Lights and shadows of Italian medical device exports

Against a non-positive economic backdrop, uncertainties related to the application of the payback weigh heavily

Published by Marzia Moccia. .

Health products Uncertainty Made in Italy Conjuncture Foreign markets Global economic trendsThe world of medical devices, although wide-ranging and heterogeneous, represents a significant part of the set of technologies underpinning people's health and wellbeing, and is characterised by a high technological turnover. In contrast to the terms 'drug' and 'medicine', which are firmly rooted in common culture, the terminology 'medical device' is rather recent. The substantial difference between a medicine and a medical device lies in the mechanism of action: the former has a pharmacological, metabolic, immunological action while the latter has a purely physical action. The category of medical devices is therefore extremely broad and ranges from patches to coronary stents to CT scanners.

The Italian medical device industry

On the Italian scene, the medical device industry represents a sector of industrial specialisation that has become increasingly important in recent years.

According to the latest estimates, the sector counts 4,449 companies, employing 118,837 people within a rather heterogeneous, highly innovative and specialised industrial fabric, where small companies coexist with large groups.

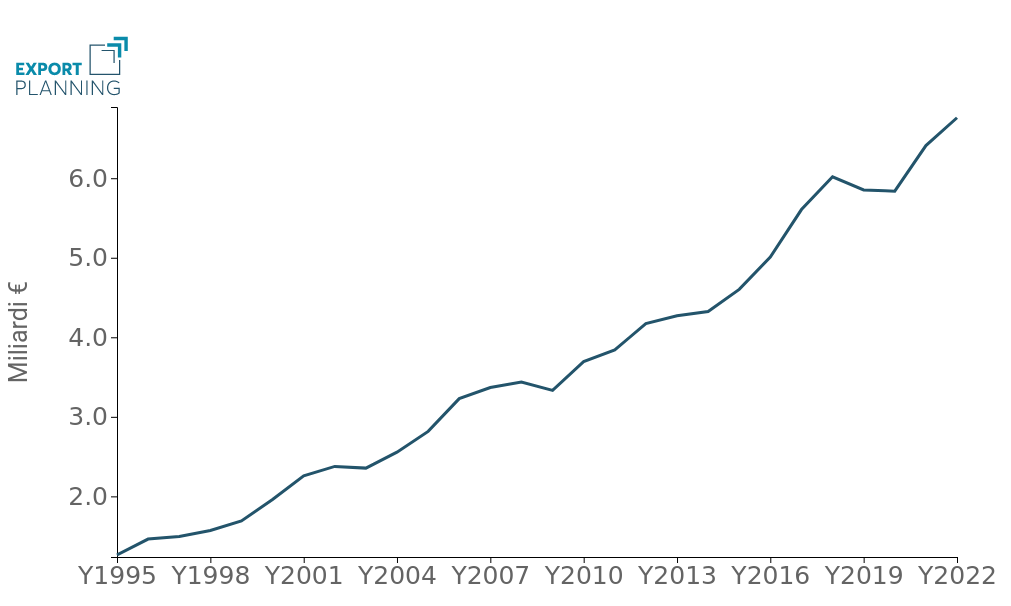

The Italian eco-system appears to be strongly integrated in the supply networks of the National Health System and boasts a broad international vocation, with an export propensity estimated to be close to 45%. Over the course of the century, in fact, exports from the Belpaese sector have experienced solid growth: while in 2000 Italy exported less than €2 billion, in 2022 it will exceed the €6.7 billion threshold (Fig.1).

Fig.1 – Italian Exports of Medical Devices

(billion euros, 1995-2022)

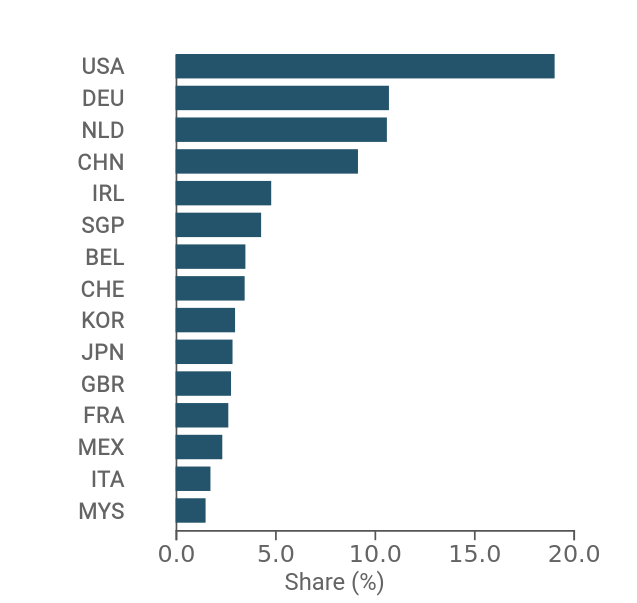

Overall, over the course of the century, Italian exporters have thus carved out a place for themselves in the international arena, albeit still as a niche, playing the role of 14th international player and holding around 2% of world demand in the sector.

Fig.2 – Leading exporters of Medical Devices

(global market share, 2022)

An uncertain global landscape

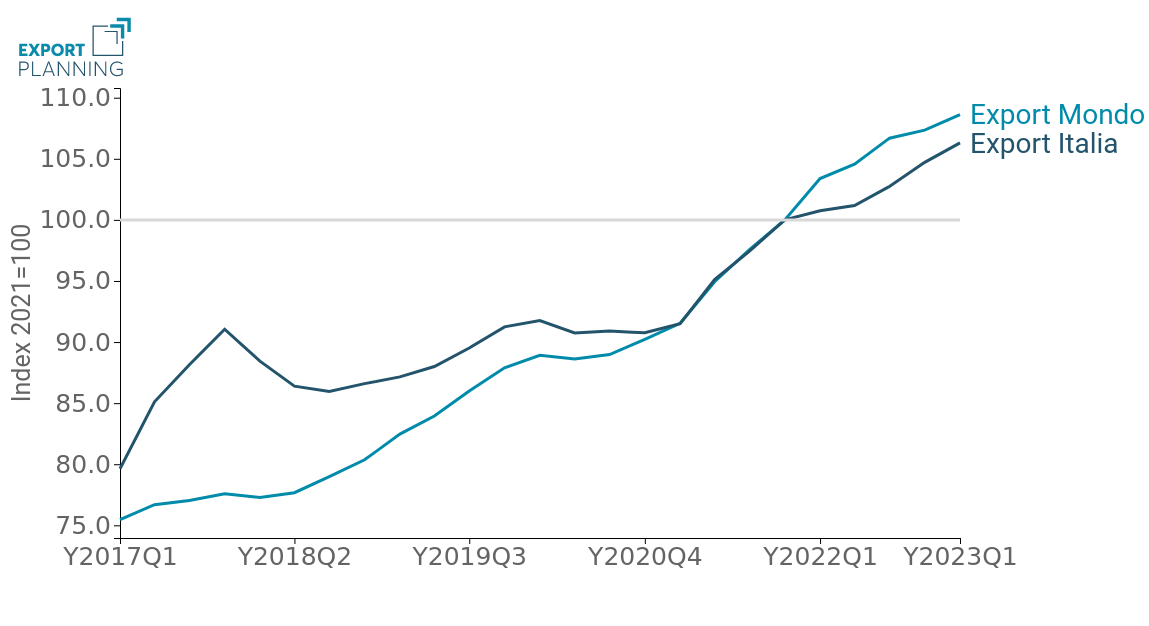

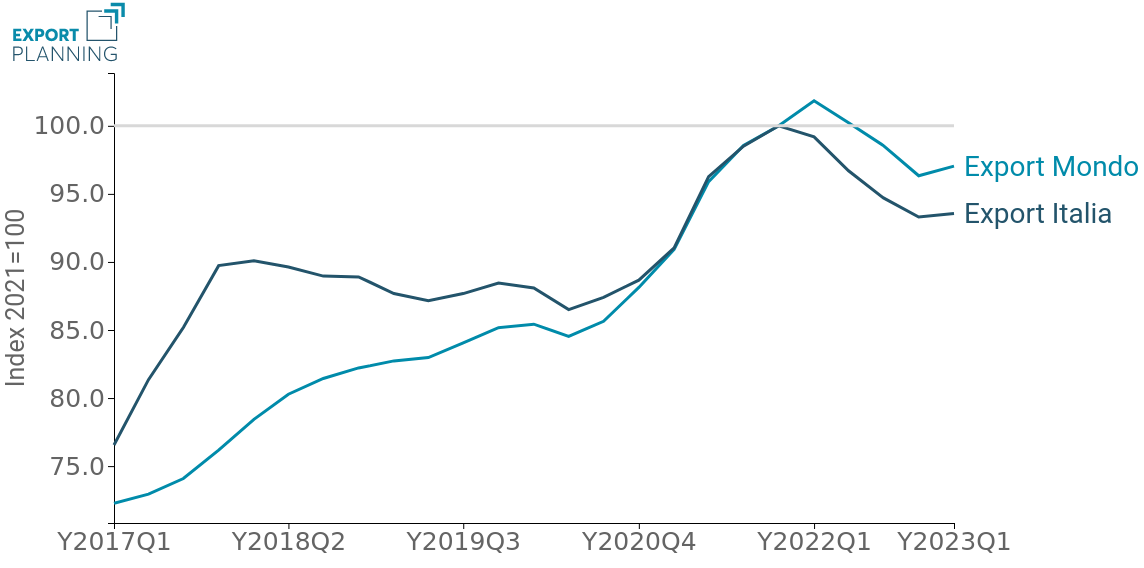

Against the long-term picture just described, however, the economic scenario for Italy's exporters appears less positive. The graph below shows the index series of the annual cumulative exports of national medical devices, comparing it with the international reference average in values in euro and in values at constant prices (i.e. net of the changes made on the price side, which therefore allows the evolution in quantity to be grasped).

Fig.3 - Italian Export vs. World Export of Medical Devices

(yearly cumulative, index 2021=100)

First of all, it is clear that the sector's performance appears significantly different depending on whether one evaluates it in nominal terms or at constant prices: supported by the generalised increase in prices, global medical device exports in value still appear to be growing, however, in quantity, the sector seems to be converging towards a slowdown in its pace of expansion, as a result of the marked growth marked above all by the pandemic context.

It is also particularly interesting to note how, since 2017, the performance of domestic exporters has substantially dominated the reference average for all periods, until it aligned with it during 2021. Starting from the most recent quarters, however, and in particular from the beginning of 2022, the dynamics of Belpaese exports underperformed the average of international exporters.

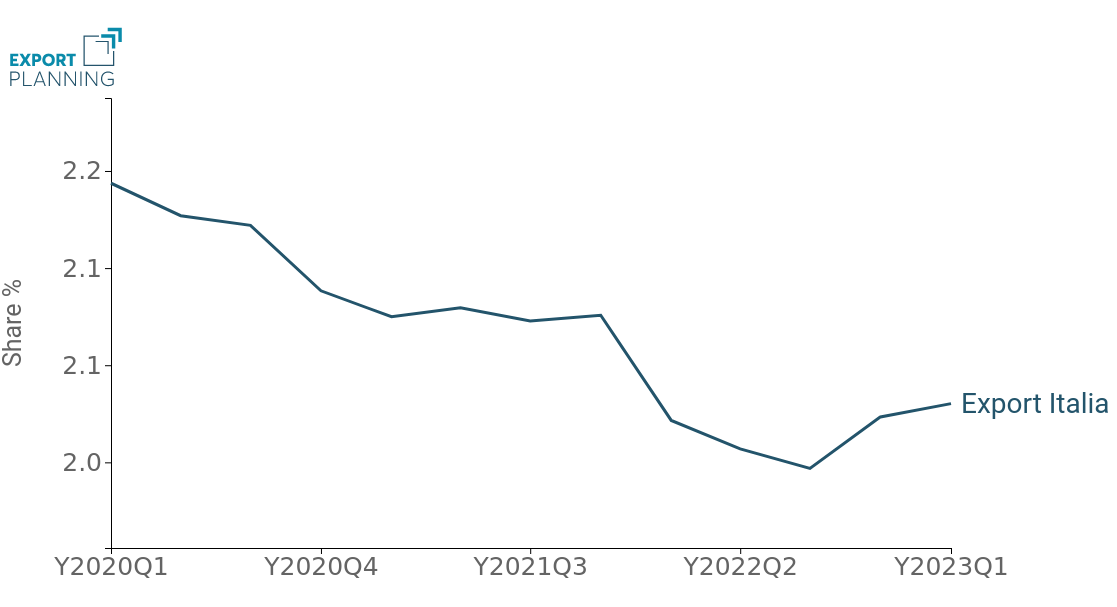

This trend has led to a sharp deterioration in Italy's global market share, which had already been declining in the post-pandemic period, starting in 2022 (Fig.4).

Fig.4 – Medical Device Exports: Global Market Share Italy

National regulatory uncertainties and the burden of payback

Adding further criticality to a sector for which the international economic situation is not particularly favourable is the national regulatory framework and, in particular, the financial demands arising from the payback. The payback mechanism was created with the intention of containing public expenditure and comes into play when the Regions exceed the annually budgeted health expenditure ceiling, requiring the companies supplying medical devices to the NHS to participate in the payback, to the extent of 50% of the excess expenditure. The instrument, which was instituted with the 2015 Financial Manoeuvre by analogy with the payback mechanism in force for public pharmaceutical spending, was in fact inapplicable until the publication of the implementing decree in the Official Gazette on 15 September 2022, which certifies the exceeding of the regional spending ceilings (relating to the years 2015-2018) and the sums to be repaid by January 2023; a deadline that has been extended several times by the Government, until the current deadline set for next 31 July. For the first four years, the amount to be repaid for companies was initially equal to EUR 2.1 billion, which was however 'calmed' by a government intervention that led to the definition of a reduced quota of EUR 1.1 billion, in order to limit the impact of the rule on companies' economic-financial balances. The measure remains particularly significant, however, due to a lack of adequate liquidity on the part of businesses to cover the financial demands arising from the payback; according to the FIFO association's pre-estimates, the amount to be reimbursed would in fact rise by a further 1.5 billion if 2019 and 2020 are also included, taking into account the pandemic emergency. In fact, a recent survey conducted by Nomisma for PMI Sanità and FIFO estimates that the payback could be particularly burdensome, especially for SMEs, which are typically more fragile and less capitalised, and which would be called upon to pay an amount equal to more than a third of the gross margins and more than 60% of the profits produced in the last financial year.

On the national scene, the issue of payback is therefore one that remains alive and well. News of the last few days comes in fact from the Lazio Regional Administrative Court, which on 27 June last ruled on the requests for suspension of the measure made by a dozen or so companies involved, accepting them all indiscriminately, regardless of the size of the company and the level of economic distress. The next few months will therefore be crucial for the possible relaunch of a sector such as that of medical devices on which uncertainties of a different nature weigh heavily, linked both to the international scenario and to the reference regulatory context that risks weighing as is on the competitiveness of Italian companies.