Agricultural Machinery: latest International Trade Figures

World demand showed signs of a downturn since the early months of the new year until it fell sharply in April. What is the performance for the top importing markets?

Published by Marzia Moccia. .

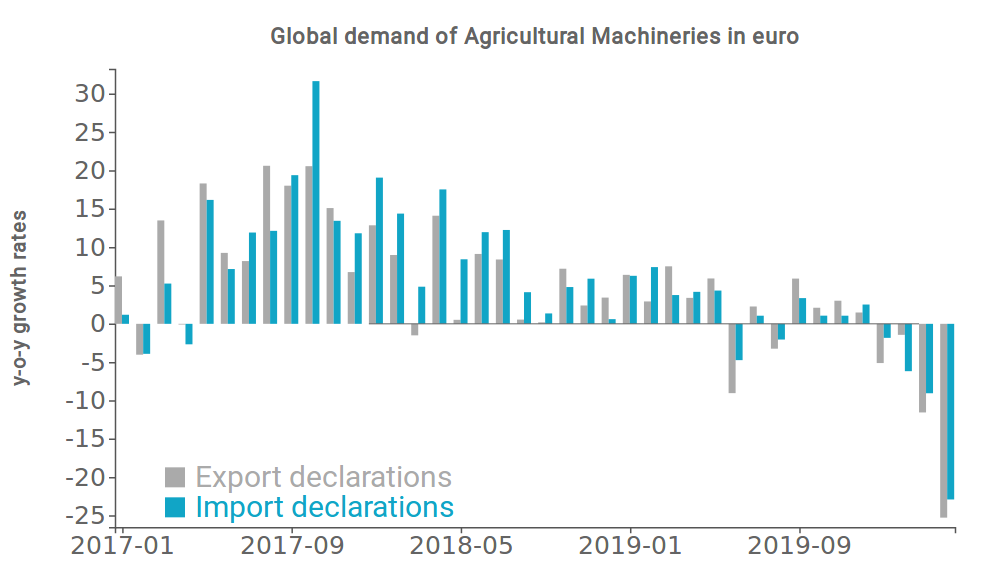

United States of America Uncertainty Conjuncture Global demand Global economic trendsSince the early months of this year, when the effects of the health crisis were still weak, global demand for Agricultural Equipment- measured in euros - has begun a phase of downturn, confirmed both by export declarations and import declarations data, as shown in the graph below.

Source: ExportPlanning

A not particularly brilliant beginning of the year has subsequently resulted in significant collapses, particularly evident in the months of March and April, when the effects of the pandemic became more robust on the international scene, leading to joint shocks on the supply and demand sides.

The month of April reported the most dramatic contraction, close to -25% in euros. In which region of the world have the worst results been recorded?

The chart below shows the top importing markets of Agricultural Machinery in relation to the rate of change recorded in Q1-2020 and in April; the value of the ball is proportional to 2019 imports value. The bisector, marked in yellow, divides the markets that saw an intensification of declines already visible in the first few months of the year from those that bucked the trend.

Source: ExportPlanning

The proposed graph highlights some relevant elements:

- The fall in imports of Agricultural Machines is strongly generalized and particularly marked for all European and American markets. In April, almost all the countries of the "Old Continent" marked a fall in a range between -25% and -35%, extending from west to east, highlighting the concomitant negative effects of the lockdown on both the supply and demand sides. The worst results were recorded for France and United Kingdom, for which the significant drop in April was associated with a downturn already visible in Q1-2020. The result was affected by the sharp drop in imports of agricultural machinery from major European partners, particularly from Germany.

For the American continent, on the other hand, Canada, Mexico and Brazil were the worst performers. In fact, the markets just mentioned showed a sharp reduction in imports, especially from the United States, the leading trading partner of the area. - Also the markets that had started the new year with positive results, during April reported a contraction of the order of 25% on average. Among these, the case of the United States, first importing market for agricultural machinery on the international scene, stands out. In Q1-2020, the American market recorded a strong increase in imports from the German partner, with an overall increase of more than 115 million euro compared to the corresponding quarter of last year. The result was also associated with an increase in imports from the main partners, such as Canada, Japan, Korea and Italy, before dropping by -14% in April, which was relatively lower than in other markets.

- In this context, the area of the world that showed the greatest resilience was Asia. With the exception of Australia and New Zealand, where the significant drop is mainly associated with the negative dynamics of imports from the United States, Japan, China, South Korea and Kazakhstan performed positively in April.

The case of the Chinese market certainly deserves further investigation. China has shown a significant growth in imports of Agricultural Machinery from USA, with an overall increase of more than 108 million euros in April. The result is due to the commitments made by Beijing in the trade agreement with Washington: Agricultural Machinery is in fact included in the long list of US manufacturing sectors of which China should increase its imports by about $77.7 billion in two years. The evidence would seem to signal Beijing's commitment to respecting the agreement, even in an economic context of absolute emergency.

Conclusions

As a durable product, the Agricultural Machinery sector was heavily exposed to the recessionary effects of the health emergency, following a phase of deterioration in world demand that has been visible since the beginning of the year. Despite the sharp contraction visible in the main European and American markets, Asia proved to be a relatively resilient area. The current international context, characterised by deep uncertainty, therefore requires the necessary planning of actions and markets to overcome the complexity of the restart.