European Exports: Signs of Weakness and a Growing Divide Between Intra- and Extra-EU Markets

Published by Veronica Campostrini. .

Europe Conjuncture Global economic trendsThe latest update of the European Union’s foreign trade data, collected by ExportPlanning within the EU Business Cycle datamart, provides a detailed picture of European export trends over the past year and a half, with particular attention to the most recent developments relating to the third quarter of 2025.

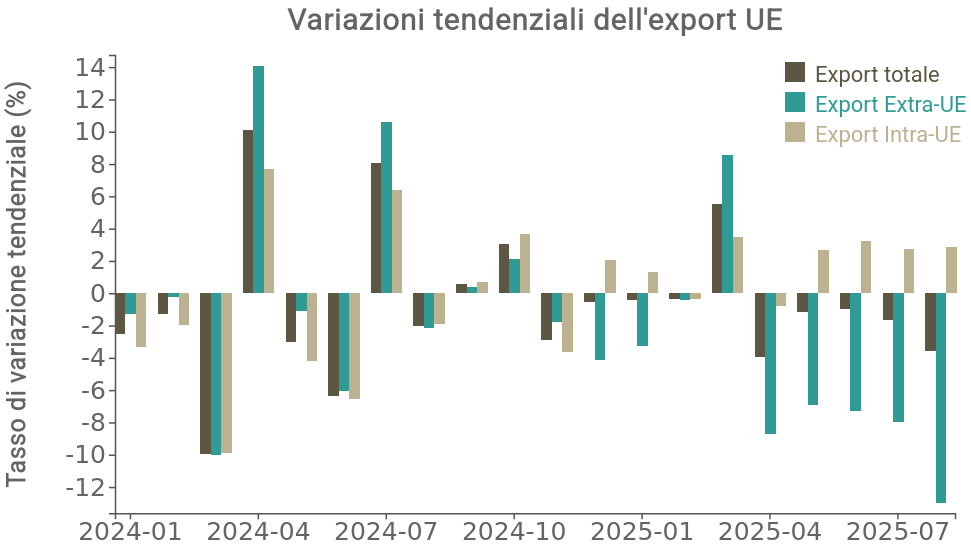

The first chart shows the year-on-year changes in monthly EU exports in euros, distinguishing between intra-EU exports (to partner countries within the Union) and extra-EU exports (to non-EU countries).

Source: ExportPlanning calculations.

After the difficulties experienced in 2023 and much of 2024, overall European export performance also showed signs of weakness in 2025, against the backdrop of a worsening international environment following U.S. protectionist actions. A now evident aspect is the progressive and sharp divergence between the performance of intra-EU and extra-EU export flows. Up until the end of 2024, both followed similar trends, but from December 2024 onward a widening gap emerged, becoming increasingly pronounced in the more recent months of 2025.

In particular, with the gradual exhaustion of the U.S. “stockpiling rush” (which was mainly concentrated in April), extra-EU exports recorded negative variations in almost all the observed periods, while intra-EU exports remained on average in positive territory.

As anticipated, one of the main causes of the deterioration in extra-EU exports can be traced back to the American protectionist shift, mainly due to the climate of uncertainty generated among economic operators. The “stockpiling” phenomenon naturally entails a subsequent and necessary normalization of the growth rate. Added to this is the strong appreciation trend of the euro observed in recent months, which makes European exports more expensive for international buyers.

It remains to be seen whether and to what extent European firms are reacting to these shocks through a reallocation of trade flows, redirecting toward other extra-EU markets the quantities no longer absorbed by the United States.

Sectoral recomposition of European exports

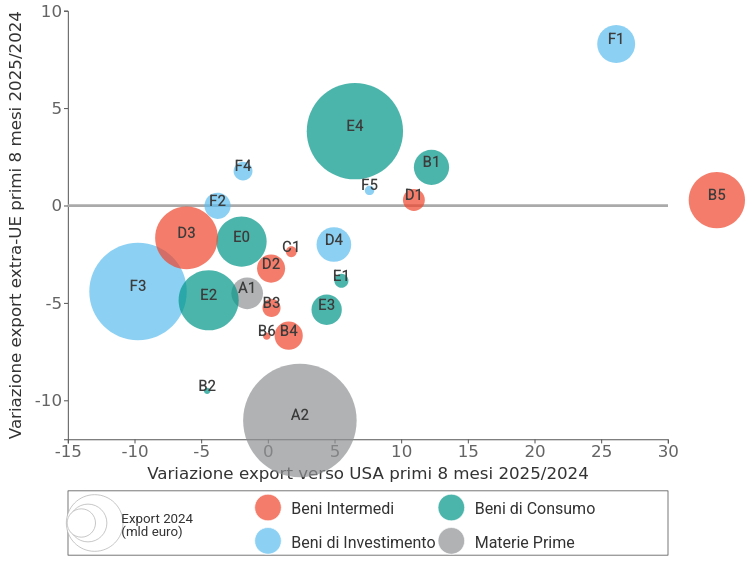

The following chart analyzes the year-on-year change in European exports in euros during the first eight months of 2025, compared with the same period of 2024.

The horizontal axis shows the change toward the United States, while the vertical axis shows the change toward other extra-EU markets (excluding the USA). The size of the bubbles represents the total export value in 2024, thus highlighting the relative weight of the various sectors.

European exports by industry

(Year-on-year changes in euros)

Source: ExportPlanning calculations.

Overall, the data outline a still-weak picture for European foreign trade. The performance of the main sectors shows that Europe has not yet achieved a genuine geographical diversification of its exports: the difficulties of extra-EU exports are not limited to the U.S. market but also extend, to a broader extent, to other international destinations.

Within this framework, however, it is possible to identify some clusters of sectoral behavior:

- Cluster 1 – Resilient sectors: includes industries that have not been negatively affected by U.S. protectionist measures, as they are currently exempt and still benefiting from stockpiling, showing growth both toward the U.S. and the rest of the extra-EU world. This group includes:

- ICT goods (F1)

- Industrial equipment (F5)

- Chemical-pharma supply chain (E4-B5)

- Unpackaged food products (B1)

- Cluster 2 – Sectors penalized in extra-EU markets: includes industries where EU exports remain stable toward the U.S. but show a decline toward other extra-EU markets. Among these:

- Most intermediate goods (B3, B4, B6, C1, D2)

- Industrial raw materials (A2)

- Home system (E3)

- Cluster 3 – Sectors in double contraction: represents the most affected industries, which have experienced a simultaneous decline both toward the U.S. and toward other extra-EU countries.

- Automotive (F3)

It is also very interesting to highlight those industries that have remained relatively resilient in this context:

Conclusions

The overall picture reveals a Europe vulnerable to external shocks, with an export structure that struggles to dynamically reorient toward long-range markets, further weighed down by the recent appreciation of the euro.

Promoting strategies of market diversification and adaptation to changes in the global context therefore represents a key tool to support the competitiveness of European exports in a complex and constantly evolving economic environment.