First Quarter 2024: Global Trade Outlook

The ExportPlanning preliminary estimates for the first quarter of 2024 confirm a global outlook of slow recovery, albeit with differentiation at both geographical and sectoral levels.

Published by Simone Zambelli. .

Global demand Conjuncture Global economic trends

The availability of ExportPlanning's preliminary estimates for the first quarter of 2024 - accessible through the datamart Global Economic Outlook - provides an overview of the international trade scenario for goods.

Following the difficulties encountered in 2023, especially during the third quarter, the beginning of 2024 shows encouraging signs, with the first positive year-on-year changes after more than a year in negative territory.

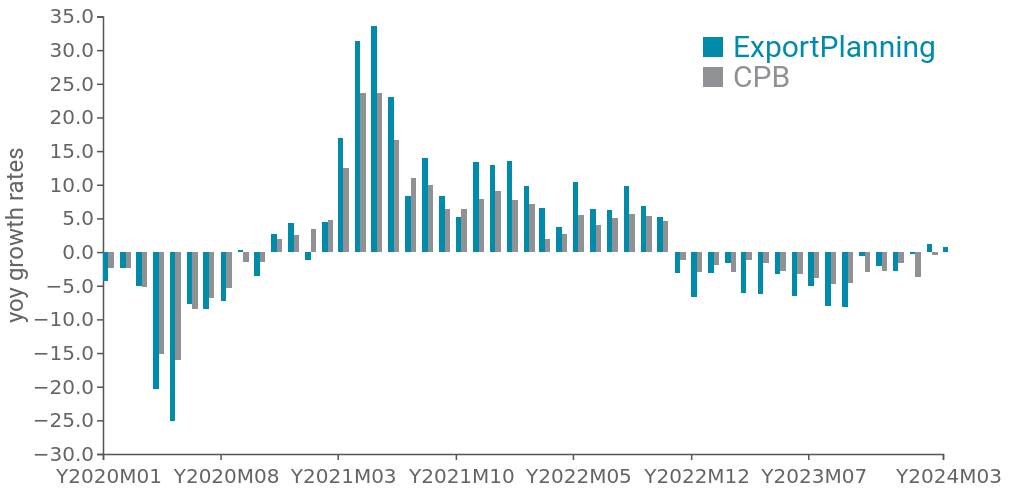

The following figure shows monthly variations at constant prices (i.e., adjusted for price and exchange rate effects), comparing data compiled by ExportPlanning with those of the Central Planning Bureau, an institute that in turn collects and processes information on international goods trade.

Fig.1 - Global Demand in Quantity

(CPB data vs ExportPlanning data, year-on-year change)

Source: ExportPlanning

It's evident how both measures exhibit a similar trend, with 2023 characterized by a steep downturn, particularly in the first three quarters of the year. Signs of a mitigated downturn are already visible from the last three months of the previous year. As presented in the article "Positive Signals from Global Goods Trade", during the last quarter, there was a progressive improvement in the demand for finished goods, amidst persistent weakness in the demand for intermediate goods and commodities, reflecting companies' "wait-and-see" purchasing policies in a context of commodity price reductions and inventory disposal.

The cautious optimism signals from the last three months of the previous year are reinforced by the latest information regarding the first quarter of 2024, when, for the first time, global goods trade returned to positive territory, with a rebound of +2% year-on-year.

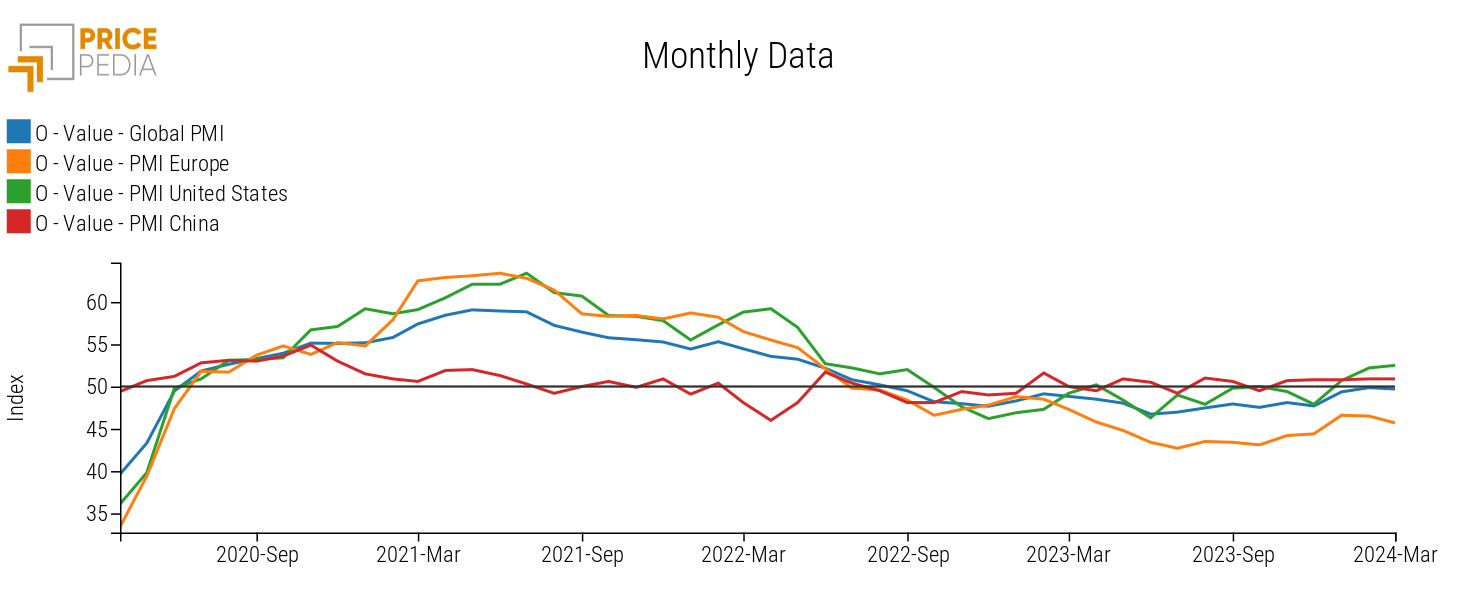

Confirming the recovery are also the signals from the trends of the global Manufacturing Purchasing Managers' Index (PMI), which provide insight into manufacturing industries using data collected from surveys conducted among purchasing managers in various countries. These indices represent market sentiment.

Fig.2 - Global Manufacturing PMI

(the gray line indicates the neutral threshold of 50)

Source: PricePedia

For the first time since the end of 2022, the global PMI has returned close to the neutral threshold of 50, following a progressive improvement concentrated in the last months of 2023. It's interesting to note that the recovery in these early months of the year is mainly driven by the United States and China, whose PMI indices have been above the critical threshold of 50 (which distinguishes between expansion and contraction) since January. Europe, on the other hand, is the region facing more difficulties, although it has also been improving in recent months, with a PMI index still below the 50 threshold.

Sectoral Analysis

Even more intriguing is the sectoral profile of the recovery in the data for the first quarter of the new year, with the first signs of rebound also for the demand for intermediate goods and commodities.

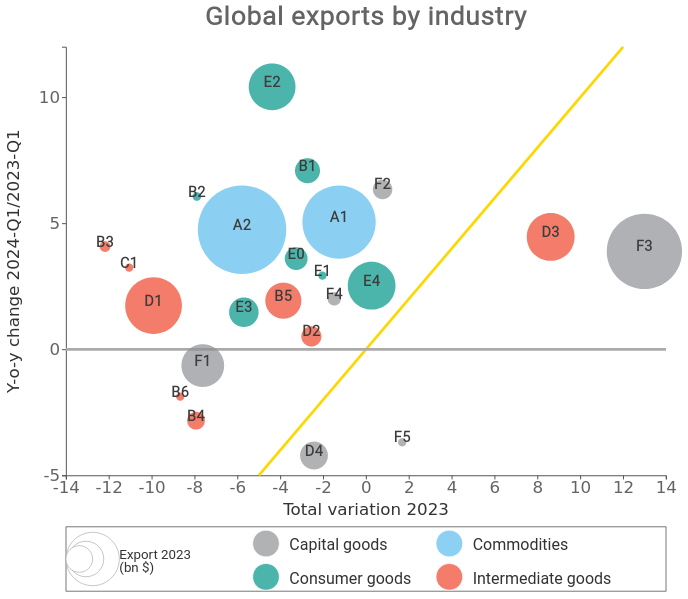

The following map positions the main industries based on the annual rate of change at constant prices for 2023 (X-axis) and the rate of change for the first quarter of 2024 compared to the corresponding quarter of 2023 (Y-axis); the size of each ball is proportional to the value of exports (always at constant prices) in 2023.

It's evident that the vast majority of sectors are situated above the bisector: this means that in the first quarter of 2024, they had a better year-on-year performance compared to the average of the previous year. Particularly noticeable are Consumer Goods, which reinforce the rebound signals already visible at the end of the year: in the first quarter of this year, Finished products for personal use (E2) grew by 14% year-on-year; also notable are food products (B1, E0), and textiles (B2).

Following consumer goods are Raw Materials, both natural (A1) and industrial (A2), and Intermediate Goods, confirming that the recovery of global trade is not only limited to final goods but also involves a manufacturing recovery.

Finally, we can observe that transportation (F3) and related components (D3) are the only goods that held up during the past year and continue to show dynamic performance at the beginning of 2024.

Conclusions

The economic scenario in the first quarter of 2024 confirms the recovery signals already recorded in the previous quarter, as documented in the article "IV Quarter 2023: Global Trade Outlook", which confirms a sentiment of "cautious optimism".

However, the positive signals are still weak and heterogeneous both geographically and sectorally. To have a comprehensive economic outlook, it is essential to constantly monitor the major ongoing phenomena, in order to prioritize markets and sectors with greater potential.