Saudi Arabia: strategic opportunities in the beauty sector for Italian companies

Published by Marzia Moccia & Heroes. .

Foreign markets Export markets Foreign market analysisThis contribution stems from the collaboration between ExportPlanning and Heroes Force Consulting

Heroes Force Consulting is a consulting firm specializing in internationalization services, whose mission is to support companies in global growth, internationalization, and turnaround processes.

Heroes Force Consulting is a consulting firm specializing in internationalization services, whose mission is to support companies in global growth, internationalization, and turnaround processes.Through an innovative approach and advanced technologies, AI and experience come together to transform challenges into opportunities, creating tailor-made strategies to compete in international markets.

Overview of the Saudi Perfume and Cosmetics Market

Over the past century, Saudi Arabia has established itself as one of the most dynamic and promising markets in the global perfumery and cosmetics industry.

Driven by a young population, increasing purchasing power, and strong attention to personal image, the demand for beauty products and fragrances has grown significantly.

The country's demographic composition is an additional strength. With 60% of the population under 30, Saudi Arabia presents an extremely young, digitally native demographic profile, open to international influences. These young consumers have grown up in an era of globalization, have unlimited access to global trends through social media, and are conscious in their beauty consumption choices, while also seeking quality and sustainability-oriented products.

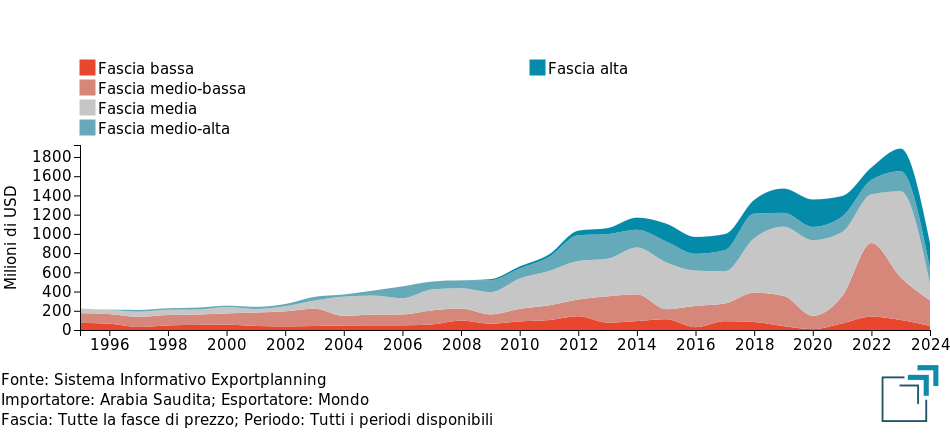

Before the Great Recession, the total value of Saudi imports of products in the perfumery and cosmetics sector stood slightly above 500 million dollars. In 2023, however, this value reached an all-time high, surpassing the 1.7 billion threshold. Although 2024 shows signs of a partial slowdown, over approximately fifteen years the market has more than doubled its import volumes, demonstrating a structural long-term growth trend.

Another distinctive feature of the Saudi market is the high willingness of consumers to pay a premium price for products perceived as high quality. It is estimated that around 50% of total imports in the perfumery and cosmetics sector fall within the high and medium-high price ranges, confirming a positioning oriented toward high value-added market segments.

Saudi Arabia: Imports of Perfumes and Cosmetics

(million USD, price range segmentation 1995–2024)

Source: ExportPlanning

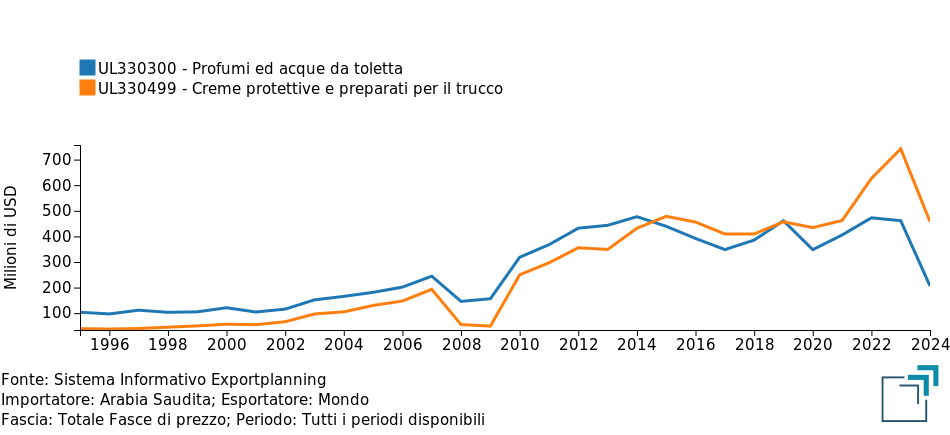

Over 70% of total imports in the sector consist of perfumes and skincare products.

Perfume, in particular, holds an important place in Saudi culture: it is considered not only an element of beauty but also a means of expressing identity, status, and hospitality. At the same time, however, the cosmetics segment has undergone rapid and significant evolution.

As shown in the following chart, imports of skincare products have exceeded perfume imports for about a decade. Moreover, the development dynamics of the two segments have been quite different over the past ten years: while perfume imports have remained relatively stable, skincare products have shown a dynamic growth trend that further strengthened post-pandemic.

Saudi Arabia: Imports of Perfumes and Skincare Products

(million USD, 1995–2025)

Source: ExportPlanning

The Players Active in the Saudi Market

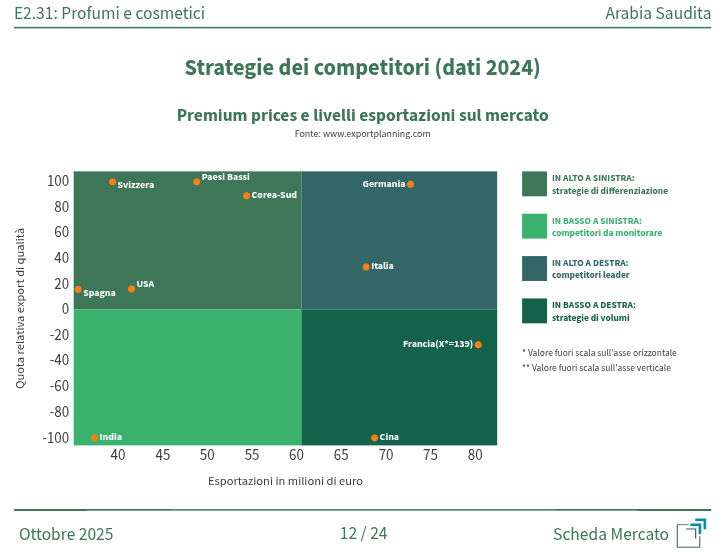

A particularly interesting aspect to map concerns the competitive positioning of different exporting countries of perfumes and cosmetics in the Saudi market.

The following chart plots the main supplier countries by export volume to the market (x-axis) and their share of high-quality exports (y-axis).

Source: ExportPlanning

Particularly noteworthy is Italy’s positioning: together with Germany, Italy stands among the leading players, holding about 8% of the market, carving out its niche with a positioning entirely focused on premium price segments.

Focus on: the Perfume Segment

Focus on: the Perfume Segment

The Saudi personal perfume market is one of the most mature and sophisticated segments of the beauty industry. A particularly significant fact is that it alone represents 57% of the entire GCC perfume market. This reflects not only the demographic and economic size of the Kingdom but also the deep cultural importance that perfumes hold in Saudi society, where the use of fragrances is an integral part of daily personal care and represents an essential element of hospitality and gifting during special occasions.

As previously mentioned, what distinctly characterizes the Saudi perfume market compared to many Western ones is the relevance of the premium and luxury segment, reflecting a consumer culture where perfume is not merely a functional product but a symbol of status, personal identity, and cultural expression. Saudi consumers are willing to invest significant amounts in high-quality fragrances, perceiving value not only in the olfactory composition but also in the packaging, exclusivity, and brand storytelling.

The premium segment is dominated by major international luxury brands, which have built a widespread presence through exclusive boutiques in leading luxury malls. However, within this segment, an increasingly interesting trend is emerging for Italian operators: the growing demand for niche and artisanal perfumes that offer uniqueness and differentiation from mainstream fragrances. The most sophisticated consumers, particularly younger age groups and those in large cities, are exploring independent European perfumeries, appreciating artisanal authenticity and the possibility of finding less common scents.

The mass market segment, while representing a smaller market share, should not be underestimated. It is growing thanks to the expanding middle class and the entry of younger consumers. Thus, there is room for brands that can offer high quality at more accessible prices, while maintaining a distinctive and aspirational positioning.

Local Consumer Preferences

Understanding the olfactory preferences of Saudi consumers is key to developing fragrances that can succeed in this market. The structure of preferences reveals an interesting division between traditional Arabic fragrances and Western perfumes, with a growing overlap area where the most innovative opportunities arise.

Traditional Arabic perfumes, dominated by the presence of oud (agarwood), represent between 40% and 45% of the market. Oud is much more than a simple perfumery ingredient in Saudi culture: it is considered almost sacred, used in religious ceremonies, special occasions, and as a distinctive element of cultural identity — making Saudi Arabia one of the world’s leading consumption markets.

Western perfumes, mainly French but also Italian, are present and appreciated in the Saudi market for their elegance, compositional refinement, and variety of olfactory families. However, even within this segment, Saudi consumers tend to favor stronger and longer-lasting fragrances compared to European or American preferences, reflecting an olfactory culture that values strong sillage and exceptional longevity. The true emerging opportunity lies at the intersection of these two worlds.

Younger consumers, particularly Millennials and Gen Z, seek hybrid fragrances that combine Arabic notes (oud, amber, musk, saffron) with premium Mediterranean ingredients (Sicilian citrus, Centifolia rose, Florentine iris, Ligurian lavender). This blending trend opens a high-value segment for Italian perfumers capable of merging creativity, material quality, and cultural sensitivity.

Another relevant trend concerns the growing popularity of unisex perfumes, consistent with Arab tradition but reinterpreted in a modern way as an expression of individuality. At the same time, the expansion of e-commerce is encouraging the use of discovery sets — sample boxes that allow consumers to explore various creations from a perfumery house before committing to a full-size bottle — reducing the perceived risk of buying untested products online. For niche brands and new entrants, these tools represent a strategic lever to promote their olfactory identity and build customer loyalty.

Focus on: the Skincare Segment

Focus on: the Skincare Segment

The Saudi cosmetics market represents a particularly interesting opportunity for Italian companies, given its rapid growth rates and structural features that make it more accessible.

As with the perfume segment, having a physical presence in major urban cities such as Riyadh, Jeddah, and Dammam, through specialized stores and multi-brand points of sale, is essential.

What makes the cosmetics market particularly distinctive compared to perfumes is its price structure. While in the perfume market, positioning in the premium segment is a must to access and differentiate, in the cosmetics sector there are also significant opportunities for more accessible price positions, provided that perceived quality and product value remain high. This opens opportunities for a wide range of Italian operators, from large companies to SMEs, who can find market spaces consistent with their production and financial capabilities. This also reflects different consumption patterns: while perfumes are often considered purchases, linked to special occasions or gifting, cosmetics are used more frequently and require regular replenishment, making consumers more attentive to the price-quality ratio while maintaining high expectations in terms of effectiveness and formulation.

Local Consumer Preferences

Saudi consumers in the cosmetics segment show distinctive preferences that reflect both growing sophistication and cultural rootedness. The naturalness and authenticity of ingredients have become increasing priorities, with particular interest in organic formulations, botanical extracts, and natural active ingredients. This trend, which mirrors global movements toward clean beauty, finds particularly fertile ground in Saudi Arabia, where it intersects with Islamic values of purity and the traditional use of natural ingredients in personal care.

Sustainability is emerging as an increasingly relevant competitive driver, especially among the new urban generations, who favor eco-friendly packaging, supply chain transparency, and reduced environmental impact.

Made in Italy enjoys a distinctive positioning: it is perceived as a guarantee of quality, advanced research, excellent Mediterranean ingredients, and refined design, facilitating the entry of Italian brands into the Saudi market.

At the same time, social media — particularly Instagram, TikTok, and Snapchat — strongly influence purchasing choices, with Saudi beauty influencers setting trends and aesthetic standards. In this context, it is strategic for Italian companies to develop authentic collaborations with influencers aligned with their brand values, enhancing storytelling and heritage.

Female empowerment further reinforces the sector’s dynamism: Saudi women are taking central roles as consumers, entrepreneurs, and creators of new brands, generating new opportunities for partnerships and development for Italian companies.

Saudi Arabia: Distribution and Market Entry Strategies

Saudi Arabia: Distribution and Market Entry Strategies

The Saudi distribution market features a dual structure that combines the strength of physical retail with the accelerated growth of e-commerce.

The traditional channel, representing about 60–65% of the market, remains dominant thanks to the luxury malls of Riyadh, Jeddah, and Dammam, where consumers seek premium shopping experiences, while traditional souks remain relevant for Arabic perfumes and locally rooted products.

At the same time, e-commerce is experiencing explosive growth, driven by advanced logistics infrastructure, growing digital trust, and purchasing convenience, especially among female consumers.

For Italian brands, adopting an integrated offline-online approach is therefore strategic: physical presence helps build trust and visibility, while the digital channel can consolidate sales and broaden brand reach.

The premium positioning of Made in Italy represents a competitive advantage, thanks to its association with quality, natural Mediterranean ingredients, and refined design. The most effective market entry occurs through partnerships with local distributors, who provide immediate market access, established relationships with retailers, and knowledge of commercial and cultural dynamics. Local distributors also offer operational and regulatory support — from logistics to Halal and eCosma certifications — and can collaborate with Italian brands on co-marketing strategies (events, digital campaigns, POS materials). Selecting the right distribution partner is therefore crucial: relying on specialized consultants with a direct local presence allows for identifying qualified partners and facilitating effective negotiations for successful market entry in Saudi Arabia.

Would you like to explore all the opportunities offered by the Saudi market? Go to the dedicated Country Report

Heroes Force Consulting is a consulting firm specializing in internationalization services, whose mission is to support companies in global growth, internationalization, and turnaround processes.

Through an innovative approach and advanced technologies, AI and experience come together to transform challenges into opportunities, creating tailor-made strategies to compete in international markets.