Advanced Technology Products: a Snapshot of US Trade

Despite the renowned US strength in the field of technological advancement, the trade balance of the segment has undergone a significant deterioration over the last years

Pubblicato da Gloria Zambelli. .

United States of America Trade balance Importexport Export markets Economic policy Check performance Foreign Market AnalysisThe outbreak of the Covid-19 pandemic on a global scale, and the related containment measures, exerted a significant economic impact, changing international consumption trends and accelerating processes that were already in place, namely in the adoption of digital technologies. As report in a previous article, the race to technological supremacy has already become a priority and, in the current context, represents a key arena in international competition.

The most strategic assets in the field of high technology are often referred to with the acronym "ATP" (Advanced Technology Products), of which the US Census Bureau provides a classification on the basis of customs codes. Gathering ExportPlanning data on US international trade, trade flows in advanced technology products can be estimated, focusing on trade balance and the export performances of the various macro-areas belonging to the cluster.

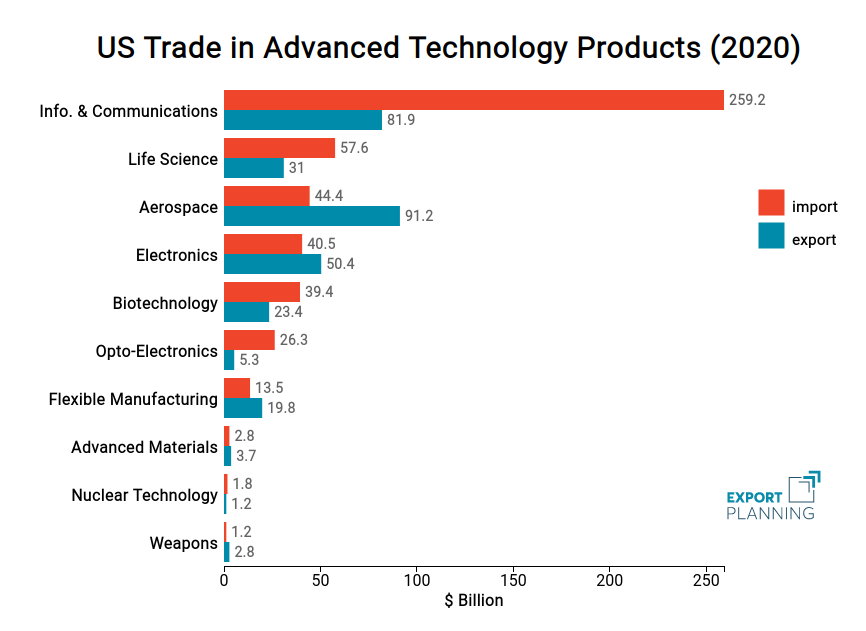

Overall, ATP are one of the largest segments of US trade and support the country's growth: ATP represented 19% of total US imports and 22% of US exports in 2020. The following graph shows import and export values recorded during 2020 for each macro-sector belonging to the ATP group.

Source: ExportPlanning elaborations.

As can be seen from the chart, despite many macro-areas recorded a trade deficit in 2020, several others proved quite resilient in spite of the currrent pandemic, managing to close the year in surplus. Particularly significant is the positive balance obtained by the Aerospace sector, for which a surplus of 46.8 USD bllion is estimated1.

Positive trade balances were also recorded in the fields of Electronics, Flexible Manufacturing, Advanced Materials and Weapons.

On the other hand, during last year, the Information & Communication macro-sector experienced a deep deterioration in terms of trade balance (-$177.3 billion), with imports amounting to over three times exports.

However, the data under analysis only consider import and export flows, not capturing the value added that US firms generate with their industry expertise in foreign countries.

ATP Trade Flows: an Historical Perspective

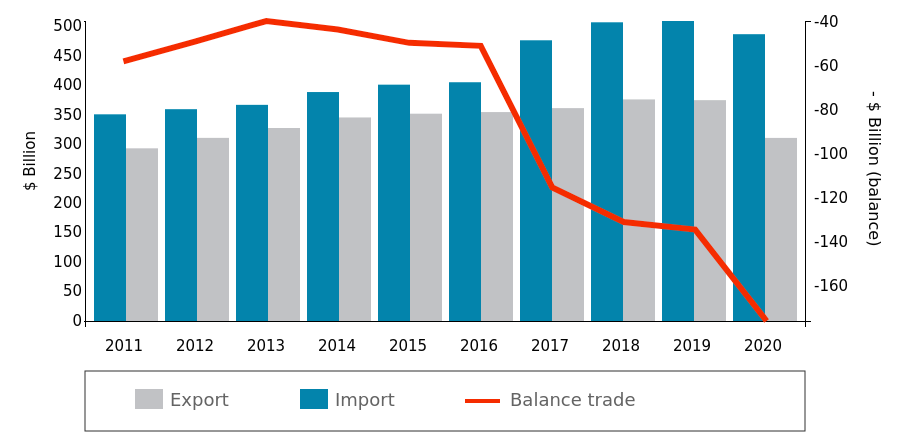

As we can see in the graph below, it is clear that, after an initial containment of the trade deficit during the early years of the current decade, the US ATP trade balance plummeted in 2017 (-$115 billion); the deficit surged to its highest level during the last year ( -$176 billion), in line with the general industry paralysis seen in the countries affected by the pandemic.

ATP: US Trade Balance (2011-2020)

Source: ExportPlanning elaborations.

The progressive deterioration of the balance of trade, due on the one hand to an increase in imports and, on the other, to a stabilization of export flows, confirms, even in this area, the defeat of the Trump administration in reducing the American trade deficit.

The effects of the pandemic on ATP flows

Focusing on US exports of Advanced Technology Products, trade flows appears to be strongly inhomogeneous among different macro-sectors.

In the following graph the different macro-areas belonging to the ATP cluster are placed according to the year-over-year rate of change in exports recorded in 2019 (on Y-axis) and in 2020 (on X-axis). The size of each ball is proportional to the value of exports in 2019. In this way, it is possible to highlight the sectors that were most penalyzed during the health crisis.

US Exports of Advanced Technology Products (% YoY change)

Source: ExportPlanning elaborations.

In the upper area of the chart, you can identify the sectors that showed the most significant growth performance during the pre-crisis year: among these we can find Nuclear Technology, Biotechnology and Weapons. Just three of the classified sector recorded negative growth in 2019.

As for 2020, the macro-sectors of Aerospace and Weapons recorded the greatest fall in exports, respectively amounting to -37% and -36% YoY; the clusters of Opto-Electronics, Advanced Materials and Information & Communication showed a drop in exports between 12% and 6%. The fall in exports recorded in 2020 has conversely been more contained in the Life Sciences and Biotechnology sectors (between -4% and -2% YoY).

Some sectors even bucked the trend in 2020, recording positive growth rates: this is the case for US exports of Nuclear Technology, Electronics and Flexible Manufacturing.

In conclusion, despite the renowned US strength in the field of technological advancement, the trade balance of the segment appears deteriorated, mainly due to the dynamics of rising deficit observed during the last years. Therefore, it will be up to the new administration to rebalance the trade deficit and find new ways to boost exports.

1. It is necessary to specify that this sector, which concerns the production of civil and military helicopters and aircrafts, as well as spaceships, includes particularly sensitive data classified by the US government.