South Korea: attractive market for cosmetics

Passion for beauty and personal care salient aspects of local consumer preferences

Published by Simone Zambelli. .

Marketselection Foreign markets Import Foreign market analysis

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

South Korea's market overall represents a robust economy, being the tenth largest economy in the world and the fourth largest in Asia, and is characterized by an upper-middle per capita income (comparable to Italy's), which has allowed the consolidation of a high-spending middle class. The country has also proven to be relatively resilient to the current international economic climate, with GDP falling by only -0.7 percent in 2020, and growth in the 2021-2023 period estimated to average +2.7 percent annually.

Within this framework, the domestic cosmetics sector in particular has become increasingly important to the country's economy, finding increasing international affirmation.

However, while the global weight held by the country as a producing country has gradually grown, the country's ability to appreciate cosmetic products and goods from the rest of the world has also increased.

Indeed, a passion for beauty, personal care and constant attention to physical appearance significantly distinguish local consumers, making South Korea a particularly receptive market for cosmetic products such as creams and makeup preparations, hair lotions and perfumes.

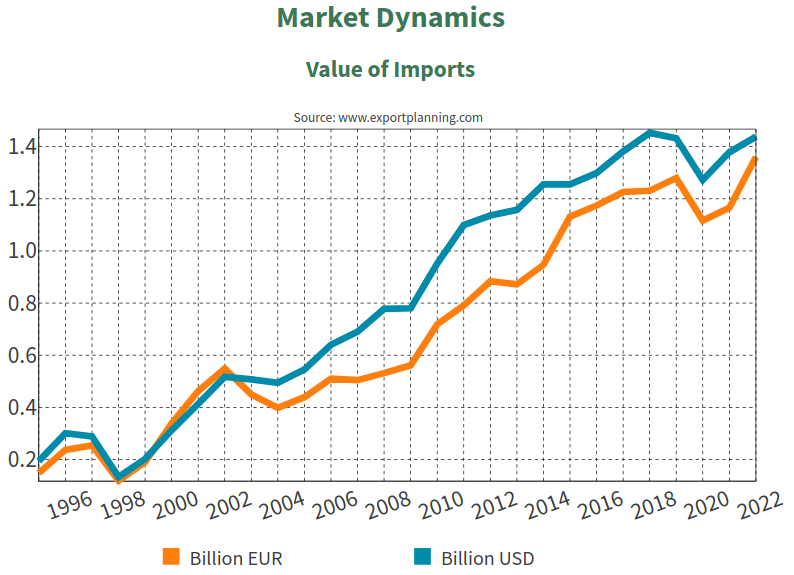

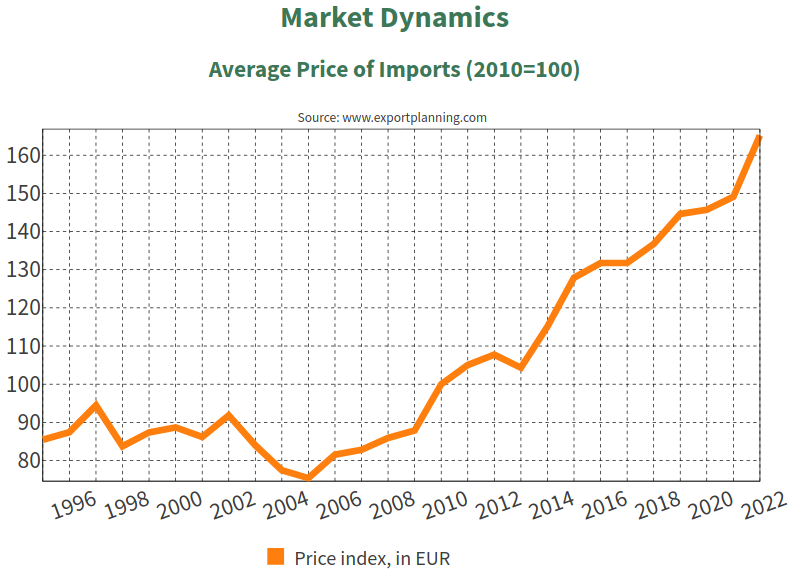

The graphs below show the dynamics of Korean cosmetics imports from 1995 to the present.

Risulta evidente come la curva delle importazioni abbia registrato una crescita costante che ha caratterizzato il secolo, arrivando nel 2022 a superare gli 1.4 miliardi di euro. The only setback was the pandemic year, although levels recovered almost entirely by the following year.

A particularly interesting statistic is that of the trend in the average import price, which, as shown in the graph shown on the right, has shown a definite upward dynamic, especially since 2008, testifying to the market's ability to purchase products of increasingly higher quality.

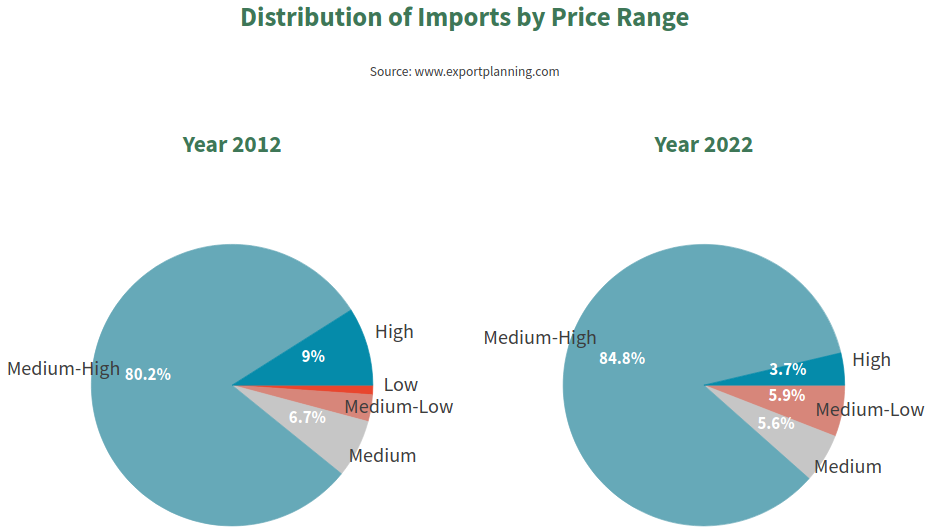

In fact, Korean demand for cosmetics is strongly oriented toward high-quality products. In fact, the distribution of Korean imports by price range highlights how the vast majority of imported products are in the mid- to upper-mid-range: in fact, for about a decade, Korean imports of premium price cosmetics (high-end and mid-range) have accounted for about 90 percent of the total imported from the country.

Source: ExportPlanning.

The competitive environment

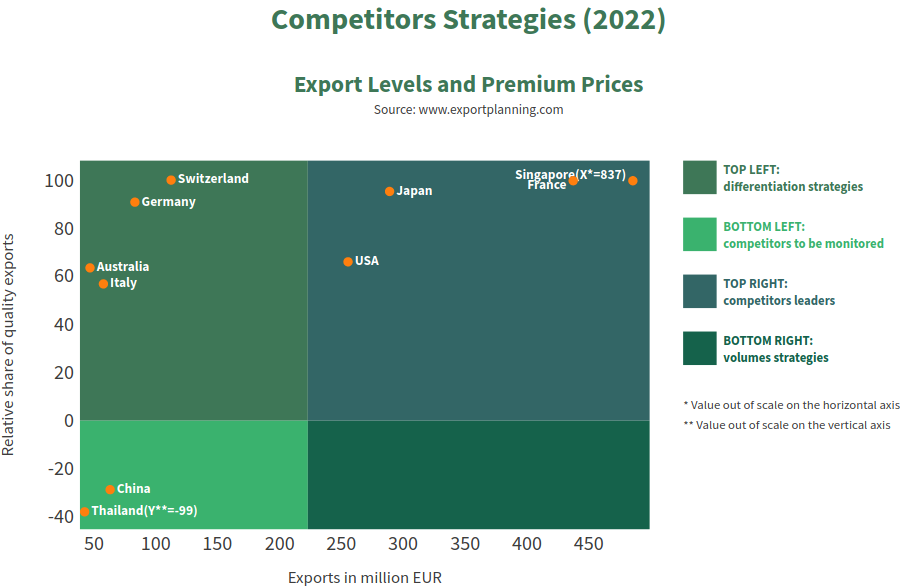

Notwithstanding a thriving local competitive environment, the main international players active in the market are largely dominated by Singapore, with more than 830 million euros exported to Korea in 2022, followed at a distance by France (430 million) and Japan (290 million).

By contrast, the Italian role is more marginal, ranking only eighth with just under 60 million.

Source: ExportPlanning.

Interestingly, however, despite being a still small market player, the Belpaese ranks in the upper left area of the graph, in the area that identifies differentiation strategies: Italy is characterized by low export values, but has a significant relative share of quality exports, on par with leading countries such as the U.S., Japan and Singapore.

The body creams segment is the largest of the total Korean cosmetics imports, reflecting the strong local focus on these products and the deep-rooted culture in Korean skin care society.

In this segment, Singapore has a market share close to 40 percent, which is followed by France (14 percent), Japan (14 percent) and the United States(10 percent). For the segment, the Italian role is still very small and close to only 1%.

Relatively better Italian positioning for the other two most significant sectors in terms of imports: perfumes and hair lotions.

Reflecting international leadership, in perfumes France has positioned itself as the leader in the Korean market since the early 2000s, increasingly widening the gap with its pursuers, so much so that in 2022 it reached a 40 percent market share. Italy, however, has managed to carve out market space for itself, ranking fourth among exporters with a share of just over 7 percent.

In hair lotions it is Japan that leads the way, followed closely by the United States and Thailand, all 3 with a market share hovering around 20 percent. Italy stands at 3.3 percent, but ranks second among European countries, just behind France.

Conclusions

South Korea's appears to be a fast-growing market for high-quality beauty products, supported by local consumer attitudes that have made the Korean cosmetics industry famous worldwide. The market's increasing focus on imported products, which has been consolidated over the century, leaves significant room for opportunity for international companies in the industry, albeit with the complexities associated with the specificity of the market. Within this framework, the room for growth for Italian companies still appears significant.