Objective: market diversification. Evidence from the CETA agreement

In the new global order, diversification has become the key concept guiding the European Union’s trade policy

Published by Simone Zambelli. .

Export Foreign markets Free trade agreements Foreign market analysisIn the new global order, market diversification has become the keyword of the European Union’s trade policy. This structural transformation is reshaping Europe’s industrial strategies, with the aim of safeguarding economic security. Geopolitical instability, fragmented value chains, and the rise of new strategic competition are pushing Brussels to rethink its economic relationships, placing economic security at the core of its agenda.

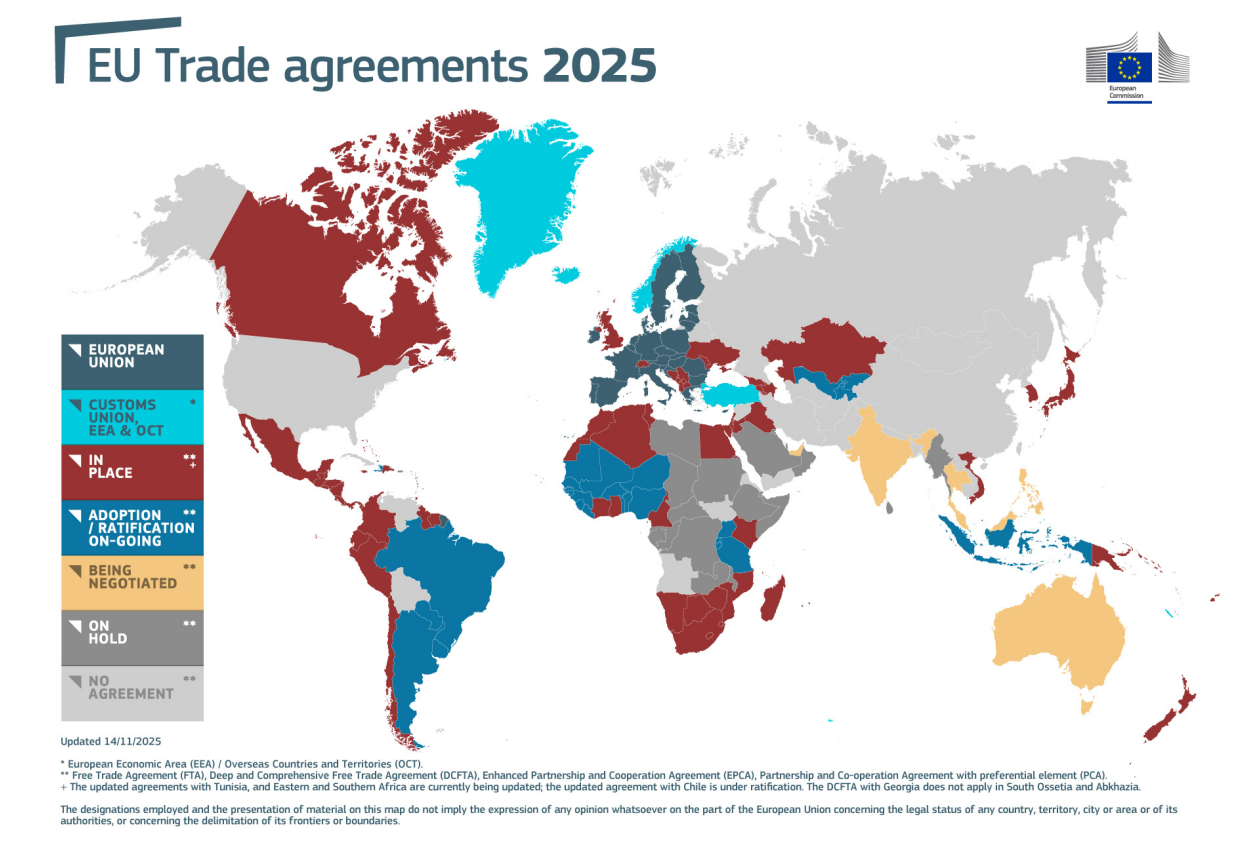

Compounding the deterioration of trade relations with the United States, the EU’s trade diplomacy is undergoing a phase of strategic consolidation, supported by a network of 76 free trade agreements signed or under negotiation—today the most extensive trade infrastructure in the world.

In this context, negotiations with Mercosur have become a pivotal dossier, not only because of the area’s economic potential but also for its geopolitical implications in the competition for access to non-EU markets. One of the essential objectives for EU trade policy is to guarantee legal certainty, predictability, and favourable market access conditions for European firms.

Source: European Commission

At the same time—despite the trade agreement signed with the U.S. administration last July—the transatlantic chapter remains one of the most complex.

The U.S. Section 232 measures continue to generate costs and operational uncertainty for European exporters, forcing companies to rethink their international positioning.

In a global context marked by asymmetry and increasingly unpredictable U.S. behaviour, the geographical diversification of export and supply markets is emerging as a pillar of Europe’s economic resilience. Within this scenario, free trade agreements (FTAs) represent a strategic opportunity to keep global trade “regulated” and open, providing clear and predictable frameworks to support firms in repositioning towards new international markets.

Any evaluation of ongoing negotiations must be grounded in the analysis of already-established results, and in this respect CETA stands as a fundamental benchmark. The EU–Canada agreement, signed in 2016, was one of the first next-generation FTAs and has long been central in the political and academic debate. Nearly a decade after its signature, it is clear that the EU’s model of “regulated” liberalisation has proven effective in boosting bilateral trade flows.

The CETA precedent: what the data tell us

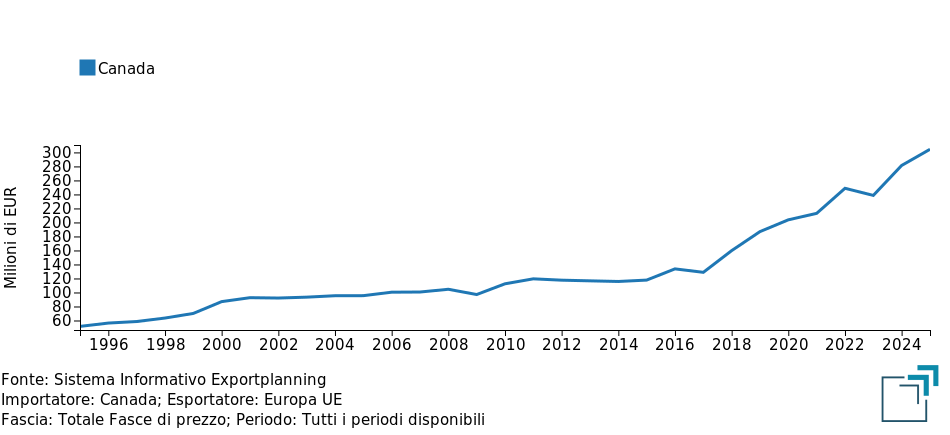

In 2016 European exports to the Canadian market totalled €34 billion. In 2024, they surpassed €54 billion, with further growth expected in 2025.

To better understand the agreement’s impact, it is useful to observe the medium-term evolution of EU exports to Canada and compare it with exports to non-EU markets.

Tab.1 – EU Exports

(CAGR 2017-2024, USD)

| Sectors | CAGR to Canada (%) | CAGR to non-EU Countries (%) |

|---|---|---|

| Agri-food | 6.3 | 4.7 |

| Automotive | 6.6 | 2.3 |

| Investment Goods | 4.6 | 2.2 |

| Chemical Industry | 3.4 | 4.9 |

| Raw Materials | 11.1 | 3.1 |

| Home System | 4.6 | 2.0 |

| Fashion System | 4.9 | 4.1 |

| Health System | 5.8 | 8.5 |

Source: ExportPlanning

Table 1 compares the compound annual growth rate (CAGR) of EU exports to Canada with those to non-EU markets (excluding Canada) over the period 2017–2024. The data reveal a clear pattern: the Canadian market has shown a significantly more dynamic growth profile across several key sectors.

More specifically, sectors such as Agri-food, Automotive, Investment Goods, Raw Materials, Home System and Fashion System exhibit stronger growth rates in Canada than in non-EU markets. The analysis of the main product categories affected by CETA shows particularly robust performance in machinery, metallurgical products and high-quality consumer goods.

In some cases, the gap is considerable. Raw Materials, which include base metals and industrial semi-finished products, stand out thanks to their much faster growth—supported by the strong integration of North American value chains and near-complete tariff elimination. The Automotive sector, bolstered by Canadian demand for specialised components, has also expanded at a pace well above that recorded in global markets. Meanwhile, Agri-food benefits from strong demand for high-value European products—such as cheese and wine—supported by geographical indication recognition and streamlined customs procedures.

EU dairy exports, for instance, more than doubled during the period (see chart below), a striking result considering that Canada itself is a producer of dairy goods. This highlights the opportunities offered by international markets where consumer preferences increasingly value variety and quality.

EU Dairy Exports to Canada

Source: ExportPlanning

Finally, the Fashion System and Home System appear to benefit from strong Canadian interest in European quality and design, with growth driven by clothing on the one hand and furniture-lighting on the other.

Two sectors present an exception: the Chemical Industry and the Health System, where export growth is higher in non-EU markets. In these segments, global demand—fuelled by international investment cycles and strong expansion in pharmaceuticals and medical devices—has outpaced Canadian demand, which nonetheless remained positive.

Conclusions

The Canadian case demonstrates how the combination of market access, high standards and reciprocal commitments provides a solid foundation for EU trade policy. CETA offers an instructive precedent for analysing forthcoming agreements—such as those with Mercosur or India—through the lens of the EU’s goal of strengthening its “open strategic autonomy”.

The dynamics observed between 2017 and 2024 suggest that Canada will continue to play a central role in the EU’s diversification strategy, alongside other priority geographies identified by the European Commission within the framework of economic security. In an increasingly unpredictable global environment, deepening relations with “reliable” partners remains a key lever for enhancing the competitiveness and stability of European companies.