First Half of 2023: the economic outlook of World Trade

The world demand situation paints a picture of light and shadow: in the first six months of the new year, the slowdown in world demand for goods continued, but did not worsen.

Published by Marzia Moccia. .

Conjuncture Global demand Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The availability of ExportPlanning pre-estimates for the first half of 2023 - accessible through the datamart World Conjuncture - allows us to document the cyclical situation of world trade in goods, in an international context where the specter of uncertainty still remains considerable.

As recounted on several occasions, global demand for manufactured goods experienced a substantial slowdown in its pace of growth during 2022, which occurred especially since the last months of last year when, for the first time since the start of the new post-pandemic expansion cycle, it entered negative territory.

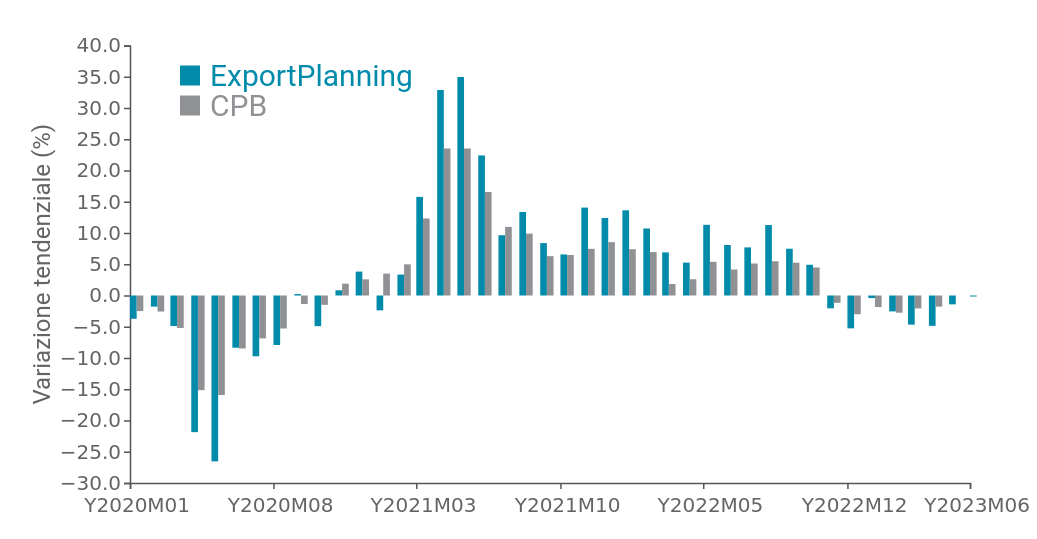

This phenomenon is evident in Fig.1, which shows the series of monthly quarterly changes in world trade in manufactured goods at constant prices, stripped of price and exchange rate dynamics, comparing the data collected and systematized by ExportPlanning with those of the Central Planning Bureau, institute, which in turn collects and processes information on international trade in goods.

Fig.1 - World demand in quantity

(CPB data vs. ExportPlanning data, trend change)

Source: ExportPlanning.

Both sources make it possible to document how demand for goods experienced a vigorous post-pandemic recovery, then converged to a gradual normalization over the following months. The most intense slowdown, however, was experienced mainly in the second half of 2022, eventually entering negative territory at the turn of last year. Although the pace of growth slowed substantially, it is interesting to point out that in the first six months of 2023 there was no further intensification of the recessionary pace, which instead remained at the values of the beginning of the year.

Overall, ExportPlanning preestimates indeed testify to a trend change in world demand of -2.3 percent in the first six months of 2023 compared with the same period last year, compared with a change of -2.6 percent in the first quarter and -2.1 percent in the second quarter.

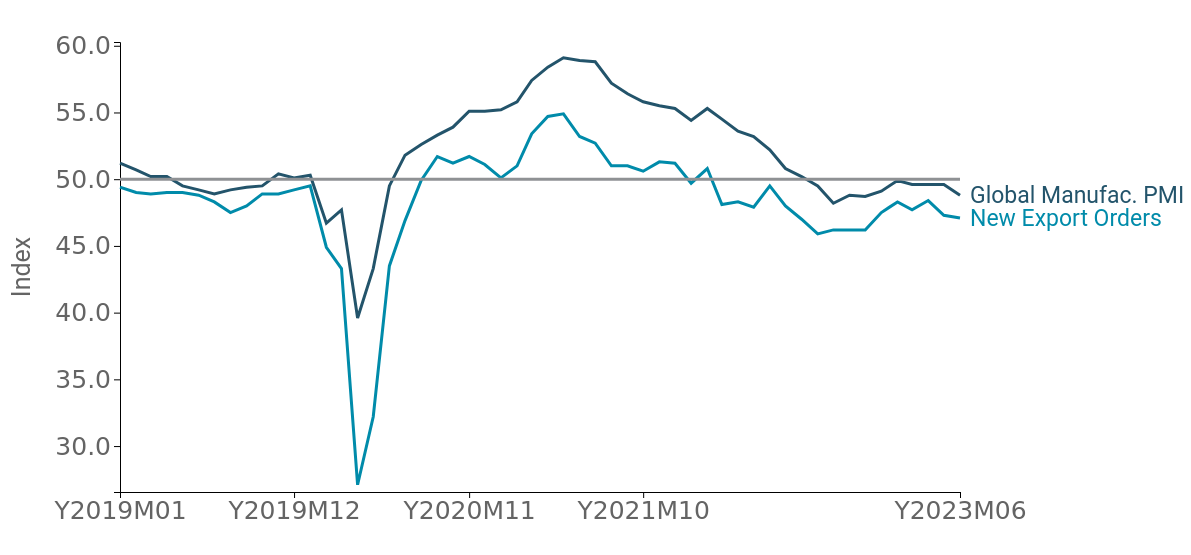

Also supporting this evidence are the signals obtainable from the Global Manufacturing Purchasing Managers Index, a "real-time" indicator of economic performance, which summarizes the outlook regarding industrial activity levels, based on companies' purchasing statements. In line with the deterioration in global manufacturing activity, since autumn 2022 the indicator has been steadily hovering below the 50 threshold (Fig.2).

Particularly significant is the New Export Orders component of the Global Manufacturing PMI, a leading indicator of the dynamics of global trade in manufactured goods. Although it, too, is stably below the expansion threshold, it has not worsened in expectations over the most recent months; on the contrary, a partial advance has been evident since the spring.

Fig.2 - Global manufacturing PMI and New Export Orders

(the line in gray signals the neutrality threshold of 50)

Source: ExportPlanning.

Compounded by the recovery in Chinese activity levels during the spring of 2023, the slowdown in world demand has thus not intensified its recessionary pace, and this is a bright spot in a picture of shadows in the current conginture. World demand for goods thus slows sharply, in line with manufacturing economic activity, but appears to be holding up more than expected.

However, the international scenario still remains highly fragile and uncertain.

Weighing most heavily on the economic outlook is more persistent inflation than initially assumed and the spillover effects on the real economy of the resulting tightening of monetary policy by the world's major central banks.

In addition, economic dynamics suggest a picture of the slowdown with differentiated impact in geographic and sectoral terms, which makes monitoring available information a key strategic lever for businesses.