Global sales of Mechanical Engineering: the 2023 performances

Strong slowdown in euro values, but when measured at constant prices an even more favorable growth result than in 2022

Published by Marcello Antonioni. .

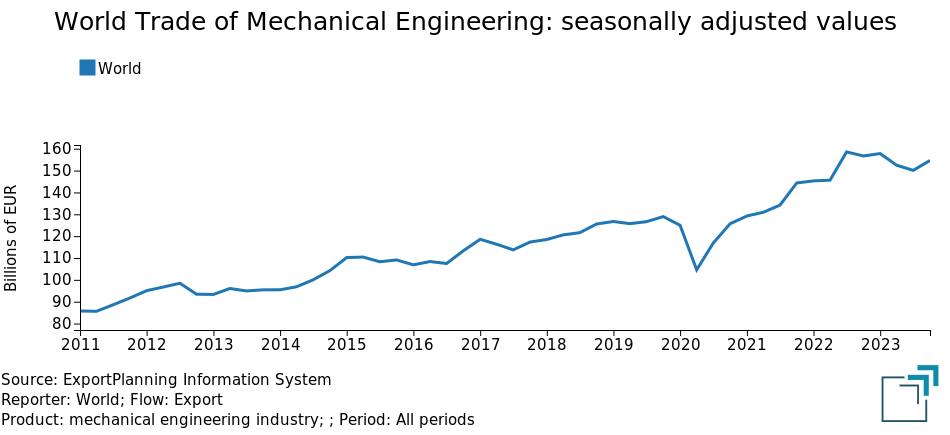

Slowdown Uncertainty Conjuncture Metal industry Global economic trendsDuring 2023 the worldwide sales of Mechanical Engineering1 highlighted a significant slowdown in their dynamics in values in euros, as documented in the graph below.

Mechanical Engineering: in 2023 a significant slowdown in global trade in euro values...

After 2022 in which global exports of the sector had recorded an average annual growth of +12.6 percent, 2023 saw - however - a first half of the year that was still overall dynamic (+6.5% trend), and then showed an evolution negative in the second half (-3.3% yoy), closing the year with a modest +1.4 percent in euro values.

Data on global exports of Mechanical Engineering, measured at constant prices2 and available in ExportPlanning Information System, also allow us to document the holding of global sales of this industry in quantity: on average in 2023 the global export of mechanical products varied and similar, it has, in fact, highlighted, at constant prices, a result of - albeit weak - growth (+1%), even more favorable than that of the previous year (+0.4%).

..but international sales of the sector held up

measured at constant prices...

World Trade of Mechanical Engineering:

values 2023 (pre-estimates) and % Year-over-Year changes at constant prices

| Bn € | % Y-o-Y changes at constant prices | |||||

| 2023E | 2022 | H1-2023 | H2-2023E | 2023E | ||

| Measuring instruments | 190.4 | + 1.7 | + 9.4 | + 5.6 | + 7.4 | |

|---|---|---|---|---|---|---|

| Tools and molds | 75.1 | - 1.9 | - 0.9 | - 1.3 | - 1.1 | |

| Pumps and filters | 66.9 | + 3.7 | - 1.7 | - 4.8 | - 3.2 | |

| Lifting and handling | 63.9 | - 2.3 | + 0.8 | - 1.1 | - 0.1 | |

| Boilers, turbines and motors | 47.1 | +10.2 | + 4.9 | - 5.3 | - 0.4 | |

| Pumps and compressors | 43.0 | - 3.1 | + 3.7 | - 3.3 | + 0.2 | |

| Electromechanical tools | 33.2 | -11.4 | -15.9 | -13.5 | -14.7 | |

| Apparatus for automatic control | 31.3 | + 4.0 | + 3.0 | + 0.4 | + 1.7 | |

| Valves and pressure reducers | 25.2 | + 0.7 | + 7.1 | + 4.1 | + 5.6 | |

| Other mechanical engineering | 71.6 | + 1.7 | + 4.6 | - 1.9 | + 1.3 | |

| TOTAL | 647.8 | + 0.4 | + 2.8 | - 0.7 | + 1.0 | |

Source: ExportPlanning - Data - Quarterly Trade Data, World Trade Datamart

..albeit with (sometimes very) significant differences

at a sectoral level.

Sectors driving and slowing global sales of the sector

The examination of the dynamics of global exports of Mechanical Engineering by sectors highlights the driving role of global sales of measuring instruments3: in 2023 the world exports of this sector experienced an average annual growth at constant prices of 7.4 percentage points (significantly accelerating compared to the 2022 average: +1.7%) .

Another sector that is significantly improving compared to 2022 is that of valves and pressure reducers4, with exports worldwide growth last year of almost 6 percentage points at constant prices (against the +0.7 percent average for 2022).

Within the item "other mechanical engineering", the case of worldwide sales of signaling devices5 should also be highlighted (+10.5% in the 2023 average, measured at constant prices, after the +12.7% of the 2022 average), penalized only partially by a decidedly less dynamic second half of the year (+3.9% year-over-year) compared to the first ( +18% y-o-y).

Finally, the resilience of global sales of pumps and compressors6 should be underlined, stable on average in 2023 (after the -3.1 percent average for 2022).

On the other hand, poor performance is seen (even largely) for global sales of electromechanical tools7, falling on average in 2023 by almost 15 percentage points when measured at constant prices, worsening the already negative performance in 2022 (-11.4%).

The "minus" signs in global sales of pumps and filters8 are less intense but still worsening compared to 2022. sup> (-3.2% on average for 2023, after +3.7% on average for 2022) and boilers, turbines and motors9 (-0.4% on average in 2023, after +10.2% in 2022).

Conclusions

Despite a slowdown in the most recent period, global sales of various and similar mechanical products have shown overall stability.

However, this performance appears diversified at the level of individual sectors of the sector, with the presence - on the one hand - of "driving" sectors and - on the other - "braking" sectors worldwide sales.

Such a heterogeneous (and rapidly evolving) framework, as shown by the dynamics of global exports in the sector during 2023), suggests that exporters of Mechanical Engineering constantly monitor the situation of the markets of interest for their area of business.

Thanks to the series of new services, named Market Insights, ExportPlanning can support the market monitoring of exporting companies, providing updated information in real time on the evolution of the markets of interest for a specific business area.

1) The following macro-sectors are included in the aggregate considered: 2) The measure Quantities at constant prices (Q). This measure includes a deflation operation, in which the historical series of monetary values (V) has been transformed into an analogous series of values expressed at constant prices, with a reference to a given year, known as the base year. For a description of the methodology applied, please refer to Methodological Note on the World Trade Datamart.

3) For a list of products included in this sector, please refer to the relevant sector profile.

4) For a list of products included in this sector, please refer to the relevant sector profile.

5) For a list of products included in this sector, please refer to the relevant sector profile.

6) For a list of products included in this sector, please refer to the relevant sector profile.

7) For a list of products included in this sector, please refer to the relevant sector profile.

8) For a list of products included in this sector, please refer to the relevant sector profile.

9) For a list of products included in this sector, please refer to the relevant sector profile.