New High for world trade in Metalworking Machine Tools

By 2022, all major segments of the sector had recovered to pre-pandemic levels, thanks to the presence of several BLOC markets (BLue OCean)

Published by Marcello Antonioni. .

Industrial equipment Conjuncture Global demand Export markets Foreign markets International marketing International marketing

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The dynamics of sectoral world trade

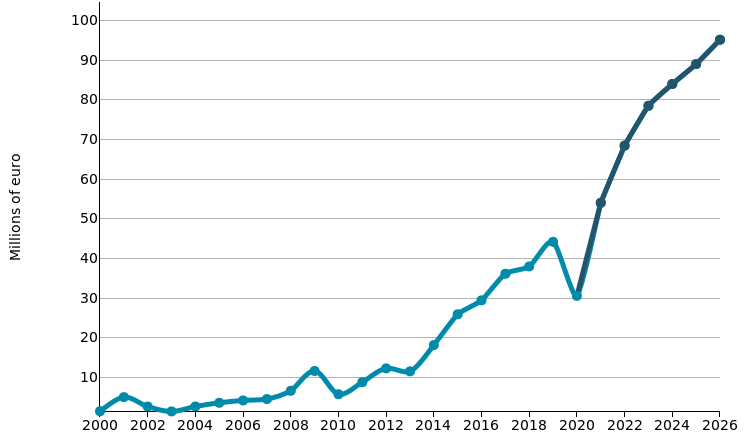

World trade in Metalworking Machine Tools1 showed growth in 2022 estimated at year-end by around 20 percentage points in euro values (and +8.2 per cent at constant prices).

Thanks to this performance, world trade in the sector should reach a new absolute maximum point at the end of the year, both in values in euro (40.7 billion: see the graph here below) and at constant prices.

Considering the period from the outbreak of the pandemic to today, the sector has been able to achieve an overall increase in world trade flows of 11.5 percent in euro values and 8.4 percent at constant prices.

All major segments of the industry are back

above pre-pandemic levels...

Pre-final 2022, all the main segments of the sector show world trade levels, both in euro values and in quantities, higher (even significantly) than pre-pandemic levels.

In particular, the machining centers for metalworking segment shows an estimated value at the end of the year of 8.6 billion euros (+18.3% compared to 2021), almost 7 percentage points higher than 2019 in values in euros ( and by almost 9 percentage points in values at constant prices).

The industrial robots segment (7.2 billion euros pre-estimate 2022) saw world trade flows increase this year by 17 percent in euro values (+4.6% at constant prices), on levels of 30 percentage points compared to 2019 (+18.9 percent at constant prices).

The numerical control lathes segment (horizontal and vertical), thanks to an increase this year estimated at over 26 percentage points in euro values (+13.4% at constant prices) is expected to close 2022 with a new high point in world trade flows (5.9 billion euros), on levels (albeit slightly) higher than the pre-pandemic ones.

Commercio mondiale di Macchine utensili per metalli

| Levels 2022 | % changes at current prices | % changes at constant prices | |||

| Segment | (Bn €) | 2022/2021 | 2022/2019 | 2022/2021 | 2022/2019 |

| Machining Centers for Metalworking | 8.6 | +18.3 | + 6.8 | + 6.2 | + 8.7 |

|---|---|---|---|---|---|

| Industrial Robots | 7.2 | +17.0 | +30.0 | + 4.6 | +18.9 |

| CNC Lathes | 5.9 | +26.5 | + 2.0 | +13.4 | + 4.9 |

| Other Machine Tools | 19.0 | +20.3 | +10.8 | + 8.6 | + 6.9 |

| TOTAL | 40.7 | +20.1 | +11.5 | + 8.2 | + 8.4 |

Source: ExportPlanning-Ulisse Datamart

.. thanks to the presence of numerous BLue OCean (BLOC) markets in the acceleration phase.

BLOC Markets

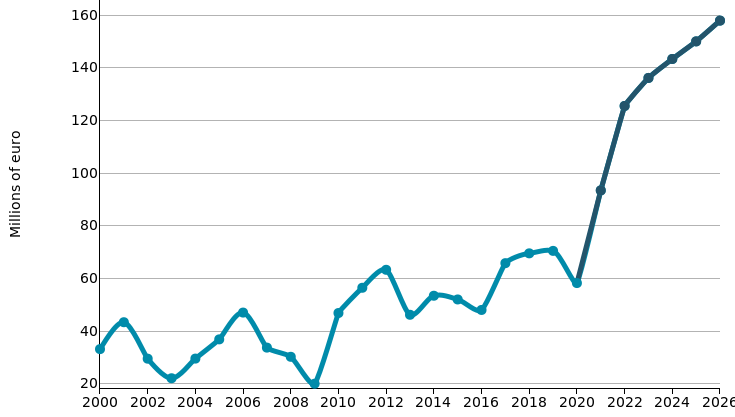

Machining Centers for Metalworking

In 2022, world trade in the machining centers for metalworking segment showed an estimated increase of over 1.3 billion euros compared to 2021; after the sharp fall experienced in the pandemic year 2020 (-2.3 billion euros, equal to over 28 percentage points), the recovery in the two-year period 2021-2022 made it possible to exceed the pre-pandemic values of 548 million euros.

This performance originates in several accelerating markets in its imports.

- Malaysia: with its estimated 126 million euros in 2022, it is the 16th importing country in the segment. After reaching a maximum point in 2006 (47 million euros), the Malaysian market had shown substantial stability, so much so that in 2016 the market level was the same as ten years earlier. In the period 2017-2022, the Malaysian market experienced an overall growth estimated at over 77 million euros (+161%). In the 2026 scenario, further increases are expected, albeit smaller in size (+33 million euro), reaching around 158 million euro;

- Saudi Arabia: this is a market with still relatively small dimensions (35th importing country in the segment), which however has shown strong dynamics in the last two years (and in particular in 2021) of growth, reaching 26 million euros (pre-estimates 2022). This growth dynamic is expected to continue, albeit with reduced magnitude, in the forecast scenario to 2026, with an expected value exceeding 30 billion euro;

- Macedonia: this is the 48th world importer of the segment in 2022, with an estimated value of 15 million euros. It is a market that saw a very strong surge in its imports in the two-year period 2021-2022, after a prolonged phase of latency. In the forecast scenario to 2026, the Macedonian market of the segment is expected to almost double its import values.

Machining Centers for Metalworking: main BLOC markets

| MALAYSIA | SAUDI ARABIA |

|

|

Source: ExportPlanning-Forecast Datamart

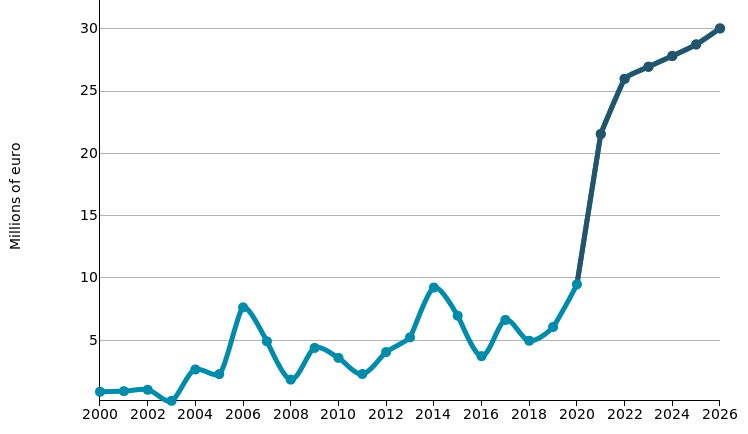

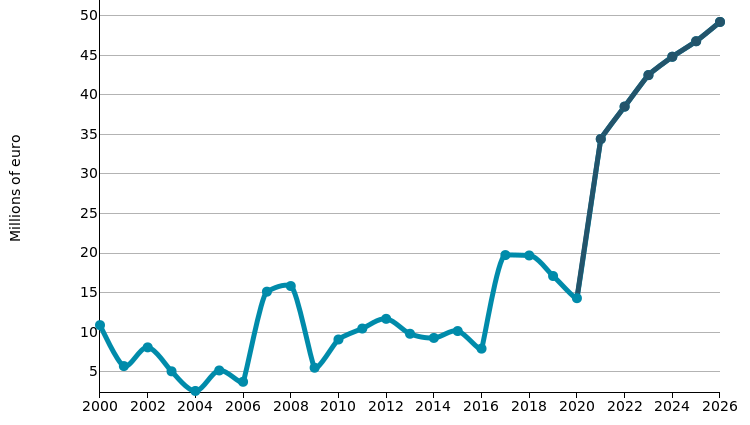

Industrial Robots

In 2022, world trade in the industrial robots segment experienced an estimated increase of over 1 billion euros compared to 2021; compared to pre-pandemic values (2019), the increase is close to 1.7 billion euros.

This performance originates in many accelerating markets in its own imports.

- Sweden: this is an emerging market in this segment (21st world importer in 2022), but which is showing a very intense acceleration phase, going from 36 million euros of imports in 2017 at around 88 million euros estimated in the final balance for 2022 (+142%). In the scenario to 2026, further increases are expected, even if dimensionally more contained in the values in euro, reaching around 96 million euro;

- Israel: this is not a market of first magnitude in the segment (39th world importer in 2022), but which has shown an overall increase of almost 4 times in the last eight years, from less of 9 million euros of imports in 2014 to the almost 35 million estimated in the final balance for 2022. In the 2026 scenario, a further increase of about 14 percentage points is expected, reaching almost the threshold of 40 million euros;

- Saudi Arabia: also in this case it is a market with still relatively small dimensions, which however has shown a strong growth dynamic in the last two years (and in particular in 2022), reaching to touch 34 million euros (against 10.3 million in 2020). This growth dynamic is expected to continue in the forecast scenario to 2026, with an expected value exceeding 40 billion euro.

Industrial Robots: main BLOC markets

| SWEDEN | ISRAEL |

|

|

Source: ExportPlanning-Forecast Datamart

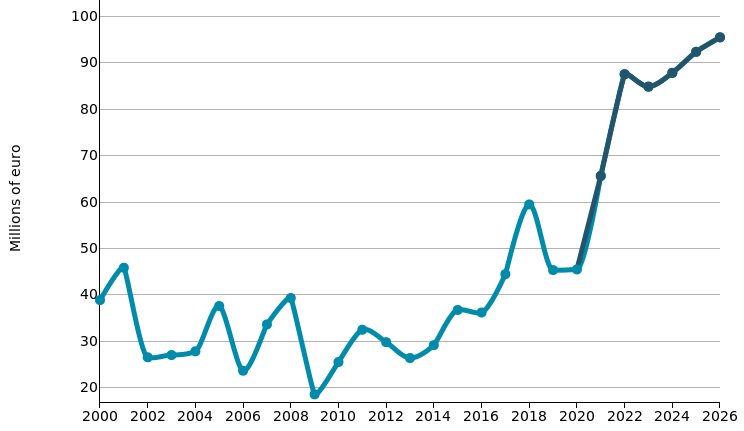

CNC Lathes

In 2022, world trade in the CNC Lathes (horizontal and vertical) segment showed an estimated increase of over 1.2 billion euros compared to 2021; after the significant drop recorded, following the Covid-19 pandemic, in 2020 (-2 billion euros, equal to approximately 34 percentage points), the recovery in the two-year period 2021-2022 made it possible to exceed the pre-pandemic values of 117 million of euros.

This performance originates in some accelerating markets in its own imports.

- Netherlands: it is the 6th world importer of CNC horizontal lathes and the 10th world importer of CNC vertical lathes. In the latter business area, this market is showing particularly accelerated growth dynamics of its imports, with a cumulative increase in the last five years exceeding 26 million euro (+343%). In the 2026 scenario, further increases are expected, albeit smaller in size (+12 million euro) in imports of CNC vertical lathes, exceeding 45 million euro;

- Vietnam: with its estimated 119 million euros in 2022, it is the 14th importing country in the segment. It is above all in the business area of CNC horizontal lathes that this market is experiencing a phase of intense growth, with an increase in the two-year period 2021-2022 alone of almost 38 million euros (+124 %). In the scenario up to 2026, further increases are expected in the horizontal lathes business area, with imports expected to grow by a total of 27 million euros, reaching over 95 million euros in this business area;

- Malaysia: with almost 49 million euros estimated for 2022, it is the 25th importing country in the segment. It is a market that in the business area of CNC horizontal lathes is showing particularly favorable dynamics: with a 2022 value of over 38 million euros (pre-estimates), Malaysian imports of this business area marked an overall increase estimated at over 30 million euro compared to six years earlier (with much accelerated dynamics in the most recent two-year period). In the 2026 scenario, further increases are expected, albeit smaller in size (+11 million euros) for imports of CNC horizontal lathes, reaching around 50 million euros.

Horizontal CNC Lathes: main BLOC markets

| VIETNAM | MALAYSIA |

|

|

Source: ExportPlanning-Forecast Datamart

Conclusions

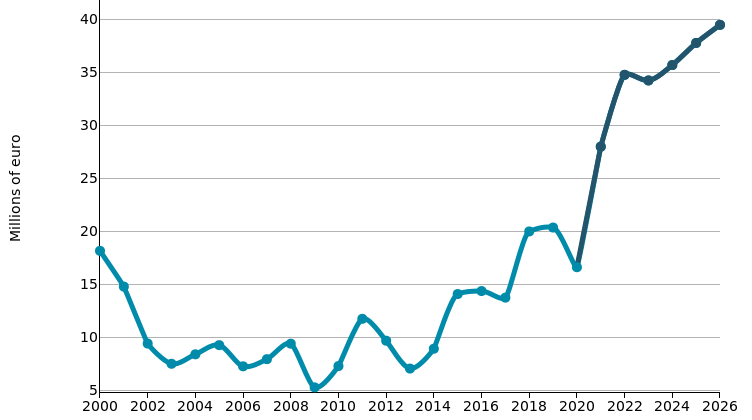

After a particularly dynamic two-year period 2021-2022 for the world trade in metalworking machine tools (also due to price increases along the supply chain and - with reference to the current year - to the depreciation of the euro), the prospects for the next four years (2023-2026) are decidedly more selective, with expectations of average annual growth in the order of 4 percentage points in euro values (see graph below reported)2.

In such a context of greater selectivity, the search for cyclically resilient BLue OCean (BLOC) markets could be a priority for exporting companies in the sector.

The instrumentation made available in ExportPlanning, in the Market Selection tool, can allow you to select the so-called BLOC markets, during the acceleration phase of your imports.

1) For a list of the segments of the sector being analysed, please refer to the relative sector profile.

2) These are sector forecasts formulated by StudiaBo, within the ExportPlanning Information System, based on the latest macroeconomic scenario of the International Monetary Fund.