Beyond Borders: Understanding the Economy Through Foreign Trade Data

The Land of the Dragon: Evidence and Opportunities

Published by Veronica Campostrini. .

Macroeconomic analysis Foreign markets Internationalisation Importexport Foreign market analysis

The analysis of foreign trade represents an essential tool for companies looking at international markets with the goal of strategic expansion. Import and export data are a key resource for interpreting a country’s economic structure, as they reflect its production dynamics, comparative advantages, degree of international openness, and sectoral interdependencies.

The high level of detail in these data by product category also makes it possible to identify supply chain opportunities that the country can offer to international businesses, thanks to a highly detailed breakdown of both consumer and capital goods demanded from abroad.

As an example, we present a case study of one of the world’s most important and complex economies: China.

Structure of Chinese Imports

In 2024, China imported goods worth a total of €2.3 trillion, confirming its position as the second-largest market in the world after the United States. The structure of imports in the Dragon Country reflects the country’s manufacturing power, as illustrated in the following table.

Tab. 1 – Main Chinese Import Sectors

(values in euros)

| Sector | Share of total Chinese imports (%) |

Share of total world imports (%) |

CAGR 2019–2024 (current prices) |

|---|---|---|---|

| Energy raw materials | 16.4 | 7.9 | +6.5 |

| Computer parts and other office machinery | 15.5 | 5.6 | +5.3 |

| Metal ores | 9.7 | 1.4 | +9.3 |

| Precious metals | 4.8 | 3.3 | +14.6 |

| Cereals, raw rice, and oilseeds | 2.8 | 1.0 | +10.8 |

A considerable share of the country's imports is oriented towards raw materials, which have a significantly higher weight compared to the global average. Equally important is the weight of ICT components, highlighting the relevance of the technology supply chain for the country.

A particularly interesting figure concerns the share of products falling into the medium-high or premium price segments, which accounts for 34% of the total – a percentage higher than the OECD average of 29%. While this segment is smaller in size compared to raw materials, it indicates the emergence of a sophisticated demand for high-quality foreign goods, especially in symbolically rich product segments.

Source: ExportPlanning elaborations

Structure of Chinese Exports

In 2024, Chinese exports reached €3.3 trillion. However, only 16% of these goods fall into the medium-high or high-end segments, compared to an OECD average of 32%. Overall, this data reflects a competitiveness still largely volume-driven, but also signals a progressive upgrading of China's export structure. Consider that in 2010 this share was just over 7%.

Source: ExportPlanning elaborations

Tab. 2 – Main Chinese Export Sectors

(values in euros)

| Sector | Share of total Chinese exports (%) |

Share of total world exports (%) |

Net exports (€ bn) |

|---|---|---|---|

| Communication equipment | 6.6 | 2.5 | 206 |

| Computers and peripherals | 5.5 | 2.6 | 132 |

| Home appliances | 2.5 | 0.9 | 81 |

| Outerwear | 2.6 | 1.5 | 78 |

| Consumer electronics | 2.0 | 0.8 | 62 |

The sectors listed reflect China’s competitive advantage in high-tech industrial areas, particularly ICT equipment and consumer electronics. The relevance of these sectors in China’s total exports is at least double the average seen in other global economies.

Focus on Strategic Supply Chains for Italy

The new version of the Country Report introduces an in-depth analysis of the supply chains most relevant for Italian exports. For each supply chain – from electrotechnical components to agricultural machinery, from fashion to agri-food – the top five products imported by China and the top three exporting countries to the Chinese market are identified.

For illustrative purposes, two emblematic cases are presented, referring to two high-potential markets for Italy.

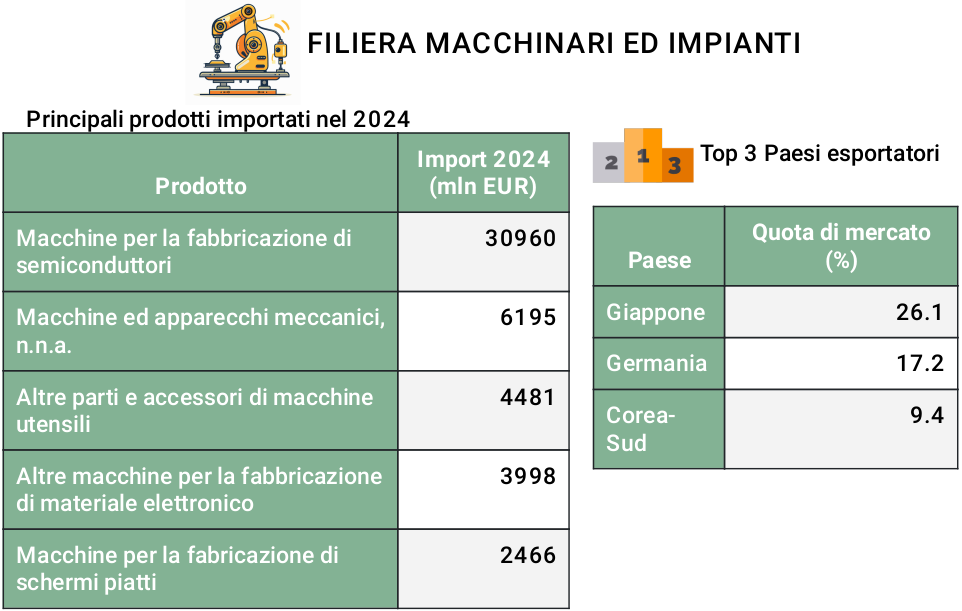

1. Industrial Machinery and Equipment

Thanks to its excellence in precision mechanics, Italy ranks as the seventh-largest supplier of industrial machinery to China, with a market share of 4.6%. However, competition is fierce: Japan, Germany, and South Korea hold 26.1%, 17.2%, and 9.4% of the market respectively. The segment is largely driven by demand for semiconductor production equipment, reflecting Beijing’s ongoing efforts to achieve self-sufficiency in chip manufacturing.

Source: ExportPlanning elaborations

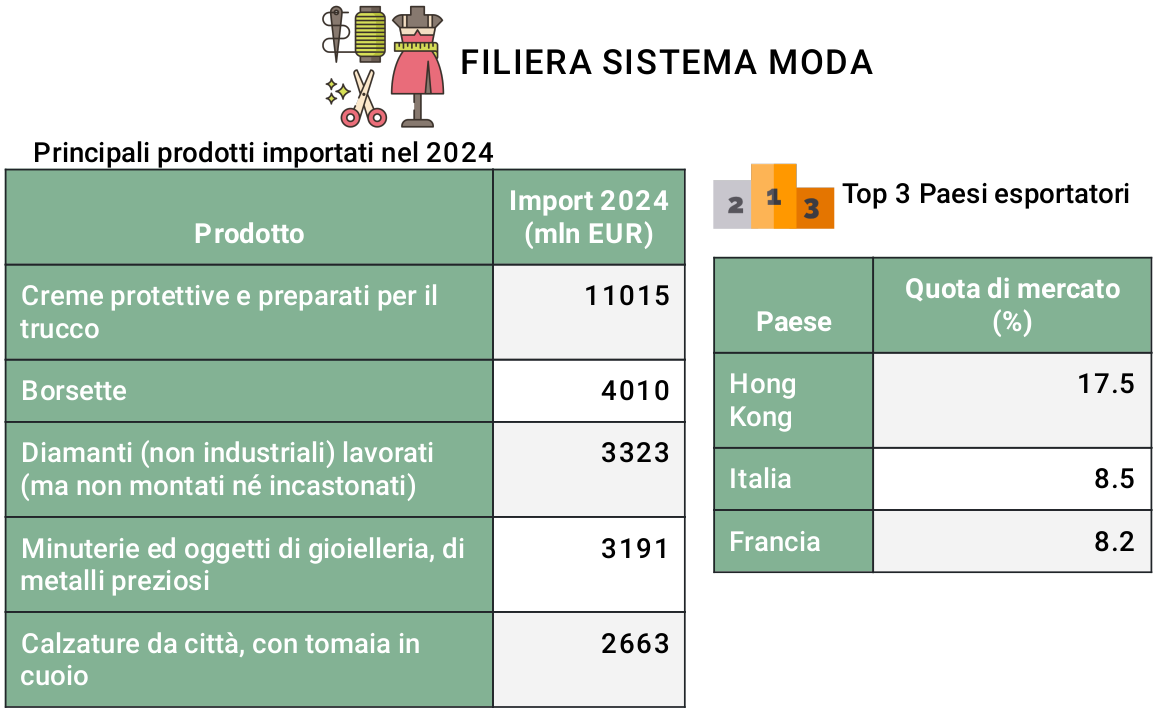

2. Fashion System

“Made in Italy” continues to enjoy an excellent reputation in China, where demand for premium products is steadily growing. Italy is the second-largest trade partner in the fashion sector, with a share of 8.5%, closely followed by France (8.2%), though still trailing Hong Kong (17.5%), which serves as a regional re-export hub.

Among the most in-demand products are protective creams and makeup preparations, in line with Chinese – and more generally Asian – consumers’ strong focus on skincare and high-end cosmetics.

Source: ExportPlanning elaborations

Conclusion

Despite an evolving geopolitical landscape, the Chinese market remains one of the most significant globally and thus full of opportunities. However, the Dragon Country is also a complex market: the analysis of its foreign trade data reveals an import structure that highlights its vast manufacturing capacity and an evolving demand for consumer goods, with a niche strongly oriented toward quality.

The upgrading of Chinese product offerings to foreign markets and its clear competitive advantage in high-tech sectors also point to opportunities for companies operating in those value chains.

For Italian companies aiming to expand in this context, it is essential to adopt a strategy based on:

- in-depth sectoral analysis;

- adapting the offering to local preferences;

- building partnerships or joint ventures, especially in regulated sectors.

Effective positioning requires awareness of global competition and careful management of pricing dynamics. But where added value is present, Italian excellence can once again make a difference.