US tariffs and wooden furniture: how relative prices and consumer choices are changing

Measuring the impact of the new US tariff regime is complex, but not impossible

Published by Marco Pappalardo. .

Trade balance Foreign markets Uncertainty Made in Italy Trade war Global economic trendsAs of October 14, 2025, the new tariffs introduced by the Trump administration on imports of timber and related products came into effect. The measure, which is far-reaching, affects not only raw timber and conifer boards, but more broadly the wood and furniture sector.

The decision stems from an investigation conducted by the U.S. Department of Commerce, which highlighted a situation of growing vulnerability for the domestic wood industry. According to the report, the increase in these imports appears to be threatening the survival of numerous sawmills, with a concrete risk of disruptions in the supply chains of wood products and a marked reduction in the utilization of production capacity in the domestic sector.

In light of these conclusions, Washington has introduced a series of differentiated tariff measures:

- a duty of 10% on raw timber and conifer boards;

- a rate of 25% for processed and manufactured wood products, which will increase to 50% starting January 1, 2026.

Regarding the second category, the new regime provides some exceptions for key trading partners:

- for imports from the United Kingdom, the duty may not exceed 10%;

- for those from the European Union and Japan, the overall rate will remain fixed at 15%.

This differentiation in tariff treatment opens up some particularly interesting considerations: the application of differentiated customs rates for trading partners actually alters the competitive structure, creating a hierarchy of “advantage” among foreign supplier countries. In particular, all else being equal, U.S. imports from the United Kingdom, EU, and Japan of wood furniture may experience an increase in competitiveness compared to the greater penalty applied to the same products exported by other foreign partners.

Before delving into this aspect, let us start with an overview of the American market through a case study: Upholstered Furniture with Wooden Frame.

Italy’s position in the U.S. market for upholstered furniture with wooden frame

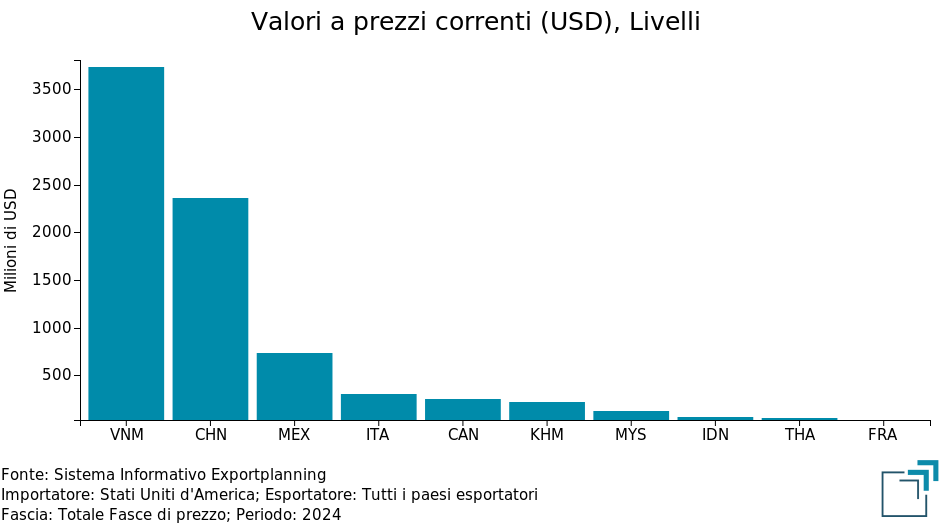

In 2024, the total value of U.S. imports for this product amounts to 8.1 billion dollars. Among the main trading partners stand out two Asian countries, Vietnam and China, which hold the most significant shares: respectively 3.74 and 2.36 billion dollars in exports to the U.S.. Italy, on the other hand, represents the main supplier among European Union countries, although with a significantly lower export value compared to the Asian leaders.

Fig.1 - U.S. imports at current prices (USD) for upholstered furniture with wooden frame, 2024

Source: ExportPlanning elaborations.

To frame the possible reaction of U.S. demand for this product, it is necessary to consider how much American consumers are willing to modify their choices in response to price changes generated by customs duties. The first aspect of analysis concerns the substitution elasticity between foreign suppliers. It measures the ease with which importers redirect demand for a specific product among different supplier countries in response to changes in relative prices.

Substitution elasticity for upholstered furniture with wooden frame

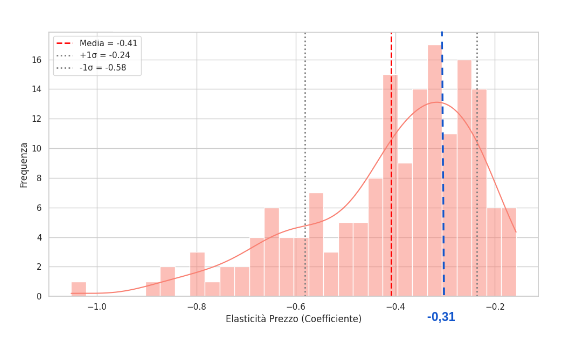

Through the development of a panel econometric model with fixed effects, it was possible to estimate the coefficient of commercial substitution elasticity between foreign suppliers of upholstered furniture with wooden frame. From the results obtained, this elasticity amounts to –0.31, a value indicating a low sensitivity of U.S. imports to relative price variations between suppliers. In line with economic theory, a substitution elasticity between –1 and 0 indicates that the product is poorly substitutable with alternatives from other countries, revealing rigid demand.

Considering also the tariff structure currently in force — 15% for European Union countries and 25% for non-EU countries (except the United Kingdom and Japan) — and assuming that the duty is fully passed on to the final price of the good, it is estimated that the impact on export volumes would lead to a 2.5% increase in demand for Italy and a reduction of about 0.7% for Vietnam and China.

Substitution elasticity for the home system

The chart below shows the distribution of substitution elasticities between foreign suppliers for various products in the furniture sector, classified according to the HS-6 digit nomenclature. The data show that the estimated substitution elasticity for upholstered furniture with wooden frame is lower than the sector average and closer to zero. This indicates a greater perceived differentiation by U.S. consumers compared to other furniture products, resulting in lower substitutability among supplying countries.

Fig.2 - Substitution elasticity of finished home products

Source: ExportPlanning elaborations.

Analysis by price range

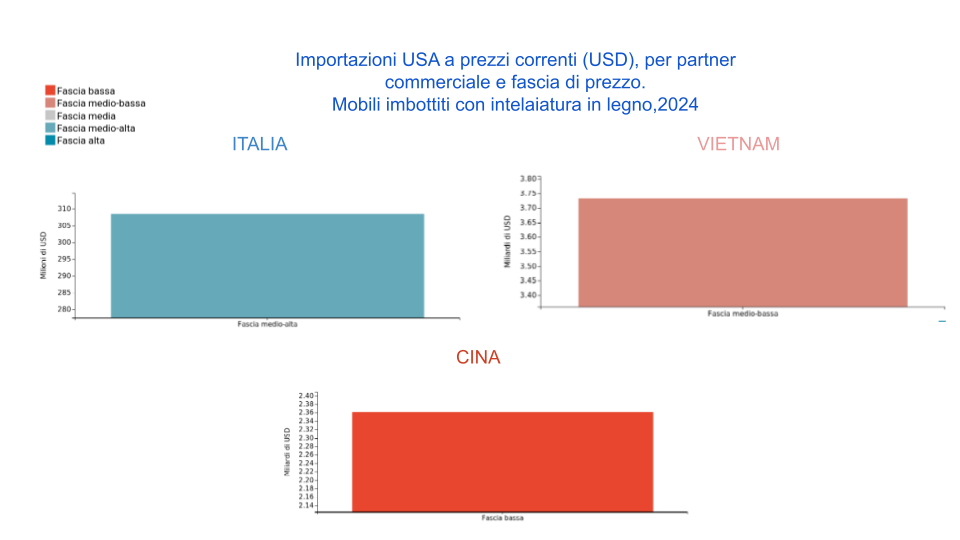

Further reinforcing the signals of demand rigidity is Italy’s market positioning, which highlights a clear distinctive positioning of Italian exporters in the most rewarding market segments. As shown in the chart below, Italian exports are concentrated exclusively in the medium-high price range, while Vietnamese and Chinese exports are positioned respectively in the medium-low and low ranges.

Fig. 3 – U.S. imports at current prices (USD), by price range of upholstered furniture with wooden frame, 2024

Source: ExportPlanning elaborations.

Ceteris paribus, therefore, the imposition of tariffs on wooden upholstered furniture does not seem to be a threat for Italy, but rather an opportunity.

Potential considerations on the U.S. domestic market

In a general equilibrium model, however, a second element to consider is the substitution elasticity between imports and domestic production, which measures how easily consumers redirect demand from an imported product to one produced domestically. As anticipated in the article U.S. Tariffs and Competitiveness: why the two elasticities simultaneously determine U.S. demand at the single product level.

It is complex to obtain information at this level of detail to measure this mechanism, but it is useful to highlight some relevant aspects:

- Absence of comparative advantage: in 2024, U.S. imports of upholstered furniture with wooden frame amounted to 8.1 billion dollars, compared with exports of 0.54 billion, resulting in a trade deficit of around 7.6 billion dollars. In other words, for every dollar exported, the U.S. imports fifteen.

- Evolution of foreign trade: between 2009 and 2024, imports of upholstered furniture grew by 6.2%, while exports increased by only 0.5%, confirming the low international competitiveness of U.S. producers.

- Structural dependence on imports: the trade configuration shows that the United States depends significantly on foreign suppliers, outlining potentially fragile domestic production.

- Rigid demand: given the low substitution elasticity between importing countries, it is plausible that the substitution elasticity with respect to domestic production is also limited.

- Cost increase: U.S. tariff policies will also raise production costs for upholstered furniture made in the U.S., insofar as they use imported production inputs.

Conclusions

The new U.S. tariff framework fits into a context of growing uncertainty for companies and markets. The evolution of U.S. demand in the wood-furniture sector will depend on multiple variables:

- elasticity of domestic demand to changes in relative prices;

- competitive positioning of the various producers, American and foreign, and their pricing policies;

- changes in the tariff regime and in the dollar exchange rate.

For Made in Italy, the combination of high product differentiation and the new tariff regime seems to represent a competitive advantage compared to other exporting countries. However, the possibility of a deterioration in comparison with U.S. competitors remains uncertain. In a context of uncertainty, it will therefore be essential to carefully monitor the evolution of trade flows of Italy, the EU, and the main competitors in the U.S. market.