U.S. Foreign Trade Outlook: Recovery on the Horizon for American Demand?

The first quarter of 2024 brings encouraging signals after a challenging 2023

Published by Simone Zambelli. .

Conjuncture United States of America Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The first quarter 2024 pre-estimates, elaborated by StudiaBo based on data from the US Census Bureau and available in ExportPlanning in the Datamart USA Economic Outlook, allow to highlight the main cyclical phenomena affecting the foreign demand conditions of the US market.

After closing 2023 with a decline of -2.1% for exports and -5.8% for imports, the first quarter of the new year has indeed opened with a cautious optimism for US imports, which again show a positive change of 3.7%, returning to positive territory after four consecutive negative quarters.

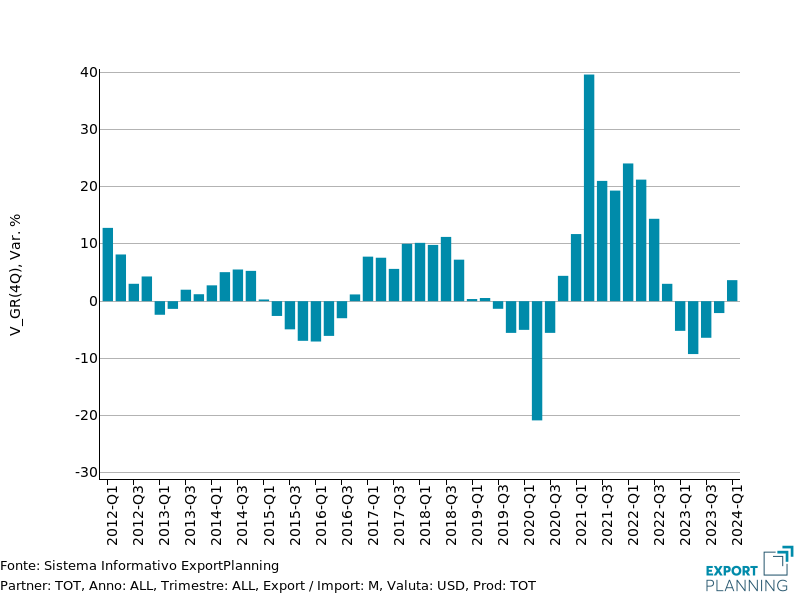

Fig. 1 - Dynamics of American demand from abroad

(year-on-year change in dollars)

The graph highlights the quarterly year-on-year variations recorded by American imports. The slowdown in trade that began as early as the fourth quarter of 2022 and intensified throughout 2023 is clearly visible, with a contraction close to -10% experienced in the second quarter of last year. Therefore, the positive signals of the first quarter of 2024 are even more significant, as they put an end to the prolonged recession phase that characterized 2023.

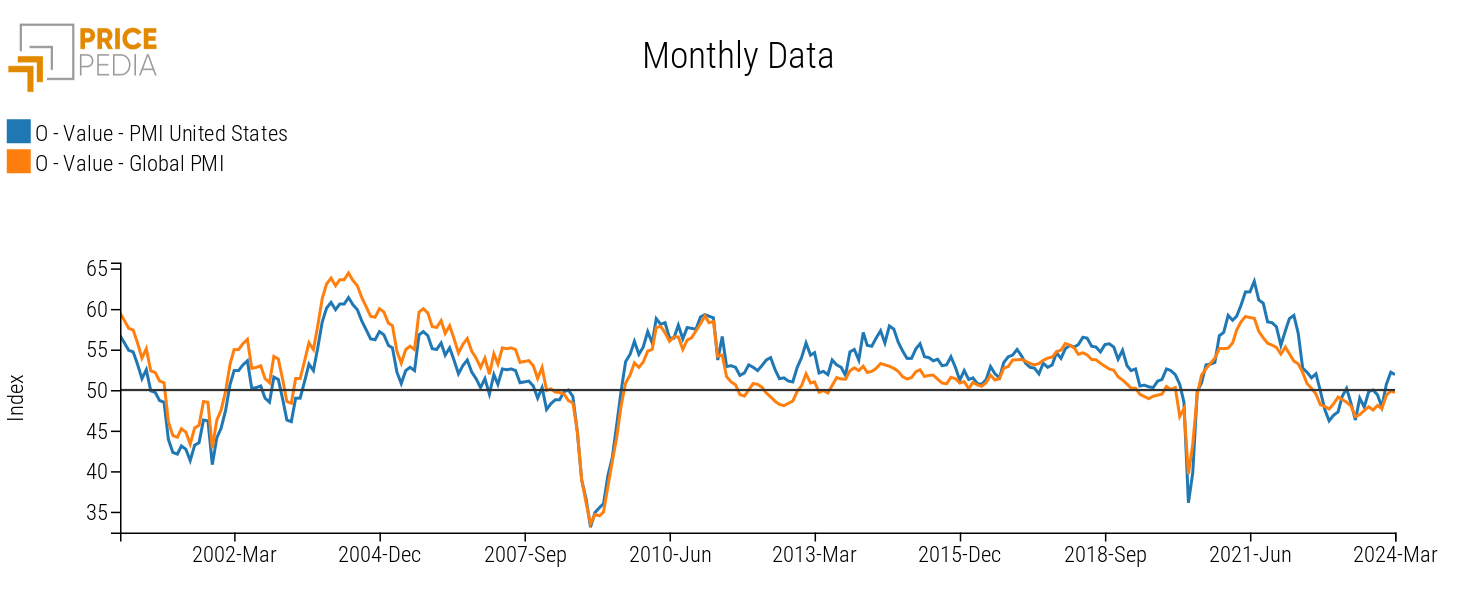

To certify what has been said, the Purchasing Managers' Index (PMI) is also shown, considered an important leading indicator of economic performance, as it reflects the opinions of purchasing managers, who are often among the first to detect changes in market conditions and demand trends.

The PMI is based on a scale from 0 to 100, where values above 50 indicate an expansion of economic activity compared to the previous month, while values below 50 indicate a contraction. Therefore, a PMI above 50 suggests an acceleration of economic activity, while a PMI below 50 suggests a slowdown.

Fig. 2 - PMI

Since the beginning of 2024, the value of the US PMI has exceeded the critical threshold of 50, surpassing the global PMI. The United States is therefore among the first countries to lead the recovery of international trade.

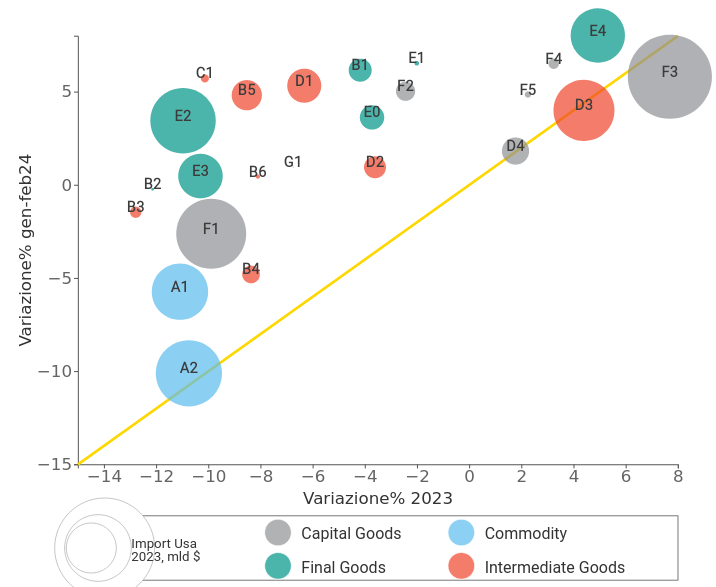

The revival of manufacturing is also evident from the sectoral segmentation of American demand: this is reported in the following graph, which compares the year-on-year variations of American imports in 2023 (x-axis) and in the first two months of 2024 (y-axis), for the main manufacturing sectors.

Fig. 3 – Variation of American demand by sectors

Source: ExportPlanning

From the displayed graph, several points for reflection emerge:

- After a complex year-end closure, the rebound affecting all intermediate goods (shown in red) is evident, providing signs of recovery after closing 2023 in broadly negative territory.

- Also noteworthy is the recovery of consumer goods (in green), as highlighted by the rebound in Fashion System (E2), Home System (E3), and Agri-food (E0 and B1).

- On the right side of the graph, we find the sectors that held up well in 2023, with the automotive sector standing out, continuing to show positive expansion rates; there are also machinery (F5 and F4) sectors that performed well, along with the acyclical sectors such as Health Products and Instruments (E4).

Conclusions

The rebound of American demand seems to suggest a restart of global trade, led by the United States; however, it is important to recognize that the stability and sustainability of this recovery will depend on a series of factors, including the effective management of global supply chains and the ability to address emerging challenges related to geopolitical relationships among the major world economic areas.