Hong Kong: Asian Hub for High Quality Consumer Goods

Published by Matteo Olivieri. .

Premium price Foreign markets Asia International marketing Market AccessibilityIn this article we highlight the role of Hong Kong as a commercial hub for quality consumer products, with particular reference to Packaged Food and Beverage and Fashion Products.

Hong Kong at the top of the market ranking

for purchasing quality consumer goods

Potentiality

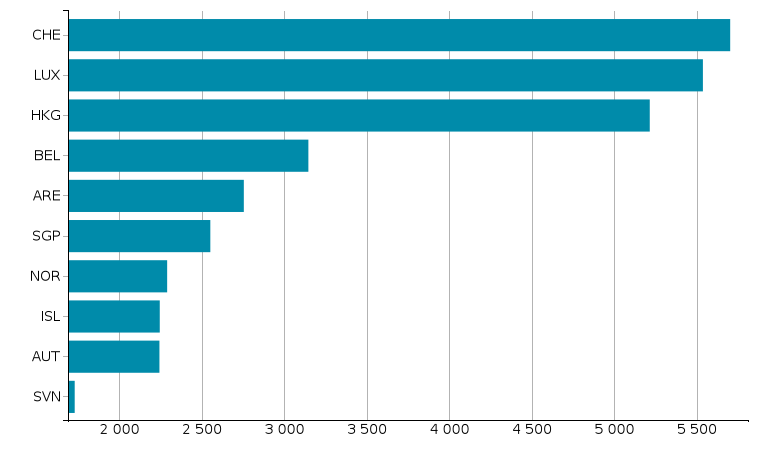

As the chart below shows, Hong Kong is at the top of the world market rankings for per capita import levels of consumer goods of quality, i.e. the highest price ranges.

Ranking of per-capita import markets for quality consumer products

(2019 data in euros)

Source: ExportPlanning - Analytics

The Hong Kong region is one of the most open economies in the world and has always been a strategical platform for trade in the Asian Far East. The merchant port of Hong Kong is the seventh in the world for container handling, behind Shanghai, Singapore, Ningbo-Zhoushan, Shenzhen, Guangzhou and Busan, thanks also to the harbour's depth suitable for every type of boat and efficient port infrastructure. The Hong Kong International Airport, ranked different times as one of the best in the world, its the eighth busiest in terms of passengers in the world.

In other words, for its infrastructure network, Hong Kong is the major strategic hub for the Asian markets, especially for the Chinese one. Just think that there are two customs that connect Hong Kong and Shenzhen accessible by subway and four customs crossings for cars.

Food and Beverage

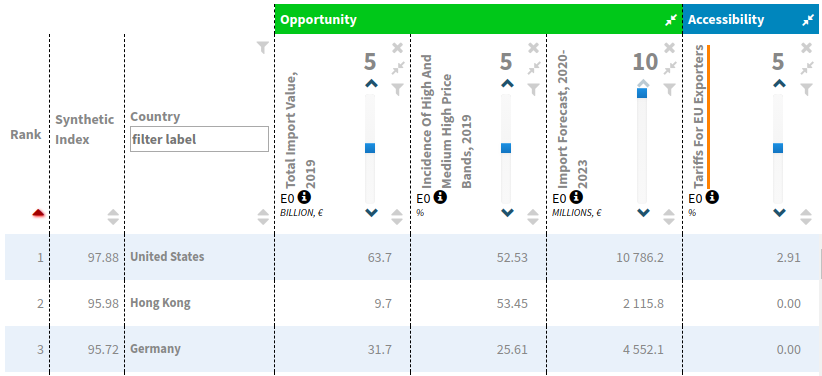

Market potential ranking for Packaged Food and Beverage

Source: ExportPlanning - Market Selection

In the Food and Beverage industry, Hong Kong is on the short-list of the high potential destinations, according to ExportPlanning data1 (see image above).

In particular, Meat and fish, processed and packaged is a sector in which Hong Kong is in first place for levels of potential, thanks to a maximum incidence of premium segments and a positive trend expected in the four-year 2020-2023 scenario.

Also worth of notice are the Confectionery sector, in which Hong Kong is at the top of the high potential market ranking (together with France and Germany), and Alcoholic Drinks, with Hong Kong at the top (together with Canada and the USA) thanks - also in this case - to a very high incidence of the "premium-price" segments.

Fashion Products

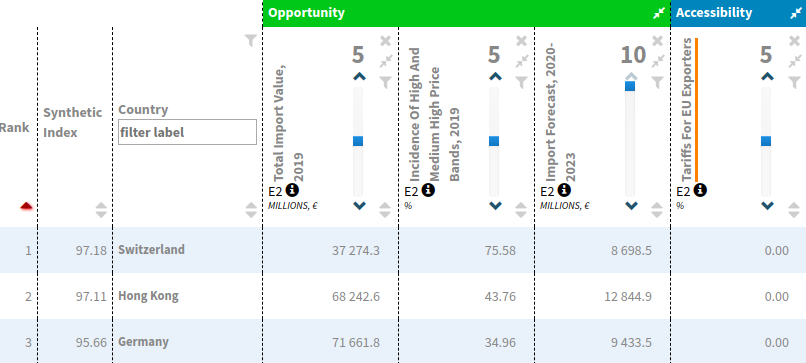

Market potential ranking for Fashion Products

Source: ExportPlanning - Market Selection

As regards Fashion Products' industry, there are the following sectorial cases at major potential:

- Jewelry: Hong Kong is in first place in terms of market potential, thanks to its impact on the peak of the highest price ranges and the expected favourable evolution of imports in the period 2020-2023

- Bags, suitcases and wallets: Hong Kong at the top of the potential list, thanks to the growing importance of the premium segments

- Perfumes and Cosmetics: Hong Kong ranks first in terms of potential, with a strong incidence of the high price bands, equal to 94% of the total imported in 2019, and in the future, an increase of 6-9% is expected in the period 2020-2023, reaching almost 7 billion euros in the value of Hong Kong imports from the world of Perfumes and Cosmetics.

Accessibility

Despite current tensions in relationships with China, the economic cooperation agreement called CEPA (Closer Economic Partnership Arrangement) signed on 29 June 2003 (and subject to improvement changes over the years) is in force between the two economies.

First of all, the signing of the Agreement for the liberalization of trade in services between Guangdong and Hong Kong represented a further step for the implementation of CEPA, which was improved by the Agreement for the liberalization of the trade in services, entered in force on 1 June 2016, the agreements on investments and technical and economic cooperation, entered into force on 1 January 2018, and the bilateral agreement on trade in goods, which came into force on 1 January 2019.

With this agreement, goods of Hong Kong origin enjoy the "zero tariff" through the improved agreement for the rules of origin (ROO). More generally are specified the principles of facilitation of trade, including the stipulation of the will of the two sides to facilitate trade by simplifying customs procedures, improving the transparency of related measures and the cooperation in the relevant sectors, and in particular by establishing measures to accelerate the customs clearance of goods.

However, increasing political instability and the possible erosion of Hong Kong's political autonomy by Beijing could constitute significant risk factors for international investors, which need constant monitoring.

1) In the market potentials considered in this article, and based on the ExportPlanning-MarketSelection tool, the following industry-specific indicators were analyzed and compared for 152 countries:

- Import Values in 2019;

- incidence of Imports' High- and Medium-High Price Ranges in 2019;

- Forecast of Imports growth in the period 2020-2023;

- Tariffs for EU exporters.