EU Exports 2025: Intra-EU Growth, Challenges Beyond the Borders

Published by Veronica Campostrini. .

Slowdown Europe Conjuncture Export Global economic trendsA still fragile cyclical outlook

The performance of European exports during the transition from 2024 to 2025 continues to reflect a complex macroeconomic environment, marked by a slow adjustment process following the difficulties that emerged in the previous two-year period. The latest data show a clear decoupling between intra-EU flows and exports directed to extra-EU markets, which remain exposed to high volatility and global uncertainties. Differences across destination markets and production sectors highlight how the recovery of European exports is selective and partial, rather than broad-based.

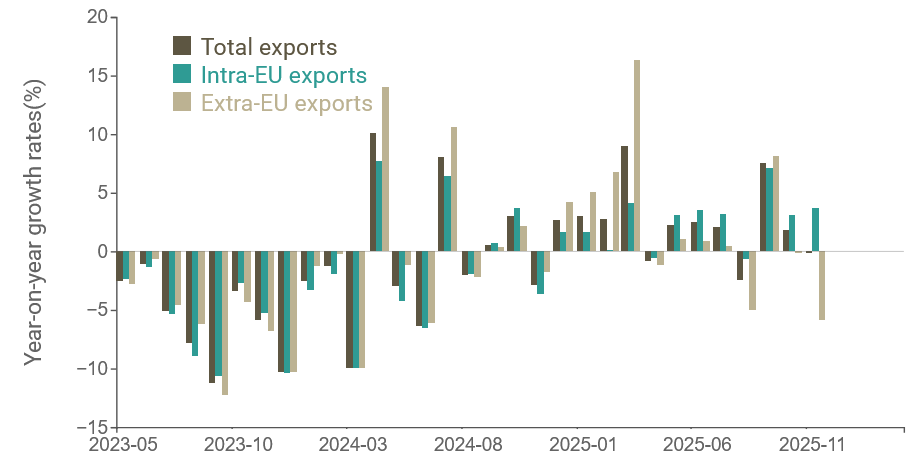

Fig.1 - Monthly year-on-year changes in European exports

Source: ExportPlanning Information System

In particular, the analysis of monthly year-on-year changes in exports shows that, after a prolonged phase of contraction, European foreign trade began to display less negative dynamics during 2025. However, volatility remains high, especially in flows towards extra-EU countries, while intra-EU trade appears overall more stable, benefiting from a gradually recovering European domestic demand.

Intra- and extra-EU dynamics: a persistent misalignment

The distinction between intra-EU and extra-EU exports represents a key lens through which to understand the current cyclical phase. Data show that in 2025 intra-EU exports maintained a generally more favorable trajectory compared to exports directed to non-European markets, which continue to be more affected by global uncertainties.

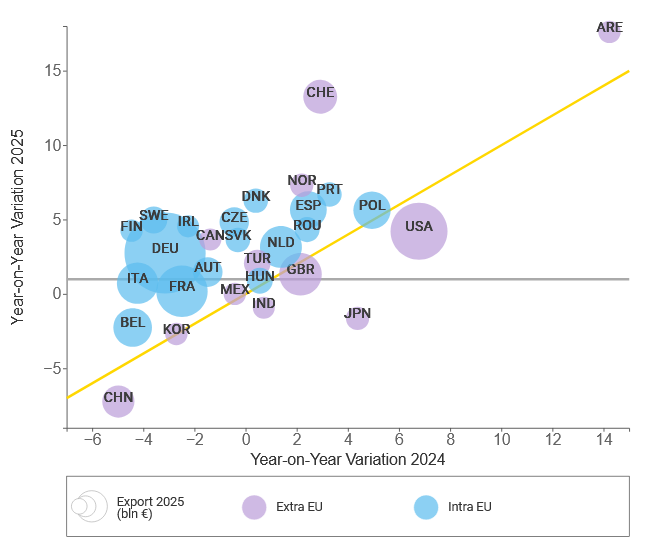

Fig.2 - European exports by main exporting countries

(Year-on-Year Variation %)

Source: ExportPlanning Information System

The comparison between Year-on-Year variation in 2024 and 2025 by individual destination country confirms this divergence. Major European partners fall within a range of growth in the 2025 pre-estimate, signaling solid trade dynamics within the single market. By contrast, the main extra-EU markets display much more heterogeneous trends: alongside economies showing a strengthening in 2025, such as Switzerland and the United Arab Emirates, there remain areas of pronounced weakness, particularly in East Asia—driven by the Chinese downturn—where the cyclical slowdown, in addition to the appreciation of the euro, continues to weigh on demand for European goods.

The sectoral composition of exports and resilience factors

Sectoral analysis helps explain the selective nature of the ongoing recovery. The sectors accounting for the highest export values to extra-EU markets remain those traditionally driving the European economy, such as pharmaceuticals, automotive, energy products, and aerospace. However, growth dynamics differ significantly across sectors.

The pharmaceutical sector confirms itself as one of the main sources of resilience, showing positive growth both towards intra-EU and extra-EU markets. The automotive sector, by contrast, shows a contraction in flows to extra-EU markets, against a backdrop of significant expansion within the Union. Other sectors, such as aerospace and energy products, display more volatile trends, strongly influenced by cyclical and geopolitical factors.

Alongside these sectors, particularly relevant signals are emerging in some high-technology and strategic segments. In 2025, European exports of machinery for semiconductor manufacturing and basic pharmaceutical products record very strong increases towards extra-EU markets, indicating that export growth is currently driven mainly by specialized niches, rather than by a generalized diffusion of the recovery.

The role of intra-EU trade and production chains

On the intra-EU front, the picture appears overall more articulated and, as anticipated, more favorable. In addition to the sectors already mentioned, signs of strengthening are observed across several industrial value chains, particularly in automotive components, batteries, and some durable consumer goods. This dynamic suggests a progressive consolidation of internal trade, consistent with strategies aimed at reorganizing value chains and strengthening European productive integration.

The greater vitality of intra-EU trade helps partially offset the weakness of exports to extra-EU markets, reducing the overall volatility of the Union’s foreign trade.

Focus on major trading partners

The analysis by individual destination market makes it possible to identify some particularly relevant dynamics. Trade with the United Arab Emirates shows a strong strengthening in 2025, driven mainly by exports of aircraft, aerospace components, pharmaceuticals, and luxury goods, confirming the strategic role of the area as a commercial hub. Canada also shows signs of growth, albeit concentrated in specific sectors such as automotive, aerospace, and ICT.

Within Europe, the gradual recovery of German demand is supported in particular by EU imports of pharmaceuticals, automotive products, and advanced components, while Switzerland confirms itself as a reference market for European products with high added value, with particularly positive dynamics in pharmaceuticals.

Conclusions

Overall, the signs of improvement observed in 2025 point to an increasing polarization between more dynamic sectors and markets and others that remain more exposed to uncertainties in the international environment.

In this scenario, the ability of the European system to strengthen the geographical diversification of exports, support sectors with higher technological content, enhance internal value chains, and strategically manage the geopolitical implications of global markets will represent a crucial factor in consolidating export competitiveness in the coming quarters.