Bosnia and Herzegovina and North Macedonia: Between Economic Growth and Trade Interconnection

Published by Veronica Campostrini. .

Europe Foreign markets Italy Foreign market analysisThe regional context

The Western Balkans are undergoing a phase of profound economic transformation. Bosnia and Herzegovina and North Macedonia, in particular, show prospects for sustained growth: according to the IMF, both economies are expected to record a GDP increase of around +3% annually in 2025. At the same time, there is strong momentum in foreign direct investment (FDI): in Bosnia, inflows exceeded one billion euros in 2024, while in North Macedonia they grew even more sharply, reaching a record high of 1.3 billion euros in the same year.

This economic vitality is closely linked to trade openness: combined imports and exports represent about 87% of Bosnia’s GDP and 112% of North Macedonia’s GDP, indicating economies that are deeply integrated into international markets.

The EU framework: the Stabilisation and Association Process

The economic and political relationship between the European Union and the Western Balkans is framed within the Stabilisation and Association Process (SAP), launched in 2000. This path supports the countries of the region – Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia and Serbia – towards gradual European integration, with the prospect of future accession.

The SAP goes beyond trade: it promotes regional cooperation (for example in the development of infrastructure and networks), the creation of a free trade area, and the progressive alignment of national legislation with the EU acquis. Through the Instrument for Pre-Accession Assistance III (2021-2027), the EU continues to support structural reforms, the rule of law and the development of market economies, guiding SAP partners in their path towards closer integration with the Union.

Europe as a privileged partner

The previous institutional framework therefore further strengthens the region’s economic ties with Europe, which remains the main commercial reference point for Bosnia and Herzegovina and North Macedonia.

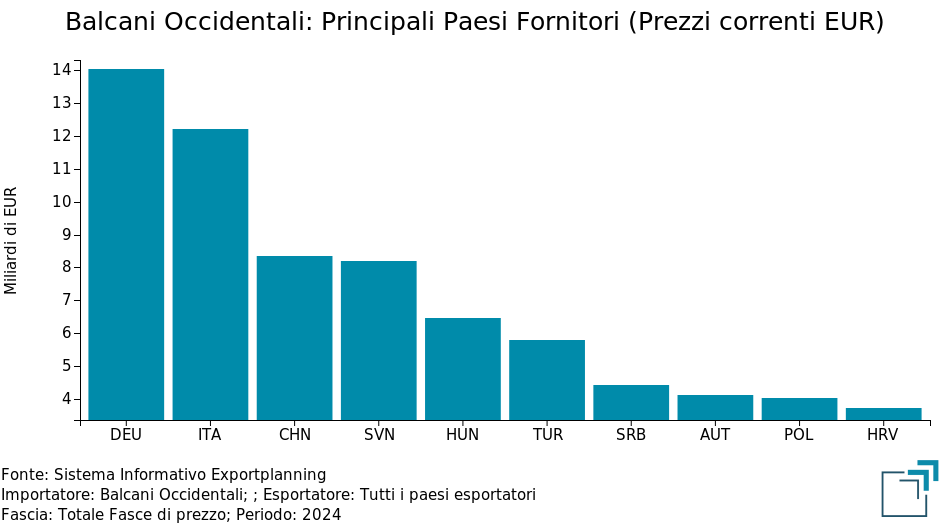

It is not surprising, therefore, that Europe remains the leading supplier to the Western Balkans, with a market share close to 70% in 2024. Globally, Germany (market share of 9.1%) and Italy (8%), followed by China (5.4%), top the ranking of the region’s main suppliers.

Source: ExportPlanning

Italy, beyond the aggregate figure, already holds prominent positions in numerous industrial and manufacturing sectors, positioning itself as a strategic industrial partner.

Bosnia and Herzegovina

Bosnia and Herzegovina has a dynamic market characterized by strong demand for agri-food products, which account for 16.7% of total imports. Despite Italy’s traditional strength in the sector and its fourth place among Bosnia’s main suppliers (after Croatia, Serbia and Germany), it still ranks seventh as a supplier in the agri-food sector. Italy therefore has growth opportunities yet to be exploited in the Bosnian market, especially considering that it already ranks among the top suppliers in several other key industries.

Tab 1: Italian positioning and market share in Bosnia by sector

| Market share | Supplier ranking | |

| Machinery and Equipment | 17.9% | 2nd |

|---|---|---|

| Fashion System | 17.2% | 1st |

| Mechanical Components | 10.8% | 3rd |

| General Mechanics | 9.4% | 3rd |

| Agricultural and Earthmoving Machinery | 8.9% | 2nd |

| Electrotechnical Components | 8.3% | 4th |

| Household Goods | 8.1% | 6th |

| Automotive | 6.3% | 3rd |

| Agri-food | 5.0% | 7th |

| Healthcare Goods | 4.9% | 6th |

Source: ExportPlanning elaborations

North Macedonia

North Macedonia has one of the highest levels of trade openness in the region, with Germany, the United Kingdom and Greece as its main suppliers; Italy ranks eighth, showing therefore room for improvement in terms of competitive positioning. In North Macedonia, as in Bosnia, demand for agri-food products is strong, accounting for 11.6% of total imports, above the global average of 9%.

Despite its lower aggregate position, Italy remains a strategic partner in key sectors where its presence is already consolidated – such as Fashion, General Mechanics, Components and Machinery.

Tab 2: Italian positioning and market share in North Macedonia by sector

| Market share | Supplier ranking | |

| Mechanical Components | 15.6% | 2nd |

|---|---|---|

| Machinery and Equipment | 14.2% | 2nd |

| Fashion System | 12.8% | 2nd |

| General Mechanics | 11.2% | 2nd |

| Agricultural and Earthmoving Machinery | 7.7% | 2nd |

| Electrotechnical Components | 7.0% | 3rd |

| Automotive | 5.7% | 4th |

| Household Goods | 5.5% | 7th |

| Healthcare Goods | 4.1% | 6th |

| Agri-food | 3.7% | 10th |

Source: ExportPlanning elaborations

Conclusions

Bosnia and Herzegovina and North Macedonia represent strategic markets for Italian companies, thanks to their geographical proximity, growing trade openness, and complementarity with Italian industrial supply.

In this context, Italy is in a privileged position to consolidate its presence: on the one hand, by strengthening already solid sectors such as mechanics and fashion; on the other, by seizing the untapped opportunities in high-demand sectors such as agri-food.

The Stabilisation and Association Process (SAP), which regulates relations between the EU and the Western Balkans, provides the institutional framework that multiplies opportunities for trade and investment. Looking ahead, the evolution of the European path of these two countries could further amplify the role of Italian companies as key commercial and industrial partners in one of the most dynamic areas of the continent.

To learn more about Bosnia and Herzegovina and North Macedonia, or other countries, download our Country Reports.