H1 2025: Global Trade Outlook

The trend of global demand by sector, excluding U.S. trade

Published by Silvia Brianese. .

Global demand Conjuncture Global economic trendsIn a complex and evolving international context, marked by various tariff agreements enacted by the Trump administration, the recent update of the Global Outlook datamart from ExportPlanning allows for an analysis of the trends affecting global demand for goods in the first two quarters of 2025.

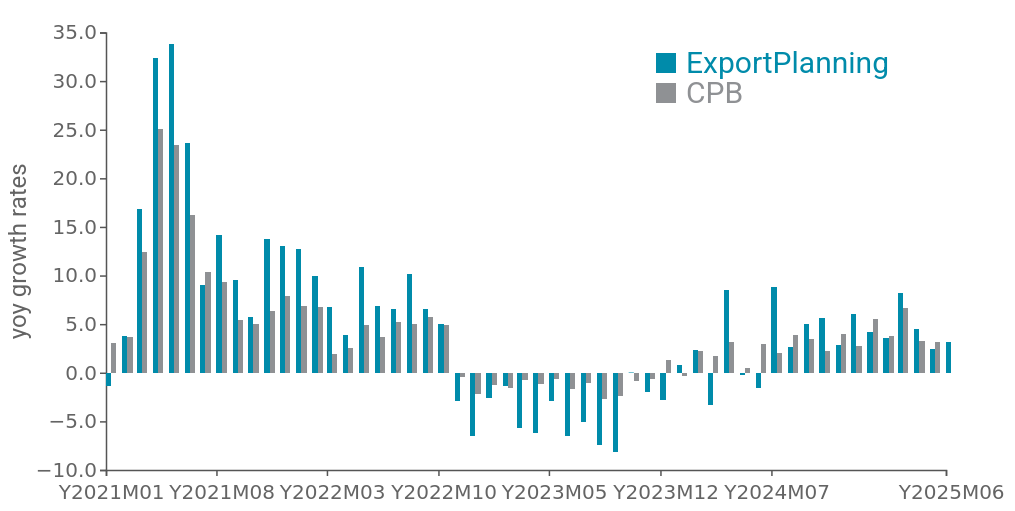

Figure 1 shows the series of year-over-year changes in global goods imports at constant prices on a monthly basis—that is, net of price and exchange rate dynamics, comparing the data collected and systematized by ExportPlanning with those from the Central Planning Bureau, an institute that also collects and processes information on international trade in goods.

Fig.1 - Global Demand at Constant Prices

(CPB data vs ExportPlanning data, YoY change on monthly data)

Source: ExportPlanning calculations

Particularly noteworthy is the fact that, overall, starting from the first quarter of the new year, the growth of global goods imports has shown signs of substantial continuity with the development trend that characterized trade at the end of 2024. In particular, for the period January–June 2025, it is estimated that global imports grew by 4.3% compared to the same period last year.

However, the overall result includes the so-called front-loading of the U.S. market—that is, the phenomenon of stockpiling in anticipation of tariffs, which was concentrated in the January–March 2025 period.

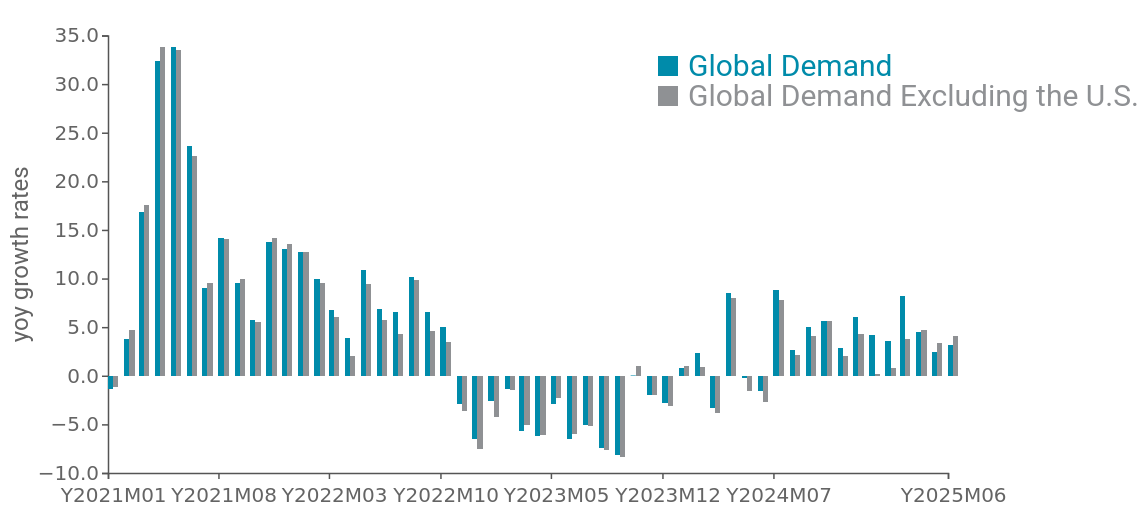

In order to observe a trend "cleansed" of extraordinary phenomena like the one just described, it is therefore possible to reconstruct global demand excluding trade flows directed to the United States. U.S. foreign demand, in fact, has a significant impact on global imports, accounting for about 30% of total global demand for goods. Figure 2 thus shows the series of year-over-year changes in global imports at constant prices, excluding the United States.

Fig.2 - Global demand at constant prices

(YoY changes on monthly data)

Source: ExportPlanning calculations

The ExportPlanning estimates, “cleansed” of U.S. trade flows, reveal significantly different signals, especially for the first quarter of 2025: global demand for goods excluding the U.S. recorded a growth of only 1.6% in the January–March 2025 period compared to the same period in 2024 (versus a year-over-year increase of 5% when U.S. trade is included), while for the second quarter they indicate a recovery of 4% compared to the previous year.

Thus, on average, the preliminary estimates for the first half of 2025 show a year-over-year growth in global demand for goods excluding the U.S. of +2.8%.

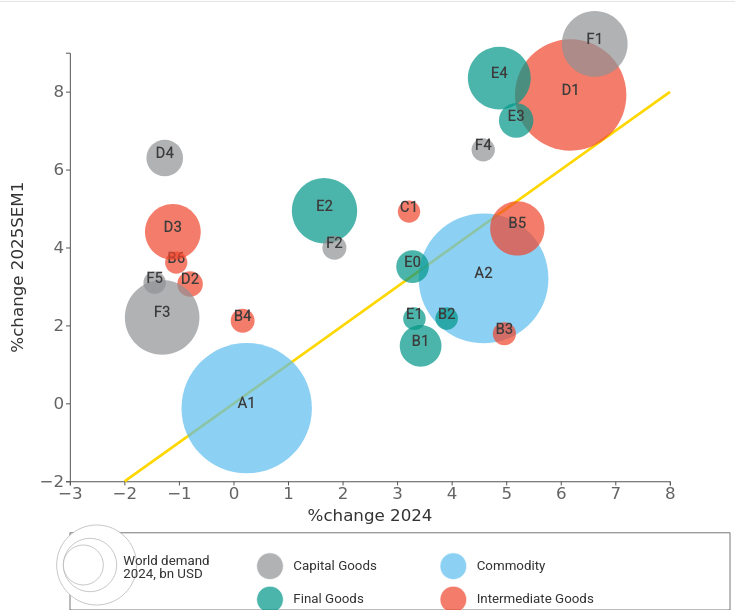

The breakdown of goods demand excluding the U.S. by sector proves to be highly informative.

Sectors Growing in the First Half of 2025

The following chart shows the main industries involved in international trade in goods, positioned according to the import growth rates recorded in 2024 (X-axis) and in the first half of 2025 (Y-axis). Once again, goods import flows are measured at constant prices, in order to provide an analysis of real trends. The bisector (shown in yellow) highlights the accelerating industries (positioned above it) and the slowing ones (below it), while the size of the circles represents the value of sector imports in billions of U.S. dollars in 2024.

Fig. 3 - Global demand map at constant prices, by industry

In the first half of 2025, excluding "extraordinary" phenomena, most sectors still show signs of demand recovery compared to the trends observed in 2024, although to varying degrees across different industries.

Specifically, in the upper-right area of the chart are the sectors that experienced a strengthening of the recovery in early 2025, following already positive trends in 2024. Among these, ICT equipment and devices (F1) and the related intermediate supply chain of electronic components (D1) stand out, mainly supported by imports of computers (and parts thereof) and communication equipment.

The Home System (E3), mainly driven by imports of household appliances, and the Health System (E4), remain key drivers of the recovery in the Consumer Goods cluster. The Fashion System (E2) also shows a notable rebound, though with very mixed dynamics.

Fresh Food (B1) and mass-market consumer goods (E1) show signs of weakening demand, positioning below the bisector, while Packaged Food and Beverages (E0) show continuity with last year’s trend.

On the left side of the chart, the automotive supply chain (D3-F3) is located, which shows partial signs of a rebound in the first half of 2025, particularly in various transport vehicles (such as agricultural and earthmoving machinery, motorcycles, and passenger cars) and in the battery and accumulator segment. Also noteworthy in this area are the strong performances of the Electrical Engineering (D4) and Industrial Plant Engineering (F5) sectors, driven especially by the growth in imports of electric motors, generators, and transformers, as well as control panels and electrical equipment.

Which Geographies Are Driving Sector Performance?

Excluding the United States, the recovery in global demand for Consumer Goods in the first half of 2025—driven in particular by growth in the Home System—was led mainly by the major European economies, with a notable role played by Germany. This trend suggests possible signs of a German economic recovery, after two consecutive years of post-pandemic recession.

As for Capital Goods, the recovery in demand for ICT equipment and devices has been driven mainly by India and Japan. The rebound in imports of industrial instrumentation and the automotive supply chain has been led by high-potential emerging economies such as India, Brazil, and Turkey.

Conclusions

Assessing global goods market trends is particularly complex in a context marked by high commercial uncertainty. Analyzing global demand excluding trade flows with the United States makes it possible to capture more robust sector trends and to observe signs of resilience in global demand, despite a still fragile macroeconomic environment.

In a complex and constantly evolving trade scenario, it is strategic for companies to closely monitor global demand trends—both from a sectoral and geographical perspective—in order to effectively guide commercial decisions and investment strategies.

The topic of monitoring cyclical trends and markets will be the focus of the next TEM MEETUP by TEM PLUS, which will take place on Thursday, July 31.