Market Diversification Objective: The EU–Mercosur Trade Agreement

Published by Marzia Moccia. .

Free trade agreements Europe Latin America Market AccessibilityAfter more than twenty years of negotiations, suspensions, reopenings, and periods of intense political tension, on December 6, 2024, the European Union and Mercosur reached a historic agreement aimed at creating one of the largest free trade areas globally. This milestone marked the prelude to the next institutional phase: on September 3, 2025, the European Commission submitted to the Council the official proposals for the signing and conclusion of the EU–Mercosur Partnership Agreement (EMPA), formally initiating the adoption process of the text.

What the trade agreement entails

From the perspective of goods trade, the EMPA provides for a broad and gradual elimination of tariff barriers: over ten years, the Mercosur countries will liberalize 90% of European industrial goods imports and 93% of agricultural products.

On the other hand, the EU commits to fully opening imports of manufactured goods from Mercosur, with liberalization following a tariff reduction schedule defined for agricultural products. For this sector, the EU has maintained a more cautious approach. For European imports of beef, pork, and poultry from the region, the liberalization process will be regulated by a tariff-rate quota system (TRQ) and safeguard clauses, while ensuring sanitary standards consistent with those in the EU.

Regarding services, the agreement also establishes an advanced liberalization framework, aimed at reducing regulatory obstacles and discriminatory practices, facilitating investment in key high-value sectors: business services, financial services, telecommunications, maritime transport, and postal services.

In particular, the agreement aims to strengthen market access conditions through two strategic directions:

- Opening Mercosur public procurement to European operators;

- Reducing non-tariff barriers, with the elimination of technical barriers and facilitated access conditions for SMEs.

The EU–Mercosur agreement, in its structure, is therefore consistent with EU-style "new generation" agreements and aims to build a high level of integration between the two economic blocs, addressing not only tariff aspects but also the establishment of shared regulatory standards and mechanisms to “correct” possible distortions and unfair competition factors.

Another important aspect to highlight is that the agreement is part of the broader architecture of preferential trade cooperation developed by Brussels, which today includes over 76 countries and constitutes the largest global network of economic agreements. This architecture has accelerated also in response to the resurgence of protectionist policies and aggressive industrial policy tools adopted internationally, primarily led by the United States.

The European strategy is structured along two complementary directions. The first is preferential access to dynamic markets, aimed at ensuring economies of scale and competitive positioning for European companies in global segments with high growth potential. The second is strengthening economic security through the geographic diversification of supplies, reduction of critical dependencies, and stabilization of strategic inputs — an approach aligned with the recent European “economic security” agenda.

Within this framework, the negotiations with Mercosur represent one of the most sensitive dossiers from a geoeconomic perspective.

The South American bloc represents a combined market of over 780 million consumers, but above all, it is a key area for sourcing strategic raw materials. The combined importance of trade and supply security places the EMPA at the center of major global value chain restructuring trajectories.

The current state of EU exports to Mercosur

As mentioned, a key aspect of the trade agreement concerns the ability to increase the competitiveness of European exports in a large market area.

Despite the significant potential, the Latin American region has historically presented substantial barriers to entry for European exporters.

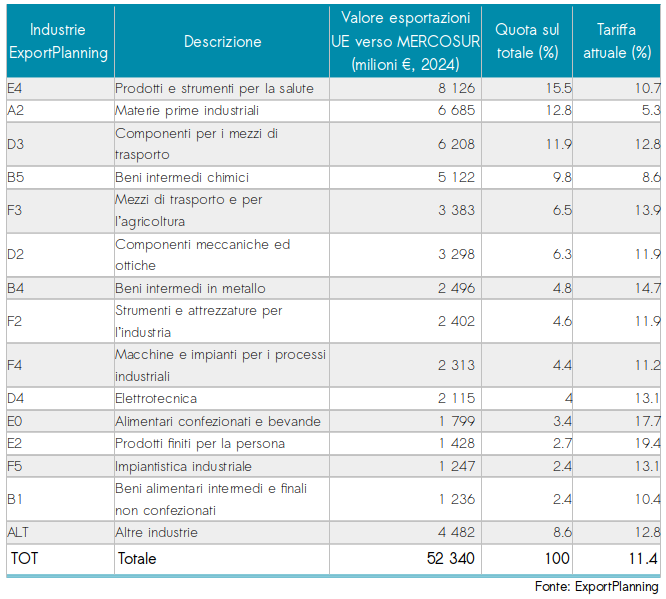

The table below provides clarity on European exports to the region in terms of values and average tariff rates applied to different sectoral categories.

Table 1: EU exports to Mercosur: values and average tariffs by industry

*The table shows value-weighted average tariffs for EU exports to the region

Among the products most exported by the Union to Mercosur are health products and instruments, industrial raw materials, and automotive components, alongside a variety of industrial goods.

Overall, these sectors face a weighted average tariff above 10%, indicating a high level of protection at Mercosur market entry.

Some segments with particularly high average tariffs are especially notable, including packaged agri-food (E0) and the fashion system (E2), which have rates higher than the European export average to the region.

Conclusions

The EU–Mercosur agreement represents a crucial step in the European trade strategy, going far beyond mere tariff reduction. Its implementation strengthens the EU’s geopolitical presence in Latin America, offers new opportunities for European and Italian companies in high-value sectors, and consolidates global value chains through more diversified and secure supplies. At the same time, the agreement establishes advanced standards in environmental, social, and commercial governance.

In summary, the EMPA not only boosts European industrial competitiveness but also contributes to building deep and strategically relevant economic integration between two globally significant economic blocs.