New Frontiers of Growth for Luxury: Leather Goods in the Markets of Thailand, Malaysia, Turkey and Poland

Premium-price shifts course: from established players to new emerging markets

Published by Veronica Campostrini. .

Premium price Foreign markets Foreign market analysisAfter more than two decades of substantial resilience to global economic crises, recent years have seen growing rumors about the greater vulnerability of the high-end segment to an uncertain international environment. In this context, it is crucial to adopt an analytical approach aimed at reconstructing an objective view of the dynamics that have shaped international trade in premium-price goods, focusing on one of the key sectors of the Fashion System and a symbol of Made in Italy luxury worldwide: Leather Goods.

Global Trade in Bags, Suitcases and Wallets

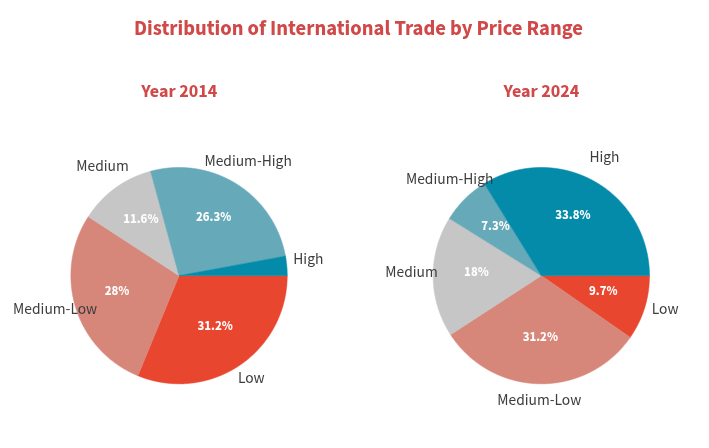

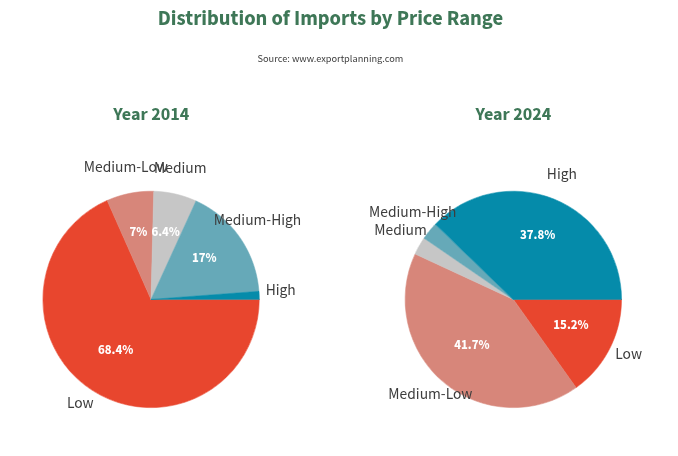

In 2024, global trade in the sector reached an all-time high of €81 billion, following a steady post-pandemic recovery. The most significant trend concerns the breakdown by price range: while in 2014 the high and upper-mid segments accounted for around 29% of global trade, today that share has exceeded 40% (see the chart below).

Source: ExportPlanning - Reporting Tool

The overall result highlights widespread growth dynamics across major international markets – the United States, Japan, France, and China itself, although the latter is affected by structural issues related to the strengthening of domestic demand. At the same time, new geographies of opportunity have emerged: in recent years, countries such as Turkey, Poland, Thailand and Malaysia have shown a robust capacity for qualitative upgrading in their demand for imported Leather Goods, positioning themselves as emerging frontiers for global luxury.

The Boom of Turkey

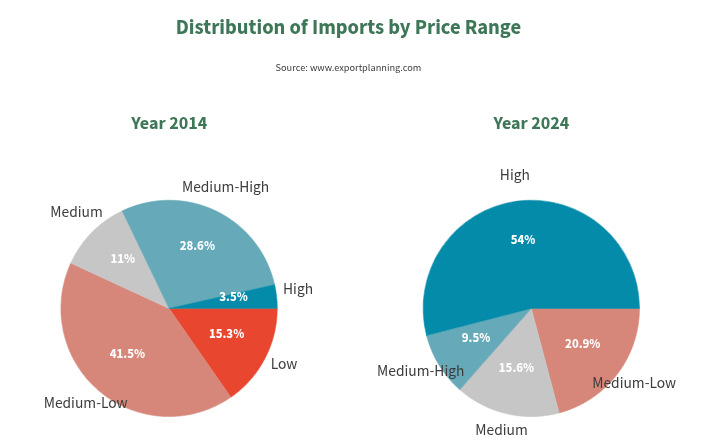

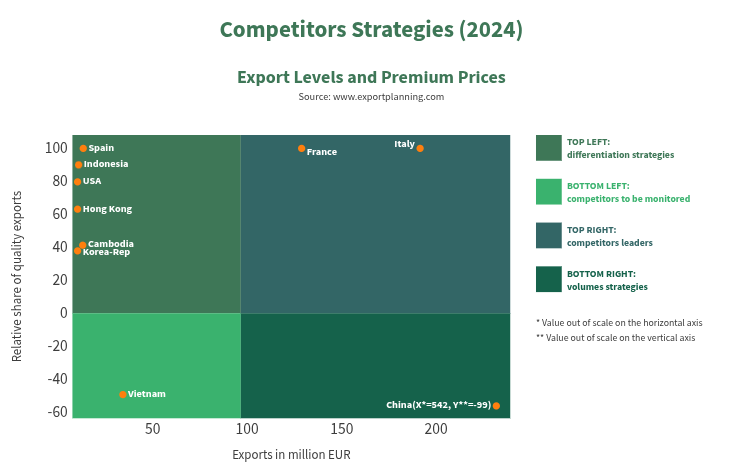

Although still a market with growth potential, with a current value of €530 million, Turkey has experienced a particularly significant evolution. Today, it is estimated that over 60% of the country’s imports of Bags, Suitcases and Wallets fall within the highest price ranges, essentially doubling their relevance compared to 10 years ago.

Source: ExportPlanning - Reporting Tool

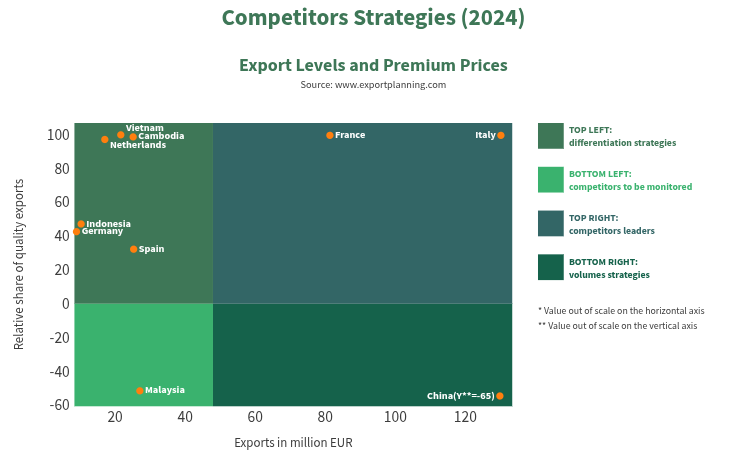

In this scenario, Italy and France emerge as the leading high-end players in the market. In particular, Italy records export values close to those of China, but with a positioning at the very top of the market.

Source: ExportPlanning

Poland’s Progressive Upgrading

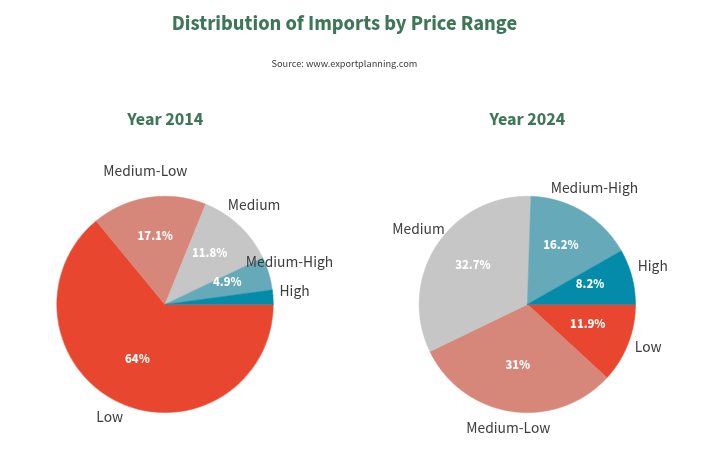

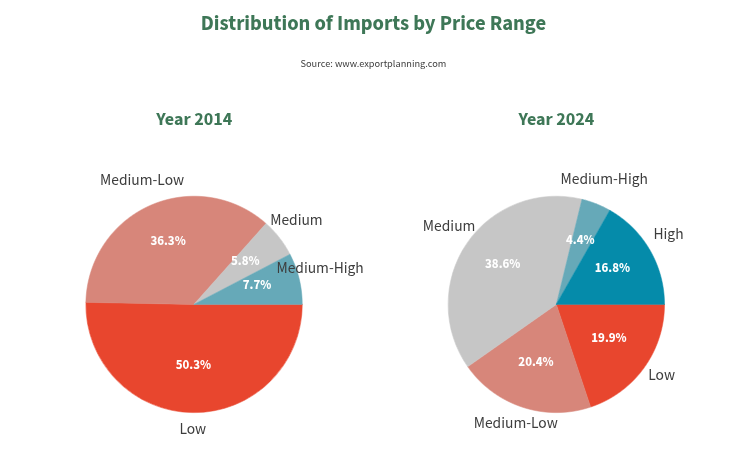

The Polish market, valued at €1.2 billion in 2024, represents an interesting case, as over the past 10 years it has shown a progressive, across-the-board upgrading in demand for imported Bags, Suitcases and Wallets. Consumers’ shift towards premium segments reflects the socioeconomic transformation of a country increasingly integrated into Europe’s manufacturing core, with rising income levels.

Source: ExportPlanning - Reporting Tool

It is worth noting, however, that despite the growth of Italian exporters, Germany remains the leader in the high-end segments of this market.

Source: ExportPlanning - Reporting Tool

The ASEAN Markets of Malaysia and Thailand

Two further emblematic cases concern the markets of Thailand and Malaysia.

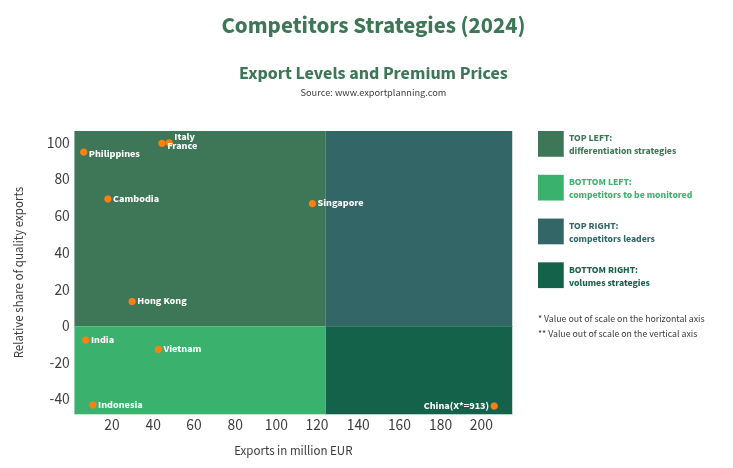

Thailand, with €951 million in imports for the sector, is the most dynamic market in the region. Demand for higher-end price ranges has increased significantly over the last decade, making Thailand an increasingly important emerging hub on the Asian landscape.

Source: ExportPlanning - Reporting Tool

China’s supply to this market is entirely concentrated in the lowest price ranges, while Italy and France are consolidating their roles as undisputed leaders in high-end supply.

Source: ExportPlanning - Reporting Tool

Turning again to ASEAN, Malaysia deserves mention: with a market value of €591 million, the country shows a clear reorientation toward higher-quality products, driven by a newly emerging middle class.

Source: ExportPlanning - Reporting Tool

In this case, however, the presence of European players still remains marginal compared to the potential.

Source: ExportPlanning - Reporting Tool

A Reshaping of the Luxury Industry

The emerging picture is that of a luxury industry in transition, where traditional markets continue to guarantee volumes but new ones show surprising acceleration. Turkey, Poland, Malaysia and Thailand do not yet match the scale of U.S. or Japanese demand, but their qualitative upgrading signals the start of a cycle that could redraw the global luxury map. For European players – and Italy in particular – this opens up spaces for strategic penetration: capturing the new elite of emerging consumers could be the key to sustaining growth over the next decade.