Foreign Direct Investment: Global Dynamics in 2019

UNCTAD data show a slight rebound in global FDI flows in 2019, but the Covid crisis could lead in 2020 to a greater collapse than that one recorded in the aftermath of the 2009 crisis

Published by Alba Di Rosa. .

Covid-19 Great Lockdown Emerging markets United States of America Foreign markets Uncertainty Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The recent update of the Foreign Direct Investment database (source: UNCTAD, United Nations Conference on Trade and Development), available on ExportPlanning, allows to analyze the latest developments in the dynamics of Foreign direct investment (FDI) on a global scale, up to 2019, outlining the pre-Covid crisis scenario that is expected to be heavily affected by the impact of the pandemic in the current year.

According to the UNCTAD definition, foreign direct investment implies a long-term relationship and reflects a lasting interest and control by an entity resident in one economy (investor) over an enterprise resident in another economy. The investor (or parent enterprise) therefore exerts a large degree of influence over the management of the enterprise receiving the investment.

According to an ECB analysis, the importance of FDI for the recipient country ranges over several areas:

- Increased efficiency through an increase in competitiveness

- Positive spillovers in terms of productivity, deriving from the integration of the domestic enterprise in the productive processes of the investing MNE

- Acquisition of new technologies and skills, which lead to an increase in the quality of physical and human capital

The FDI inflow can therefore represent a contribution to the economic development of the country, and the analysis of these dynamics can be useful to identify which countries are becoming particularly attractive, grasping variations in the map of opportunities.

2019 Scenario

FDI inflows

According to the latest World Investment Report, in 2019 global FDI flows showed a modest increase (+3%), after the falls recorded in 2017 (-22%) and 2018 (-13%). This growth is mainly due to the increase in flows to developed economies (+5%), while developing economies as a whole recorded a marginal reduction in inflows. Flows to advanced economies showed an uptick, in spite of a sluggish macroeconomic performance and a situation of continuous uncertainty, mainly related to trade tensions and Brexit.

Among emerging countries, the largest increases in inward FDI flows occurred for Russia (+$18.5 billion), Brazil (+$12.2 billion) and India (+$8.4 billion).

Looking at the ranking of the largest recipients, while registering a slight fall compared to 2018, the United States confirmed in 2019 their role as the main global destination for FDI flows ($246.2 billion). On the other hand, inflows to China, the second largest recipient, kept on growing, reaching an all-time high of $141.2 billion.

FDI outflows

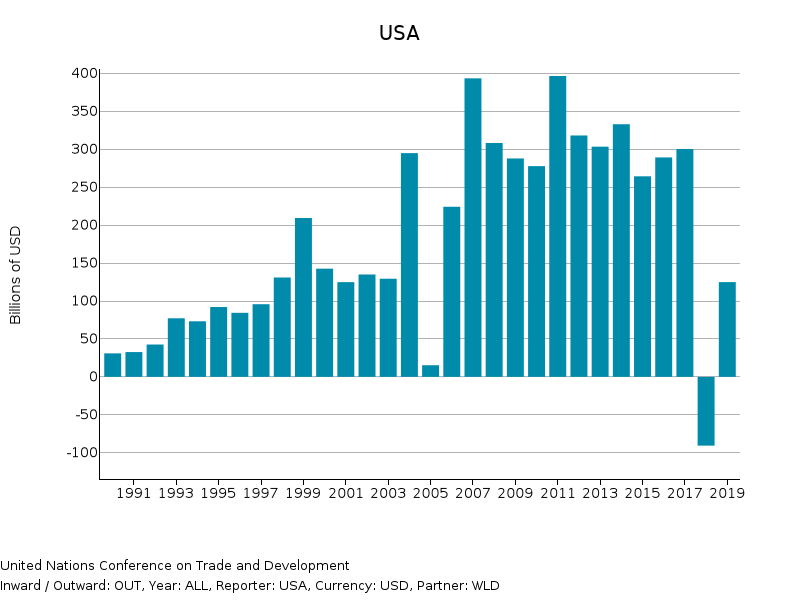

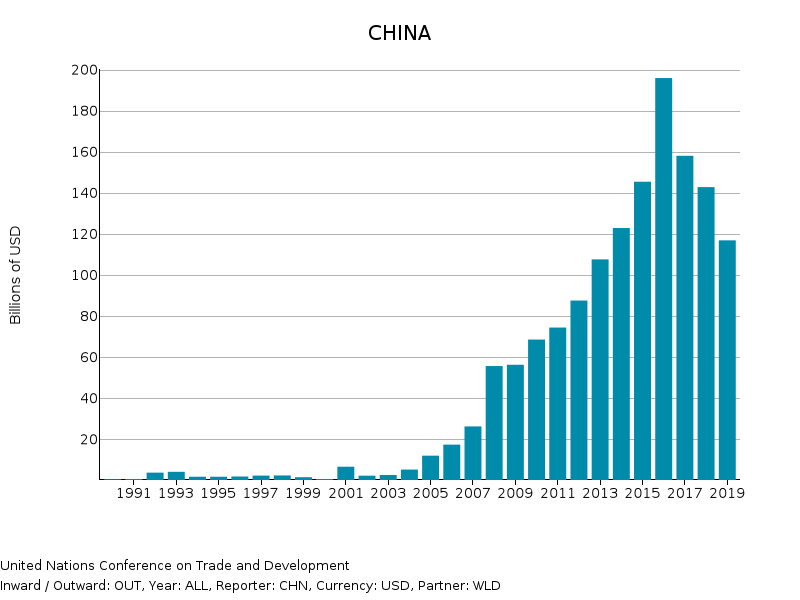

In terms of outflows, Japan remains the world's largest investor, with significant growth in 2019 (+58%). On the contrary, the role of China as an investor shrinks: while in 2018 FDI outflows from the country of the dragon were slightly lower than Japan’s, in 2019 China fell to 4th position in the global ranking for major investors, for a total amount of FDI outflows of $117 billion - lows not seen since 2013. Outflows from the United States and the Netherlands were slightly higher and, for both countries, experienced a rebound from the negative value recorded in 2018.

According to the World Investment Report 2020, China's reduced role as an investor is linked to increasing restrictions on FDI outflows, geopolitical tensions and the difficult trade and investment policy environment. The rebound in US outflows is instead attributable to the fading effect of President Trump's fiscal reform, which in 2018 led to large repatriations of foreign earnings, recorded as negative FDI outflows.

FDI outflows from the US and China (1990-2019)

|

|

Covid crisis and the outlook for 2020

In line with many other economic activities that have been blocked by lockdown policies, many investment projects have also been frozen or postponed following the start of the health emergency. Which will be its impact on foreign direct investment, in 2020 and in the years to come?

UNCTAD forecasts a fall of up to 40% in global FDI flows in 2020, and a return to growth in 2022. The expected fall could therefore be even sharper than the one recorded in the aftermath of the 2009 Global Financial Crisis, in a scenario strongly dominated by uncertainty.