Food Machinery: United States continues to be the leading market. Which states are driving the growth?

In the first quarter of 2024, the USA is by far the most dynamic market for global exports in the sector

Published by Marcello Antonioni. .

American States Check performance Industrial equipment Marketselection United States of America Export markets Global economic trendsWorldwide exports of Food Machinery

World trade data for the first quarter of 2024, available in the World Trade Datamart, highlight - after a phase of significant slowdown in euro values - signs of strengthening of world exports of Food Machinery1: +10.5% in euro values (+4.8% at constant prices) compared to the corresponding period 2023.

In the first quarter of the year, global sales of food machinery, although penalized by the declines in the markets of Russia, Australia, Poland and China, found support, once again, from the US market (+367.8 million euros compared to the corresponding period in 2023) and, to a lesser extent, from Brazil, Mexico and United Arab Emirates.

The US market is therefore confirmed as the main destination for global sales of Food Machinery (with approximately 3.8 billion euros in 2023)2, destination driving global demand for the sector: in the period 2020-2023, global sales of Food Machinery aimed at the US market grew overall by over 1.3 billion euros, clearly the largest increase relevant among the world markets of sector3.

From 2019 to today, the US market has shown an overall increase in imports of Food Machinery from the world

of almost 1.7 billion euros

World Exports of Food Machinery:

main driving markets in the 1st quarter of 2024

| Level 2023 | Delta (Million €) | ||

| Market | (Billion €) | 2023/2019 | Q1-2024/Q1-2023 |

| United States | 3.8 | +1 306 | +367.8 |

|---|---|---|---|

| Brazil | 0.4 | - 60 | + 63.7 |

| Mexico | 0.7 | + 29 | + 58.6 |

| United Arab Emirates | 0.2 | + 55 | + 36.6 |

| India | 1.0 | + 285 | + 32.3 |

| Japan | 0.5 | - 20 | + 31.1 |

| Indonesia | 1.1 | + 257 | + 29.4 |

Source: ExportPlanning - Quarterly World Trade Datamart

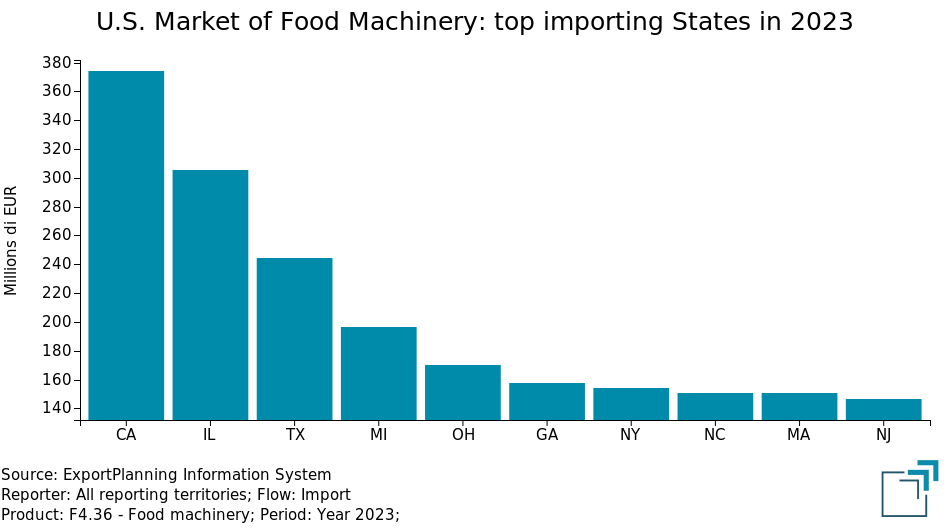

Total imports of Food Machinery by American states

The import data for the United States, broken down by state and partner country, available in the Quarterly Trade of American States Datamart, allow to document, within the US market, the most relevant geographical areas and those driving the overall demand (and from Italy) for food machinery in the period most recent.

In particular, in the 2023 final balance we note the record of imports of food machinery from California [CA] (374 million euros), followed by Illinois [IL] (306 million €), Texas [TX] (244 million €), Michigan [MI] (€197 million), Ohio [OH] (€170 million), Georgia [GA] (€158 million), New York [NY] (€154 million),North Carolina [NC] (€151 million), Massachusetts [MA] (€150 million) and New Jersey [NJ] (€147 million).

With reference to the period 2020-2023, however, the major contributions to the growth of US imports of Food Machinery are derived - in order - from the markets of Michigan (+142.4 million euros), Ohio (+96.6 M €), California (+92.9 M €), Florida (+92.7 M €) and Georgia (+91 M €).

Finally, the table below shows the American States that have highlighted the greatest year-over-year increases in imports of Food Machinery in the first three months of 2024. Above all, the performance of the State of Michigan (+68.8 million euros compared to the corresponding period in 2023), followed by those of Texas (+39.9 M €), California (+25.4 M €), Washington (+18 M €), Kentucky (+10.5 M €) and Pennsylvania (+10.4 M €).

U.S. Imports of Food Machinery:

main driving States in the 1st quarter of 2024

| Level 2023 | Delta (Millions €) | ||

| American State | (Millions €) | 2023/2019 | Q1-2024/Q1-2023 |

| Michigan | 197 | +142.4 | +69.8 |

|---|---|---|---|

| Texas | 244 | + 73.1 | +39.9 |

| California | 374 | + 92.9 | +25.4 |

| Washington | 50 | + 4.0 | +18.0 |

| Kentucky | 34 | + 14.0 | +10.5 |

| Pennsylvania | 141 | + 37.2 | +10.4 |

Source: ExportPlanning - Quarterly Trade of American States Datamart

Conclusions

The data for the first quarter of 2024 confirmed the driving role of the US market for worldwide sales of Food Machinery4.

In particular, the US food machinery market shows widespread growth at a territorial level.

The analysis of quarterly imports from American states, which can be broken down by partner country, can allow us to document the territories of the US market that are continuing to offer positive contributions to the growth of global sales of Food Machinery.

1) See the list of products included in this analysis in the following table.

2) In the 2023 world food machinery markets, behind the United States are China (2.4 billion euros) and - further away - Germany (1.3 Bn €), Indonesia (1.1 Bn €) and Russia (1 Bn €), with only the Indonesian market growing in the most recent quarter.

3) In the 2020-2023 period, well behind the US market, we note - in absolute increases - the growth of the markets of China (+481 million euros), Turkey (+381 M €), Germany (+304 M €), United Kingdom (+290 M €) and India ( +285 M €).

4) In particular, in 2023 the US market ranked first in the world for imports of machines and equipment for baking, machines and equipment for industrial meat processing, machines and apparatus for mixing and kneading and machines for the manufacture of sugar and confectionery products.