Q4 2023: Global Trade Outlook

The pre-estimates by ExportPlanning for the fourth quarter of 2023 reveal an economic scenario still in negative territory, but with positive signals

Published by Simone Zambelli. .

Global demand Conjuncture Total goods Global economic trends

The availability of ExportPlanning's preliminary estimates for the fourth quarter of 2023 - accessible through the datamart World Economic Outlook - provides an overview of the international trade scenario for goods.

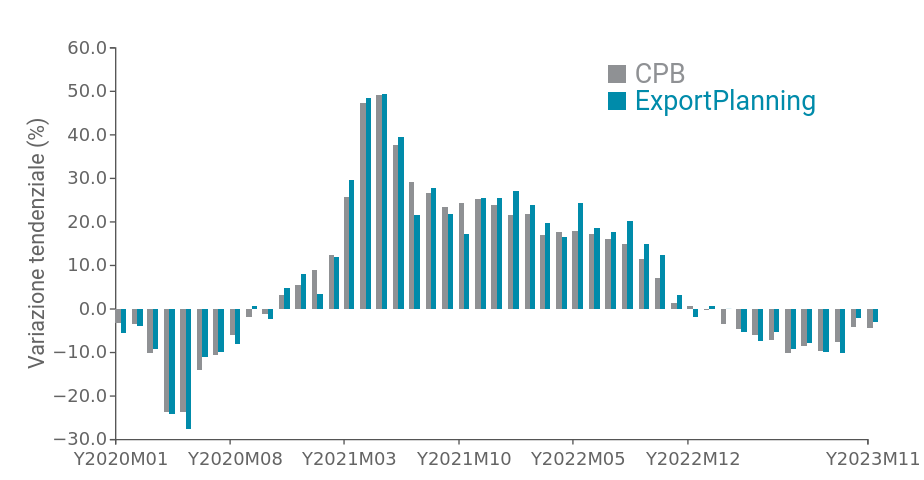

2023 has been a particularly challenging year globally, marked by a significant slowdown. For the first time since overcoming the global pandemic, between the end of 2022 and the beginning of 2023, global goods trade in dollars entered negative territory, indicating a slowdown that progressively intensified until the third quarter of 2023. This is documented in Fig.1, which presents the monthly year-over-year changes in current dollar prices, comparing data processed by ExportPlanning with that of the Central Planning Bureau, an institute that collects and processes information on international goods trade.

Fig.1 - Global demand in dollars

(CPB data vs ExportPlanning data, year-on-year variation)

Source: ExportPlanning

It is evident how both measures present very similar values, confirming the validity of the shown dynamics. After the rebound in 2021 and the strong growth that characterized the entire 2022, 2023 shows bearish variations, especially in the third quarter, where global demand declined by over 9%. However, in the fourth quarter of last year, we can observe a phenomenon of recovery: the year-on-year variations are still negative but increasingly closer to zero.

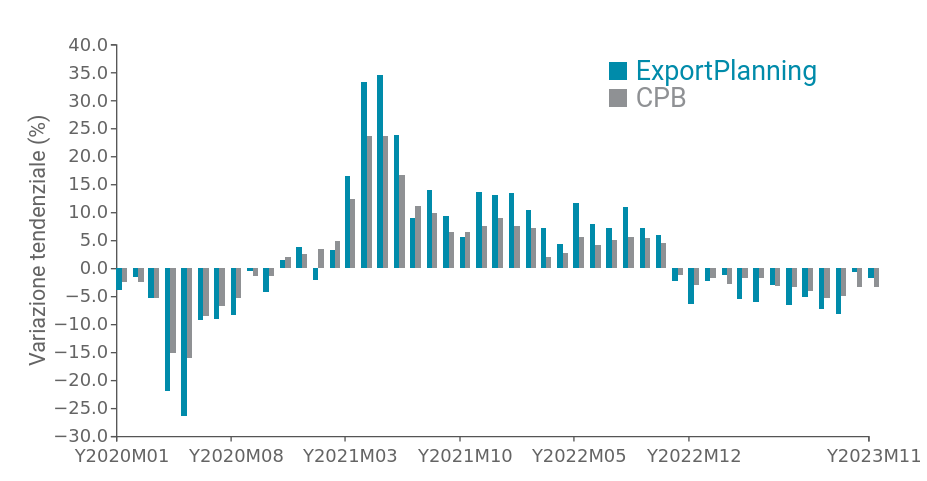

To provide a clearer view of the economic dynamics, we need to eliminate the effect of prices and exchange rates, which often significantly influence the final values, in order to analyze the economic dynamics in real terms.

Fig.2 - Global demand in quantity

(CPB data vs ExportPlanning data, year-on-year variation)

Source: ExportPlanning

Excluding price dynamics, global demand for goods, as measured by ExportPlanning, experienced a year-on-year decline of 3.1% in the first quarter of 2023, with two additional contractions of 5.2% in the April-June period and 6.8% in the July-September period. In the fourth quarter, the decline was relatively contained (-0.5%).

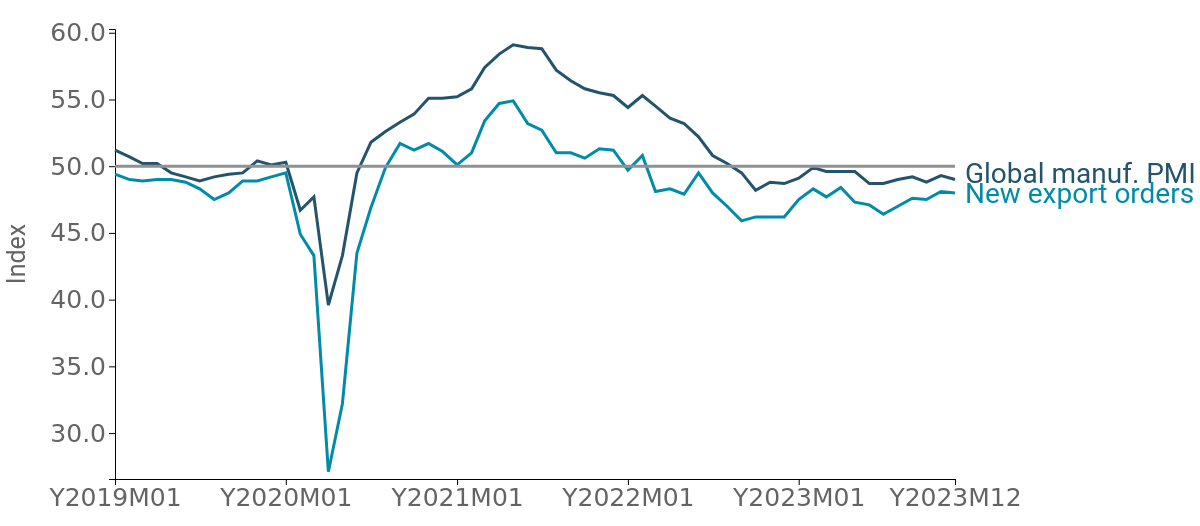

Another interesting point of analysis is the Purchasing Managers Index (PMI) in manufacturing, which provides an overview of the manufacturing industry using data collected from surveys directed at purchasing managers of companies. The PMI, therefore, represents the market sentiment.

Fig.3 - Global Manufacturing PMI and New Export Orders

(the gray line indicates the neutrality threshold of 50)

Source: ExportPlanning

From the graph, the slowdown in global demand for goods and the downsizing of industrial activity are evident in the aftermath of the post-Covid rebound: by the end of 2022, both indicators (Global Manufacturing PMI and New export orders) had fallen below the critical threshold of 50 (which distinguishes between expansion and contraction). The New Export Orders component of the Global Manufacturing PMI, an anticipatory indicator of the dynamics of global trade in manufactured goods, is still below the threshold but has shown slight improvement in the last months of 2023.

The economic scenario appears to be still complex; however, signs of recovery are evident, as documented in the article "Positive signals from global trade". The role of information is therefore crucial to constantly monitor the ongoing major phenomena and allocate resources accordingly to markets with higher potential.