U.S. Tariffs on Italian Pasta: Between Risks and Resilience

Published by Marco Pappalardo. .

Importexport Made in Italy Trade war Italy International marketingIn recent days, the Trump administration has preliminarily announced an additional duty of 91.74% on Italian pasta which, added to the 15% already applied to European goods, would bring the total customs burden to over 100%.

The decision for this new trade tightening was taken following the periodic reviews conducted each year by the U.S. Department of Commerce on imports of Italian pasta, at the request of some American companies. In this round, the companies examined were La Molisana and Garofalo, accused of having sold their products at prices below market value, a practice known as “dumping.” According to the U.S. administration, the measure therefore aims to protect the domestic market from forms of competition deemed unfair.

The additional duty, scheduled to come into effect on January 1, 2026, would directly affect the two companies under investigation — La Molisana and Garofalo — and would exceptionally extend to eleven other Italian companies, including Barilla, Rummo, and Sgambaro.

Italy’s position in the U.S. durum wheat pasta market

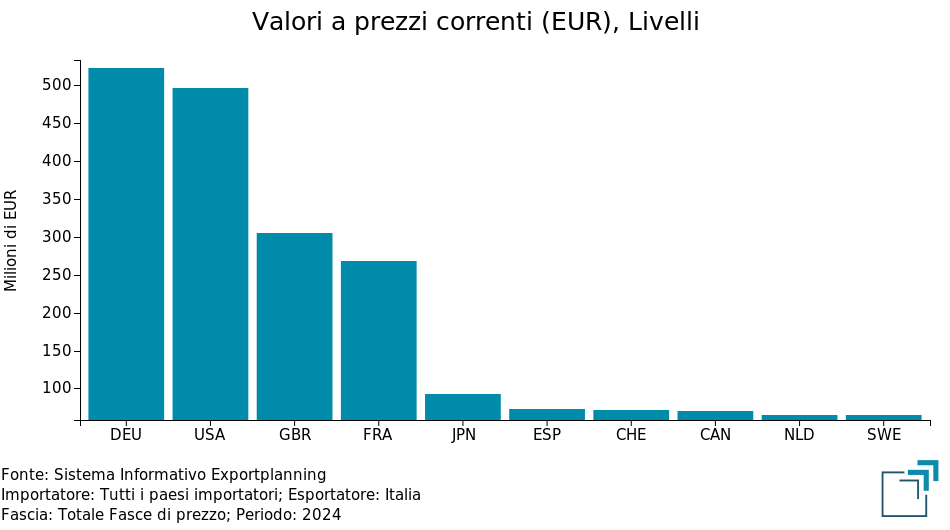

As shown in the chart below, the United States represents the main Extra-EU destination market for Italian pasta, with export values close to 500 million euros in 2024.

Fig.1 - Main destinations of Italian durum wheat pasta exports, 2024

Source: ExportPlanning elaborations.

Italy is indeed the largest supplier of durum wheat pasta to the U.S., holding more than 50% of the market share.

Fig.2 - Main suppliers of durum wheat pasta in the U.S. market, 2024

Source: ExportPlanning elaborations.

As highlighted in the article “U.S. Tariffs and Competitiveness: Why Substitution Elasticity Matters”, in order to correctly assess the impact of a tariff increase on U.S. demand, it is necessary to consider consumers’ willingness to change their choices in response to higher prices for imported goods, replacing them with lower-priced alternatives.

This reaction can be measured through the estimation of the trade elasticity of substitution with respect to relative prices, broken down into two components:

- The elasticity of substitution between imported goods and domestic production, which measures how much American consumers replace foreign goods with those produced in the United States;

- The elasticity of substitution between foreign suppliers, which indicates the propensity to replace a good imported from one country with similar products offered by other exporters.

Since information on domestic demand and prices of national goods is not available at the individual product level, estimating the elasticity between foreign suppliers can be considered a proxy for the elasticity between imports and domestic production, as the two measures are closely correlated.

Substitution elasticity for durum wheat pasta: an econometric estimate to assess the impact of the new duty on U.S. imports

In this regard, an econometric model was developed to estimate the variation in U.S. foreign demand for durum wheat pasta following changes in relative prices among foreign suppliers.

The first results show that the trade substitution elasticity between foreign suppliers of durum wheat pasta is equal to -0.45. This means that, following an increase in the relative price of Italian pasta compared to that of other suppliers on the U.S. market — assuming a total tariff rate of 100% and the full transfer of the tariff cost to consumers — it is estimated that the quantity demanded by U.S. consumers would decrease by just over 25%.

Considering that, according to economic theory, the substitution elasticity assumes negative values, a figure between -1 and 0 indicates a less-than-proportional reduction in demand compared to the increase in relative prices. This result confirms that Italian durum wheat pasta can be considered a differentiated product and therefore not easily replaceable with alternatives from other foreign suppliers.

Assessing the substitutability of durum wheat pasta compared to other food products

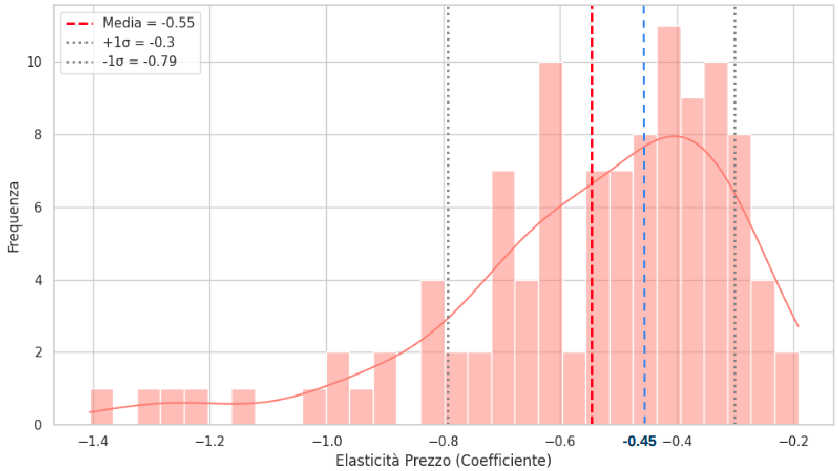

The chart below shows the distribution of substitution elasticities between foreign suppliers for various products in the processed food and beverages sector, classified according to the HS nomenclature.

It can be observed that the substitution elasticity of durum wheat pasta (represented by the blue dashed line) is closer to zero than the average substitution elasticity of the Food and Beverage sector (red dashed line), indicating that, in the U.S. market, Italian durum wheat pasta is less replaceable by imports from other foreign suppliers compared to the average of other Food & Beverage products.

It should be noted, however, that most food and beverage products show an elasticity value around -0.4, indicating moderate substitutability overall.

Fig.3 - Substitution elasticity of processed food and beverages

Source: ExportPlanning elaborations.

Conclusions

The analysis of substitution elasticities shows that Italian durum wheat pasta is a product with low substitutability. This implies that, despite the increase in tariffs, Made in Italy maintains a differentiated position compared to the offer of other international suppliers, thanks to its perceived quality and distinctive product characteristics.

For Italian companies, understanding the degree of substitutability and substitution elasticities therefore plays a strategic role: such information makes it possible to assess demand resilience, adapt commercial and pricing strategies, and thus defend their market positioning.