Global trade outlook: a barometer of Non-US markets in the first half of 2025

Global demand trend by country, excluding the US trade

Published by Silvia Brianese. .

Global demand Import Conjuncture Global economic trendsIn the previous article H1 2025: Global Trade Outlook, the dynamics of global demand for goods during the first six months of 2025 were analyzed with a sectoral focus, identifying those industries that, despite a complex scenario, are providing growth opportunities for global imports.

Equally interesting is the segmentation of global manufacturing demand in terms of destination market performance, in order to identify those countries – excluding the United States – that have remained in positive territory during the first half of 2025.

As seen in the sectoral analysis, excluding the United States from the global outlook allows for a trend that is “cleansed” of extraordinary phenomena such as the front-loading effect (or “stockpiling”) in anticipation of tariffs.

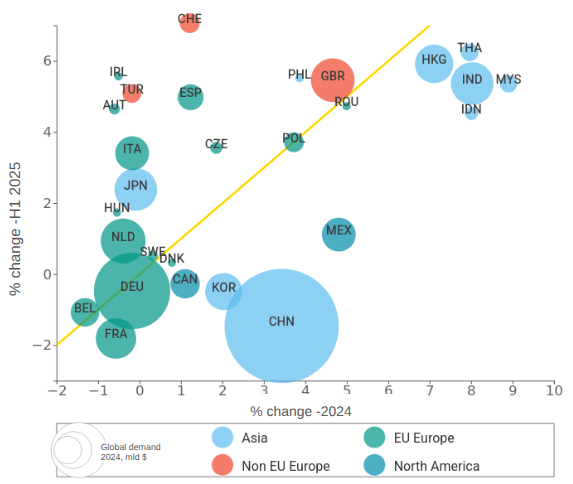

The chart below shows the main international markets – in addition to the US – positioned according to the import growth rate recorded in 2024 (X-axis) and in the first half of 2025 (Y-axis). Goods import flows are measured at constant prices, in order to provide an analysis of real trends. The bisector (shown in yellow) highlights the economies that are accelerating in this early part of 2025 compared to 2024 (positioned above the line) and those that are slowing down (positioned below); the size of the circles represents the import size of each country in billions of dollars.

Fig. 1 - Map of the world's major importers at constant prices

Source: ExportPlanning calculations.

The map shown can be considered a "barometer" of global demand dynamics excluding the United States, where it is possible to distinguish, in the upper-right quadrant, those economies still resilient to the international context and continuing to show signs of import growth in line with last year. In the bottom-left area, instead, we find those economies still characterized by weak demand for foreign goods.

Europe: Diverging Trends Among EU Markets,

with Growth in Turkey, Switzerland, and the UK

While Spain, Italy, and the Netherlands recorded positive import performance in the first half of 2025, demand for foreign goods remains weak in many other European economies. Notable among these are Germany, France, and Belgium. However, it's worth noting that Germany is showing early signs of recovery in the household appliances sector.

A particularly interesting case is that of Turkey, an emerging economy that experienced a significant rebound in the first half of 2025 (compared to last year), driven especially by imports in the automotive supply chain.

The United Kingdom is also seeing a recovery in foreign goods demand, thanks to increasing imports across multiple sectors.

US Trade Partners Slowing Down

In the first half of 2025, the economic outlook for Canada and Mexico, the United States’ main trading partners, shows a slowdown in goods imports, which remain significantly below the bisector.

Asia: China Slumps, Japan Recovers,

and India Slows Down

In the first half of 2025, Asian economies show an overall slowdown in foreign goods demand, driven particularly by China and South Korea, both of which registered a decline in imports compared to 2024.

Chinese imports, in particular, appear to be affected by both structural factors linked to weak domestic demand and indirect effects of US trade policy.

A different situation can be observed for India, Thailand, Hong Kong, Malaysia, and the Philippines, which—despite a mild slowdown in imports compared to 2021—remain firmly in positive territory in the first half of the year.

In an overall weak context for foreign demand among developed Asian economies, Japan shows signs of recovery, with imports growing in the first six months of 2025, particularly in the electronic components and transport parts sectors.

Conclusions: Monitoring Global Demand

to Guide Strategic Decisions

When viewed from a country perspective, the current global outlook reveals a highly fragmented picture of foreign demand.

Given the current trade environment—characterized by ongoing uncertainty—it remains essential for companies to monitor the evolution of global demand, both geographically and sectorally, in order to make informed strategic decisions and investment choices.