Electrical engineering: the BLue OCean (BLOC) markets to focus on

In 2022 reached a new maximum point in the global flows of this industry, thanks to the presence of numerous markets in an acceleration phase

Published by Marcello Antonioni. .

Electronics Uncertainty Marketselection Foreign markets Industries International marketingThe electrotechnical industry1 is among the most dynamic in terms of world trade in the most recent period: as of 2022, world trade in electrotechnical products has reached new absolute maximum point, a good 37 percentage points higher than pre-pandemic levels if measured in values expressed in euro and about 20 percentage points higher if measured at constant prices, as documented by the graph below.

All the main sectors of the electrical engineering industry have (in some cases largely) recovered their pre-pandemic levels...

In the preliminary balance of 2022, within the electrotechnical industry, we note the excellent performance of world trade in the wires and cables, switches, plugs, sockets and electrical panels sector, which grew compared to 2019 in 24.2 per cent in values at constant prices (+37.2% in values denominated in euro).

Another sector with decidedly favorable performances is that of electric motors, generators and transformers, which shows an increase in world trade of around 20 percentage points in the valuation at constant prices compared to 2019 (and as much as +46.2 % in euro values2).

Double-digit percentage growth compared to 2019 also characterized the world trade of switchboards

(+15.9 percent at constant prices; +27.2 percent in euro values), parts for electrical equipment (+18.3 percent at constant prices; +25.2 percent in euro values) and other electrical engineering (+13.2 percent at constant prices and even +37.1 percent in euro values, with a - therefore - particularly significant increase in prices denominated in euro: +23.9%).

World Trade of Electrical Engineering

| Values 2022 | % changes at current prices |

% changes at constant prices |

|||

| Segment | (Bn €) | 2022/2021 | 2022/2019 | 2022/2021 | 2022/2019 |

| Wires and cables, switches, plugs, sockets and electrical panels | 256.9 | +21.1 | +37.2 | + 7.4 | +24.2 |

|---|---|---|---|---|---|

| Electric motors, generators and transformers | 220.4 | +26.5 | +46.2 | +10.5 | +19.6 |

| Parts for electrical equipment | 105.4 | +18.1 | +25.2 | + 5.7 | +18.3 |

| Switchboards | 77.1 | +22.5 | +27.2 | +10.7 | +15.9 |

| Other electrical engineering | 52.6 | +29.0 | +37.1 | +13.0 | +13.2 |

| TOTAL | 712.4 | +23.0 | +36.7 | + 8.8 | +19.9 |

Source: ExportPlanning-Annual Trade Flows Datamart

.. thanks to the presence of various BLue OCean (BLOC)

markets in an accelerating phase, especially in the Asian area.

The BLOC markets

Wires and cables, switches, plugs, sockets and electrical panels

In 2022, world trade in the wires and cables, switches, plugs, sockets and electrical panels3 sector reached 257 billion euros (+69.6 billion compared to 2019). This performance originates in various markets - especially Asian ones - in an acceleration phase in their imports, measured in values at constant prices.

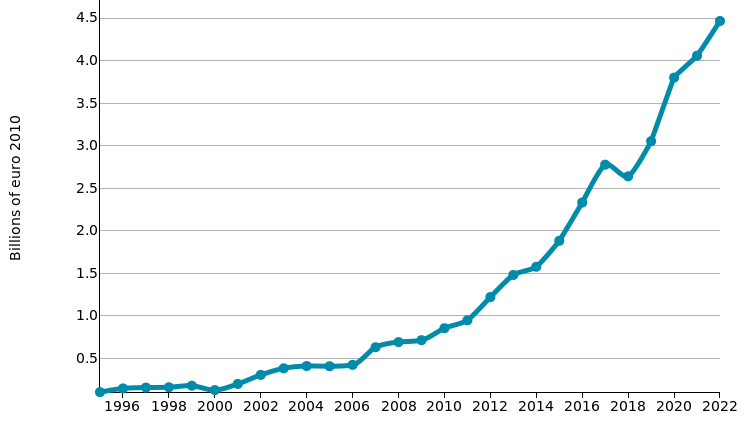

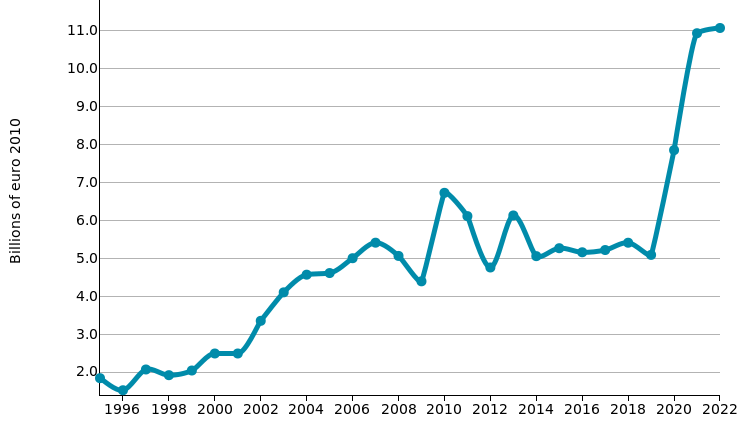

Some of the main BLOC markets (BLue OCean) of the sector, with particular reference to the ASEAN area, are the following:- Vietnam: with its 6.6 billion euros in pre-final 2022, it is the 8th import market in the sector in the world. As shown in the graph below (with imports expressed in values at constant prices), there is a very favorable growth trend in this market over the last decade; in the last three years (2022/2019), in particular, there was an overall increase in imports of over 46 percentage points in values at constant prices;

- Thailand: with 4.8 billion euros in 2022, it is the 15th world importer in the sector, characterized by very accelerated growth dynamics, as evidenced by an overall performance in the last three years (2022/ 2019) by +62 per cent in values at constant prices (see the graph below).

Wires and cables, switches, plugs, sockets and electrical panels:

selection of BLOC markets

| VIETNAM | THAILANDIA |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Electric motors, generators and transformers

In 2022, world trade in the electric motors, generators and transformers4 sector exceeded 220 billion euros (+70 billion compared to 2019). This performance originates in several accelerating markets in its imports, measured in values at constant prices.

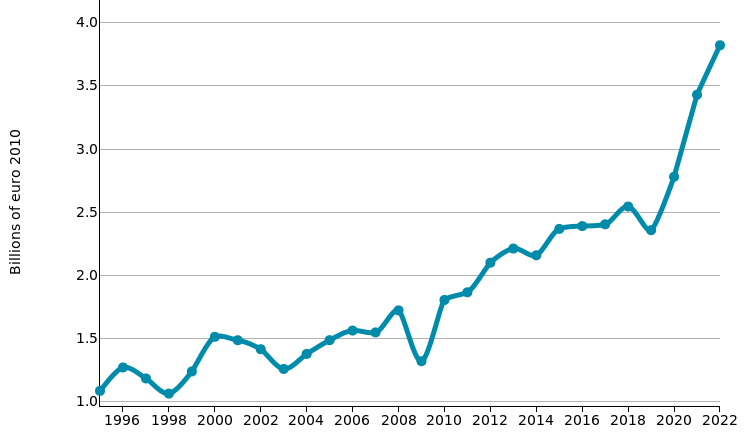

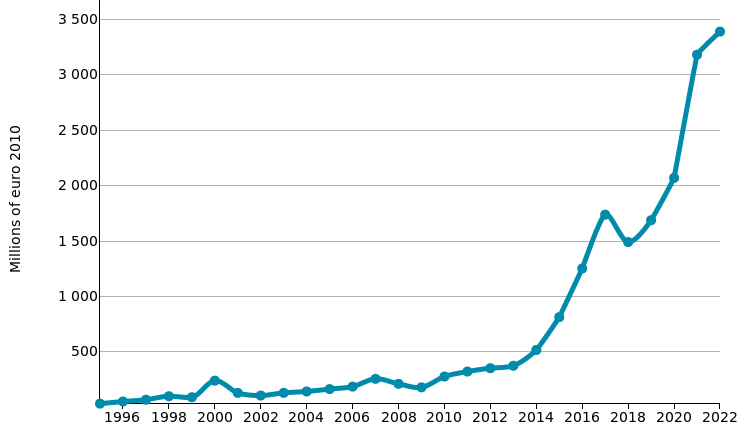

Some of the main BLOC (BLue OCean) markets in the sector, in the long and short range are as follows:- Vietnam: with its 7.5 billion euros in pre-final 2022, it was the 6th import market in the sector in the world. As shown in the graph below (with imports expressed in values at constant prices), there is a very favorable growth trend in this market over the last decade; in the last three years (2022/2019), in particular, there was an overall increase in imports of +95% in values at constant prices;

- Poland: with approximately 5 billion euros in 2022, it is the 15th world importer in the sector, characterized by accelerated growth dynamics, as evidenced by an overall performance in the last three years (2022/ 2019) by +51 per cent in values at constant prices (see the graph below).

Electric motors, generators and transformers: selection of BLOC markets

| VIETNAM | POLAND |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Parts for electrical equipment

In 2022, world trade in the parts for electrical equipment5 sector exceeded 105 billion euros (+21.2 billion compared to 2019). This performance originates in various markets (above all Asian) in an acceleration phase in its imports, measured in values at constant prices.

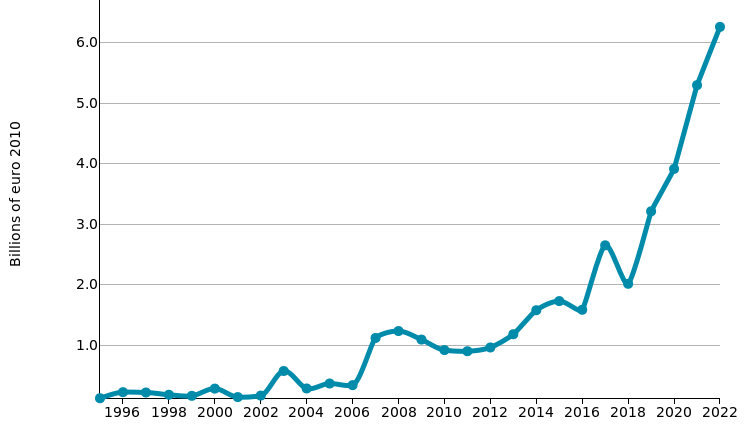

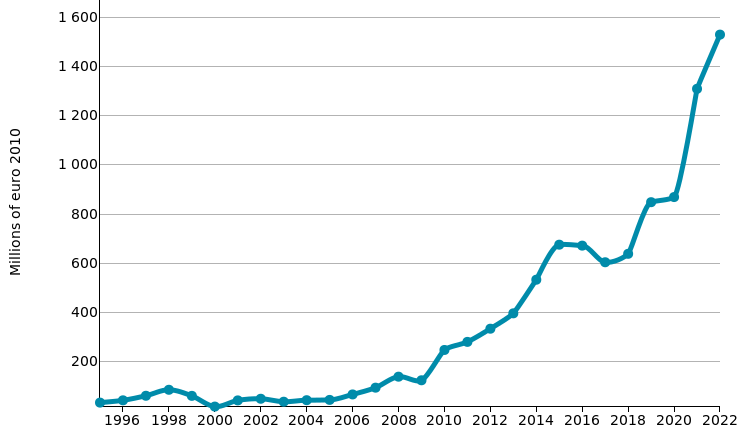

Some of the key BLOC (BLue OCean) markets in the industry are as follows:- China: with 11.6 billion euros in 2022, it is the 2nd absolute world importer of the sector (behind the USA), characterized by particularly accelerated growth dynamics in the last three years (2022/ 2019), which marked a jump of 118 percentage points in values at constant prices (see the graph below);

- Vietnam: in 2022 its imports reached 3.7 billion euros, ranking 6th among the sector's markets in the world. As shown in the graph below (with imports expressed in values at constant prices), there has been a particularly favorable growth of this market over the last decade; in the last three years (2022/2019), in particular, there has been an overall doubling of imports measured at constant prices.

Parts for electrical equipment: selection of BLOC markets

| CHINA | VIETNAM |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Switchboards

In 2022, world trade in the switchboards6 sector exceeded 77 billion euros (+16.5 billion compared to 2019). This performance originates in various markets (above all Asian) in an acceleration phase in its imports, measured in values at constant prices.

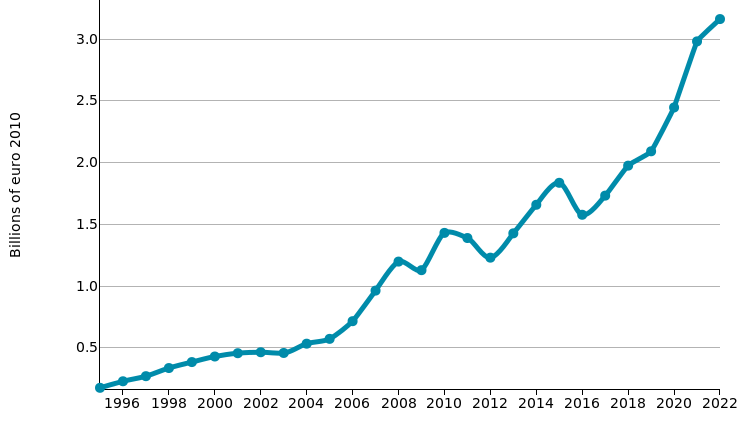

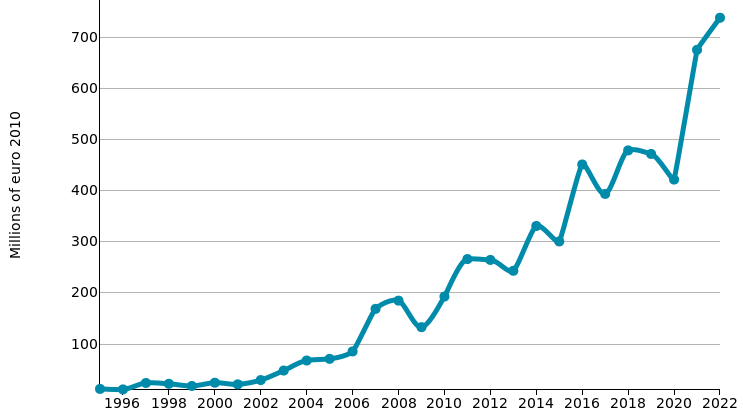

Some of the key BLOC (BLue OCean) markets in the industry are as follows:- Vietnam: with 1.3 billion euros in 2022, it is the 20th world importer in the sector, which is also characterized by particularly accelerated growth dynamics; in the last three years (2022/2019) imports from this market have achieved an overall increase of over 80 percentage points in values at constant prices (see the graph below);

- India: in 2022 its imports reached a value of 844 million euros, ranking 26th among the sector's markets in the world. As shown in the graph below (with imports expressed in values at constant prices), there has been a particularly favorable growth of this market over the last decade, even when measured at constant prices.

Switchboards: selection of BLOC markets

| VIETNAM | INDIA |

|

|

Source: ExportPlanning-Annual Trade Flows Datamart

Conclusions

Many factors, certainly including the ongoing ecological transition processes, are supporting the worldwide demand for products from the electrotechnical industry. After a particularly dynamic two-year period 2021-2022 for world trade in electrotechnical products (+18.6% annual average, in euro values), the prospects for the next four-year period (2023-2026) are, however, definitely more selective (especially with reference to the current year [+2.3%], certainly influenced by the slowdown of the international economy but also by the expected reduction in the prices of the productive inputs used by this industry), with average annual growth expectations in the order of +4.4% in values in euro7.

In such a context of greater selectivity, the search for foreign markets BLue OCean (BLOC), resilient to the cycle, should be a priority for exporting companies in the Electrical Engineering industry.

The instrumentation made available in ExportPlanning, in the Market Selection module, can allow you to select the so-called BLOC markets, during the acceleration phase of your imports.

1) For a list of the segments analysed, please refer to the relative sectoral description.

2) The significant growth experienced by the world trade of electric motors, generators and transformers in prices in euros (estimated at +26.6% in the period 2022/2019) is attributable to the strong increases experienced by materials of the sector, as for example in the case of the electrical steel. As documented in PricePedia platform, the prices of grain-oriented electrical steel continue to highlight maximum levels (in March 2023 in the order of +164% compared to March 2019 for the type with widths greater than or equal to 600 mm, and +116% for that with widths less than 600 mm. In the 2022 average the average price of grain-oriented Electrical steel was more than 100 percent higher than the 2019 average.

3) For a list of the products included therein, please refer to the relevant segment description.

4) For a list of the products included therein, please refer to the relevant segment description.

5) For a list of the products included therein, please refer to the relevant segment description.

6) For a list of the products included therein, please refer to the relevant segment description.

7) These are sector forecasts formulated by StudiaBo, within the ExportPlanning Information System, based on the latest macroeconomic scenario of the International Monetary Fund.