Subsidies and environmental challenges: European tariffs on Chinese EVs

Published by Simone Zambelli. .

Europe Automotive Import Foreign market analysis

The European Commission has recently launched an anti-subsidy investigation into the Chinese battery electric vehicle supply chain under Regulation (EU) 2016/1037, provisionally concluding that it has benefited from unfair subsidies, which pose a threat of economic harm to EU battery electric vehicle producers.

In light of these conclusions, the Commission has preliminarily communicated the level of provisional countervailing duties that may be imposed starting from July 4 on the three Chinese manufacturers included in the investigation sample:

- BYD: 17.4%;

- Geely: 20%;

- SAIC: 38.1%.

For the remaining Chinese manufacturers that cooperated in the investigation, a weighted average duty of 21% is hypothesized, rising to 38.1% for those who did not cooperate. As specified by the European Commission itself, these countervailing duties would be added to the ordinary import duty of 10% levied on imports of battery electric vehicles.

The results of this investigation also follow President Biden's announcement to introduce tariffs equal to the full customs value (100%) on American imports of electric vehicles from China, which thus paints an increasingly tense and opposing picture of trade relations between the so-called West and the Rest.

The growth of Chinese manufacturers and the European market

To understand the reasons behind the proceedings initiated by the Commission, we need to contextualize the rise of Chinese manufacturers on the global stage and the current competitive situation in the European market.

Until recently, Chinese electric cars were synonymous with rather small and inexpensive vehicles, although in recent years we have witnessed an "upgrading" of the Dragon players. It is enough to consider that, as documented by ExportPlanning customs data, in 2021 it is estimated that a Chinese export electric car had an average FOB (Free On Board which from the point of view of the production-distribution value chain can be considered as the producer's price, net of consumption taxes and margins of subsequent distribution stages) unit price of slightly less than $18,000 per unit; in 2023, however, this value has progressively risen, reaching $23,000.

However, considering that the average cost of the same type of car for other international electric vehicle exporters, such as the United States and Germany, is between $40,000-55,000 per unit, the price gap that still exists between the different suppliers is evident.

Even in the face of a highly competitive price, in recent years there has been a marked growth in Chinese sector exports to the European market.

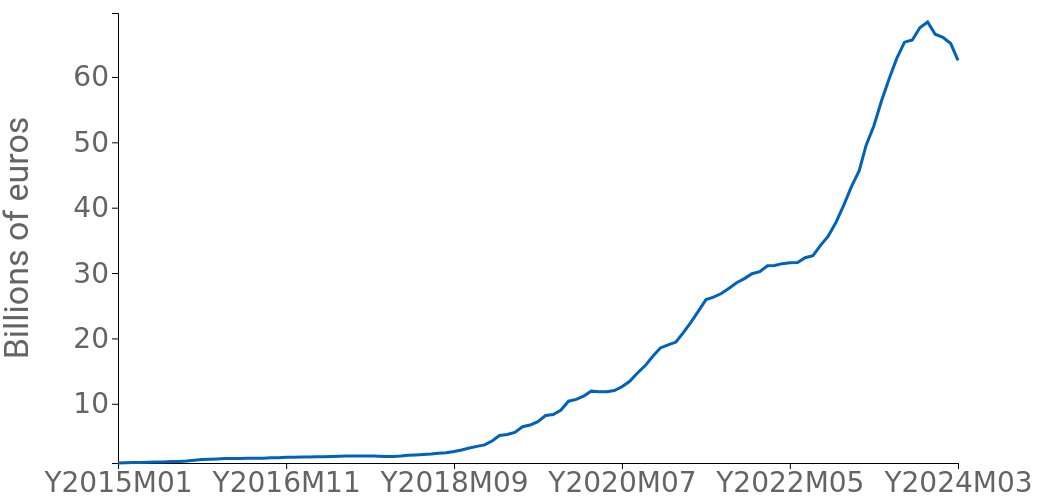

Fig.1 – European imports of electric vehicles

(annual cumulative)

Source: ExportPlanning

As highlighted in Fig.1, European imports of Chinese electric vehicles have shown a visible acceleration starting from 2021. This trend reflects the evolution of the European market towards more sustainable mobility, supported by favorable policies, technological innovations, and increasing environmental awareness among consumers. The slight decrease observed at the beginning of 2024 does not seem to represent a reversal of the trend, but rather a market adjustment after years of rapid growth and a sign of greater uncertainty, linked to the opening of the European Commission's investigation file at the end of last year.

In particular, it is interesting to compare the Chinese rise with other exporting countries in the European market.

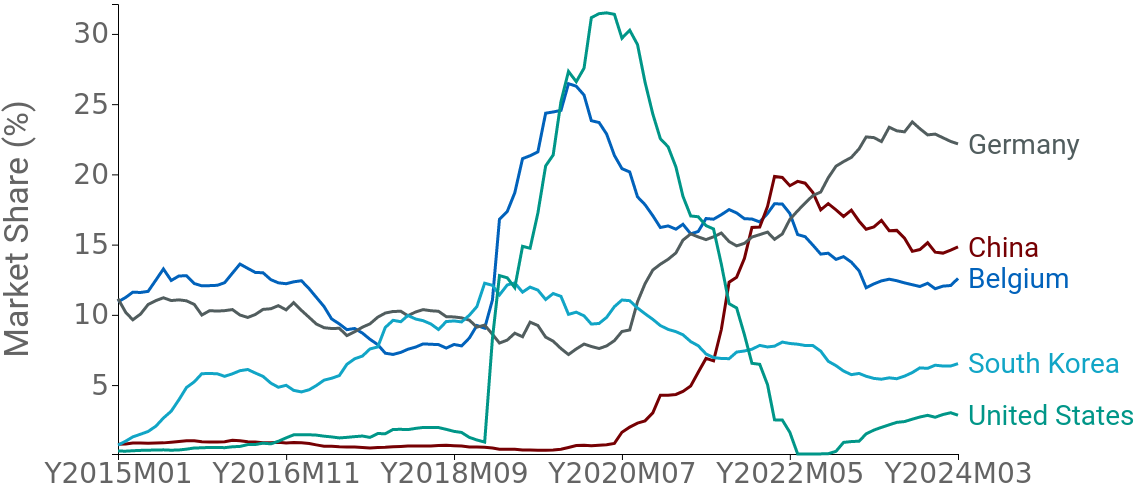

Fig.2 – European imports of battery electric vehicles: market share of main trading partners

(annual cumulative)

Source: ExportPlanning

Fig.2 clearly shows a fierce competition between various countries in supplying electric vehicles to the Union market. Germany and China emerge as the main players, with market shares ranging between 15-20%. Belgium, home to European brand factories, and South Korea also hold significant positions, accounting for about 10% of the market. The United States, however, saw a notable peak but then a significant decrease in its exports to the market.

Therefore, while consumer interest in a new mobility model appears strong, from an industrial policy standpoint, what concerns the European Commission and the American administration is the ability to ensure fair competition. The duties announced by Europe are, in fact, attributable to the temporary measures provided for by the World Trade Organization, at which the EU has requested the opening of an anti-subsidy investigation on Chinese-produced electric vehicles. The EU may impose such measures based on the more or less cooperative attitude of the People's Republic in conducting the investigation that must determine whether the production of Chinese electric vehicles benefits from excessively generous subsidies for free entry into the European market.

Still in the field of industrial security, another issue not to be ignored also pertains to the supply chain of raw materials for the electric industry. An element that undoubtedly favors the Chinese industry is the high level of vertical integration of battery and electric vehicle supply chains – from mineral processing to battery and vehicle production – as well as lower costs for labor, production, and financing. Outside China, there is thus a need for the EU as well as the US to build an adequate and competitive supply chain that can optimize costs and reduce dependence on the Asian giant, which plays a leading role in the trade of batteries and components for electric vehicles (for more information, see the article The future of EVs: challenges and opportunities for the European Union).

Conclusions

The situation of electric vehicle imports in Europe reflects an accelerated transition towards sustainable mobility, with a growing presence of vehicles from China, suspected of benefiting from subsidies and therefore subject to additional duties. The context is complex, however, with not only economic but also geopolitical implications, especially regarding the strategic supply of materials such as lithium and electric car batteries. Innovations such as new lithium extraction techniques could play a crucial role in the sustainable future of this industry in Europe.