EU–China: the evolution of the trade relationship and new sectoral balances

Published by Veronica Campostrini. .

Foreign markets Importexport Trade balance Foreign market analysisThe evolution of the trade balance in goods between the European Union and China today represents one of the most relevant lenses through which to understand the new asymmetries of international trade and the structural challenges facing the European industrial base. An analysis of bilateral flows shows how the economic relationship between the two areas has gradually shifted from a logic of productive complementarity to one of direct competition, with growing implications for the EU’s manufacturing structure.

The evolution of the EU–China trade balance

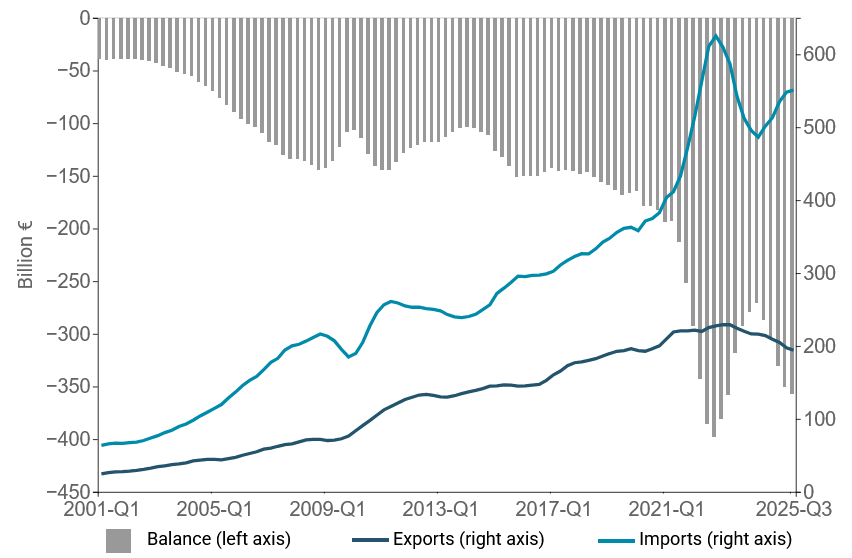

The chart in Fig.1 illustrates the trend of the annual cumulative trade balance in goods between the EU and China from 2001 to the present. The main evidence that emerges is the structural and persistent nature of the European deficit, which has widened over time as imports from the Chinese economy have grown systematically faster than European exports to Beijing.

After an initial phase of gradual deterioration, the deficit accelerated significantly in the post-pandemic period, reflecting both tensions along global value chains and China’s central role as a global manufacturing hub. In recent years, the EU’s negative balance has exceeded €300 billion on an annual cumulative basis, ranking among the most significant bilateral imbalances in global trade.

Fig.1 – EU: trade balance in goods with China

(billion euros, annual cumulative)

Source: ExportPlanning Information System

The phenomenon appears particularly significant for several reasons. First, it reflects the structure of the Chinese economy, which remains heavily export-oriented, where the weakness of domestic demand weighs on the performance of European exporters. In this context, exports represent the main outlet for absorbing excess production capacity, resulting in a Chinese trade surplus of exceptional size, increasingly concentrated in medium-to-high technology manufacturing. This dynamic has progressively intensified competitive pressure on key trading partners, fueling defensive reactions and a growing politicization of trade imbalances.

It is in this context that the further widening of the European Union's trade deficit with China should be seen, particularly evident in the post-pandemic period and amplified by the gradual US-China de-coupling, which has contributed to reallocating part of Chinese export flows towards the European market. Notably, the EU-China deficit is now larger than that of the United States, indicating a relative deterioration of Europe's competitive position.

The European trade deficit is therefore not a purely cyclical phenomenon but reflects a Chinese economy that is still heavily export-led, in which weak domestic consumption translates into greater competitive aggressiveness in foreign markets. In this context, the combination of Chinese industrial overcapacity and European demand exposed to price competition negatively affects the performance of EU exporters, strengthening trade tensions and pressures for defensive measures.

From Complementarity to Competition

In the early phase of trade integration, the EU–China relationship was characterized by strong complementarity: the European Union exported investment goods, machinery, and high-value-added products, while importing mainly consumer goods and low-cost manufactured items.

Over the past decade, this model has progressively changed. Chinese industrial policies, aimed at strengthening advanced manufacturing and technological upgrading, have enabled the country to expand its international presence in increasingly strategic sectors, reducing the competitive space for European industry even in traditionally well-protected segments.

Sectoral Reading of Trade Imbalances

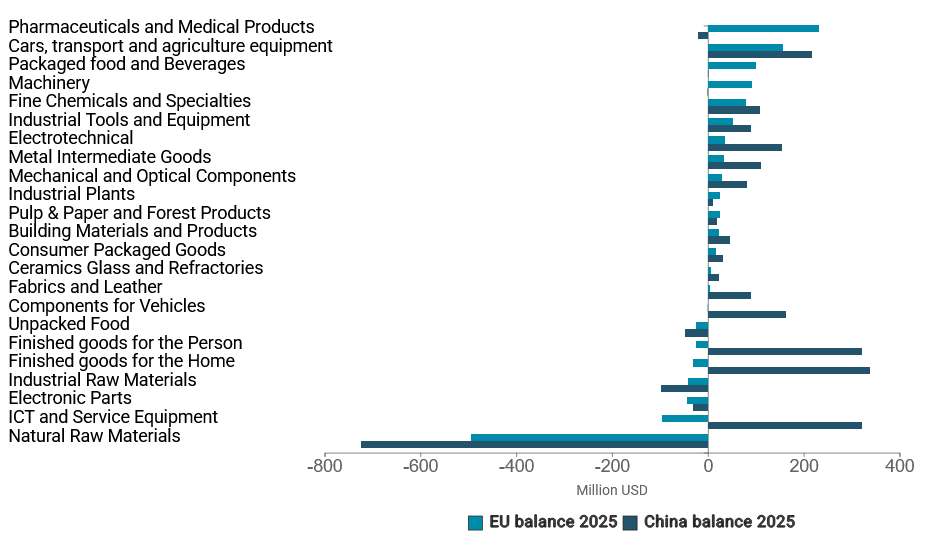

The sectoral breakdown of the trade balance held by the EU and China against the world allows for a more precise understanding of this phenomenon.

The following chart (Fig.2) shows the trade balance of goods by sector in 2025, comparing the positions of the European Union and China.

Fig.2 – EU and China: trade balance in goods by sector, 2025

(million dollars)

Source: ExportPlanning Information System

The chart highlights that there are few major EU industries not threatened by the so-called "Chinese advance": in particular, these are the Health System, the largest contributor to the EU trade balance, Packaged Food and Beverages, and Machinery and Equipment for Industrial Processes, where European leadership still appears solid.

On the other hand, the number of EU specialized industries in which the Chinese trade balance has shown marked growth in recent years is increasingly crowded. These industries include Transport Equipment, strongly influenced by the rise of the Chinese industry in the electric vehicle sector, Chemical Intermediate Goods, Industrial Equipment, and Electrical Engineering, sectors characterized by high technological intensity and strategic positioning along the global value chains.

This configuration highlights that EU-China competition is not limited to traditional low-value-added sectors, but is increasingly concentrated in the heart of the new global manufacturing, in segments crucial to the technological and energy transition, such as the electrification of transport, the digitalization of industrial processes, and renewable energy.

Conclusions

The trade deficit between the European Union and China should therefore be interpreted as a structural phenomenon, reflecting a new equilibrium in international trade and an increasingly direct competition in key manufacturing sectors. The concentration of imbalances in strategic industries points to growing pressure on the European industrial base, particularly in the areas of technological and energy transition.

In this context, European firms are called upon to strengthen strategies of innovation and differentiation, while for policy makers the key challenge lies in balancing market openness with industrial policy and trade defence instruments.