Home Products: world trade declining in 2023, but not in the premium segments

At the end of the year, an overall decline of close to 7 percentage points is estimated in euro values, but with decidedly favorable performances in the premium segments

Published by Marcello Antonioni. .

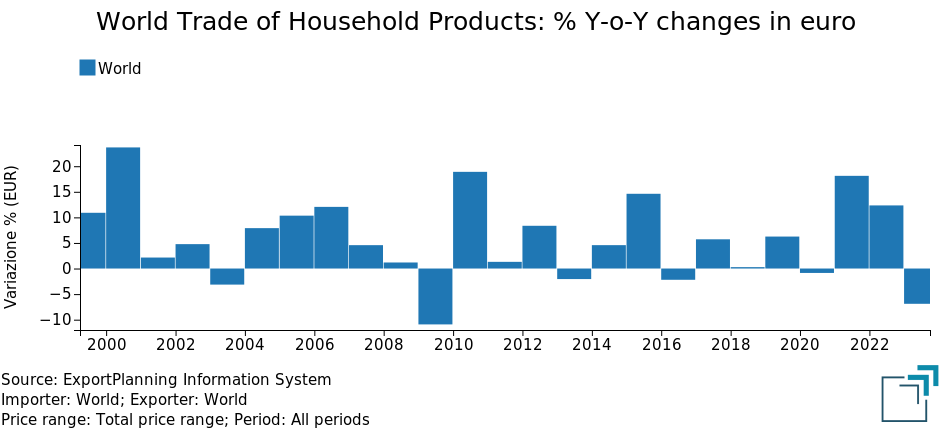

Home items Premium price Uncertainty Conjuncture Slowdown Industries International marketingBased on the 2023 preliminary final data from ExportPlanning, the world trade of Home Products1 is expected to close the year with a decline of more than 6 percentage points compared to 2022, both in euro values (-6.5%) and at constant prices (-6.9%).

Inflation and restrictive monetary policies in the main world markets have produced recessive effects on the low-end segments of the Home Products' industry...

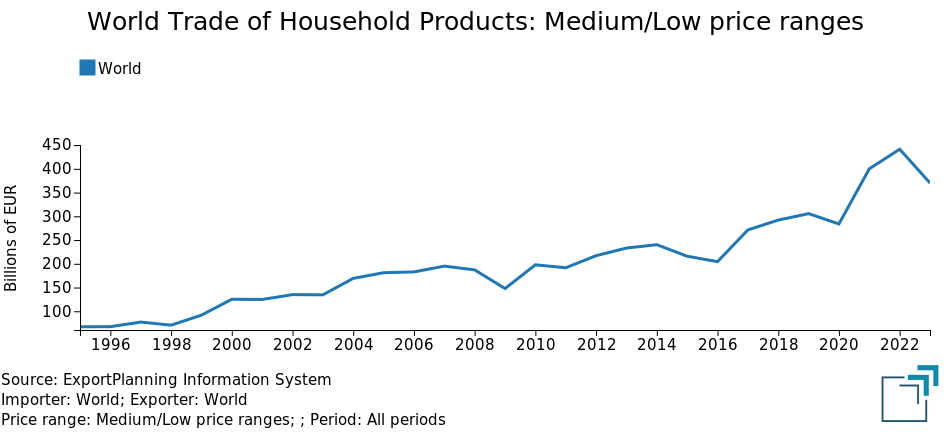

The reduction in global trade in Home Products appears to be essentially attributable to the strong contraction in flows in the medium/low price ranges, estimated at over 16 percentage points in euro values compared to 2022, which reduces its weight on global trade in the industry from 54 percent in 2022 to 48.6 percent estimated at the end of the year.

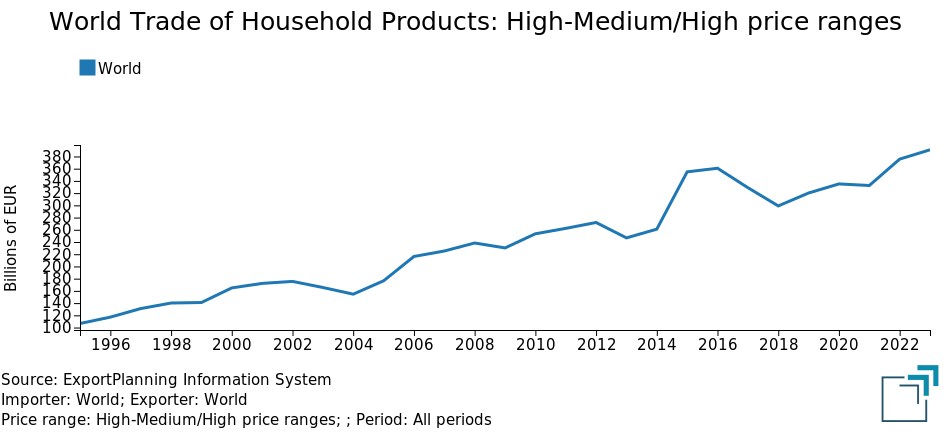

On the other hand, world trade in Home Products in the higher price ranges has been able to maintain growth.

In particular, high price range trade flows are estimated to close the year with an average annual growth of over 17 percentage points in euro values (going from 8.5 percent to 10.7 percent of trade world of the industry).

Furthermore, the trade flows of the Medium/Medium-High price ranges have been able to maintain - albeit weak - growth (+1.5% estimated at the end of the year in euro values compared to 2022), with progress in their relative weight on the industry's world trade (from 37.5 percent last year to 40.6 percent this year).

World Trade of Home Products by Price Ranges

(shares at current prices)

| 2019 | 2020 | 2021 | 2022 | 2023E | |

| High price range | 8.7% | 11.4% | 6.3% | 8.5% | 10.7% |

|---|---|---|---|---|---|

| Medium/Medium-High price ranges | 42.5% | 42.8% | 39.1% | 37.5% | 40.6% |

| Low/Medium-Low price ranges | 48.8% | 45.9% | 54.6% | 54.0% | 48.6% |

| TOTAL | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

Source: ExportPlanning - Data - Annual Trade Data, Ulisse Datamart

Conclusions

As already documented for the Fashion industry, the weakening of global demand for Home Products during 2023 saw differentiated patterns in consumer choices, with a strong downsizing of the lower price ranges (more exposed to the effects of high inflation and fast growing interest rates experienced in the main world markets), to the advantage - instead - of sales in the highest price ranges.

This phenomenon appears, in some ways, in analogy to what happened during the previous crisis (Great Lockdown) in 2020, when consumer preferences had shifted on the "premium-price" segments: compared to a drop in the "low-cost" segments of more than 32 percentage points when measured in euros, global trade in the high-price range of Home Products had increased by almost 30 percentage points in euro values, with a significant increase in its relative share of the industry's world trade.

1) For a description of the sectors included in the aggregate considered, please refer to the relevant industry profile.