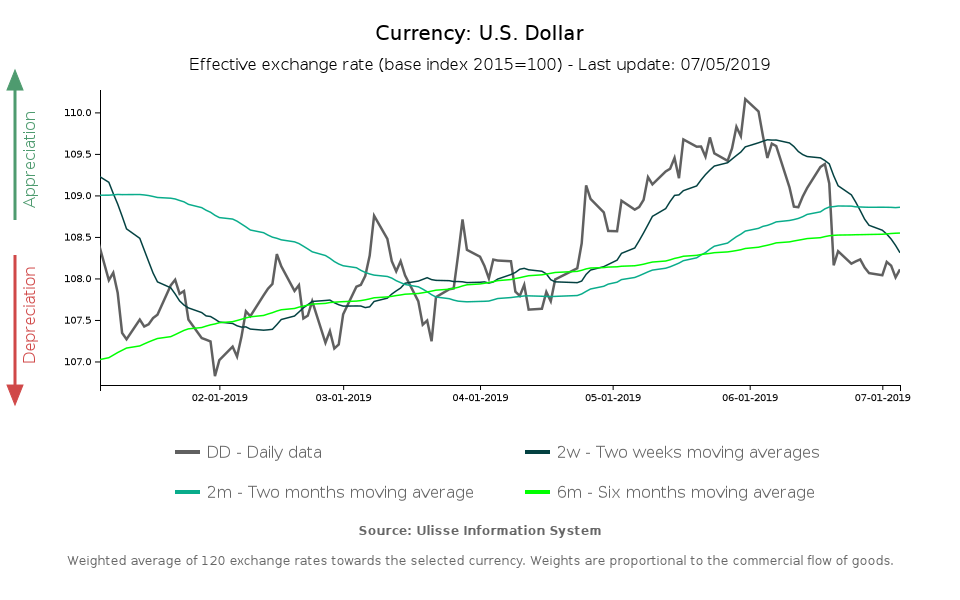

Good News is not enough to Raise the Dollar

The dollar's recovery is limited by expectations of a near-term slowdown in the US economy

Published by Luigi Bidoia. .

Dollar Euro Emerging markets Exchange ratesThe dynamics that characterised June have continued in the past week. Amid expectations of a reduction in US interest rates, almost all developing country currencies continued their appreciation against the dollar. In the last month, the South African Rand (4%), Turkish Lira (2%), Mexican Peso (3%), Russian Ruble (3%), Brazilian Real (2%), Thai Baht (2%) and the Indian Rupee (+1%) all appreciated against the dollar. The Argentine Peso also significantly appreciated against the dollar (+ 6%), creating conditions for a significant contribution by the exchange rate to contain inflation in the country. The appreciation of the emerging economies currencies also found support in oucomes of the Osaka G20 meeting, which marked the start of a truce in the trade war between China and the US.

As regards other exchange rates, the dollar was relatively stable with almost all major currencies of the developed countries.

Also of note is the slow but progressive depreciation of the Sterling Pound, which is now approaching maximum values seen in the immediate aftermath of the Brexit referendum.

During the last month, the dollar depreciated by 1.2% in terms of its effective exchange rate.

At the end of the week, two news items moved foreign exchange markets: the first concerned the number of jobs created in the American economy; the second was orders from German industry.

In June, the US economy created more than 200,000 new jobs, reducing the likelihood of a sharp slowdown in the US economy in the short term and above all, making a short-term reduction in US interest rates less likely. If the prospect of a drop in interest rates is removed, the strengthing of exchange rates with emerging countries over the last month will reduce.

In Germany, after a pause in industrial production in April, industry orders during May suffered a YoY downturn of 8.6%, worsening the already negative expectations. The focus of the crisis has been the automotive industry, but the slowdown is now spreading to other sectors. Prospects of a rebound in the European economy have been reducing, weakening the euro. Both news items favoured a strengthening of the dollar.

Despite the news and a truce in the trade war with China, the dollar did not appreciate this week, signaling how protracted are the expectations of an imminent slowdown in the American economy.