 60% against the greenback since early autumn. On Wednesday, the central institution began selling foreign currency reserves in an attempt to support the lira, as well as initiated transactions at the Borsa Istanbul Derivates Market due to "unhealthy price formations in exchange rates", deemed unrealistic and completely detached from economic fundamentals. Direct forex interventions through selling transactions were also reported for today.

After the recovery of Turkish foreign exchange reserves observed in recent months, it therefore seems time for the TCMB (Central Bank of the Republic of Turkey) to take advantage of what it has accumulated to avoid a currency collapse. However, the confidence of international observers remains extremely limited, given the lack of orthodoxy currently characterizing Turkey in terms of monetary policy.

New variant and markets' uncertainty

Another element at the center of the current financial scene is certainly the uncertainty related to Omicron, the new Covid-19 variant, which keeps safe-haven currencies at the center of the scene. The new variant is in fact bringing with it the fear of new lockdowns and limitations, already introduced in several European countries.

Financial markets therefore perceive a general sentiment of panic, although the effectiveness of the vaccines with respect to the new variant is not yet known with certainty. Markets fear can be seen, for example, in the exchange rate of Thailand, a country highly exposed to tourism, which has weakened significantly in recent weeks.

In such a context of uncertainty, a complete normalization would therefore still be far away, even from the point of view of monetary policy1. However, the theme of inflation remains at the center of central banks' attention, pushing towards the hypothesis of a potential anticipation of a rate hike.

In the last week a statement of Powell, president of the US Federal Reserve, has taken center stage. Speaking of inflation, he said that "it's probably a good time to retire that word (transitory) and try to explain more clearly what we mean. An inflationary pressure, initially considered with certainty as transitory, is therefore beginning to raise the doubts of experts.

In this context, the theme of monetary policy normalization is entering analysts' reflections also with regard to the EU scenario, which is going through a similar context of inflation still on the rise - although at lower levels compared to the US case.

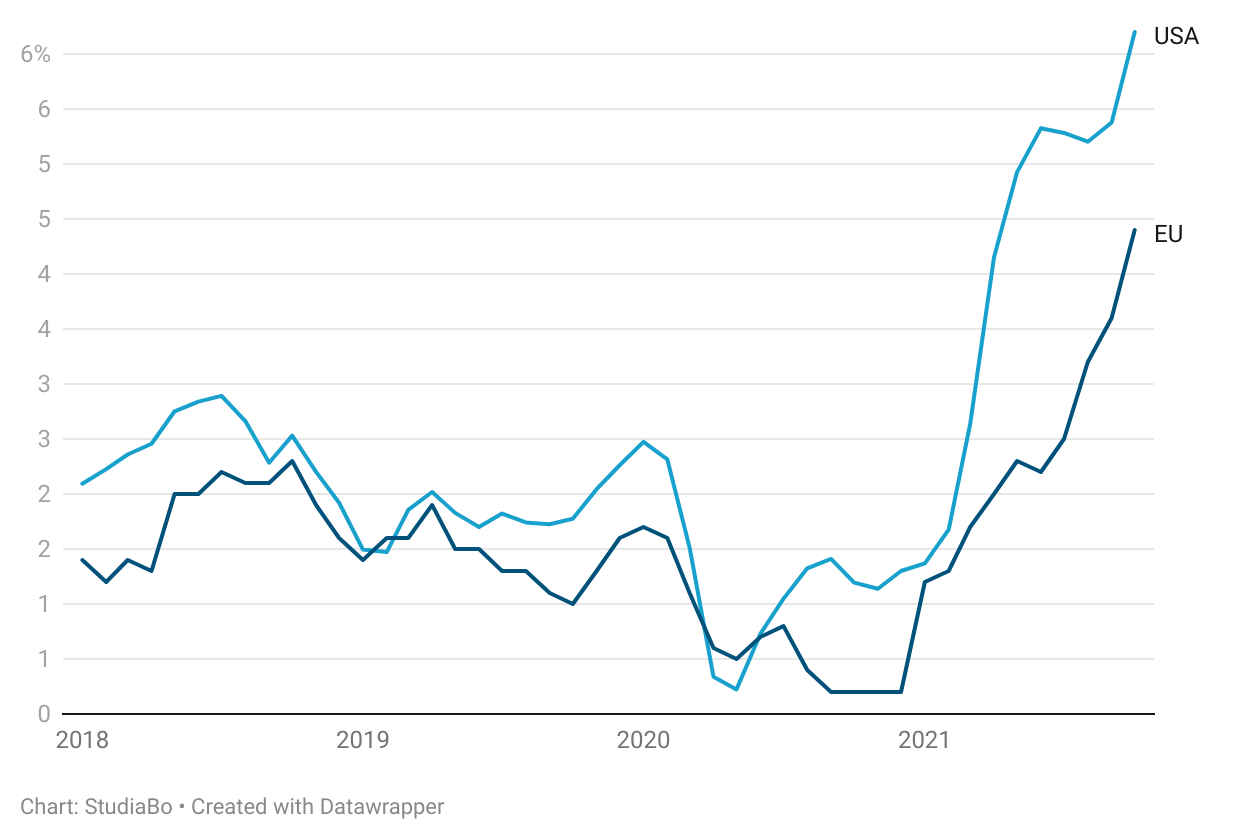

Monthly inflation rate

(January 2018 – October 2021)

As can be seen from the graph, since H2-2020 inflation has been on the rise again in the US and, since early 2021, in the EU27 as well. The latest months have proved increasingly hot: in October inflation reached 6.2% for the US and 4.4% for the EU. For the month of November just ended, Eurostat forecasts a further increase of 4.9%.

The initial forecasts of the central institutions of a temporary phase of inflation, following the Covid shock, are thus beginning to be questioned by some of the observers of the international economic scenario.

1. As reported in a previous article, an approach of monetary policy normalization has mainly been started by emerging countries, while central banks in most developed countries have, for the moment, left their benchmark interest rates unchanged.