The evolving global economy: the central role of trade policy in a persistently uncertain outlook

Published by Alba Di Rosa. .

IMF Trade war Macroeconomic analysis Uncertainty Economic policy United States of America Global economic trendsThe International Monetary Fund (IMF) has recently released its latest forecasts for the international macroeconomic scenario (World Economic Outlook, October 2025). A central factor is, of course, the new US trade policy measures, to which the global economy is gradually adapting.

While in the previous April scenario, in line with Trump's initial announcements, IMF's keywords were “uncertainty” and “downward revision” for global economic growth prospects, developments in the following months actually proved to be among the least gloomy in the range of possible developments assumed by the Fund. Although Trump's actions represented a “major departure from trade policy rules and norms”, the subsequent conclusion of trade agreements with several countries and the inclusion of multiple exemptions from tariffs mitigated the overall impact of the shock.

Credit is also due to the United States' trading partners, most of whom refrained from retaliating, thereby keeping the global trading system largely open. The private sector also demonstrated agility, significantly front-loading imports in the first half of the year and quickly reorganising their supply chains.

Global GDP revised upwards, but uncertainty remains high

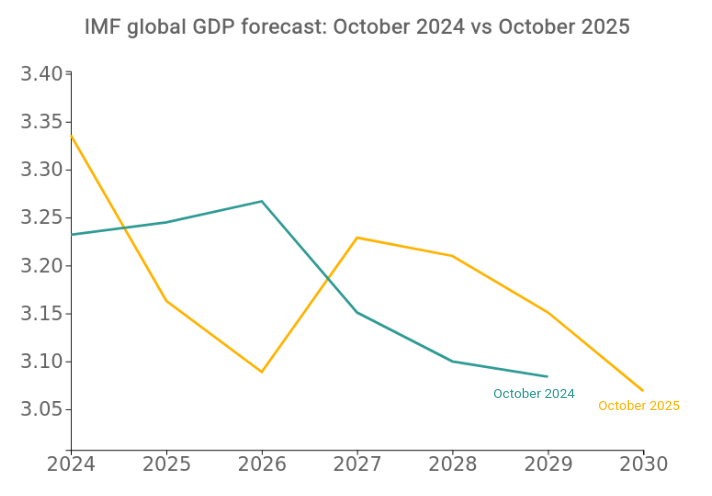

In this context, estimates for global GDP growth in 2025 have been revised upwards compared to last April: while in spring the Fund forecast a 2.8% growth for the global economy in 2025, it now estimates a 3.2% increase (+3.1% in 2026).

The estimated growth for 2025 has therefore returned to the levels assumed at the end of last year, before the start of Trump's second term; however, the same cannot be said for the estimated growth for 2026. In fact, in the second half of 2025, the significant front-loading effect – a temporary factor that supported the global economy ahead of the entry into force of tariffs – is expected to run out. Considering, therefore, a slowdown in global economic growth in the second half of this year and only a partial recovery in 2026, the IMF estimates a cumulative global output loss of around 0.2% by the end of next year.

Source: StudiaBo elaborations on IMF data

Overview of risks

Despite a relatively solid first half of 2025 in terms of international economic performance, the outlook remains fragile and risks are skewed to the downside. We must not forget that, at present, the United States, the world's largest importer of goods, has an average tariff close to 20%, and trade tensions continue to pose a threat to global economy.

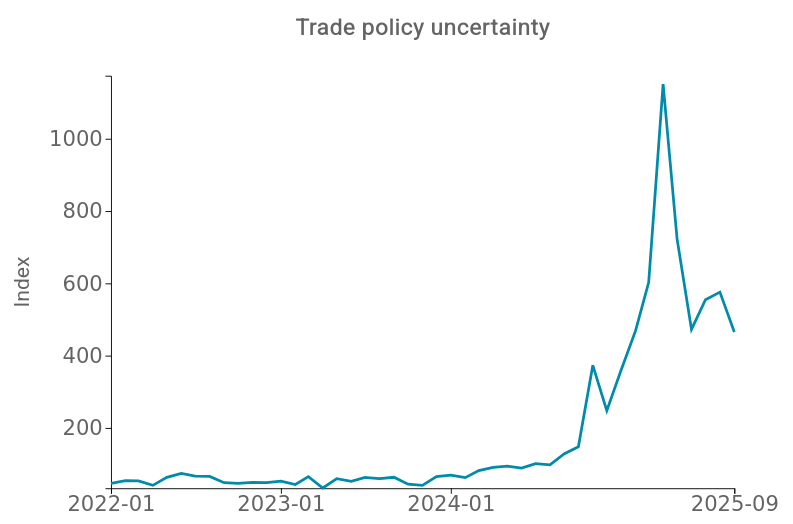

This trend is confirmed by the global Trade Policy Uncertainty Index which, although down from last spring's peak, remains well above its historical average – in the absence of clear, transparent and lasting agreements, and with attention beginning to shift from the final level of tariffs to their impact on prices, investment and consumption.

Source: StudiaBo elaborations on policyuncertainty.com data

According to the Fund, it’s not just trade uncertainty: other factors are weighing on the global economic outlook, as well.

- First and foremost, the current Artificial Intelligence boom, which bears some similarities to the dot-com bubble of the late 1990s, with significant profit expectations that may ultimately not be met.

- In second place we can find China, the Asian giant, whose growth prospects remain weak, with real estate investments continuing to decline and the strong contribution of manufacturing exports to the country's growth not expected to be sustainable in the long term.

- Another risk factor highlighted by the Fund is the pressure on policy-making institutions such as central banks (think of the Trump-Federal Reserve disputes in recent months) which, if successful, would undermine the credibility of central banks and their ability to ensure price stability.

Although downside risks prevail in the current scenario, some important upside risks could rapidly improve the outlook: first, resolving and reducing policy uncertainty would give a significant boost to the global economy. The Fund therefore reiterates the primary role of policies, which can and must contribute to restoring confidence and predictability, improving (where possible) global economic growth prospects.