U.S. tariffs and a weak dollar: Europe's challenges

The European Union amid negotiation uncertainty, protectionist pressures, and dollar depreciation

Published by Marzia Moccia. .

United States of America Trade war Uncertainty Made in Italy Global economic trends

On July 7, 2025, the U.S. administration officially extended the suspension period for the enforcement of “reciprocal” tariffs, postponing their implementation to August 1, 2025.

The Executive Order, published on the official White House website, thus represents an extension of about three weeks compared to the originally scheduled deadline of July 9.

At the same time, the U.S. government proceeded with the dispatch of “tariff letters” to a number of trade partners, communicating the new country-specific tariff rates.

Several countries have already received notification of the tariff rates effective from August 1, including both allied economies – such as Japan and South Korea, which face 25% tariffs – and key ASEAN economies, with tariffs ranging from 25% for Malaysia to 40% for Laos and Myanmar. In Europe, Bosnia and Serbia are also affected, facing tariffs of 30% and 35% respectively.

As highlighted in the article U.S. imports of goods in the aftermath of Liberation Day, the countries that received the first round of “tariff letters” seem to reflect developments in the American market following Liberation Day and the introduction of the “minimum” reciprocal tariffs, which failed to curb the growth of certain categories of goods still cost-effective to source from abroad, particularly in the case of ASEAN economies.

Currently, the United States has, in effect, announced only three trade agreements, still in preliminary form, with the United Kingdom, China, and Vietnam. However, the technical details of these agreements have not been made public, making them difficult to assess.

And the European Union?

As of today, the European Union has not received a notification letter regarding tariff rates, which many observers see as a sign that negotiations, despite some challenges, are ongoing. However, predicting the outcome of these talks remains difficult.

According to the latest reports, Brussels is pushing for a framework agreement with differentiated tariffs: an average rate of 10% on general exports – maintaining the one already in place since April – with reductions for strategic sectors such as alcoholic beverages and aircraft, and potential exemptions or quota mechanisms for critical sectors like automotive and industrial metals (25% on cars, 50% on steel and aluminum).

However, Europe’s position is fragmented across Member States, and uncertainty about the final outcome remains particularly high.

The depreciation of the dollar and the so-called “implicit tariff”

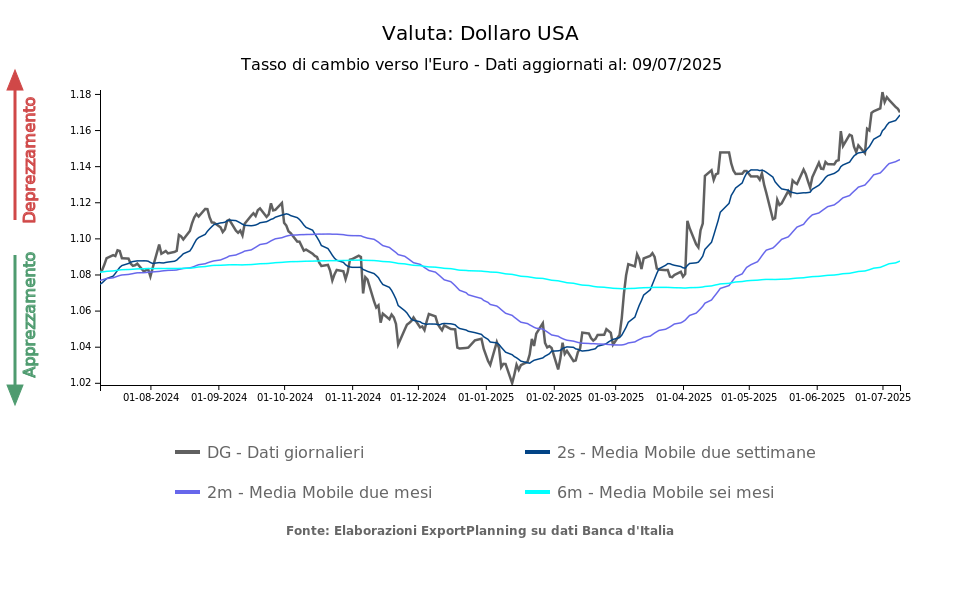

Beyond the outcome of negotiations, one issue European exporters will undoubtedly have to confront is the significant depreciation of the dollar (see the graph below).

Source: ExportPlanning elaborations

From the start of the presidential term to June 30, the dollar has lost about 13% of its value against the euro.

This trend, while signaling a loss of confidence among international investors in the U.S. economy, represents an “additional implicit tariff” for EU exports, making European goods less competitive in the U.S. market.

Conclusions

In an international context marked by growing trade uncertainty and instability in transatlantic relations, the need for European businesses to adopt adaptation and resilience strategies is increasingly evident. U.S. tariff policy and the concurrent weakening of the dollar are indeed factors significantly impacting the competitiveness of European exports.

In light of these developments, it is becoming ever more important for exporters to strengthen their systematic monitoring of foreign trade data – not only to promptly detect risk signals, but also to identify new paths of opportunity in global markets.

In the current scenario, diversification of the market portfolio is a strategic lever essential to reducing dependence on politically and commercially tense markets and to tapping the potential of high-growth emerging economies: investing in trade intelligence and strategic flexibility is key to navigating the new balance of the global economy with clarity and proactivity.